WASHINGTON — Triple-A rated Baltimore County expects to competitively sell $262 million of general obligation bonds tomorrow, including the largest amount of recovery zone economic development bonds sold by any issuer to date.

The Maryland county, ranked third most populous and second for jobs in the state, plans to issue $32.6 million of economic development bonds, the total amount it was allocated by the Internal Revenue Service under the American Recovery and Reinvestment Act. The taxable bonds offer issuers a 45% interest cost subsidy from the federal government.

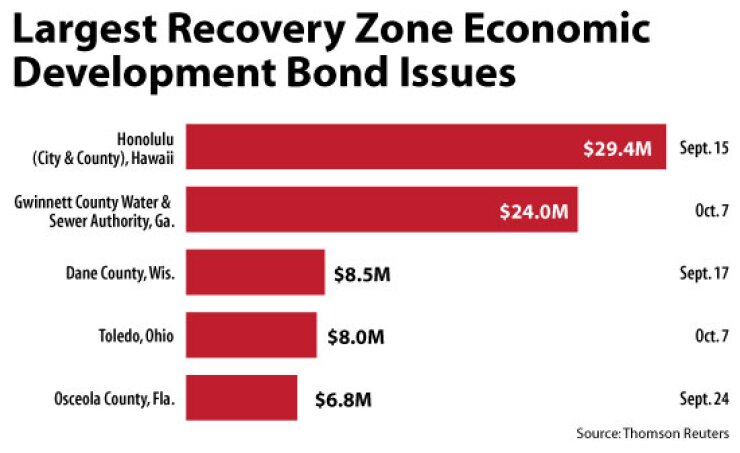

About $124 million of recovery zone economic development bonds have been issued, with Hawaii’s $29.4 million deal the largest thus far, according to Thomson Reuters.

Including the economic development bonds, Baltimore’s bonds are expected to be sold in five series: $36 million of metropolitan district Series A bonds maturing between one and 10 years; $70.6 million of Series B bonds maturing between 11 and 30 years; $60 million of public improvement Series A bonds with terms between one and 10 years; and $63 million of public improvement Series B bonds maturing between 11 and 20 years. The metropolitan district bonds will be supported first by water and sewer revenues and then by the county’s taxing power.

The county may sell the four series as direct-pay Build America Bonds. The two Series A bonds, if they are priced as tax-exempts, will be used to redeem outstanding bond anticipation notes. The Series C economic development bonds will fund school construction and mature in one to 20 years.

Baltimore also will be issuing $19.4 million of Series D qualified school construction bonds, which will be privately placed to Guggenheim Partners LLC. Baltimore County public schools received $19.4 million of QSCB authority under the ARRA for QSCBs to be issued this year.

McKennon Shelton Henn LLP is bond counsel and Public Resources Advisory Group is financial adviser for the transaction.

The Baltimore County bonds are rated Aaa by Moody’s Investors Service and AAA by Fitch Ratings. Standard & Poor’s is expected to rate the bonds AAA, according to Robert J. Burros, the county’s investment administrator. The ratings apply to $1.39 billion of the county’s outstanding GO debt. The $73 million of certificates of participation that Baltimore has outstanding are rated Aa1 by Moody’s and AA-plus by Fitch.

Burros said he does not expect the county to have trouble pricing its bonds. Maryland last week postponed issuing $603 million of refunding bonds because of difficult market conditions. But Burros noted that the state was able to issue its new-money debt last week.

Baltimore’s tax base growth has partially mitigated rising unemployment, Moody’s analysts said in a report. The county’s tax base has increased by an average of 11% annually since 2004, adding $82 billion to revenues as of fiscal 2009. The unemployment rate was 7.6% in August compared to the 9.6% national average. The state had a 7.1% unemployment rate by comparison.

The county tapped its general fund balance to fill an $8.9 million revenue gap for fiscal 2009. Income tax revenues, recordation, and transfer tax revenues dropped amid the economic contraction and the real estate market downturn.

The county’s fiscal 2010 budget projects a 6.6% reduction in income tax revenues from fiscal 2009 collections, largely related to declines in capital gains. Moody’s analysts said they expect the county to maintain a balanced general fund.

Baltimore last sold bonds in February. JPMorgan priced $97.5 million of refunding bonds at a true interest cost of 2.0%, according to Thomson Reuters.