-

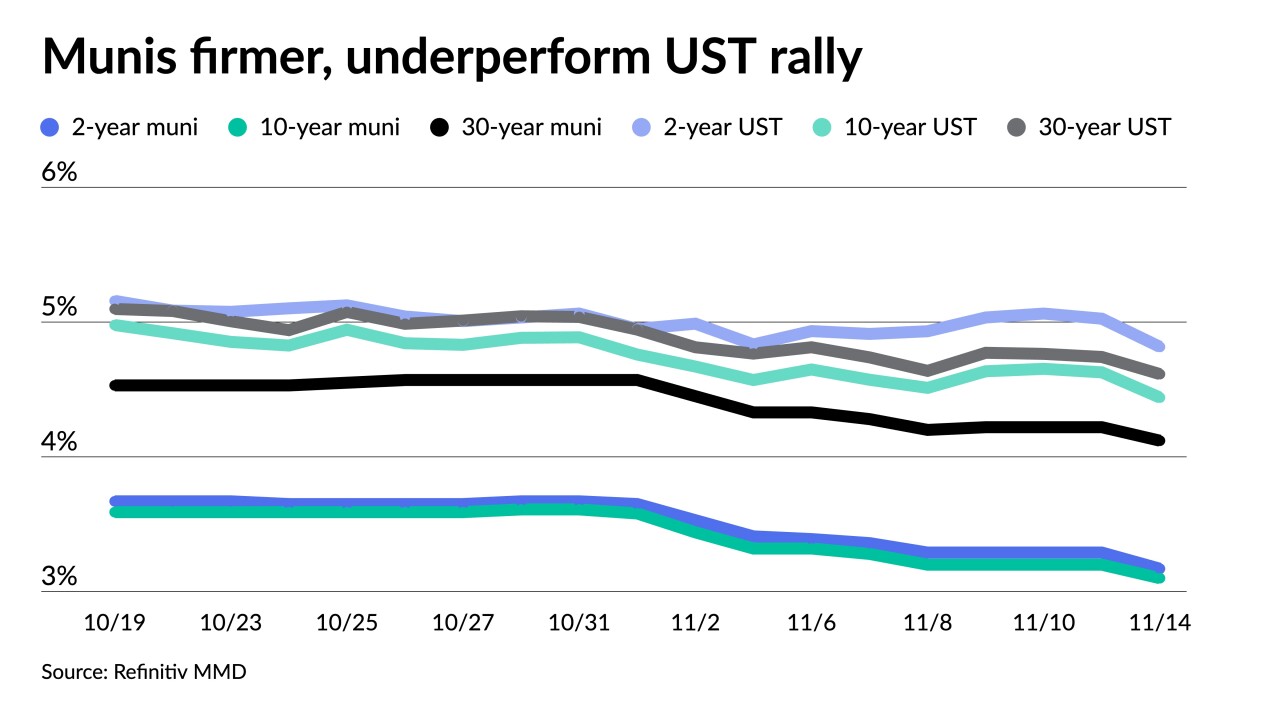

The large drop in yields since the end of October can be reflected in sentiment that investors expect a potentially dovish Fed next year, and that a soft landing narrative gives them "permission to finally purchase the bonds they've been admiring," said MMA's Matt Fabian.

November 21 -

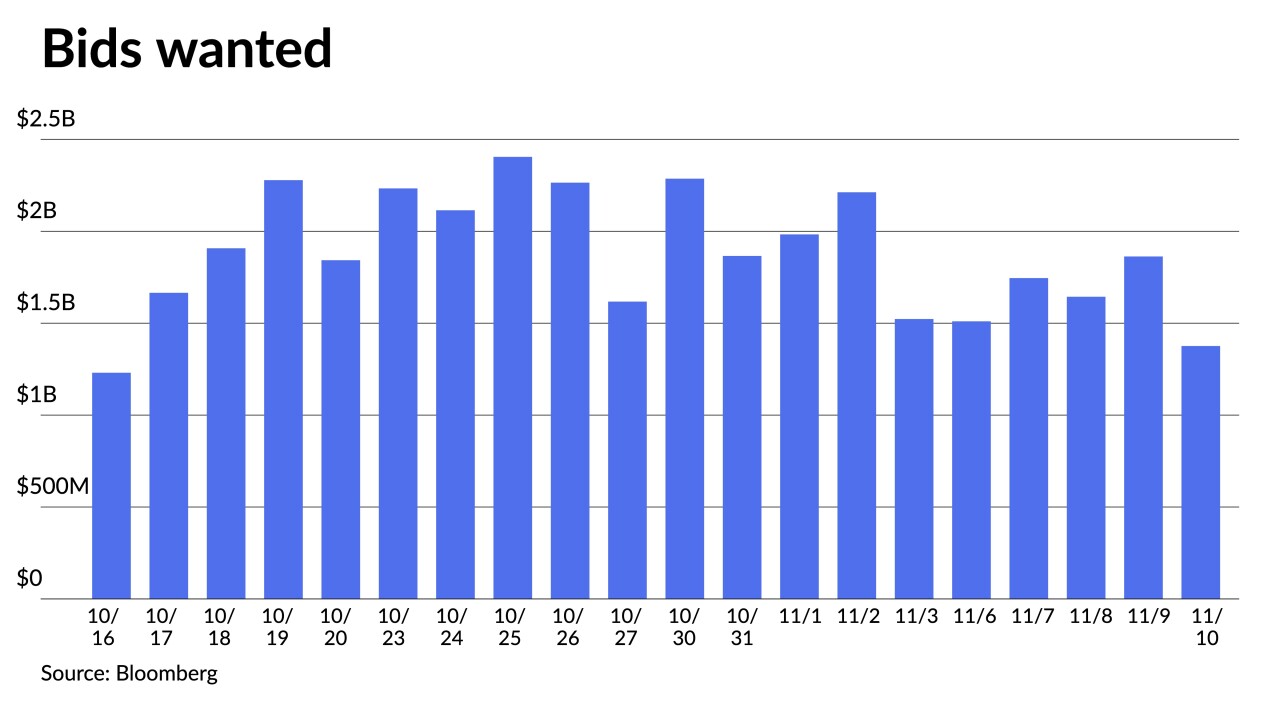

This year has seen an increase in and an earlier start to tax loss harvesting amid rapidly rising interest rates and stronger equity market performance.

November 21 -

The rally in munis over the last three weeks has "pushed ratios to levels that we have not seen since the start of the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 20 -

Tradeweb created a model that examines outstanding municipal securities, both tax-exempts and taxables, and it looks for similarities in bond features, such as maturities, call dates, use of proceeds and coupon structures.

November 20 -

BofA Global Research strategists said they believe peak muni yields in this Fed tightening cycle were attained in October 2023 and "the bull market for munis is underway."

November 17 -

The municipal dashboard solves three challenges: bond linkage, pricing and spread aggregation.

November 17 -

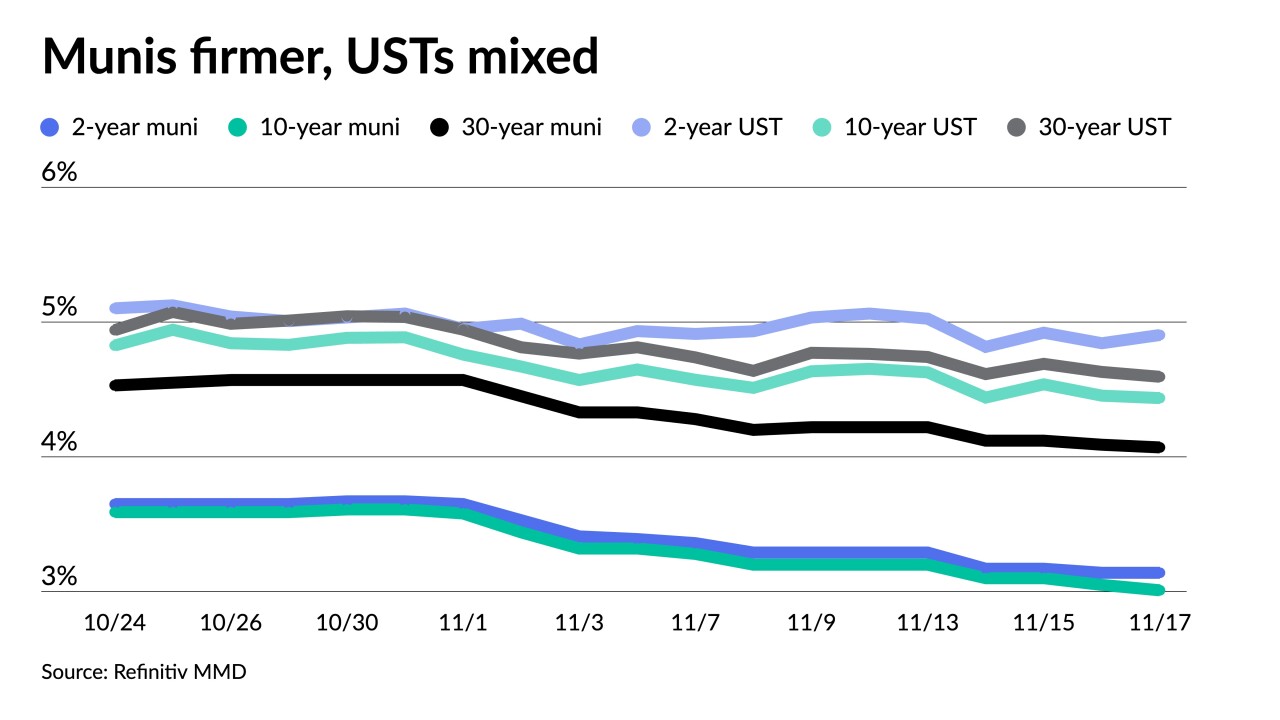

"Demand is firming up. Interest rates have moved off the recent highs. Intermediate muni yields are about 50 basis points off from those highs," said Stephen Shutz, head of tax-exempt fixed income and a portfolio manager at Brown Advisory.

November 16 -

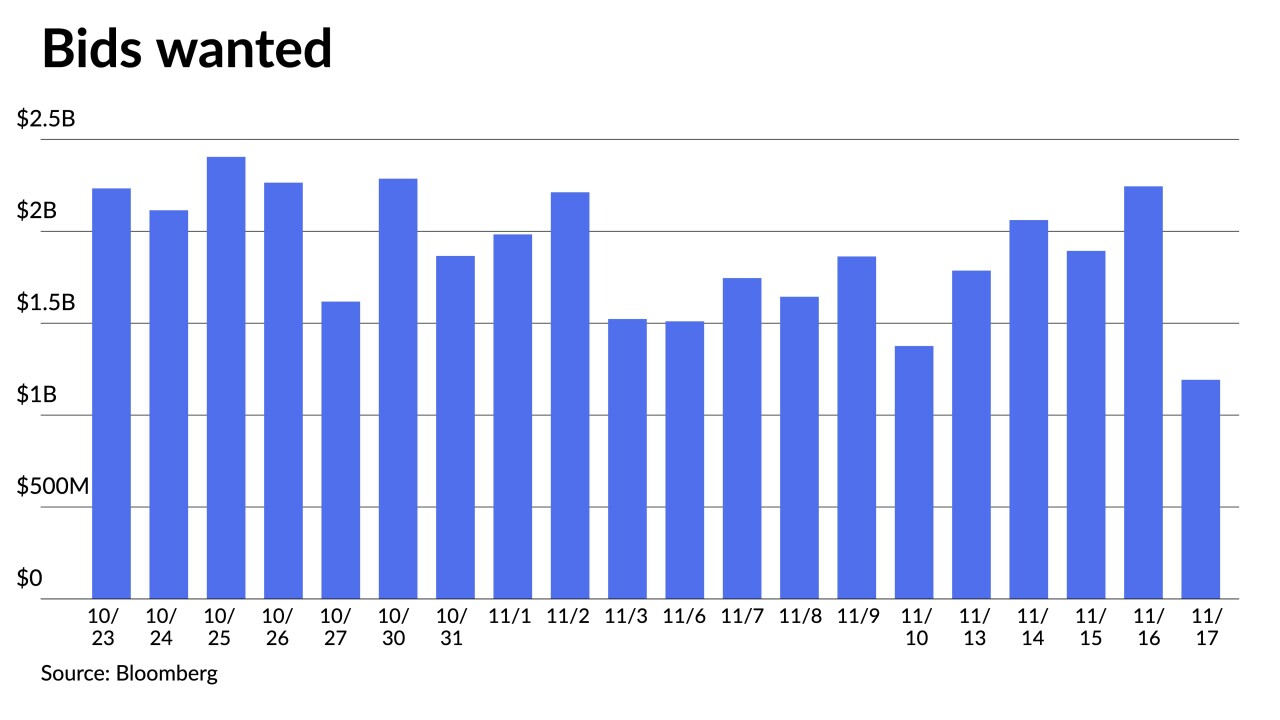

"Everyone is reevaluating and taking a breather after the numbers [on Tuesday]," a New York trader said.

November 15 -

Munis yields fell nine to 12 basis points, depending on the curve, but underperformed larger gains along the UST curve. Large new-issues began pricing.

November 14 -

November "continues to be off to a strong start as yields have fallen an average of 34 basis points across the curve since the start of the month," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 13