CHICAGO — As school districts’ issuance of qualified school construction bonds picks up, the market is seeing its first competitively sold transactions of the tax-credit bonds, with several Midwestern district issues done and several more — including one from Milwaukee Public Schools — on the horizon.

Market participants — including independent financial advisers — lean towards the position that the complexity of marketing a tax-credit bond, especially one newly created in the stimulus act, lends itself to a negotiated transaction. For some districts, however, local or state restrictions require general obligation issues be sold competitively.

The double-A rated Sun Prairie Area School District in Wisconsin last month sold $23 million of QSCBs, marking the first such issue in the state and the first to be sold competitively nationally, according to the district’s financial adviser, Robert W. Baird & Co.

The district received a low supplemental coupon bid of 1.14 % from JPMorgan. Though required under Wisconsin law to bid their bonds competitively, districts have some leeway to reject excessive bids. The district accepted the low bid as it was in line with market rates, officials said.

The district — which received its allocation from the state’s $125 million share of QSBC authority — will use proceeds from the sale towards its three-year building campaign that includes plans for a new high school and renovations to convert a former high school into a new upper middle school. The use of the program is expected to save the district about $11 million, according to Baird.

“Since Sun Prairie was the first district in the state to secure these bonds, Baird and the legal professionals at Quarles & Brady and Godfrey and Kahn had to act in a very fast manner, and I appreciate that,” said Phil Frei, the district’s deputy administrator for business and operations.

The stimulus program applies to eligible projects for new construction, rehabilitation or repair of public school facilities, purchase of related equipment, or new land for future construction. QSCBs are one of a handful of tax-credit programs in the stimulus in which investors receive a tax credit from the federal government in lieu of interest from the borrower.

At $22 billion, the two-year qualified school construction bond program is the largest and most generous, with a 100% tax credit compared to different levels of credits on the other bonds. The program directs 40% of the allocation to the 100 largest school districts in the U.S., with the remainder going to states that will dole out authority to individual districts. The program provides $11 billion this year and $11 billion in 2010.

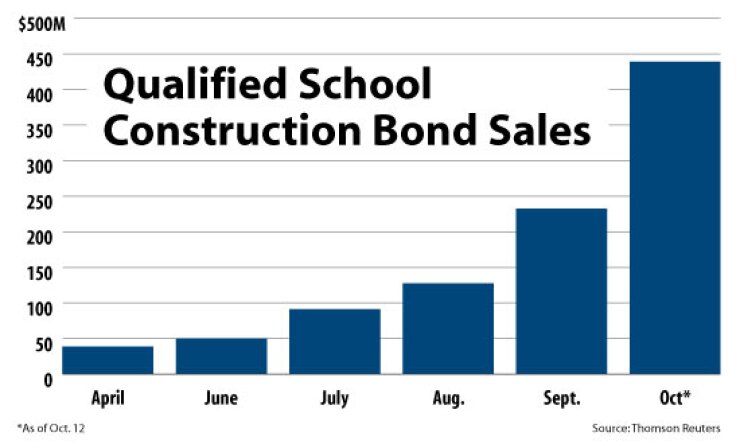

About $1 billion in more than 60 transactions has sold so far this year beginning in April. After a slow start the numbers have been on the rise with $128 million sold in August, $233 million in September and $439 million so far this month, according to Thomson Reuters.

While some market participants would prefer to wait in order to gain greater market acceptance for the bonds as their novelty wears down and remaining issues are resolved, districts are acting on their allocations so as to not forfeit their award for the year. Market participants are also still awaiting guidance from the Treasury Department on how the bonds’ tax credit can be stripped from the principal, a move that could increase investor demand, although they differ on the impact it would have on districts’ borrowing costs and say that’s no reason to delay a sale.

The tax-credit qualifying interest rate is set by the Treasury Department on a daily basis based on a review of a pool of bonds. The rate is supposed to allow districts to issue their bonds at par, but that has not been the case in recent months as even highly rated districts have been forced to supplement the Treasury’s rate with some additional interest. Treasury officials said at a recent conference that they are aware of the complaints and are examining the basis and methodology of the rate-setting process.

Milwaukee is working on the competitive sale of up to $53 million of general obligation-backed QSCBs on behalf of its school district. The plan was endorsed by the Common Council’s Finance Committee last week and a preliminary council vote was expected yesterday.

The struggling district — being eyed by local and state leaders to be handed over to city control — would finance deferred maintenance projects and a multipurpose addition to one of its schools. City comptroller W. Martin “Wally” Morics’ office, which issues the city and school district’s debt, is looking at selling as soon as December.

The city would like to tap just a piece of its direct authorization this year, and issue more next year as project funding needs demand, but there is some concern over whether the district would lose its allocation.

“We like to match our cash flows with expenditures but one of the issues we are trying to resolve is what happens to the district’s allocation if it’s not issued before Dec. 31,” said deputy comptroller Michael Daun.

Under the Treasury’s existing rules, any districts that received a state allocation would automatically cede their unused authority back to the state at the end of the year. The rules don’t specifically address the fate of the individual allocations doled out to the largest 100 districts.

“I expect to see some guidance on that issue fairly soon,” said Jeremy Spector, a partner at Mintz Levin Cohn Ferris Glovsky and Popeo PC. In the interim, he said he expects bond lawyers will recommend that large districts in fear of losing their allocation waive their authority back to the state in order to preserve it. The districts would likely then have to apply to the state for its reinstatement.

Milwaukee — a frequent borrower rated in the double-A category — has the ability to reject bids if officials deem them too high given the market’s prevailing rates. If no bids are received, the city would then issue a request for proposals to select an underwriter to negotiate a sale. Daun and public debt specialist Richard Li said they see some additional benefits in waiting to issue until next year as the bonds’ novelty wears off.

In his comments, Daun advocated for changes in the way Treasury sets the rate to honor the intent of the program to allow districts to issue bonds for qualified projects at par based on the tax credit. Milwaukee has no choice but to go with a competitive sale and Daun and Li see benefits and downsides to such a transaction. A negotiated sale would allow the city more flexibility and control in the timing, but given the limited number of current investors in the bonds there may be little benefit to negotiating a structure.

Providing a stark illustration of just how difficult it can be to market some issues competitively, the Grafton School District in North Dakota received just one bid for its $600,000 sale yesterday with a 6% supplemental coupon. The district’s financial adviser Chuck Upcraft, a senior managing consultant at Public Financial Management Inc., worked on the sale and will recommend that the district reject the bid. North Dakota law requires GOs to be sold competitively but like Wisconsin, districts can reject unreasonable bids.

“We will now try to negotiate a sale. We will talk to underwriters and also to financial institutions about a private placement and are hopeful we can get the transaction done at a fair and reasonable rate,” Upcraft said.

Upcraft blamed the lack of interest in the bonds on the program’s novelty, limited buyers, and on the district’s profile as a smaller, unrated unit of government looking to sell just a small amount of debt.

“If this was a double-A rated credit with a $5 million deal we might be a different story,” he said. The firm is also advising on the unrated Sargent Central School District’s sale today for $3 million, but Upcraft fears a similar outcome. The firm is also working with Minneapolis Special School District, which is rated between the low double-A and mid-double A category on its planned sale later this year of about $21 million of QSCBs. The district has not decided whether it will sell competitively or through negotiation.