Berkshire Hathaway Assurance Corp. stands ready to start insuring primary market deals.

On Friday, Standard & Poor's assigned a AAA rating to the newest entrant in the bond insurance business, marking the first rating that Berkshire Hathaway has garnered for wrapping bonds in the primary market. The outlook is stable.

The rating reflects a capital surplus of about $1 billion for BHAC as well as a guaranty provided to the bond insurer by Columbia Insurance Co., a AAA-rated subsidiary of Berkshire Hathaway Inc., Standard & Poor's said in a release. A letter from Columbia that promises timely payment for any of BHAC's financial guaranty obligations also buttresses the rating, the agency said.

A representative from Berkshire Hathaway Assurance did not return calls seeking comment.

Columbia owns 51% of BHAC, while National Indemnity Co. - another subsidiary of Berkshire Hathaway Inc. - owns the remaining 49%, according to the Standard & Poor's release. At the time of the BHAC rating, Standard & Poor's also assigned a AAA financial enhancement rating to Columbia.

BHAC is now registered to do financial guaranty business in 48 states and the District of Columbia. The bond insurer received its first license from insurance regulators in New York, who were worried about a lack of capacity in the municipal financial guaranty industry. Over the past few months, many of the market's monoline bond insurers have suffered downgrades at the hands of the rating agencies, seriously impairing their ability to provide insurance policies on municipal bond issues.

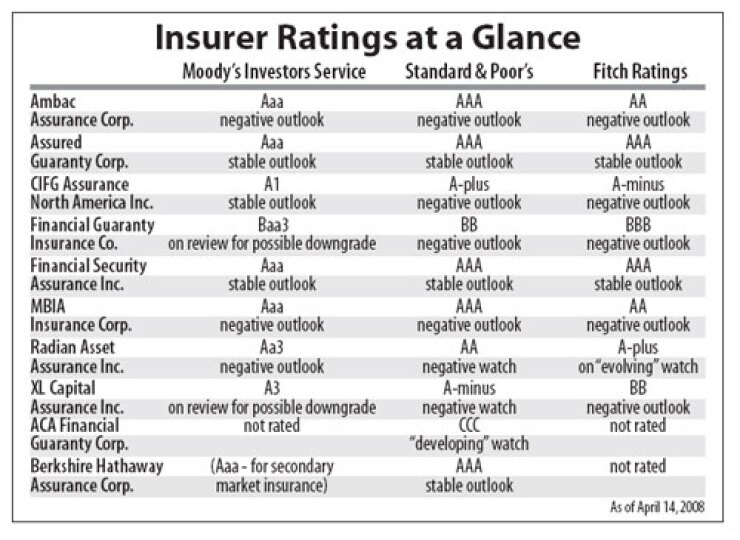

Berkshire Hathaway Assurance joins Financial Security Assurance Inc. and Assured Guaranty Corp. as the market's only triple-A rated insurers with a stable outlook, though it is unclear how the market will respond to the fact that Berkshire still does not have primary market ratings from two of the three rating agencies.

"Obviously they have to start somewhere, and the Standard & Poor's rating is a good place," said Jeffrey Timlin, vice president at Sage Advisory Services. "But to facilitate a market where they can start marketing themselves as a viable alternative they will need ratings from two rating agencies, in particular [Moody's Investors Service]."

However, Moody's has assigned a rating to BHAC, albeit not the coveted primary market insurance. In February, the agency gave Warren Buffett's bond insurer a Aaa rating for secondary market insurance. That rating, using a methodology similar to that of Standard & Poor's, relies on a contingent payment insurance policy from Aaa-ratedNational Indemnity.

With secondary market insurance, bonds are placed into a custody account, which then issues a custodial receipt. It is this receipt that is then assigned a financial guaranty insurance policy by BHAC and held by the investor.

Fitch Ratings has not yet assigned a rating to BHAC, though it does have a AAA corporate rating for Berkshire Hathaway Inc., a spokesman said.

Berkshire Hathaway Assurance made its first foray into the municipal market in early January, insuring more than $10 million of general obligation bonds issued by New York City in the secondary market for Goldman, Sachs & Co.

Since then, the bond insurer has wrapped more than one hundred issues in the secondary market. At the time of the Moody's ratings announcement, analysts at the agency said 112 deals had been rated with BHAC insurance.