-

The new tax law that terminated advance refundings of bonds after Dec. 31, 2017, does not specify that only "tax exempt" refundings are prohibited.

April 2 -

The bonds were used to finance the acquisition and renovation of an assisted living facility in Alabama by Dwayne Edwards, who the SEC charged with fraud last year.

March 16 -

New Jersey lawmakers are tackling legislation that would create an easier path for developers to finance large-scale economic development projects with bonds.

March 9 -

The SEC told a federal court that it will not pursue a judgment against the muni advisor firm or its principal unless it appears that the settlement process has stalled.

February 27 -

Brad Waterman says it's unfair for the IRS to withhold documents pertaining to a "suspected practitioner misconduct" charge that was filed against him but never investigated.

February 8 -

NABL details at least seven alternatives for outstanding bonds as well as five ways that new bond transactions can be structured.

February 5 -

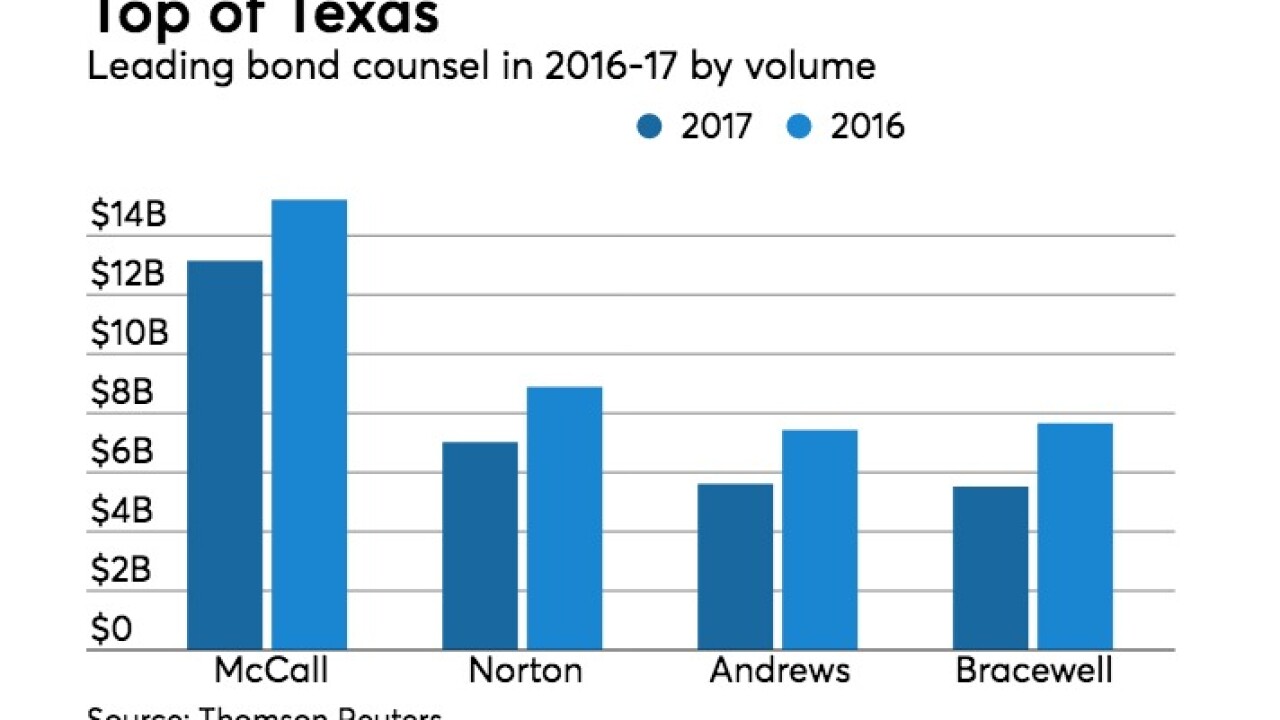

Orrick Herrington & Sutcliffe will establish its second-largest public finance team in Houston with more than two dozen hires from Andrews Kurth Kenyon.

February 5 -

Anna Sarabian specializes in general government, which includes cities, counties and special districts.

January 31 -

Sen. James Lankford, R-Okla., and Rep. Robert Pittenger, R-N.C., have asked the GAO how many tax-exempt munis were used for abortion-related facilities during the past 20 years and what was the associated federal tax liability.

January 23 -

State lawmakers will consider restructuring the Santa Rosa Bay Bridge Authority’s defaulted bonds and taking ownership of the Garcon Point Bridge.

January 10