-

The Nashville Metropolitan Airport Authority is issuing municipal bonds to finance upgrades to an airport bulging at the seams after rapid traffic growth.

January 8 -

Boys Town, Nebraska, home of a high-profile sanctuary for troubled kids, heads into the bond market after a two-notch downgrade and recent abuse claims.

January 7 -

Bond sales by Texas issuers rose 21% to $82.52 billion, putting the state in second place behind California and well ahead of third-place New York.

January 6 -

The Maine Municipal Bond Bank is bringing back its transportation revenue bond program, with a few changes to bolster the bonds' credit.

January 5 -

Oregon transportation bond payments protected even if tax repeal succeeds, rating agencies say.

January 2 -

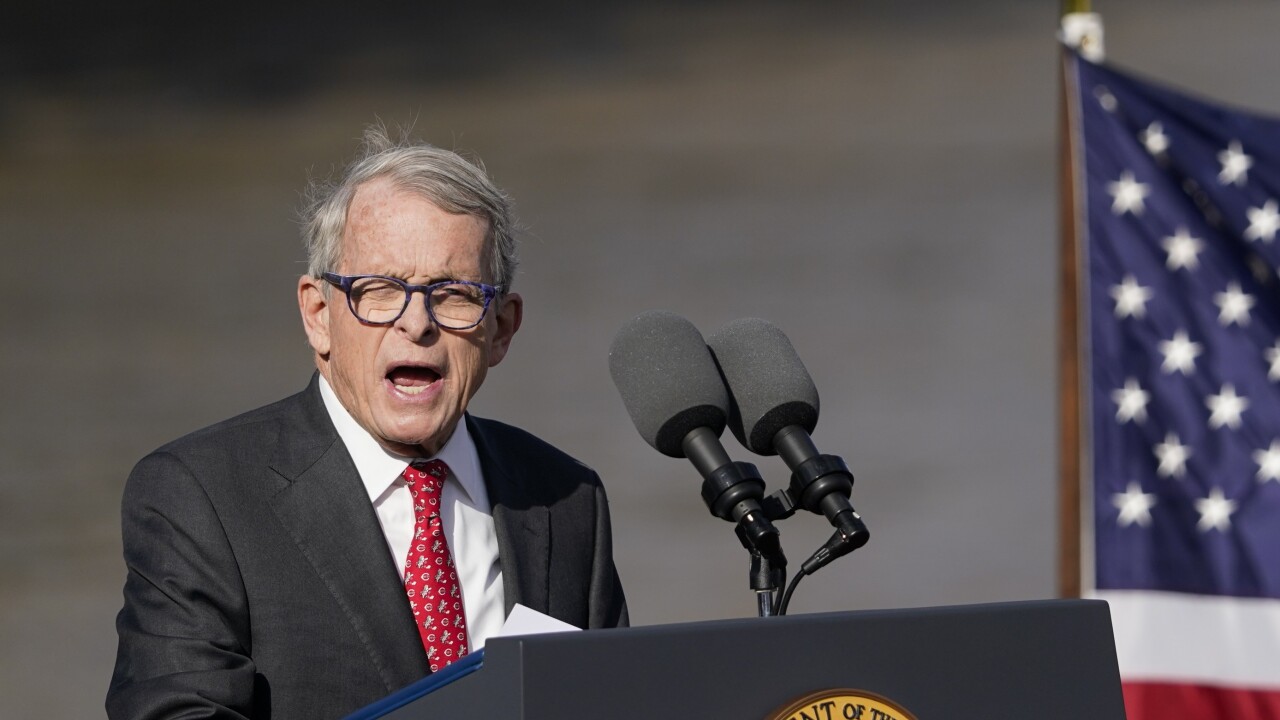

When Ohio Gov. Mike DeWine signed property tax reform bills, there was hope in Columbus it would appease voters who backed a push to abolish property taxes.

December 31 -

Fiscal 2027 budget proposals are being rolled out against a backdrop of unclear impacts from federal tax cuts and policy changes.

December 30 -

Washington Gov. Bob Ferguson unveiled a supplemental budget with GOP-opposed bond plans, as he preps a rain-soaked and flood-damaged state for more deluges.

December 26 -

Chicago's city council passed its alternative budget over the weekend. Mayor Brandon Johnson hates it, but said he would not veto it.

December 24 -

Credit pressures are expected to persist for municipal bond issuers facing water scarcity and increasing costs for projects to produce new supply.

December 23 -

States and cities in the Northeast will have to balance economic challenges and federal cuts driven by the Trump administration and congressional GOP.

December 22 -

The Equitable School Revolving Fund, which has more deals in the works, has maintained its strong credit profile even as the sector has experienced headwinds.

December 19 -

Two student housing developments in Orlando and Tampa, Florida, financed by speculative-grade bonds in 2024, have shown signs of strain.

December 18 -

The Ohio State University went to market Tuesday with a $560 million deal to refund taxable Build America Bonds into tax-exempt debt.

December 17 -

Property taxation is being targeted in a growing movement across the nation for cuts or elimination to address homeowner angst over rising tax bills.

December 16 -

Pasadena and the Rose Bowl Operating Co. are suing UCLA, saying plans to relocate football games to SoFi stadium could jeopardize $130 million in revenue bonds.

December 12 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Stargate data centers in Michigan and Wisconsin illustrate the risks to municipalities of such projects and the growing backlash to data centers.

December 10 -

Four of Dallas Area Rapid Transit's 13 member cities took action to ask voters in May whether they want to withdraw from the agency.

December 9 -

Investors are about to get a chance to buy bitcoin-backed municipal bonds. It won't be the last, according to the team behind the New Hampshire-based deal.

December 8