-

"Investors are acknowledging that the Fed is nearing the end of its rate tightening cycle which is supporting a relief rally in stocks and lower bond yields, said Bryce Doty, senior vice president at Sit Investment Associates.

February 1 -

Total volume for the month was $21.931 billion in 417 issues versus $26.292 billion in 770 issues a year earlier, according to Refinitiv data.

January 31 -

Investors will likely sit on the sidelines until after this week's Federal Reserve Board rate announcement.

January 30 -

Investors will be greeted Monday with a new-issue calendar estimated at $847 million.

January 27 -

On the buy side, lower interest rates and an extreme imbalance between supply and demand is supporting the municipal market's positive tone, according to JB Golden, executive director and portfolio manager at Advisors Asset Management.

January 26 -

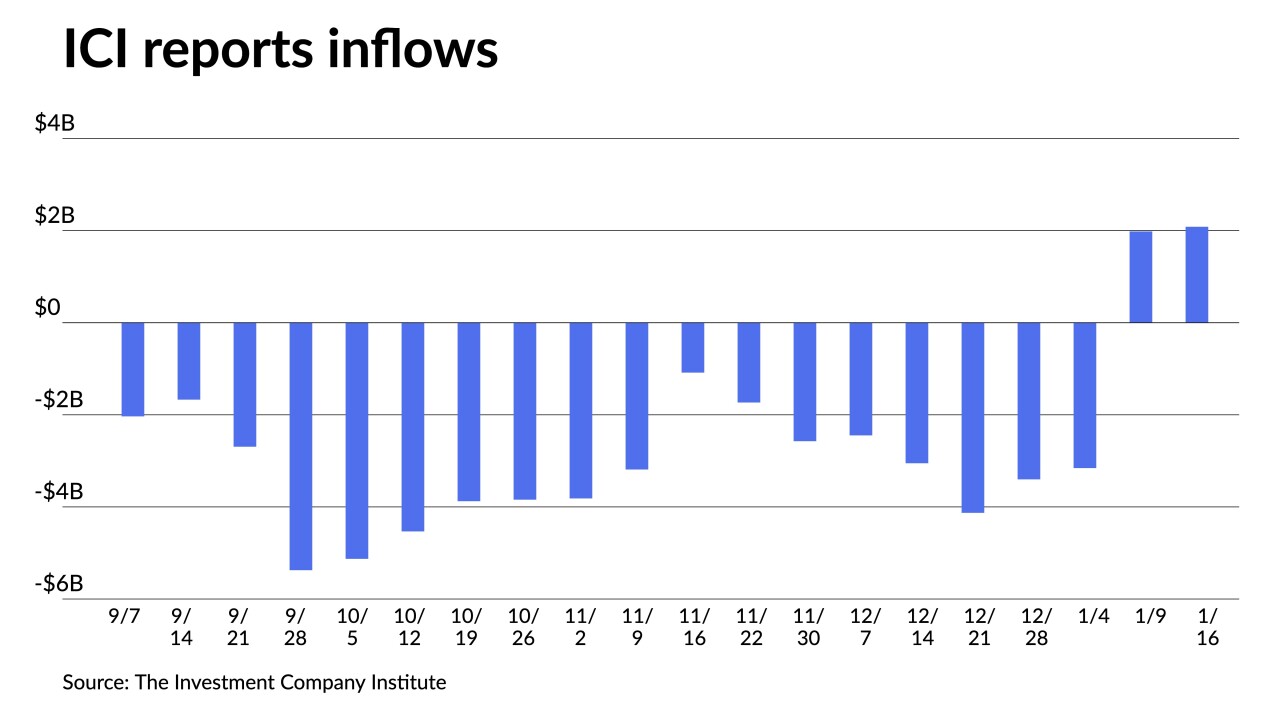

Inflows continued with the Investment Company Institute reporting investors added $2.083 billion to mutual funds in the week ending Jan. 18, after $1.982 billion of inflows the previous week.

January 25 -

The 2023 "January effect" seems to be "displaying typical behavior given relatively thin issuance this month and demand patterns that have been buoyed by four of six reinvestment needs," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 24 -

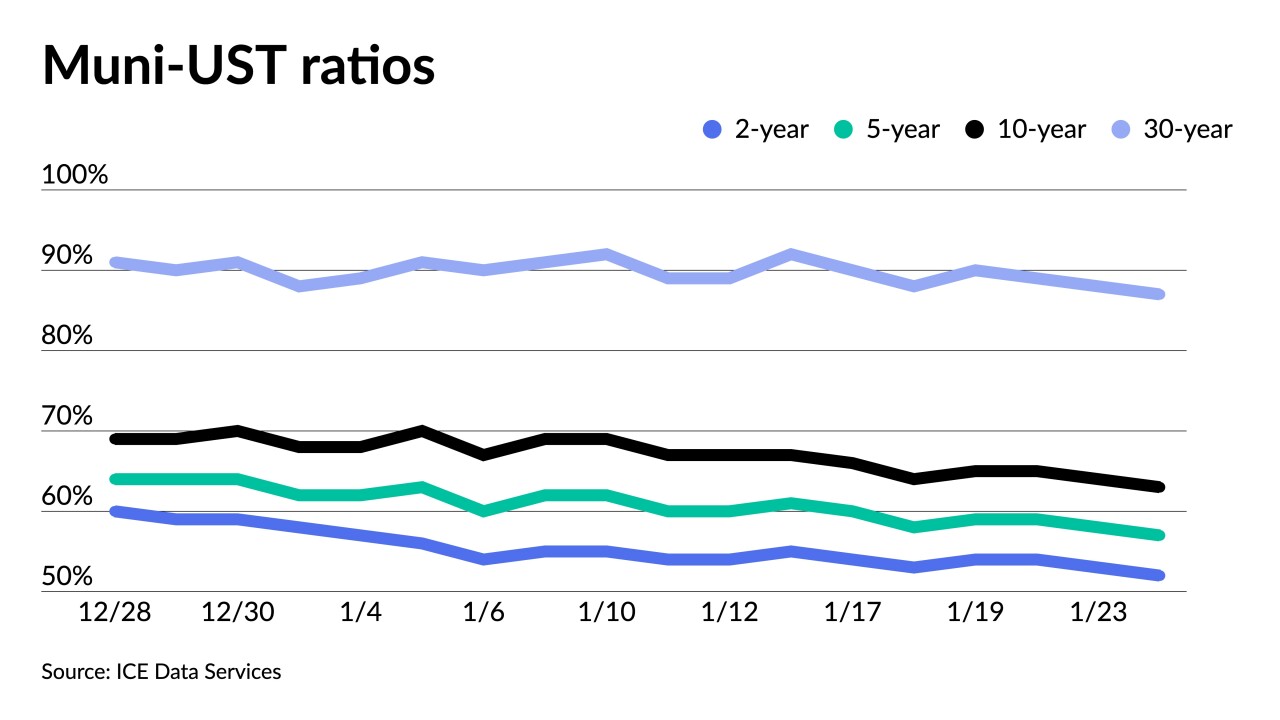

For the first time in several weeks, munis last week outperformed "by a wide margin and across the entirety of the yield curve," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

January 23 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.520 billion.

January 20 -

The primary "pumped new life into an already-firm market with a lower yield range being established," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

January 19 -

Inflows returned, with the Investment Company Institute reporting investors added $1.982 billion to mutual funds in the week ending Jan. 11, after $3.157 billion of outflows the previous week.

January 18 -

Demand for muni bonds has slowly started make a comeback, with Jason Wong, vice president of municipals at AmeriVet Securities, saying, "this demand is a welcome sign to the tax-exempt sector as rising yields pushed investors to the sidelines."

January 17 -

Volume for the upcoming week is estimated at $8.34 billion, consisting of $6.30 billion of negotiated deals and $2.04 billion of competitive sales.

January 13 -

Underwriting fees generated for the board totaled some $7.4 million, an almost 50% drop from the $14.3 million the board received in 2020.

January 13 -

Outflows lessened, with the Investment Company Institute reporting investors pulled $3.157 billion from mutual funds in the week ending Jan. 4, after $3.402 billion of outflows the previous week.

January 11 -

"There was strong demand for the Pennsylvania Housing Finance Authority deal, which was three times oversubscribed," said a New York trader.

January 10 -

This week's "manageable" calendar will continue what has been a quiet start to the new year in the municipal market, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

January 9 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.303 billion.

January 6 -

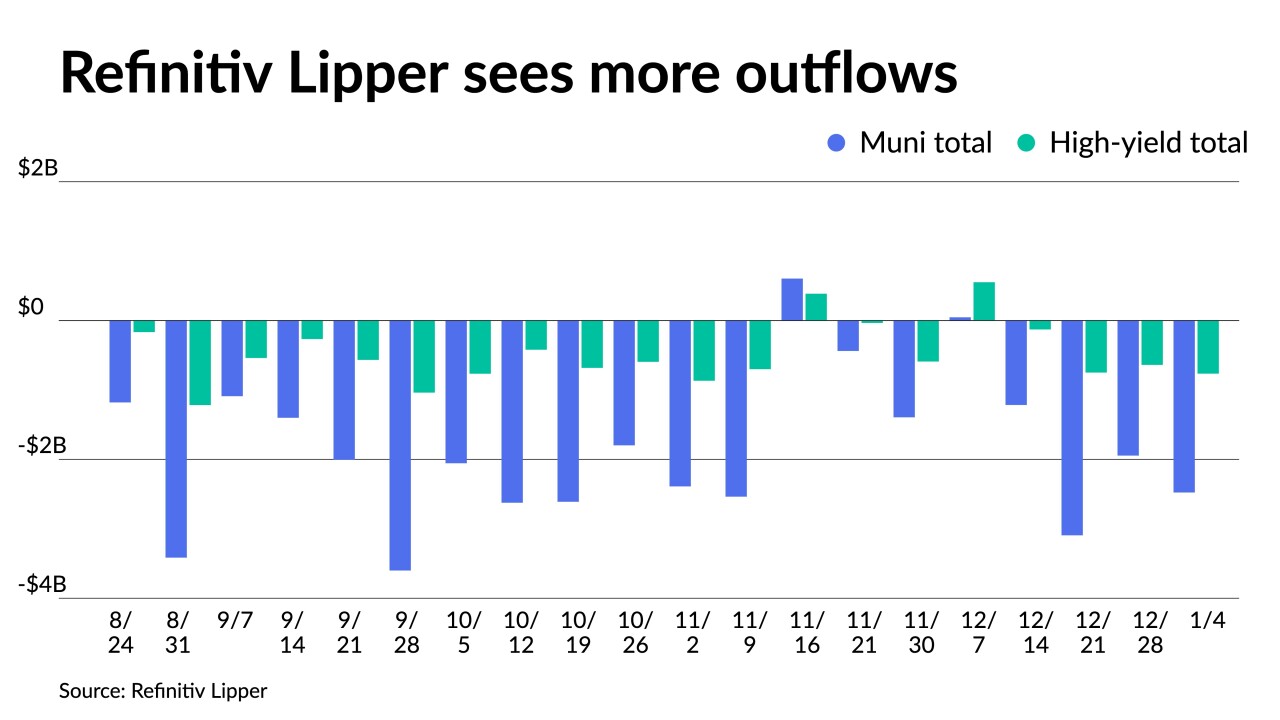

Outflows continued as Refinitiv Lipper reported $2.477 billion was pulled from municipal bond mutual funds in the week ending Wednesday after $1.946 billion of outflows the week prior.

January 5 -

The muni market "is being teed up to enter 2023 from a relative position of strength," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 3