-

Investors will see more than $7.8 billion of supply to start off September, following a record issuance month in August. The calendar is led by the North Texas Tollway Authority's $1.126 billion of system revenue refunding bonds while high-grade Massachusetts leads the competitive slate with $850 million of exempt and taxable general obligation bonds.

August 30 -

The sale follows the utility's successful initiation of two nuclear power units in the last 13 months.

August 29 -

Chicago will bring to market $1 billion of bonds for O'Hare International Airport, part one of a three-phase financing plan for 2024.

August 28 -

The East County AWP Joint Powers Authority plans to construct a water reclamation project using the debt.

August 27 -

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

New York state's issuers topped the Northeast charts as issuance rose in nearly every sector of the market during the first half of 2024.

August 19 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

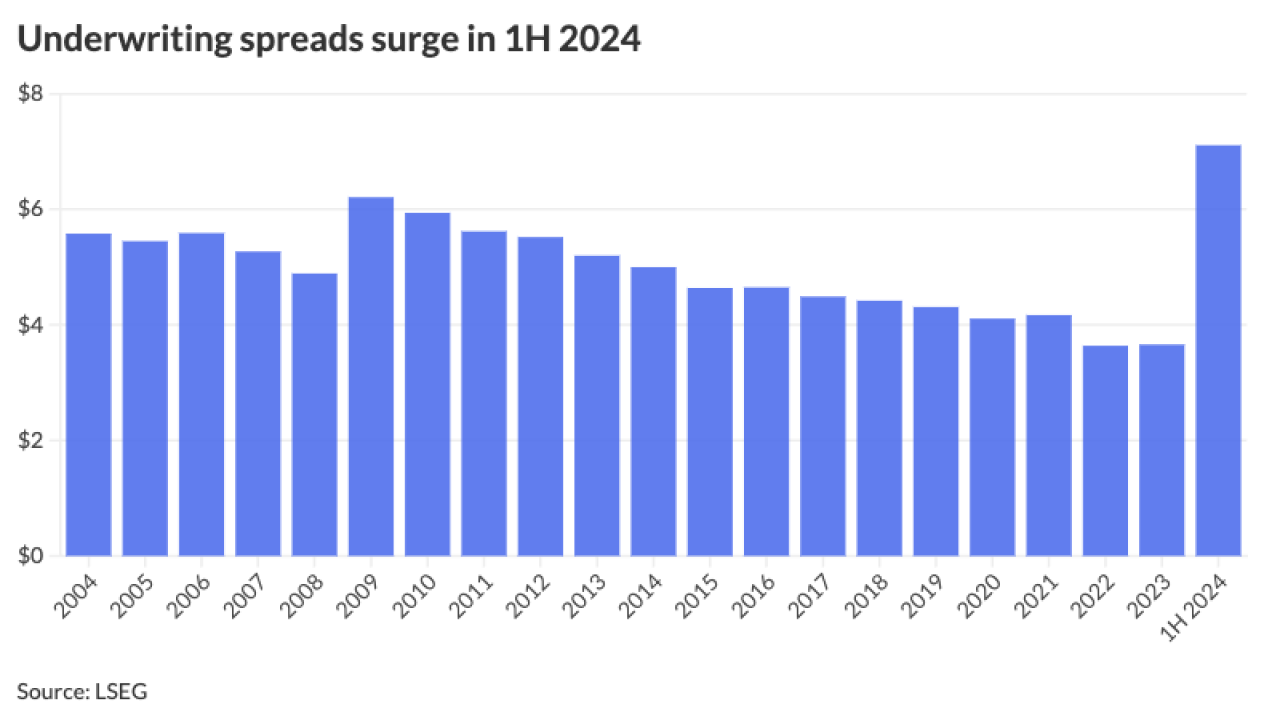

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

Dallas Fort Worth International Airport received a S&P rating upgrade and a positive rating outlook from Moody's ahead of a $750 million bond sale next week.

August 13