-

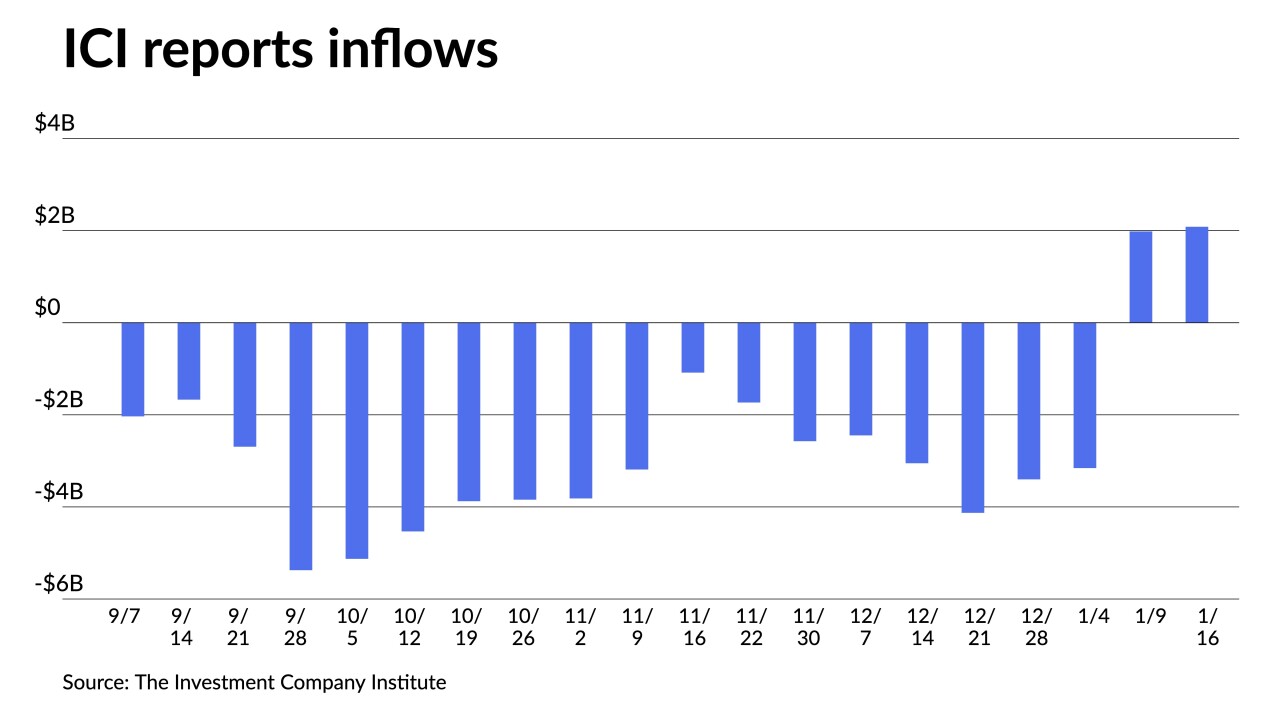

Inflows continued with the Investment Company Institute reporting investors added $2.194 billion to mutual funds in the week ending Feb. 8, after $1.471 billion of inflows the previous week.

February 15 -

"Markets were expecting (hoping, praying) to get further confirmation that a peak is in and the decline is at least steady, if not accelerating," said Jan Szilagyi, CEO and co-founder of Toggle AI.

February 14 -

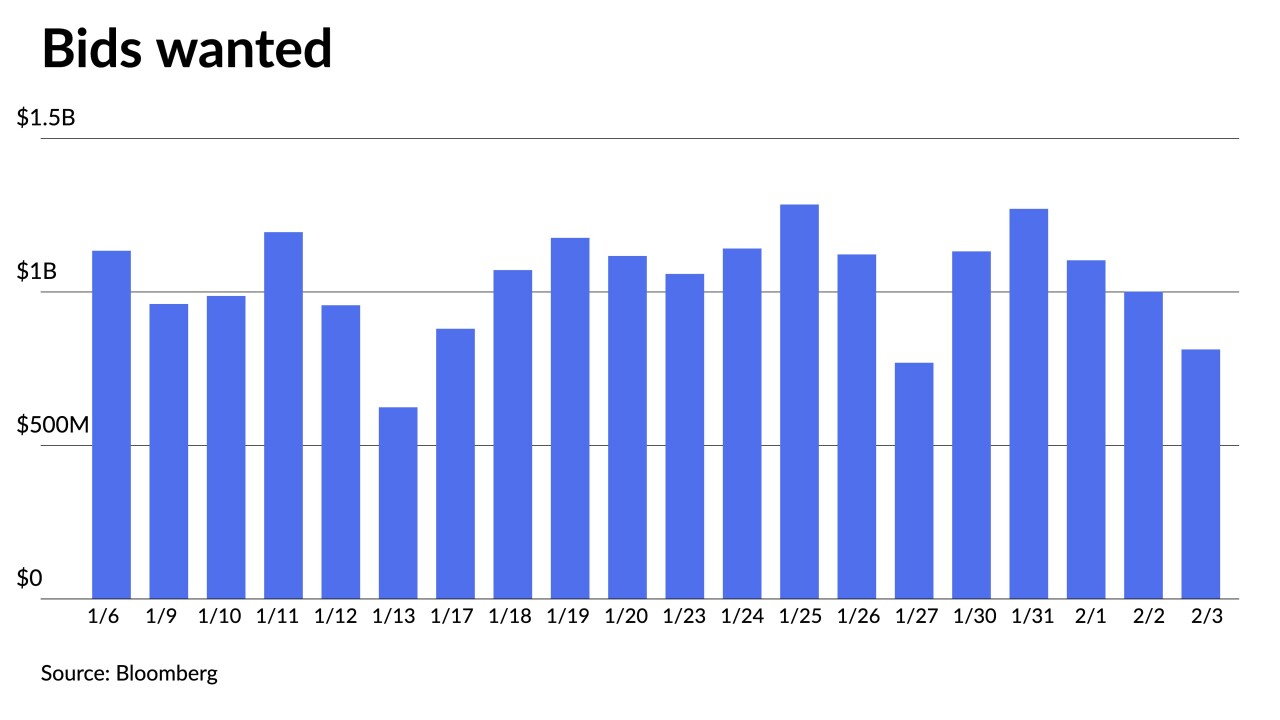

February municipal bond activity compared to last month is brisk yet more finicky in the face of an ongoing supply shortage, according to Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co.

February 13 -

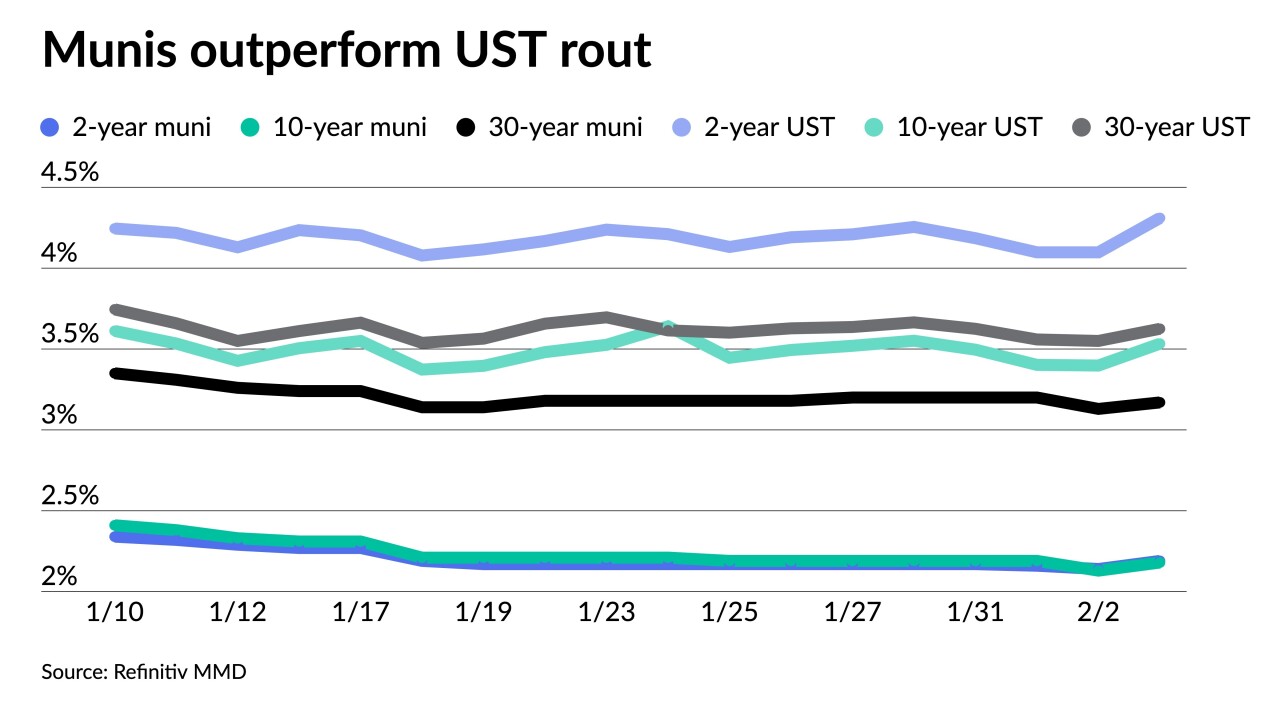

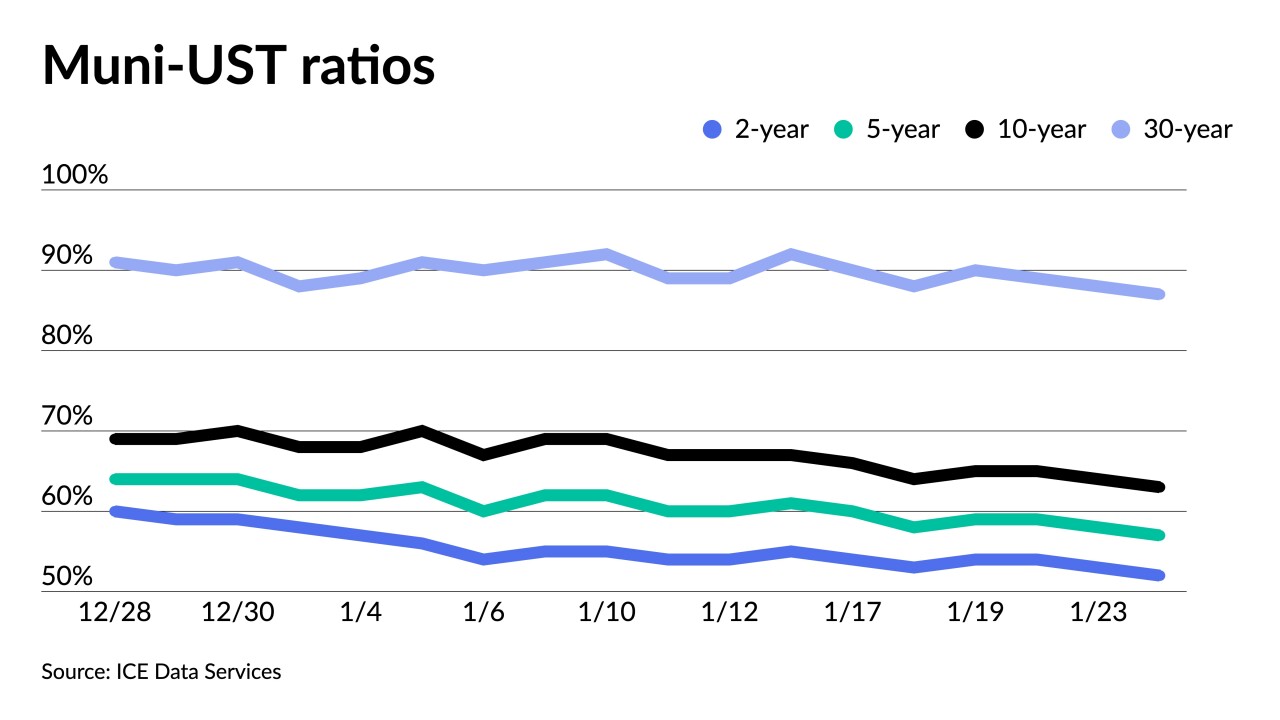

"This peculiar shape of the muni yield curve has created a conundrum for investors, as all high-quality municipal bonds, with the possible exception of the long end, have become quite rich," Barclays strategists said.

February 10 -

Inflows returned as Lipper reported $775.006 million was added to municipal bond mutual funds in the week ended Wednesday after $361.649 million of outflows the week prior.

February 9 -

Although there is some volatility in the municipal market, the landscape is in good shape, according to Cooper Howard, fixed income strategist at Charles Schwab.

February 8 -

"The market started the year with a reduction of the oppressive pressure caused by last year's heavy net outflows from mutual funds," said CreditSights strategists Pat Luby and Sam Berzok.

February 7 -

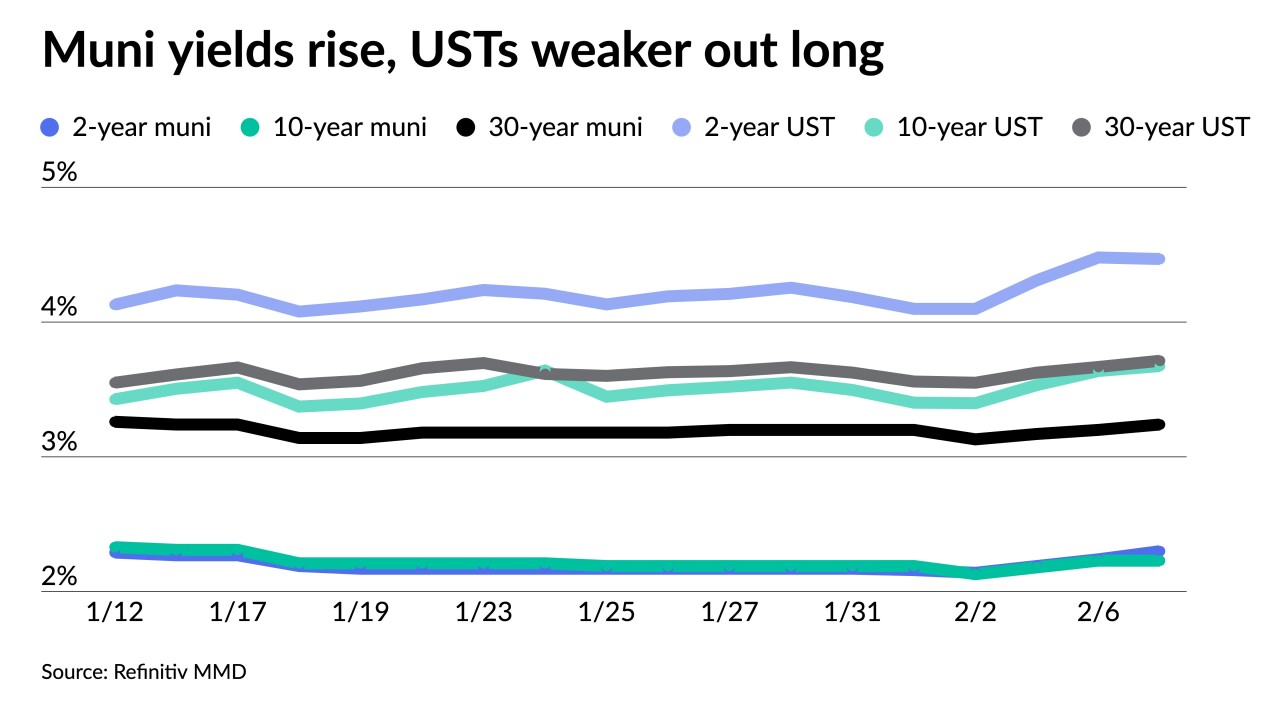

"We did see some bump in the curve as a result of the FOMC hiking rates by 25 basis points on Wednesday," said Jason Wong, vice president of municipals at AmeriVet Securities. "However, with an unexpected high employment number, fixed-income yields rose."

February 6 -

Friday's payrolls "surprised to the upside, with nonfarm payrolls increasing 517,000 last month after an upwardly revised 260,000 gain in December," Barclays strategists said.

February 3 -

A few developments in recent sessions "may have staying power should the new outlook on upcoming FOMC actions gain traction," said Kim Olsan, a senior vice president of municipal bond trading at FHN Financial.

February 2 -

"Investors are acknowledging that the Fed is nearing the end of its rate tightening cycle which is supporting a relief rally in stocks and lower bond yields, said Bryce Doty, senior vice president at Sit Investment Associates.

February 1 -

Total volume for the month was $21.931 billion in 417 issues versus $26.292 billion in 770 issues a year earlier, according to Refinitiv data.

January 31 -

Investors will likely sit on the sidelines until after this week's Federal Reserve Board rate announcement.

January 30 -

Investors will be greeted Monday with a new-issue calendar estimated at $847 million.

January 27 -

On the buy side, lower interest rates and an extreme imbalance between supply and demand is supporting the municipal market's positive tone, according to JB Golden, executive director and portfolio manager at Advisors Asset Management.

January 26 -

Inflows continued with the Investment Company Institute reporting investors added $2.083 billion to mutual funds in the week ending Jan. 18, after $1.982 billion of inflows the previous week.

January 25 -

The 2023 "January effect" seems to be "displaying typical behavior given relatively thin issuance this month and demand patterns that have been buoyed by four of six reinvestment needs," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 24 -

For the first time in several weeks, munis last week outperformed "by a wide margin and across the entirety of the yield curve," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

January 23 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.520 billion.

January 20 -

The primary "pumped new life into an already-firm market with a lower yield range being established," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

January 19