-

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

July 22 -

The new-issue calendar is at $9.7 billion the week, led by the Texas Transportation Commission with $1.7 billion of first-tier and second-tier revenue refunding bonds.

July 19 -

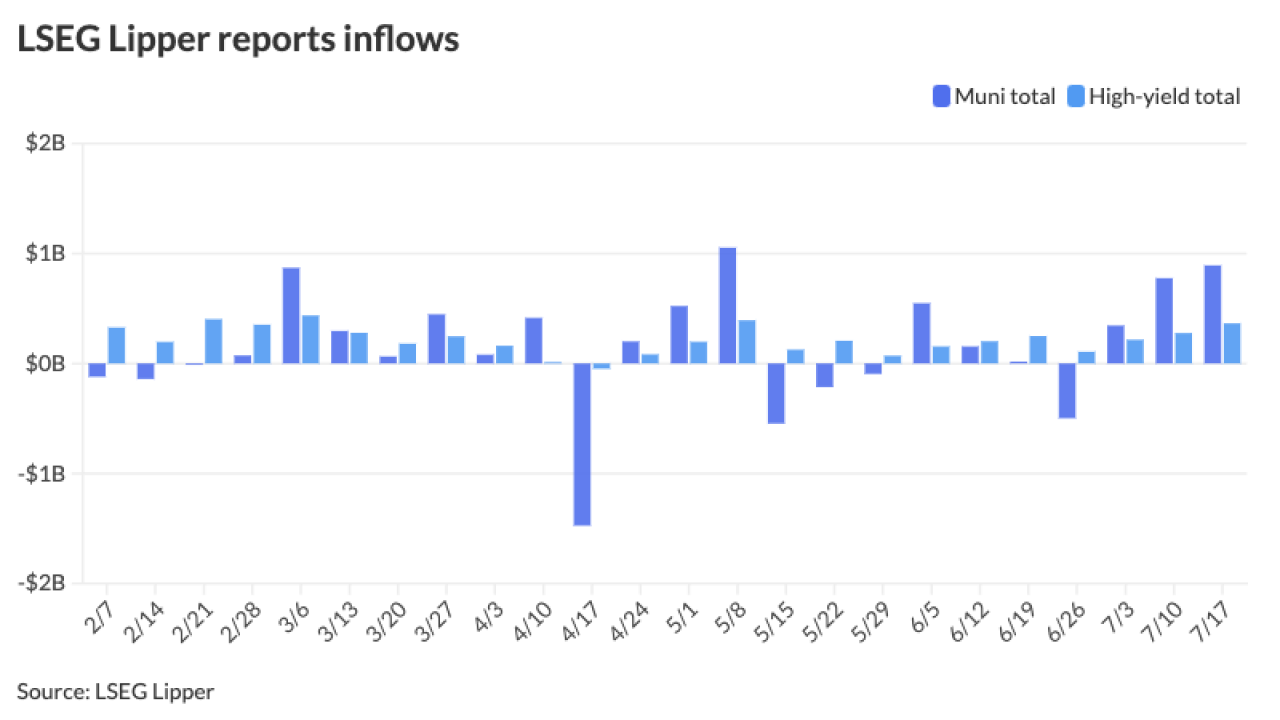

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after $775.3 million of inflows the week prior, according to LSEG Lipper.

July 18 -

Single party control of a state eases perception of bond default risk associated with laws like Chapter 9, a study found.

July 18 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Volume is predicted to continue at "robust levels," possibly through the fourth quarter, said Matt Fabian, a partner at Municipal Market Analytics.

July 16 -

Financial markets are trying to "absorb" the outcome of higher odds of Trump winning in November, said James Pruskowski, chief investment officer at 16Rock Asset Management.

July 15 -

In the summer, the market will largely move "sideways" and underperform late in the third quarter to early in the fourth quarter, "while possibly recouping most of its losses late in the year depending on the outcome of November elections," said Barclays strategists.

July 12 -

"Bond yields are plunging [Thursday] as rate cut expectations soar following this morning's consumer price index release, which depicted the first month of deflation since July 2022," noted José Torres, senior economist at Interactive Brokers.

July 11 -

Large-scale issuers, including state-level transportation authorities, counties and sales tax entities, have "planned volume to coincide with implied demand," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 10 -

Overall, demand is "high," an ongoing tailwind for munis, along with solid fundamentals, Nuveen strategists said.

July 9 -

Competitive deals are slated to total about $2.9 billion, near the highest for any week this year, said J.P. Morgan strategists.

July 8 -

The new-issue calendar rises to $9.175 billion next week, with $6.089 billion of negotiated deals coming to market and $3.086 billion of competitive deals on tap.

July 5 -

"The forces of municipal fundamental and technical measures are setting up a reconciliation against higher UST yields," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 3 -

July will see $35.2 billion of redemptions, down 13% month-over-month but still 35% higher than 2024's monthly average of $27 billion, said Pat Luby, head of municipal strategy at CreditSights.

July 3 -

"With a nonexistent new-issue calendar and heavy dealer balance sheets, we expect the muni market to get a bit 'grabby' over the next few weeks," AllianceBernstein strategists said.

July 2 -

"While valuations are still historically tight, the extra demand through the summer should help support the muni market in the coming weeks," Birch Creek strategists said.

July 1 -

In a week that culminated in headline-grabbing events — a presidential debate, several Supreme Court decisions, more macroeconomic data to add to Fed policy expectations — municipals closed on a quiet note and in the black for June.

June 28 -

Municipal bond mutual funds saw outflows as investors pulled $498 million from funds after $16 million of inflows the week prior, according to LSEG Lipper. High-yield funds still saw inflows.

June 27 -

June supply appears to be finishing above $45 billion, the third highest monthly total in the last 10 years, said Kim Olsan, vice president of municipal bond trading at FHN Financial.

June 26