-

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

The recent rally is good news for munis, which have "posted a total-negative return loss for three straight months," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

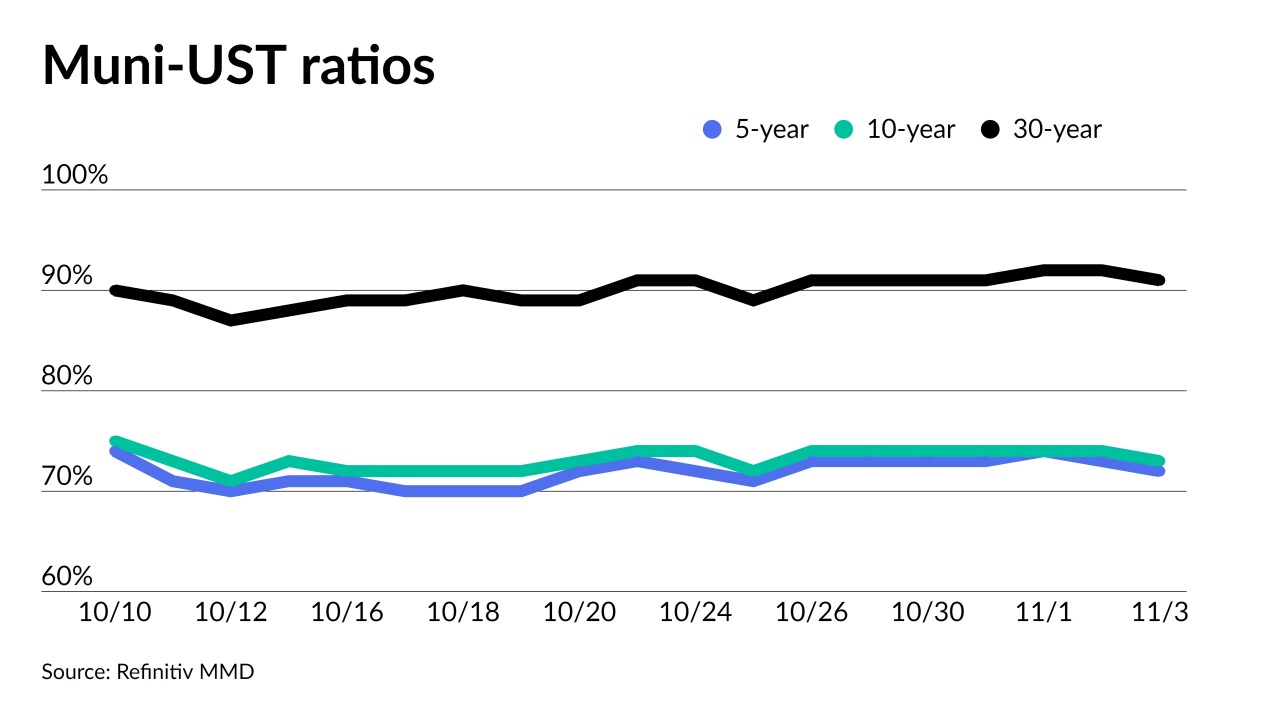

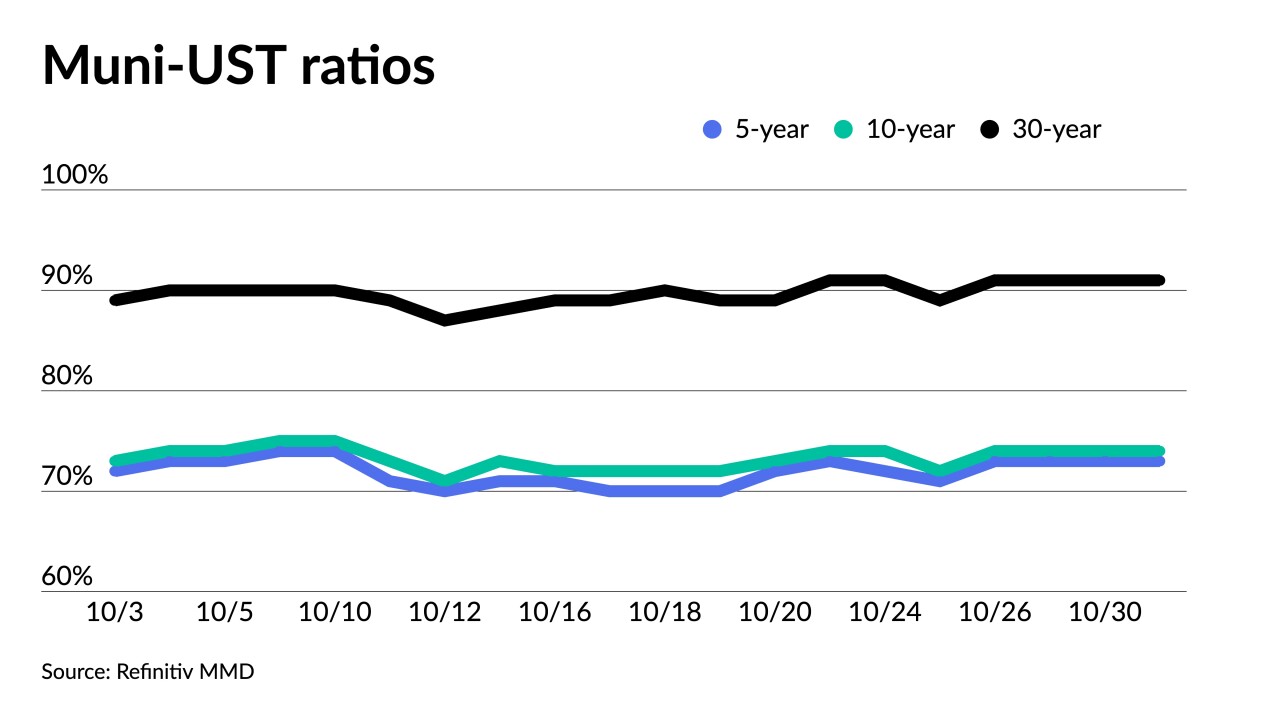

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

Bond Buyer Senior Reporter Keeley Webster shares an interview with California Treasurer Fiona Ma on her run for lieutenant governor as a prelude to a fireside chat Wells Fargo Director Julia Kim conducted with the state treasurer at The Bond Buyer's California Public Finance conference.

October 31 -

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30 -

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

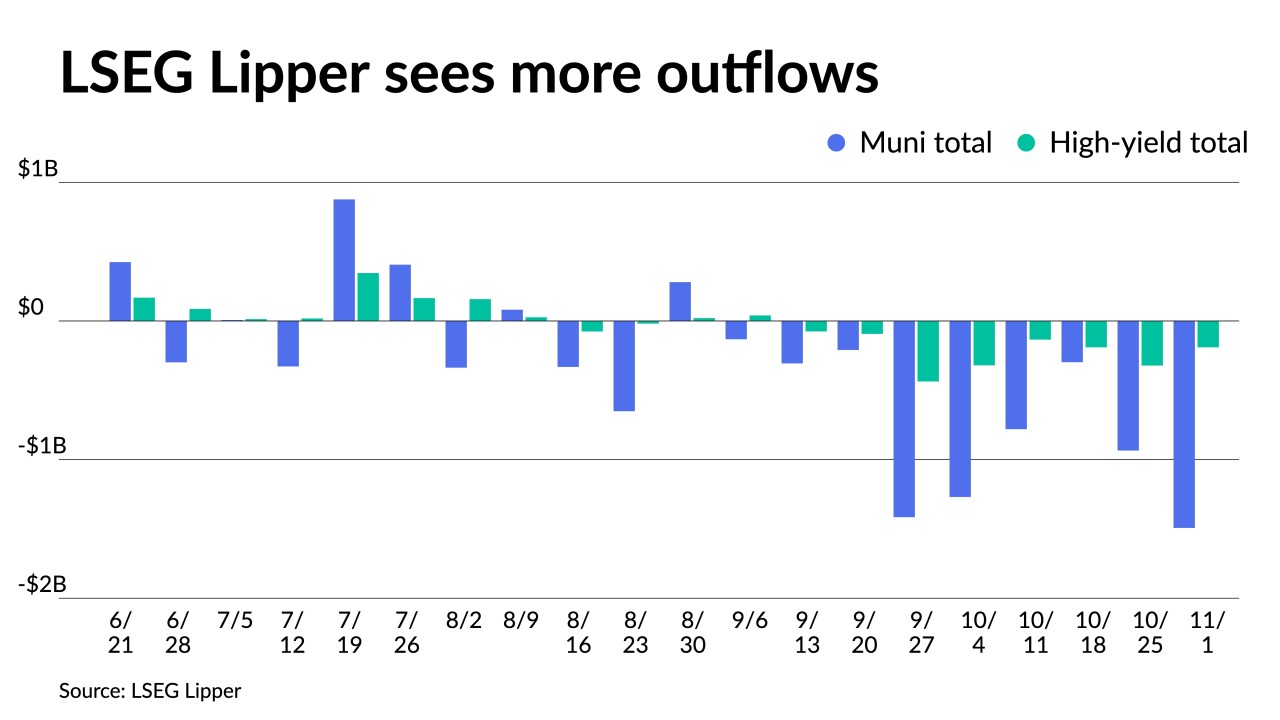

Investors continue to pull money from muni mutual funds with LSEG Lipper reporting $934.7 million of outflows for the week ending Wednesday after $297 million of outflows the week prior.

October 26 -

Municipal mutual fund losses continued last week — but to a lesser extent — as the Investment Company Institute Wednesday reported investors pulled $1.291 billion from the funds in the week ending Oct. 18 after $2.645 million of outflows the previous week.

October 25 -

Munis experienced some firmness Tuesday, but "whether or not that's going to be for more than a nanosecond remains to be seen," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 24 -

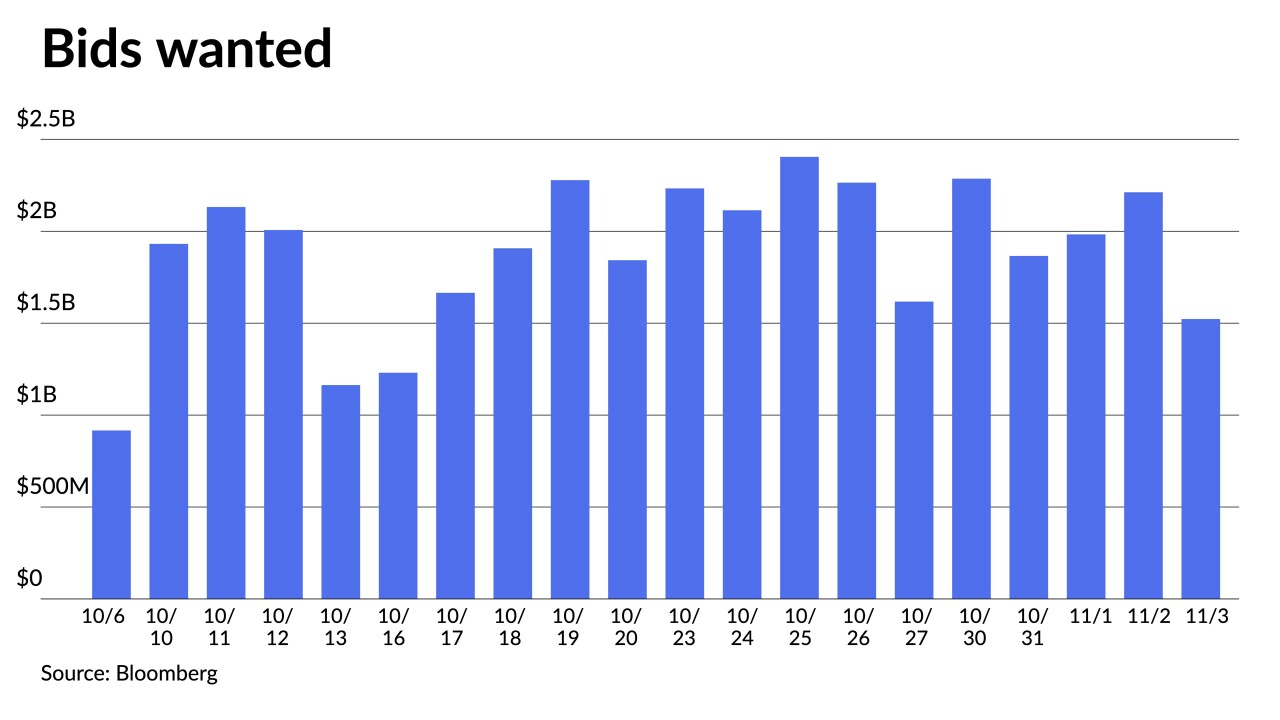

An elevated new-issue market is on the horizon with $14.87 billion, per The Bond Buyer's 30-day visible supply.

October 23 -

The new-issue muni calendar is estimated at $8.522 billion next week with $6.075 billion of negotiated deals on tap and $2.446 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

October 20 -

LSEG Lipper data Thursday showed $297 million of outflows from municipal bond mutual funds for the week ending Wednesday after $780.1 million of outflows the week prior.

October 19 -

Pessimism reigned during the state of the union panel at The Bond Buyer's California Public Finance conference in San Francisco.

October 19 -

Municipal mutual fund losses continued last week as the Investment Company Institute reporting investors pulled $2.645 billion from the funds in the week ending Oct. 11. ETFs see more inflows, though.

October 18 -

Munis are now following along with broader Treasury market weakness, and "at the same time are also attempting to manage some of the healthiest issuance that we've seen this year," said Morgan Stanley's Matthew Gastall.

October 17 -

Royden Durham and Tony Tanner, portfolio managers at the Aquila group of funds, talk with Chip Barnett about what's special about Kentucky and Arizona -- what's the same and what's different -- within their municipal bond markets. (18 minutes)

October 17 -

"The combination of higher yields and this week's heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis," said CreditSights strategists Pat Luby and Sam Berzok.

October 16