-

For the coming week, investors will be greeted with a new-issue calendar estimated at $304.5 million. This marks the lowest week of issuance in 2023.

June 30 -

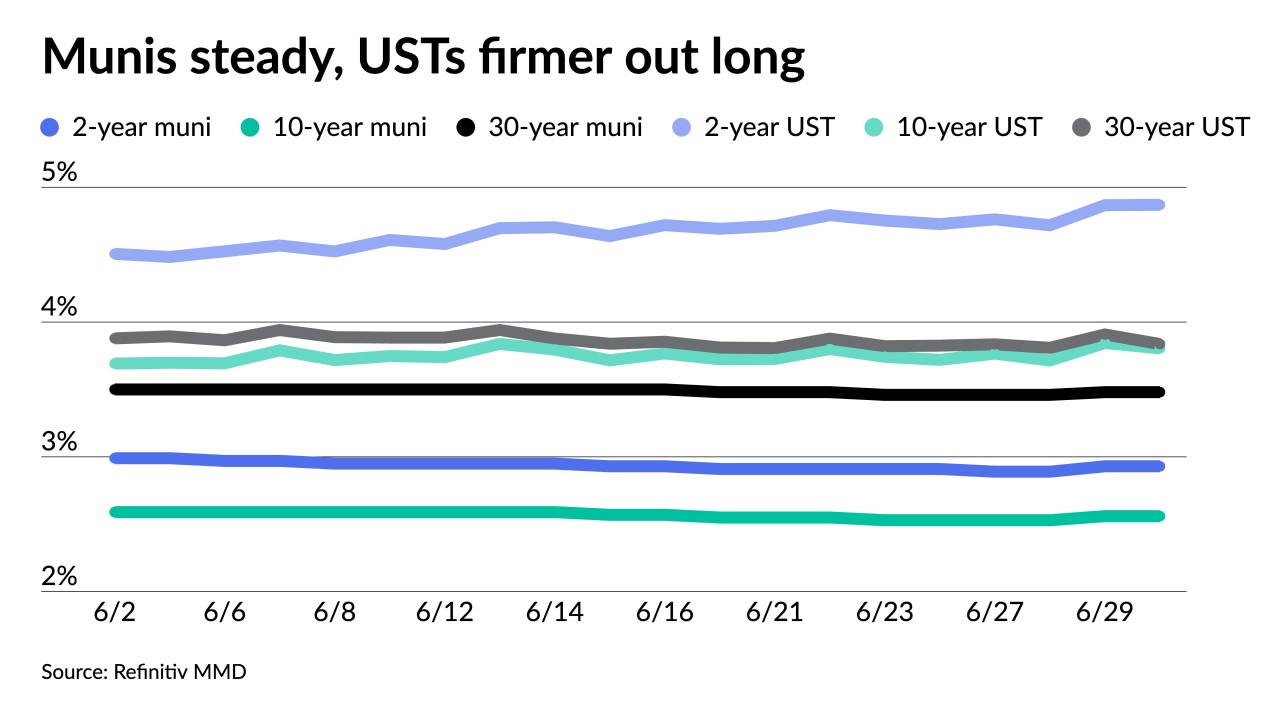

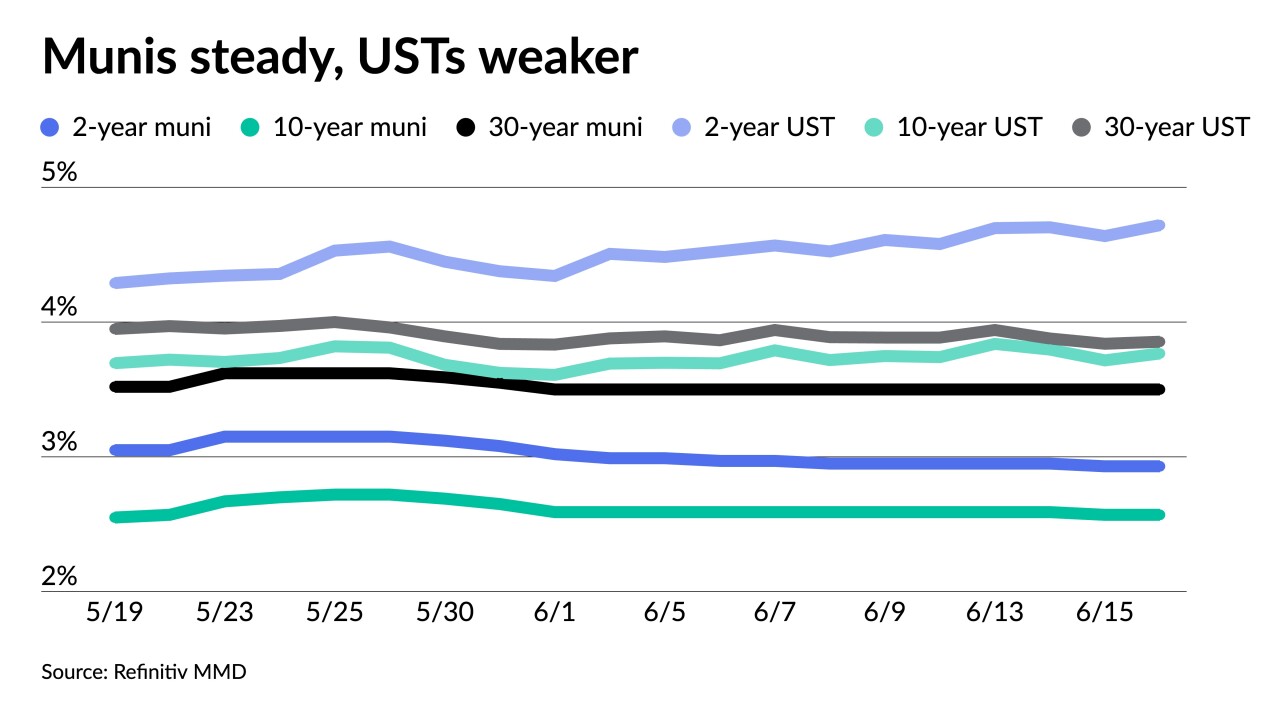

Triple-A yields rose one to five basis points, depending on the scale, as secondary trading showed cheaper prints and some new-issues had to be cheapened to clear the market while USTs saw larger losses of up to 16 basis points on the three and five year.

June 29 -

With the first half of the year ending on Friday, municipal sources say the second half of the year will be off to a good start.

June 28 -

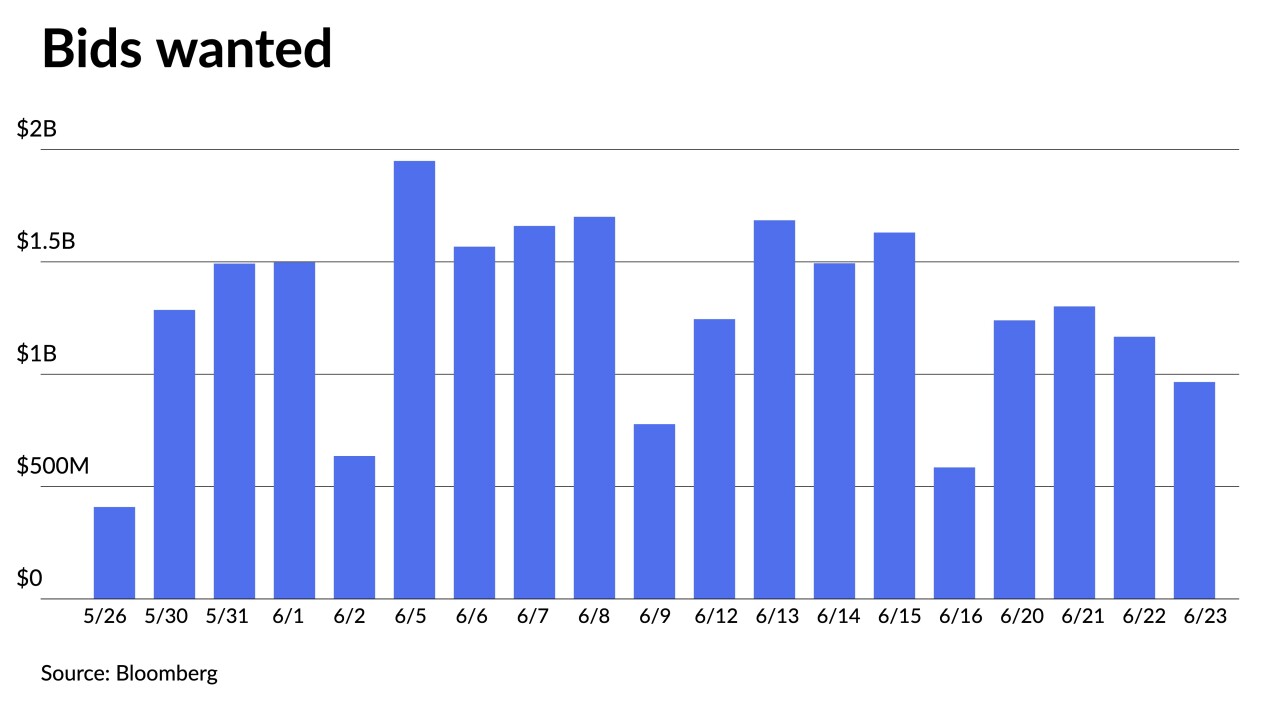

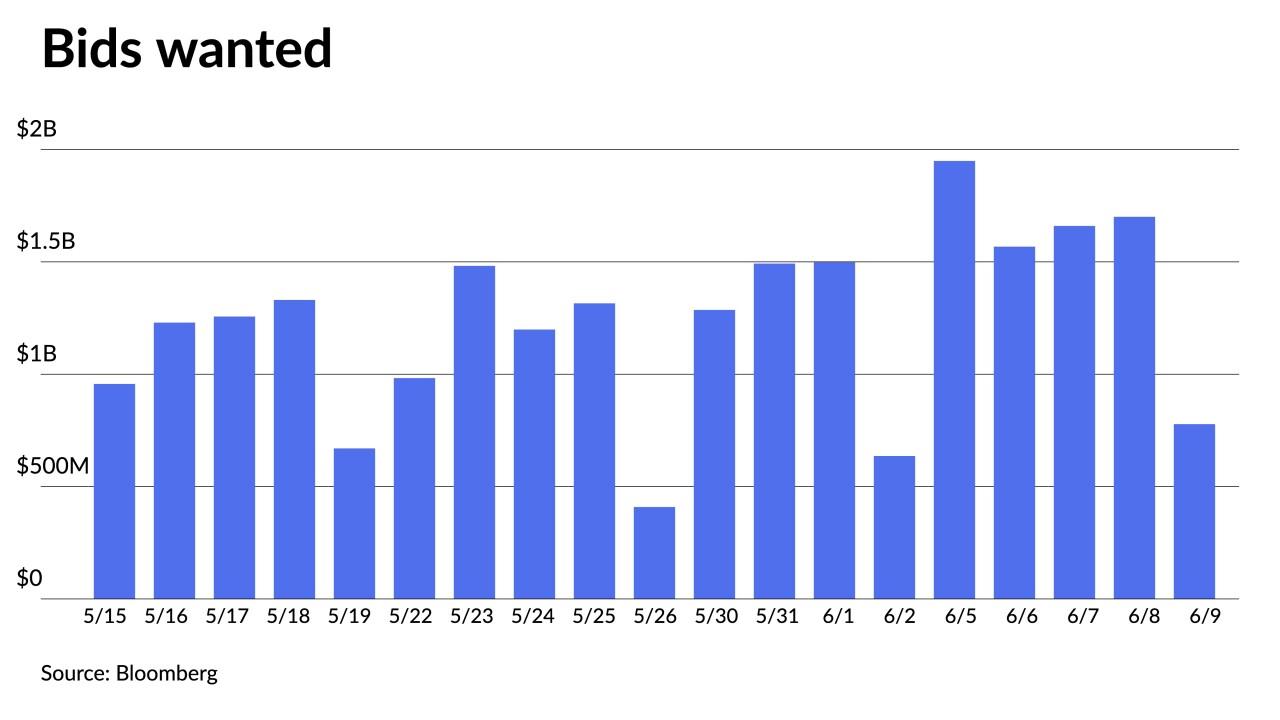

While supply has started to pick back up with an outsized primary market calendar this week, it's still not enough to meet demand, said Cooper Howard, a fixed income strategist at Charles Schwab.

June 27 -

Despite a slow start to the week, "buyers are becoming more constructive, and there's increased buying going on," said Pat Luby, a CreditSights strategist.

June 26 -

The $6.9 billion new-issue calendar features high-grade deals from Georgia, Washington and Massachusetts, among other frequently traded credits, which should provide direction for scales.

June 23 -

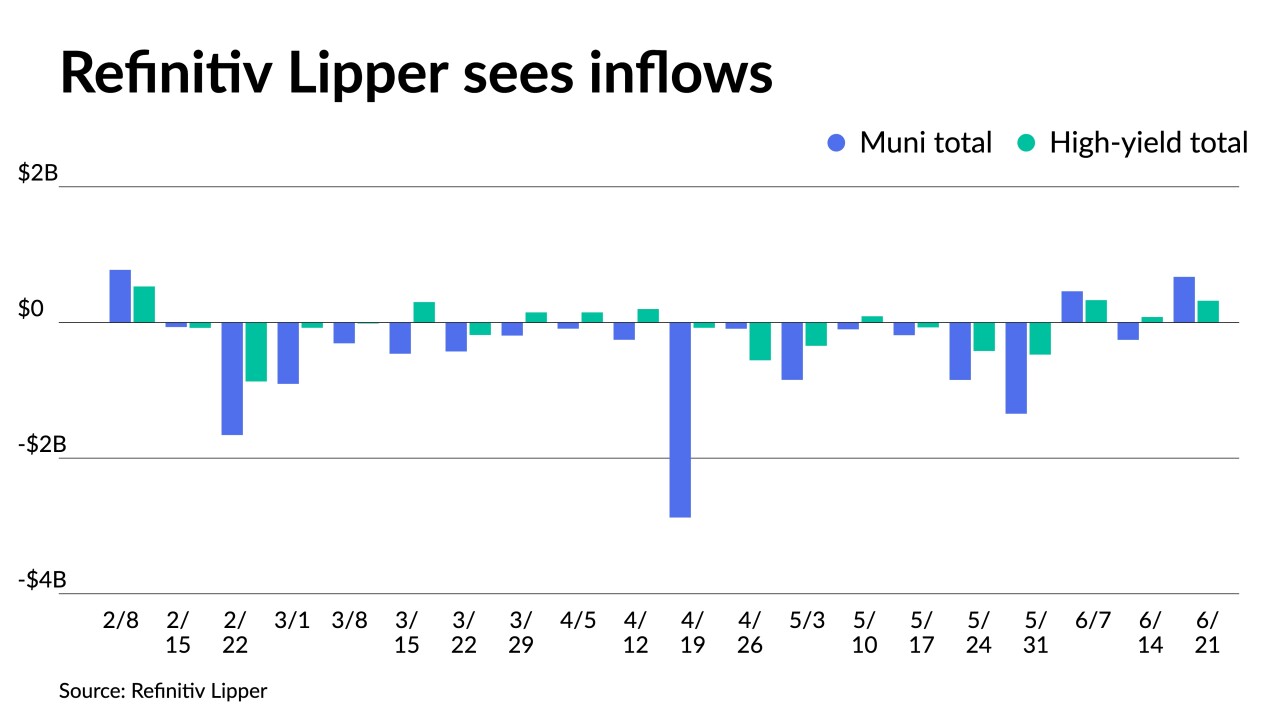

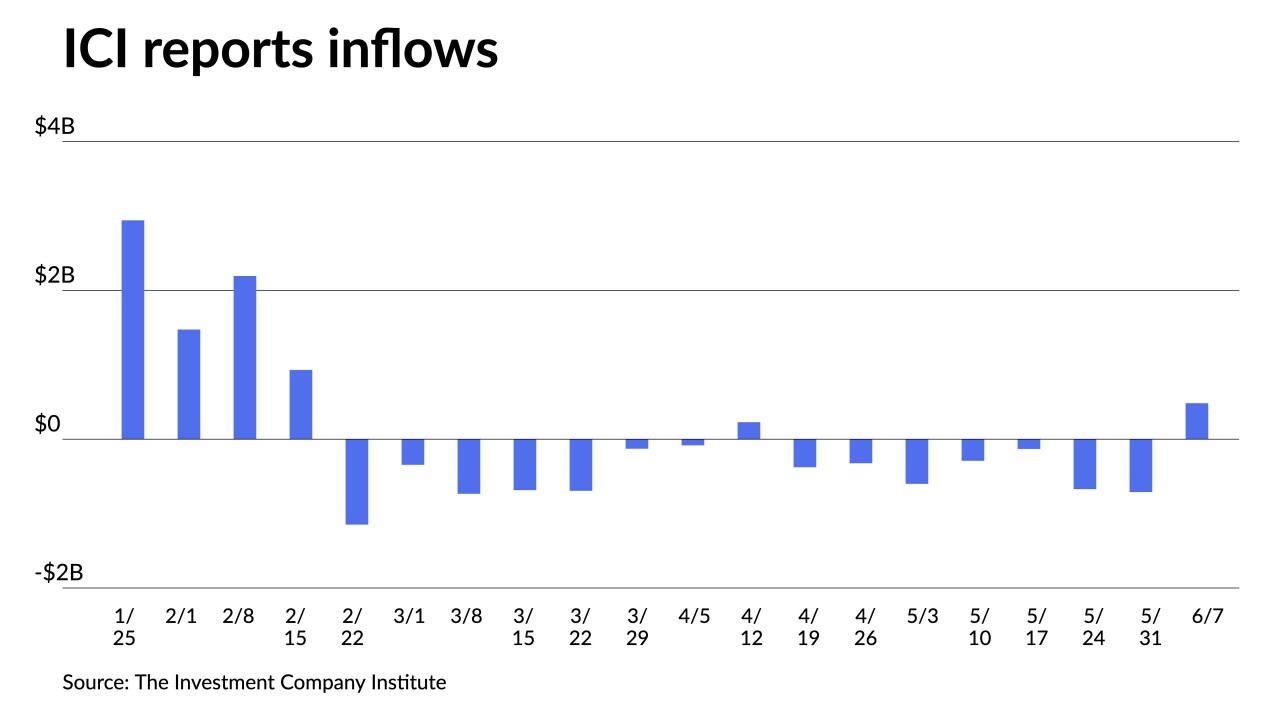

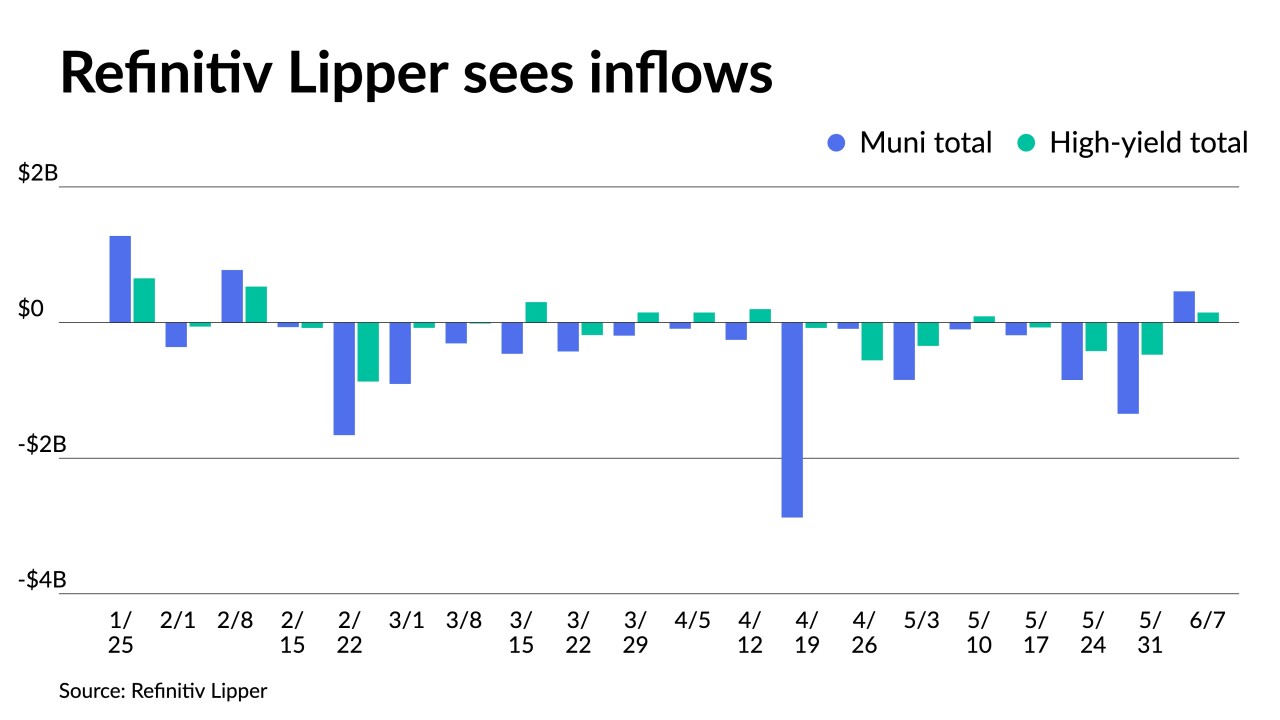

Municipal bond mutual fund inflows returned as Refinitiv Lipper reported investors added $672.288 million for the week ending Wednesday following $256.532 million of outflows the week prior.

June 22 -

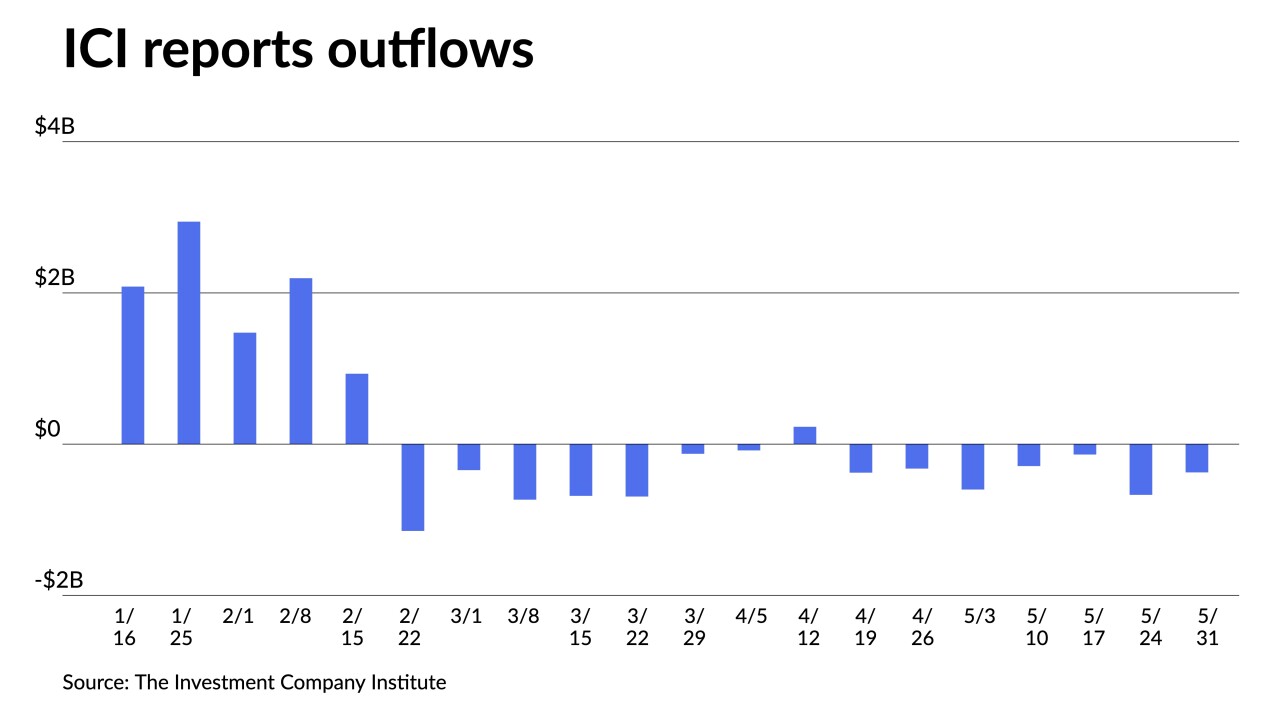

The Investment Company Institute reported investors added $16 million to municipal bond mutual funds in the week ending June 14, after $495 million of inflows the previous week.

June 21 -

Due to the Fed meeting-induced lighter new-issue calendar last week, and a holiday-shortened week this week, Birch Creek strategists said, "buyers had no qualms about putting cash to work."

June 20 -

Investors will be greeted with a new-issue calendar estimated at $5.031 billion led by several New York issues.

June 16 -

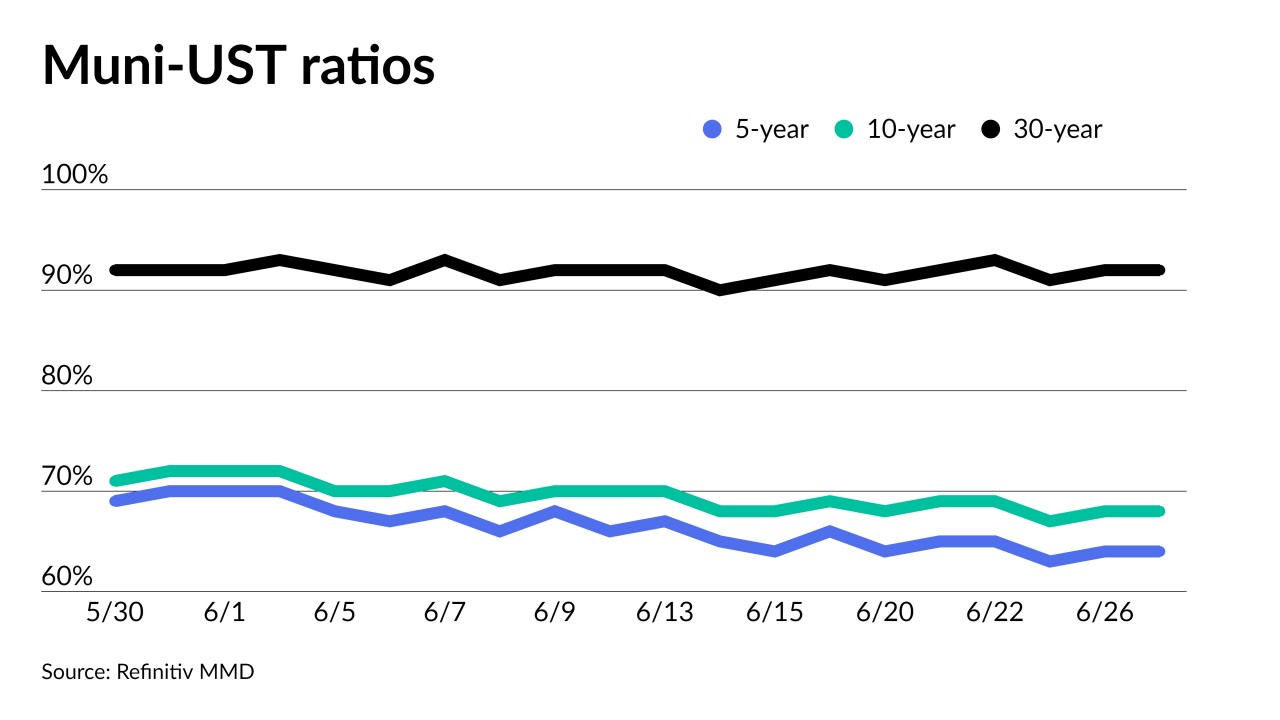

Those "holding out for wider yields or relative value" are frustrated due to an extremely tight muni range, but FHN Financial's Kim Olsan said, "the reality is that supply has yet to materialize to force that change."

June 15 -

Munis did not follow USTs yet, "but given the outperformance of munis over the last couple days and while I wouldn't be surprised if they weaken a little given how expensive ratios are," said Breckinridge's Matt Buscone.

June 14 -

The Louisiana Stadium and Exposition District is selling bonds to continue renovations on the Caesars Superdome, which will host the 2025 Super Bowl.

June 14 -

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Matthew Gastall and Daryl Helsing of Morgan Stanley delve into how municipals are performing versus other asset classes, where taxable munis fit and how they see the market performing heading into the summer reinvest. Jessica Lerner hosts. (36 minutes)

June 13 -

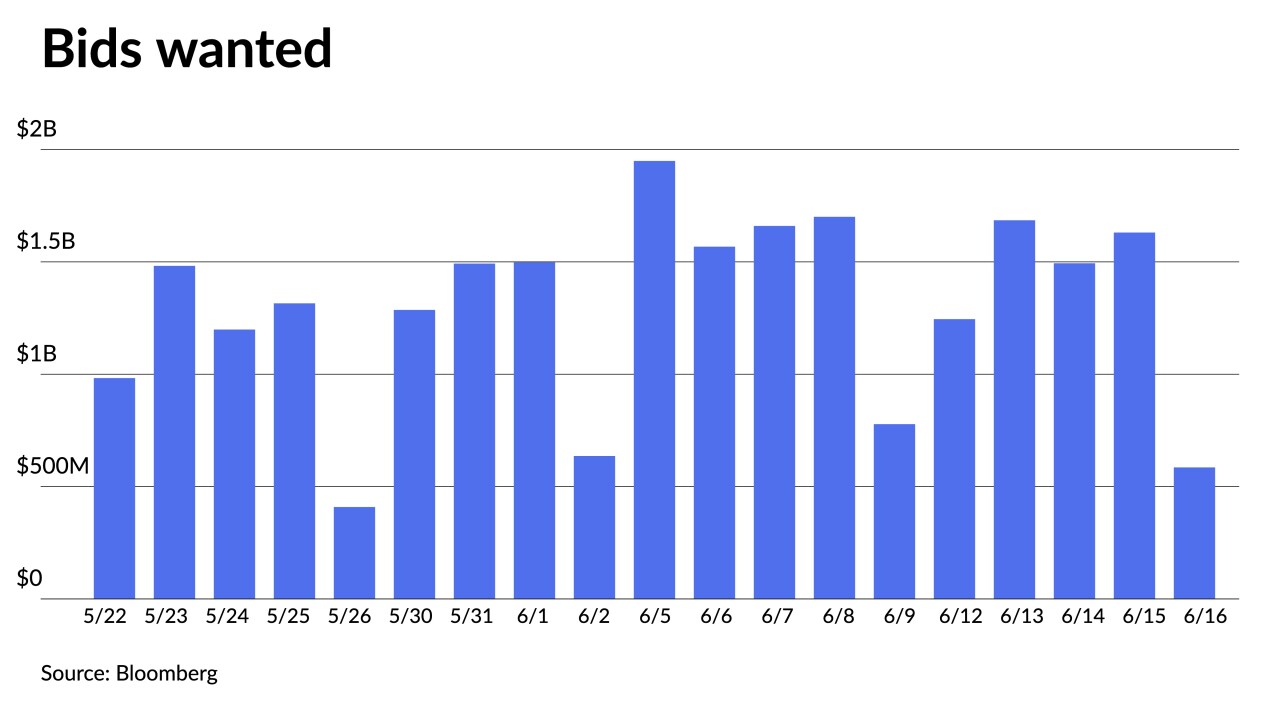

Elevated new issues, Federal Deposit Insurance Corp. sale lists, and heavy reinvestment cash "helped to offset each other [last] week and keep the muni market stable," said Birch Creek strategists.

June 12 -

Municipals have continued outperforming, "building on the trend that started in late May," Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said.

June 9 -

"How fund flows end up shaping up this week is going to be very meaningful for how we start the summer," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

June 8 -

The Investment Company Institute reported investors pulled another $374 million out of municipal bond mutual funds in the week ending May 31, after $671 million of outflows the previous week

June 7 -

"June started out fairly strong for the municipal market as the relative cheapness attracted investors looking for an opening to start buying bonds at higher yields," said Roberto Roffo, managing director and portfolio manager at SWBC Investment Company.

June 6