-

High-yield muni issuance totals $20 billion year-to-date, "reflecting normalization from relatively depressed levels in 2023 ($7.6 billion over the comparable period), and now virtually equal to the trailing five-year average for the period ($20.1 billion)," said J.P. Morgan strategists, led by Peter DeGroot.

September 26 -

The Investment Company Institute reported $1.329 billion of inflows into municipal bond mutual funds for the week ending Sept. 18 after $1.402 billion of inflows the week prior. Exchange-traded funds saw $55 million of inflows after $1.048 billion of inflows the previous week.

September 25 -

Demand for munis looks "fairly stable" for now, particularly after the 10- to 25-basis-point rally ended in the 30 days before the Federal Reserve cut rates last week, Municipal Market Analytics, Inc. said, noting the "bull-steepening adjustment" looks like the 30-day move before the beginning of the Fed's last cutting cycle, at the end of July 2019.

September 24 -

Several factors make the current market "an attractive entry point" into the muni market, AllianceBernstein strategists said. For one, municipal valuations are cheap to fair value relative to U.S. Treasuries, partially due to the surge of supply in 2024.

September 23 -

"Active ETFs are becoming an integral part of investor portfolios around the world, with financial advisors increasingly incorporating them into their models-based practice," a BlackRock spokesperson said.

September 23 -

"Should September's positive returns hold as we expect, it would mark the fourth consecutive month of positive total returns — the first such period since the five-month period spanning from March through July 2021," BofA strategists Yingchen Li and Ian Rogow said.

September 20 -

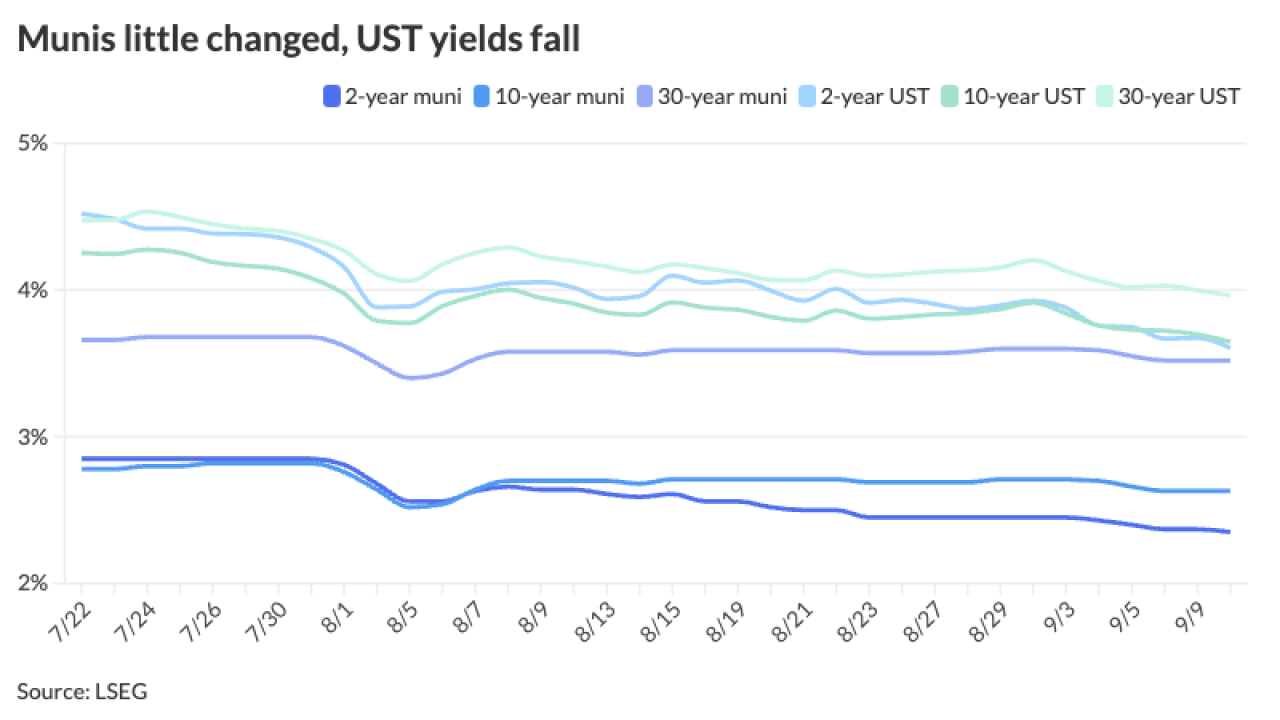

While the municipal market barely budged following the Fed's decision to cut rates 50 basis points, Thursday saw muni yields rise up to two basis points, depending on the scale, but still lagged the weakness in USTs. LSEG Lipper reported $716 million of inflows into municipal bond mutual funds.

September 19 -

The product is designed to give SOLVE's customers visibility into "next-trade" pricing data for more than 900,000 munis.

September 19 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Fed rate cuts "should lead to positive price action for both taxable and tax-exempt bonds, and current nominal yields remain well above where they were when the Fed was more dovish, implying generous room to rally from here," said Matt Fabian, a partner at Municipal Market Analytics, Inc.

September 17 -

Despite the underperformance to USTs, munis saw positive momentum during the first two weeks of September with the asset class returning 0.68% so far this month and 1.99% year-to-date.

September 16 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

Ciraolo, who spent more than 17 years at Goldman Sachs, has been brought on as a senior vice president in corporate and municipal short-term securities to help expand SWS' taxable muni franchise through commercial paper trading.

September 6 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5 -

Most weeks in September are expected to see around $10 billion of issuance, which could easily grow if a prepaid gas deal is thrown into the mix, said Jason Appleson, head of municipal bonds at PGIM Fixed Income. Bond Buyer 30-day visible supply sits at $16.46 billion.

September 4