-

The MSRB has taken the relatively rare step of asking for public comments on a draft set of frequently asked questions related to the board's primary muni advisor rule.

February 15 -

The Municipal Securities Rulemaking Board wants to prepare broker-dealers for a forthcoming seismic regulatory change.

February 13 -

The Securities and Exchange Commission's spending would be beefed up and its focus on retail investors and self-regulators in the municipal market would be increased under the fiscal 2019 budget request made public Monday.

February 12 -

The Bond Dealers of America is proposing a multi-faceted "business plan" that would give dealers more time to comply with a rule requiring them to disclose their markups and markdowns to retail customers.

February 8 -

MA and broker-dealer compliance with relatively new rules, as well as the MSRB and FINRA, will be in the spotlight.

February 7 -

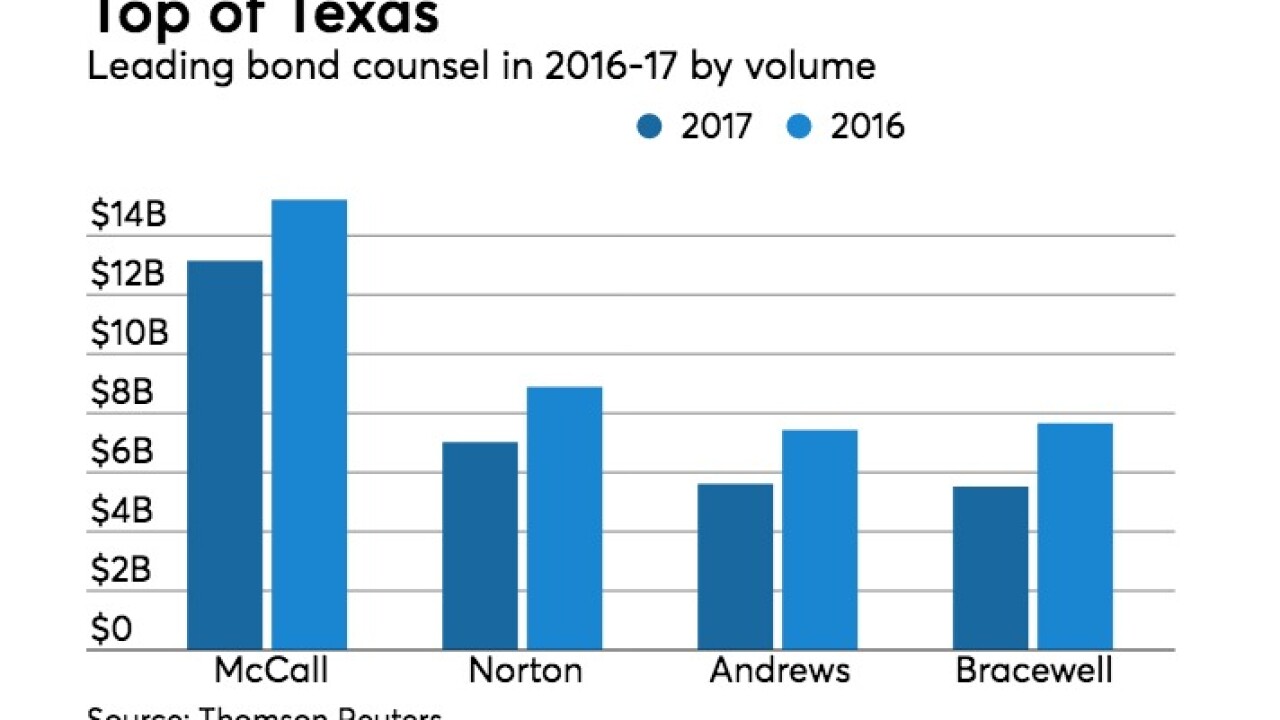

Orrick Herrington & Sutcliffe will establish its second-largest public finance team in Houston with more than two dozen hires from Andrews Kurth Kenyon.

February 5 -

All but one of the remaining defendants in the Securities and Exchange Commission's case against Ramapo, N.Y., have agreed to settlement terms, according to court documents.

February 2 -

The sanctions involved eight transactions of Alaska bonds issued in 2015 and FINRA found the firm had inadequate supervisory procedures.

February 1 -

The Municipal Securities Rulemaking Board's decisions at last week's board meeting reveal that it feels a sense of urgency as the clock ticks down toward the effective date of its landmark markup disclosure rule.

January 29 -

SIFMA is urging the MSRB to be more forthcoming in providing interpretive guidance to dealers and other regulated entities.

January 24 -

The Municipal Securities Rulemaking Board issued a report saying its oversight of the muni market without enforcement power is among the advantages it offers as a self-regulator.

January 22 -

Municipal advisors would be subject to most of the same requirements as dealers under a proposed new advertising rule, but would be even more limited in certain ways.

January 19 -

The Consumer Financial Choice and Capital Markets Protection Act of 2017 would modify 2014 regulations in a way that would benefit municipal bonds and state and local governments.

January 17 -

The bill would restore an important source of liquidity for state and local governments and the financing of critical infrastructure projects in communities across the nation.

January 17

-

Three firms and an individual were fined a total of $187,500 for a range of rule violations related to the use of alternative trading systems, spending during rating agency trips, unsuitable trading, and untimely reporting of munis.

January 12 -

The first meeting of the Securities and Exchange Commission’s Fixed Income Market Structure Advisory Committee focused mostly on corporate bonds and barely addressed the municipal securities market.

January 11 -

The Municipal Securities Rulemaking Board’s net assets rose about $5.1 million to $74.4M in fiscal 2017, according to audited financial statements, adding to a healthy reserve the MSRB said it needs to ensure uninterrupted operations.

January 11 -

Best execution, suitability, and other areas of concern for the municipal as well as corporate markets are among FINRA regulatory and exam priorities for 2018.

January 10 -

The SEC's first muni enforcement case of the year shows its willingness to use the Dodd Frank Act to punish some breaches of fiduciary duty that hadn't yet been spelled out by the MSRB.

January 8 -

The Municipal Securities Rulemaking Board is looking for five people knowledgeable about the muni market to sit on its board starting Oct. 1.

January 8