-

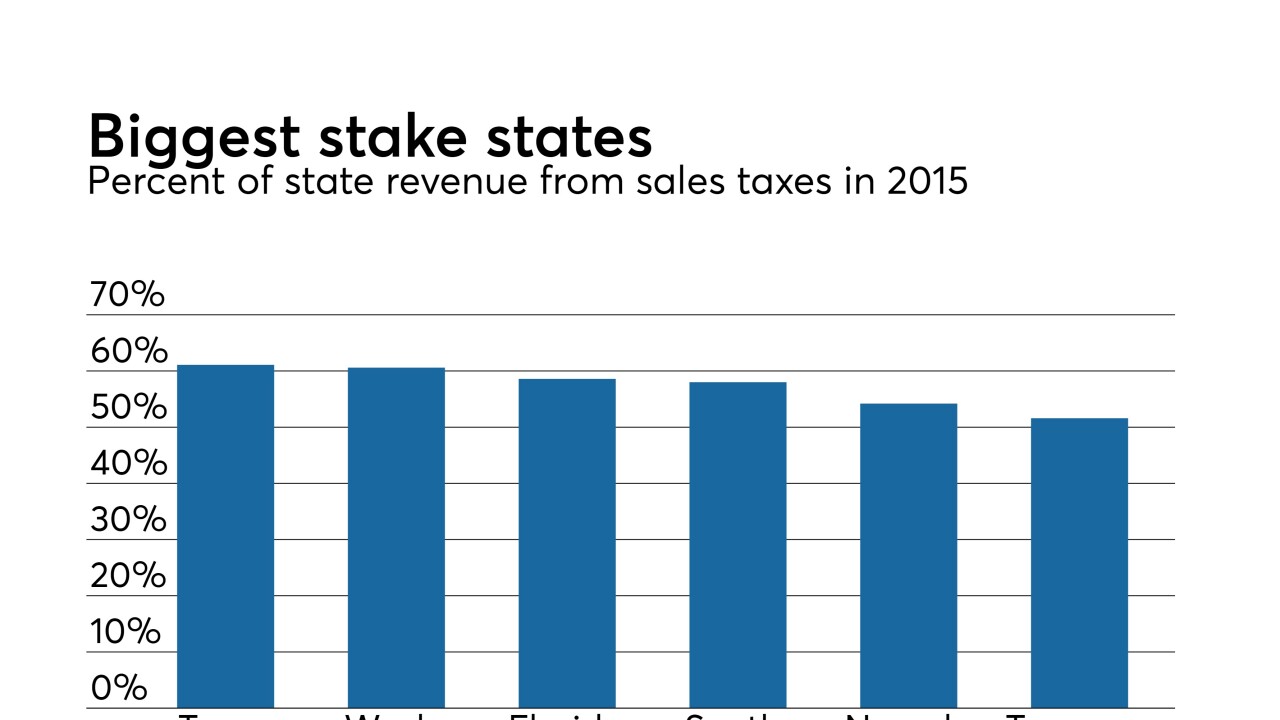

A high court ruling on online sales taxes that favors the states “could gradually improve long-term revenue growth prospects,” Fitch said.

April 16 -

Muni issuance will pick up next year, said George Friedlander, managing partner of Court Street Research Group.

April 13 -

Alaska's credit quality and the future of some existing and proposed bonding programs hang in the balance as lawmakers wind down the clock in Juneau.

April 12 -

The proposed legislation formally allows certain but not all taxpayers to have access to their IRS audit case file prior to dispute resolution hearings, ending the requirement to file a request under the Freedom of Information Act.

April 11 -

For the first time in nearly 30 years, Oklahoma has raised taxes to deal with a teachers strike, a credit positive step, says Moody's Investors Service.

April 9 -

The Legislature's budget failed to provide debt service on some bonds, decimated reserves, and lacked full funding for core services, Gov. Matt Bevin said.

April 9 -

Employers in New York also are allowed to implement a 5% payroll tax as a way of paying some of their employees’ state income taxes.

April 6 -

It's important and constructive to talk about these kinds of alternatives to advance refundings, market participants said.

April 4 -

Voters in Wisconsin also rejected a measure to abolish the state treasurer's office.

April 4 -

Surging sales tax revenue shows economic strength across several sectors, Texas Comptroller Glenn Hegar says.

April 3