-

Issuance remains heavy this week, but while it's elevated, the muni market is "structurally undersupplied," meaning if 2024's record level of $500 billion-plus of issuance was doubled, the market could still digest it quite well, said Wesly Pate, a senior portfolio manager at Income Research + Management.

March 5 -

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

"Apathy and caution" were the theme of the past week, said Birch Creek strategists.

March 3 -

The Trump administration wants to shed federal office space, and bonds backed by those leases are feeling the heat.

March 3 -

New York City leads the negotiated calendar with $1.4 billion of GOs, followed by the Regents of the University of California with $1.2 billion of general revenue bonds.

February 28 -

While UST yields rose up to five basis points out long Thursday, the current rally "that has taken the 30-year UST closer to where the 10-year yield traded a week ago has not impacted the same range in munis," said Kim Olsan, senior fixed income portfolio manager at NewSquare.

February 27 -

It has been a bit of a "heavy start" to the year for issuance, said Jeff Devine, a municipal research analyst at GW&K.

February 26 -

Muni prices continue to "show relative resilience" despite a nearly record pace of issuance, said Matt Fabian, a partner at Municipal Market Analytics.

February 25 -

Last week, "there was no meaningful economic data to digest and yields were slightly lower," said Daryl Clements, a portfolio manager at AllianceBernstein.

February 24 -

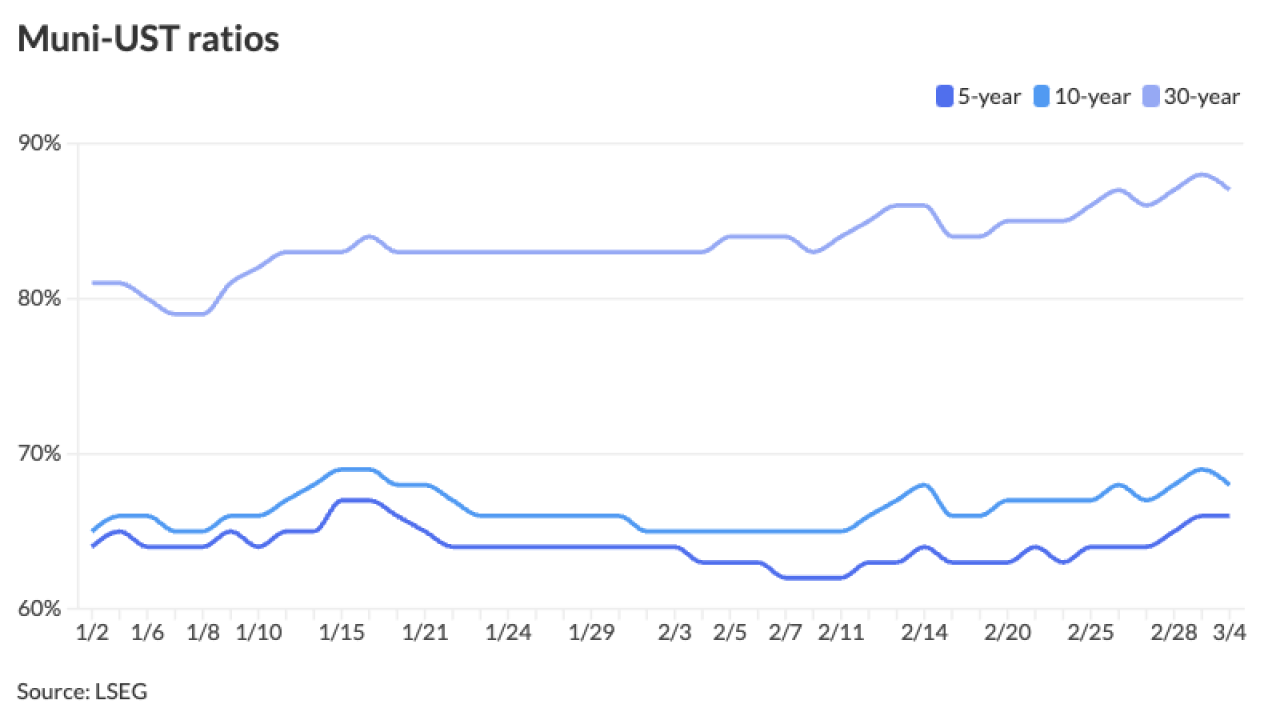

Market activity has been somewhat "subdued," and USTs yields have been "relatively well-behaved," though the 10- to 30-year rates have slightly underperformed, moving up three to five basis points, said Barclays strategist Mikhail Foux.

February 21 -

The Trump administration singled out the Las Vegas-Los Angeles bullet train for praise Thursday, the same day the deal priced.

February 21 -

Investors added $546.3 million to municipal bond mutual funds in the week ending Wednesday, following $238.5 million of inflows the prior week, according to LSEG Lipper data.

February 20 -

The Investment Company Institute reported outflows of $336 million for the week ending Feb. 12, following $852 million of inflows the previous week.

February 19 -

Municipals were narrowly mixed to start the holiday-shortened week, but the lighter supply should buoy the market.

February 18 -

Most federal lease debt has large bullet maturities that require refinancing, asset sales or a new lease to avoid default.

February 18 -

An investor-driven selloff followed the Los Angeles wildfires. ICE Data Services experts join to discuss the reaction, credit impact and growing role of climate risk data.

February 18 -

"This week's rate volatility made muni trading challenging as Treasury rates have been moving up and down abruptly on the back of inflation releases and tariff news," said Barclays strategist Mikhail Foux.

February 14 -

Investors added $238.5 million to municipal bond mutual funds in the week ending Wednesday, following $1.124 billion of inflows the prior week, according to LSEG Lipper data.

February 13 -

Portfolio managers seem more sanguine about threats to the tax exemption from Congress.

February 13 -

Inflation is front and center this week, with the consumer price index report released on Wednesday and the producer price index on Thursday.

February 12