-

The New York MTA has not sold fixed-rate transportation revenue bonds since February 2021. The first maturity of that deal (4% 11/15/44) priced at +81 and was evaluated at +78 as of Wednesday by BVAL, according to CreditSights strategists. The same maturity but with a 5% coupon was priced at +59 to BVAL.

March 18 -

Marc Livolsi was promoted to lead U.S. Public Finance New Issue Marketing and Business Development, and Evan Boulukos will lead Assured's Secondary Markets desk, both of whom will report to Chris Chafizadeh, senior managing director and co-head of Public Finance.

March 18 -

"While rate volatility returned this week, should the market return to range-bound levels for a protracted period of time, investors might want to add exposure to sectors that provide the most value and have underperformed thus far," Barclays said.

March 15 -

Inflows continued for the third consecutive week as LSEG Lipper report fund inflows of $295.5 million for the week ending Wednesday with high-yield hitting the 10th consecutive week of positive flows.

March 14 -

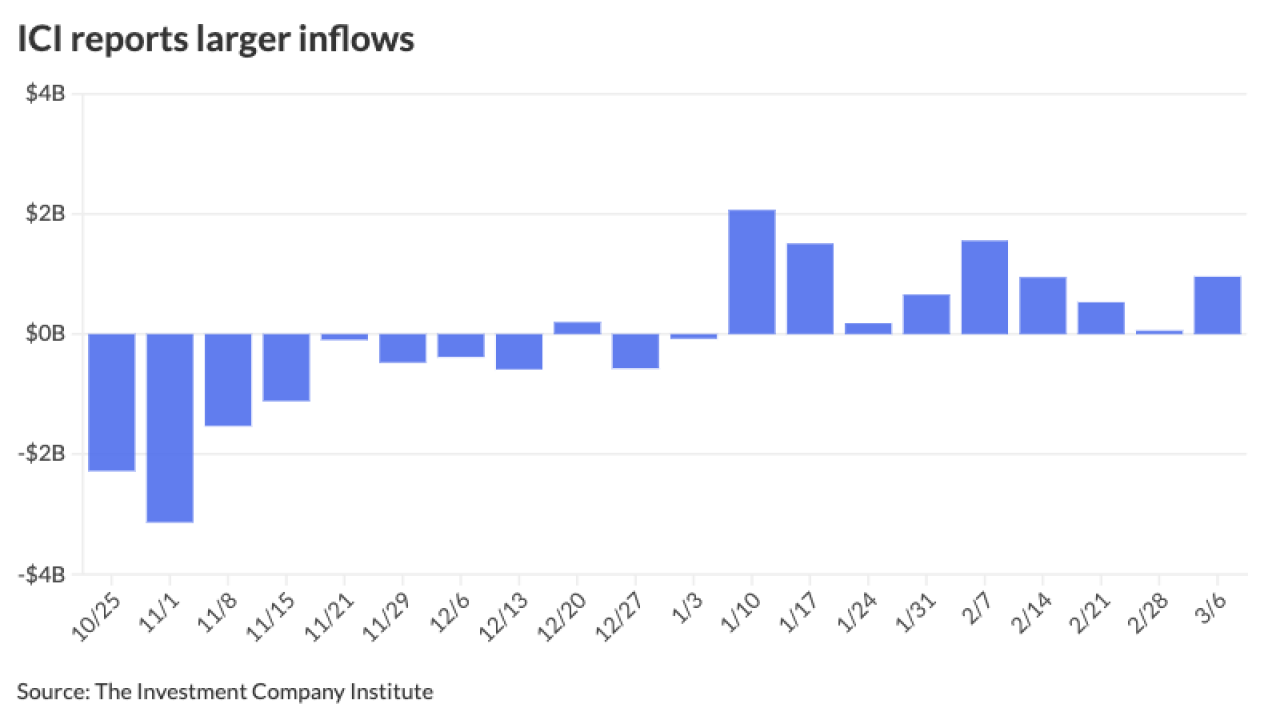

The Investment Company Institute reported larger inflows into municipal bond mutual funds for the week ending March 6, with investors adding $956 million to funds following $57 million the week prior.

March 13 -

Narens' hiring complements Stifel's public finance practice and the types of deals the firm is doing, said Betsy Kiehn, managing director and head of Stifel's Municipal Capital Markets Group.

March 13 -

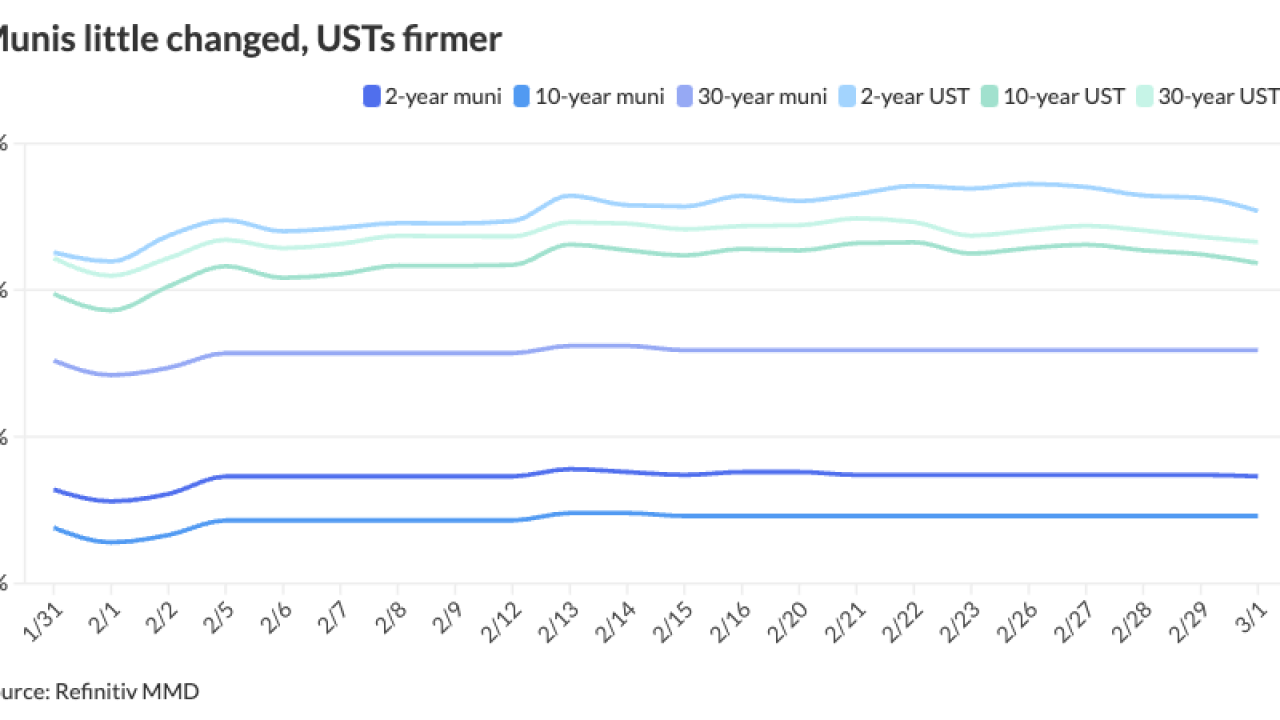

"The muni AAA [high grade] curve has been relatively steady thus far in March, but lags relative to the broader fixed income market after sizable muni outperformance in February," said J.P. Morgan strategists.

March 12 -

Issuers have increased their debt sale in recent weeks, as issuance has come in above $70 billion year-to-date, according to LSEG data

March 11 -

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

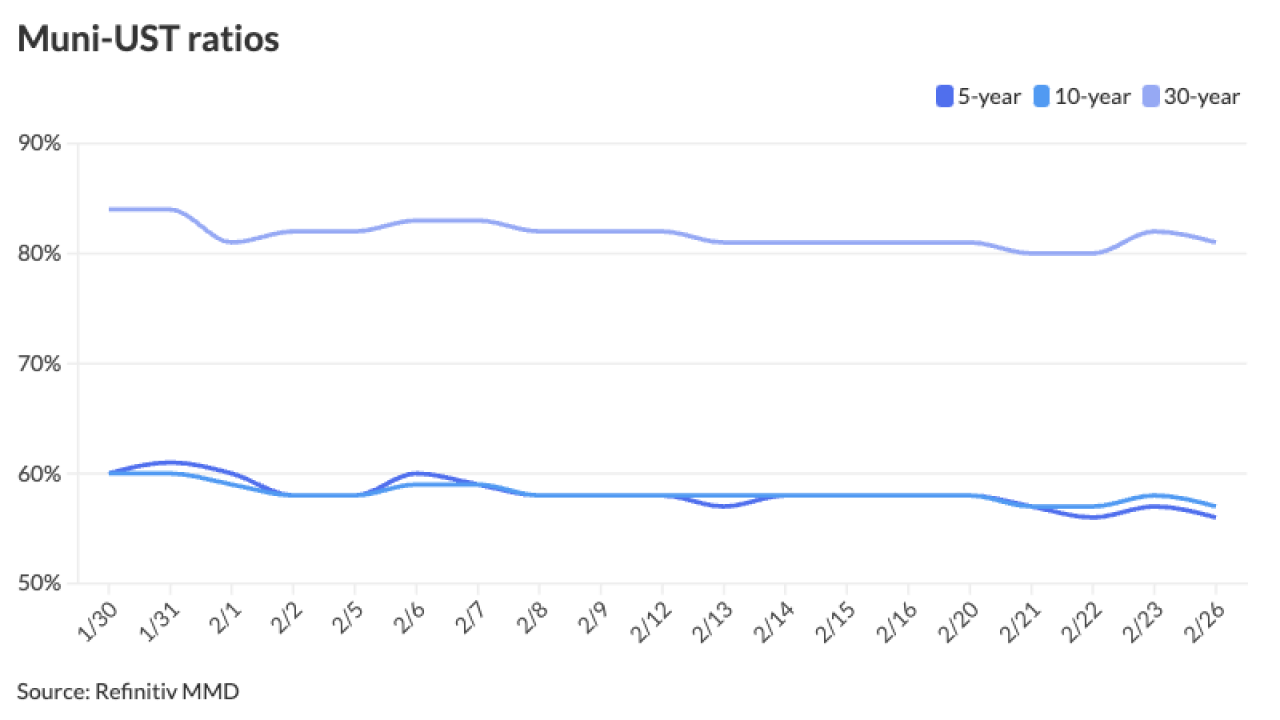

The market is being led more by supply and demand than ratios or even rates. As ratios sit at extremely tight levels, there are buyers engaging at these levels, but large amounts of cash continue to sit on the sidelines.

March 7 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

Large deals were repriced to lower yields while the secondary market was lightly traded, leading to little changed triple-A yield curves and underperformance to Treasury market gains. Despite a growing calendar, the supply demand imbalance remains with much cash on the sidelines.

March 5 -

The muni market "exhibited similar themes from the past few weeks as extremely rich valuations and the upcoming unfavorable supply/demand picture have led to a measured buyer base," said Birch Creek Capital strategists in a report.

March 4 -

The negotiated calendar is led by the Regents of the University of California with nearly $1 billion of general revenue bonds.

March 1 -

The new guidance modifies rules that stretch back to 2005.

March 1 -

Municipals look poised to close out February a touch in the black following a more constructive tone Thursday after being in a 'holding pattern' for much of the past two weeks.

February 29 -

Issuance is already slated to be healthy next week, with some large deals on the calendar.

February 28 -

Munis should remain well bid until issuance picks up "dramatically," said Nuveen's Anders S. Persson and Daniel J. Close.

February 27 -

CreditSights said states with the largest payments are Texas at $2 billion, Pennsylvania at $1.5 billion, South Carolina at $1.3 billion and California at $1.2 billion

February 26 -

The bonds are rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency. All four rating agencies have a stable outlook on the credit.

February 26