-

The week ahead boasts some big-name issuers and rare credits, which should provide interesting price discovery. The new-issue calendar totals $6.08 billion, with a larger competitive calendar coming in at $2.4 billion.

February 23 -

Supply is expected to increase in the coming weeks, and there may be more rate-direction volatility, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

February 22 -

Policymakers appear to be concerned about the possibility of cutting interest rates too soon, according to minutes of the Federal Open Market Committee's Jan. 30-31 meeting, released Wednesday.

February 21 -

"With the new economic data signaling a delay of the Fed starting rate cuts to further into the year, we should continue to see yields rise until we get near to the Fed's target of a 2% 'neutral' rate for inflation," said Jason Wong, vice president of municipals at AmeriVet Securities.

February 20 -

"With supply still low, and fund outflows just marginal, it is not clear what would substantially cheapen the market, and we could get stuck in the current range for some time time," Barclays strategists said.

February 16 -

Municipal bond mutual funds saw the second week of outflows, with LSEG Lipper reporting $142.2 million of outflows for the week ending Wednesday. High-yield funds saw inflows.

February 15 -

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The muni market will see "continued strength," said Wesly Pate, senior portfolio manager at Income Research + Management, largely due to a a dearth of new-issue supply.

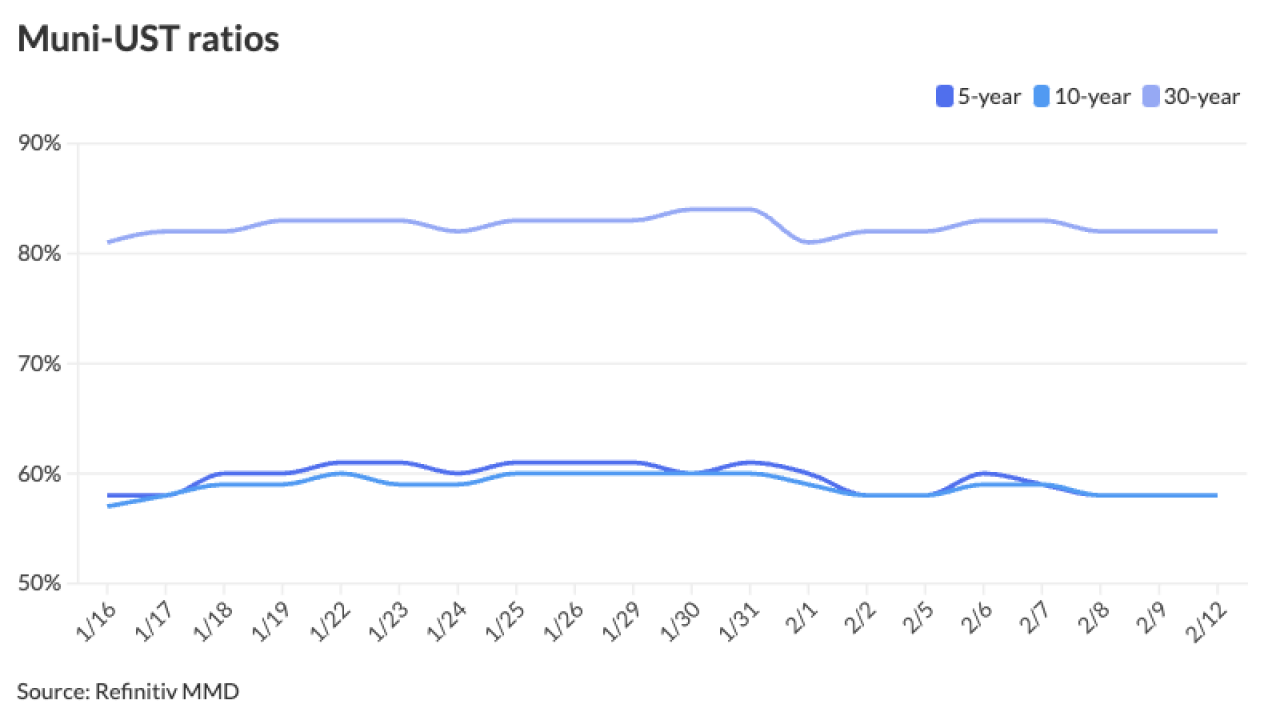

February 12 -

"Even though it is hard to see the market falling out of bed and underperforming in the near term, we are more cautious going into March," Barclays PLC said in a report.

February 9