CHICAGO - The Missouri Highways and Transportation Commission voted last week to drop its first-of-a-kind plan to use $700 million of private-activity bonds under a federal pilot program to repair 802 bridges in favor of issuing Garvee bonds after the original plan grew too expensive due to the credit crunch.

The commission late last year named the Missouri Bridge Partners as the best value contractor for the program under a design/build/maintain model.

The plan called for private-activity bonds to be issued through the Missouri Development Finance Board under a federal pilot program established in 2005 that allows private companies to benefit from the issuance of up to $15 billion of tax-exempt private-activity debt to finance the construction of transportation projects and rail-to-truck freight facilities.

The bonds are not subject to state private-activity bonding volume caps and the federal government had approved the allocation.

The bond proceeds would cover the costs of replacing and rebuilding 802 bridges over the next five years. The company would then maintain the bridges for a 25-year period. In addition to the bond proceeds, the plan relied on a roughly 10% equity contribution from the contractor to help finance the repairs and reconstruction.

The bonds would be repaid with so-called availability payments the state would make to the company over the life of the contract. Those availability payments - originally estimated at about $50 million - would be pledged to bond repayment.

The funds would come from the state's share of federal bridge funds. The worsening credit crunch sapped any potential financial benefits of the program as the costs for the contractor of raising the private equity contribution rose, which in turn would drive up the state's payments.

"The cost of the private equity just made a private financing unaffordable," Missouri Department of Transportation chief financial officer Roberta Broeker said yesterday. The cost of the availability payments had risen to at least $65 million.

One benefit of the innovative use of the federal pilot program was to get the work completed faster at less costs using a private company and a universal design/build model. Transportation departments more typically design and then bid one bridge at a time. The transportation departments of other states were watching Missouri, as the program was expected to serve as a model. The state of bridges across the country received heightened attention due to the collapse last year of the downtown Minneapolis Interstate 35W bridge. A replacement bridge opened last week.

The state's revised plan calls for the issuance of up to $700 million of grant anticipation revenue vehicle bonds beginning as soon as next year.

The state still intends to use a similar design/build plan on about 554 bridges in which one contractor will be sought to design and then build the bridges. Maintenance may not be included. The state will advertise for contractors this fall and make its selection by next spring.

The remaining 248 bridges to be improved will be contracted using a modified design/bid/build approach, where projects are grouped by type, size, or location to accelerate construction schedules.

Officials are paying close attention to federal action given concerns over the impact a lack of funding in the Highway Trust Fund could have on its bridge funding. Congress approved $8 billion recently to cover a deficit in the fund.

As the department moves forward with its revised plans, officials are also gearing up for the mid-October sale - pending market conditions - of their first Garvee sale to fund a separate project. Citi is the book-running senior manager for the $150 million sale, Public Financial Management Inc. is the financial adviser, and Gilmore & Bell PC is bond counsel.

Proceeds will provide funding for the reconstruction of Interstate 64 in St. Louis. The $536 million project relies on a mix of federal and state funding and is expected to be completed next year.

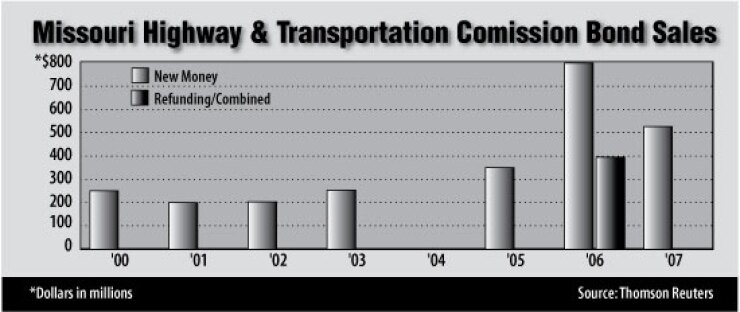

The commission in the summer of 2007 sold $550 million of new-money, state highway revenue bonds and plans another issue of $350 million in 2010 to wrap up a $2 billion borrowing program.