-

To work well, public policy in a democracy must be transparent and allow time for debate, input and analysis. The given time frame on the House GOP tax bill, which will have broad ramifications for infrastructure development, healthcare and higher education costs and affordable housing, provides little opportunity for a democratic process of debate and compromise to take place.

November 8 Consultant

Consultant -

In a document rife with broken promises and misstatements about the muni market, the “Tax Reform” proposal beats up on the municipal bond market and state and local bond issuers to an extent never envisioned prior to the publication of that proposal.

November 8 Court Street Group Research

Court Street Group Research -

House Ways and Means Committee Republicans rejected an effort to keep the full deduction for state and local taxes.

November 7 -

The House GOP bill, if passed, would lower feasibility of P3s, Fitch said.

November 6 -

Municipal yields were down by as many as seven basis points amid concern that tax reform may crimp supply.

November 6 -

Advance refundings were 27% of market last year, PABs were 19% and most were 501(c)(3)s.

November 6 -

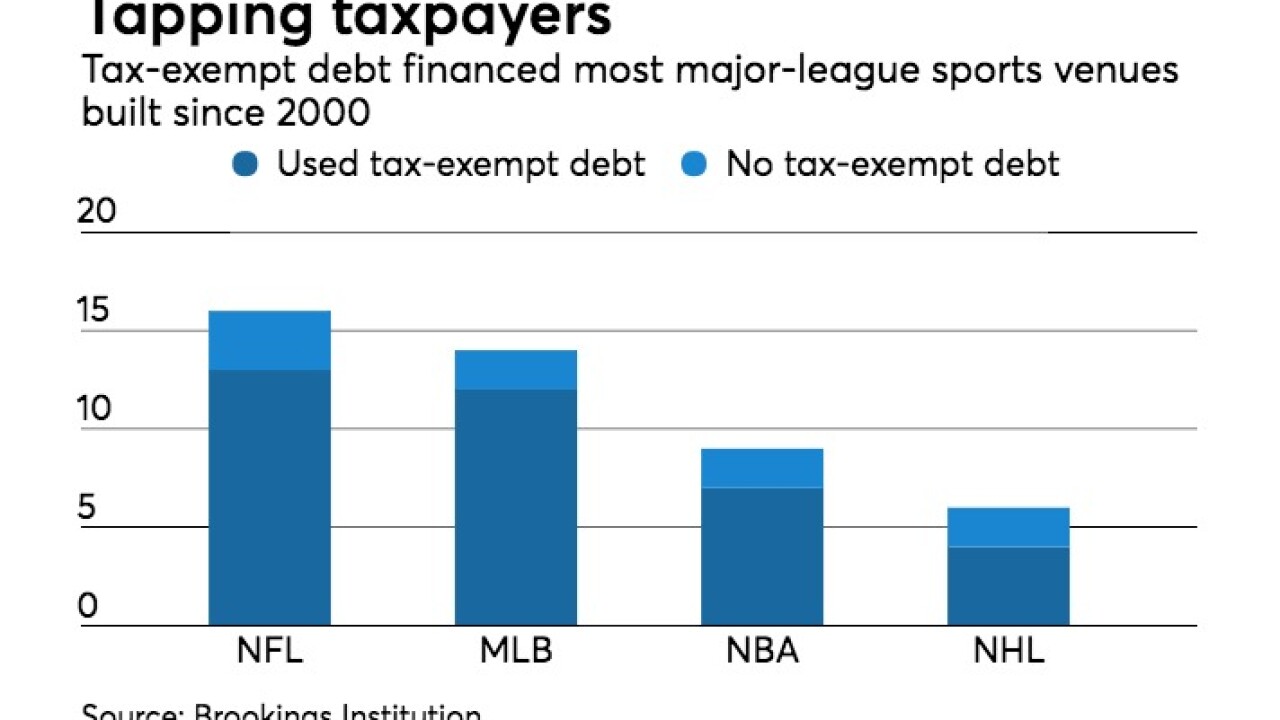

Construction of the bond-financed stadium for the Raiders was to begin this fall.

November 6 -

“This is a work in progress,’’ said Rep. Jackie Walorski, R-Ind.

November 6 -

Arlington, Texas planned to issue $500 million of tax-exempt bonds in 2018 for a Major League Baseball venue.

November 6 -

Retail and institutional municipal bond investors hope volume of nearly $9 billion is a sign of consistent elevated weekly volume for the remainder of the year.

November 6 -

With nearly $9 billion in volume, thanks to a large refunding deal, market participants expect issuance will remain strong as issuers try to beat tax reform.

November 6 -

Already facing the potential loss of several key financing tools and a 20% corporate tax rate that would cheapen the relative value of tax-exempt munis, there could be even more pain in store for the municipal market when the Senate weighs in.

November 3 -

The House Ways and Means Committee begins deliberations on the 429-page tax reform bill noon Monday.

November 3 -

Refundings on the calendar for the week ahead spurred speculation that issuers may rush deals to market before they are banned by the GOP tax plan.

November 3 -

With a tax bill on the table that places the cost of tax cuts on the municipal finance market, the time to voice opposition is now.

November 3John Hallacy Consulting LLC -

Top-shelf municipal bonds were stronger on Friday around midday, as market participants were still going over the details of the GOP tax reform bill.

November 3 -

The municipal bond market is still chewing over the details of the GOP tax reform bill, and considering its implications.

November 3 -

Market participants reacted negatively to the proposal in the tax reform bill to eliminate advanced refundings and private activity bonds, saying it would crimp volume and the savings issuers can get when rates fall. In the primary, strong demand met a Virginia issuer's $737 million PAB.

November 2 -

Retail investors are overcoming concern over interest rates and tax reform by extending duration, upgrading to high-quality, and buying defensive premium bonds.

November 2 -

The bill, which calls for the elimination of advance refundings, private activity bonds, tax credit bonds, and tax-exempt stadium bonds, would shrink the municipal market despite preserving the tax-exemption on muni bond interest.

November 2