-

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

"Munis are poised to continue this rally into December as we can end 2022 on a high note and close out the worst-performing year on record for munis," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 5 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.893 billion.

December 2 -

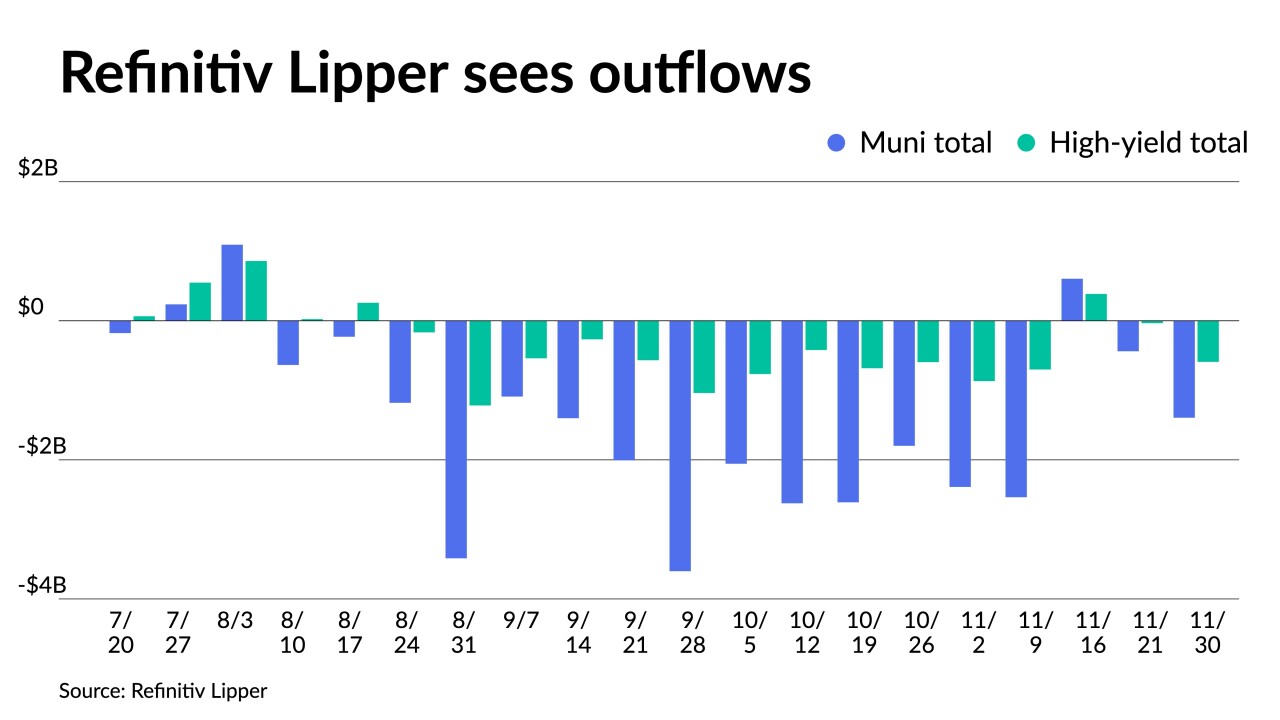

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, MMA notes in a weekly report.

November 29 -

The Bloomberg Municipal Index is at positive 4.06% as of Friday. Bloomberg indices show high-yield returning 4.17%, taxable munis returning 4.38% in November while the Impact Index is at positive 4.66%.

November 28 -

Markets took the news that it will soon be appropriate to increase the Fed funds target rate at a slower pace as good news.

November 23 -

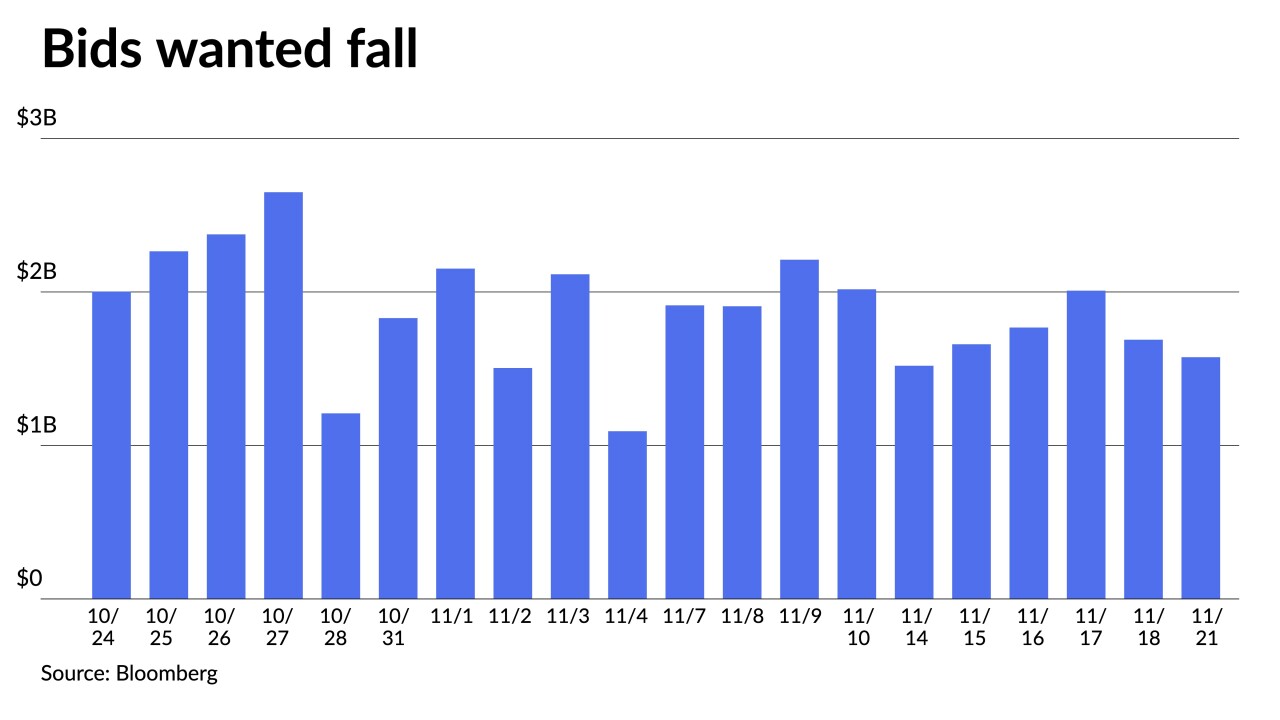

Lower supply in 2022 has somewhat helped the market avoid larger losses, many participants have said.

November 22 -

The negotiated calendar this week is very light due to the Thanksgiving holiday, with only four deals above $100 million.

November 21