-

The Investment Company Institute on Wednesday reported another round of large outflows, this week at $3.502 billion, up from $2.647 billion of outflows in the previous week.

March 9 -

Secondary trading showed weaker prints, moving triple-A yields higher by three to seven basis points, outperforming larger losses in UST. California priced $2.2 billion of GOs for retail.

March 8 -

As municipals continue to underperform the moves in U.S. Treasuries, current ratios are attractive and present a buying opportunity.

March 7 -

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4 -

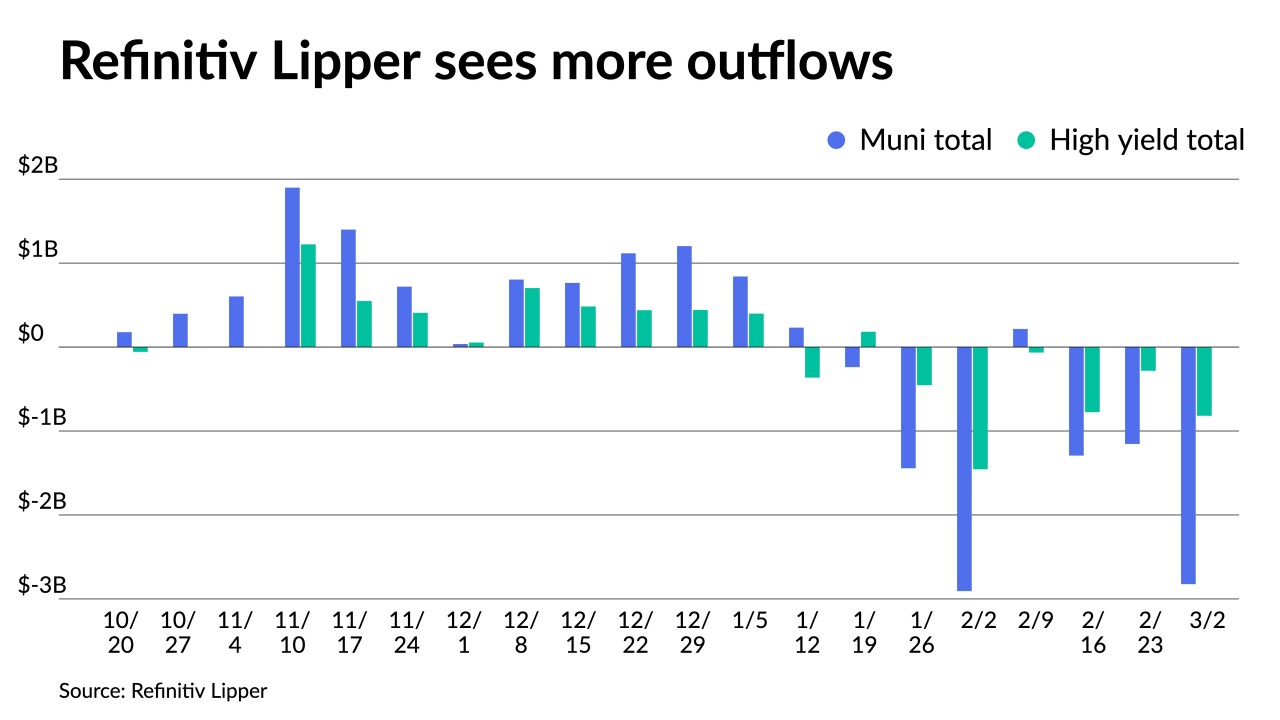

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

The MSRB’s annual fact book, released on Wednesday, shows that par amount trading volume was down 28% in 2021 when compared with 2020.

March 3 -

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

March 2 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

February 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25