-

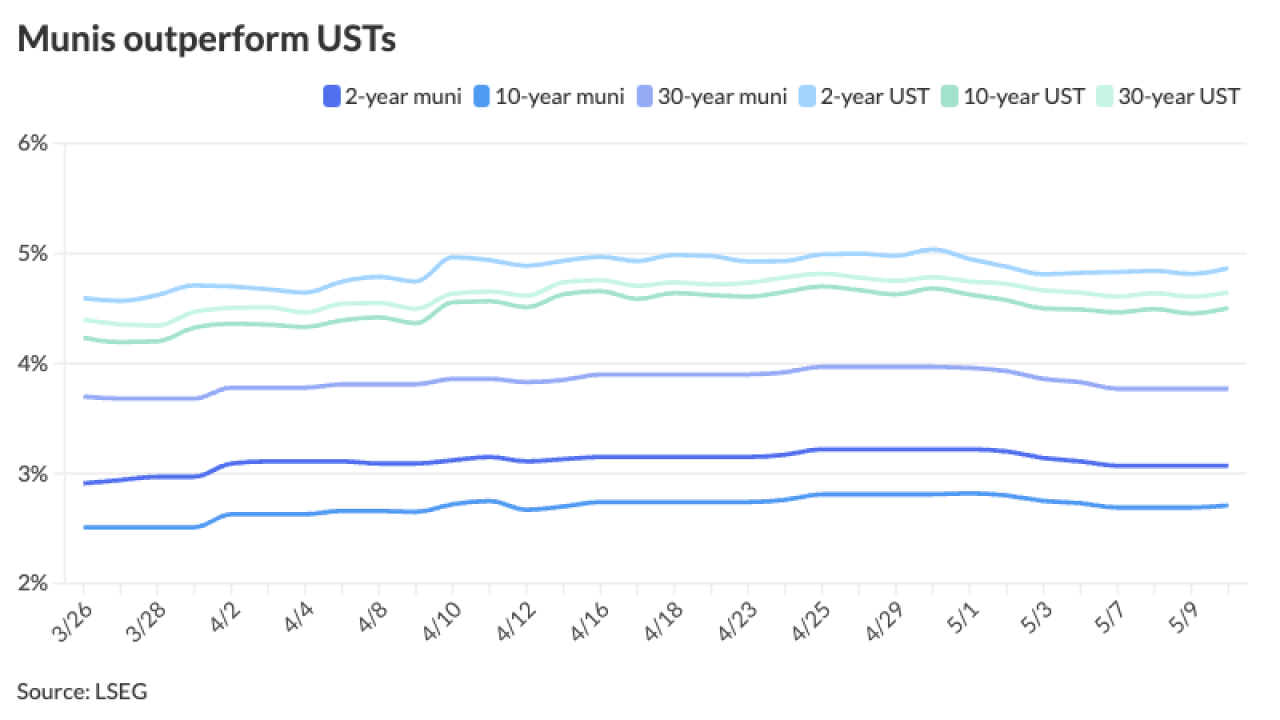

"While we acknowledge that the market tone is weaker [Monday], we are generally constructive regarding valuations and expect this week's supply to be absorbed fairly well after last week's giveback of the richening witnessed over prior weeks," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

May 20 -

"The industry is built on relationships, and it's powered by technology," said Josh Rosenblum, head of algorithmic trading at Brownstone.

May 20 -

There are nearly 30 new-issues over $100 million on tap across the credit spectrum, led by the week's largest negotiated deal from Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds. The competitive calendar ticks up with several high-grade names.

May 17 -

"In terms of credit quality, high-yield funds proved resilient" while investment-grade funds saw outflows of $673 million, noted J.P. Morgan's Peter DeGroot in a market note.

May 16 -

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the data continues to point to a trend of inflation falling further, said Jeff Lipton, a research analyst and market strategist.

May 15 -

This week's issuance is above the 2024's year-to-date weekly average of $7.6 billion, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

May 14 -

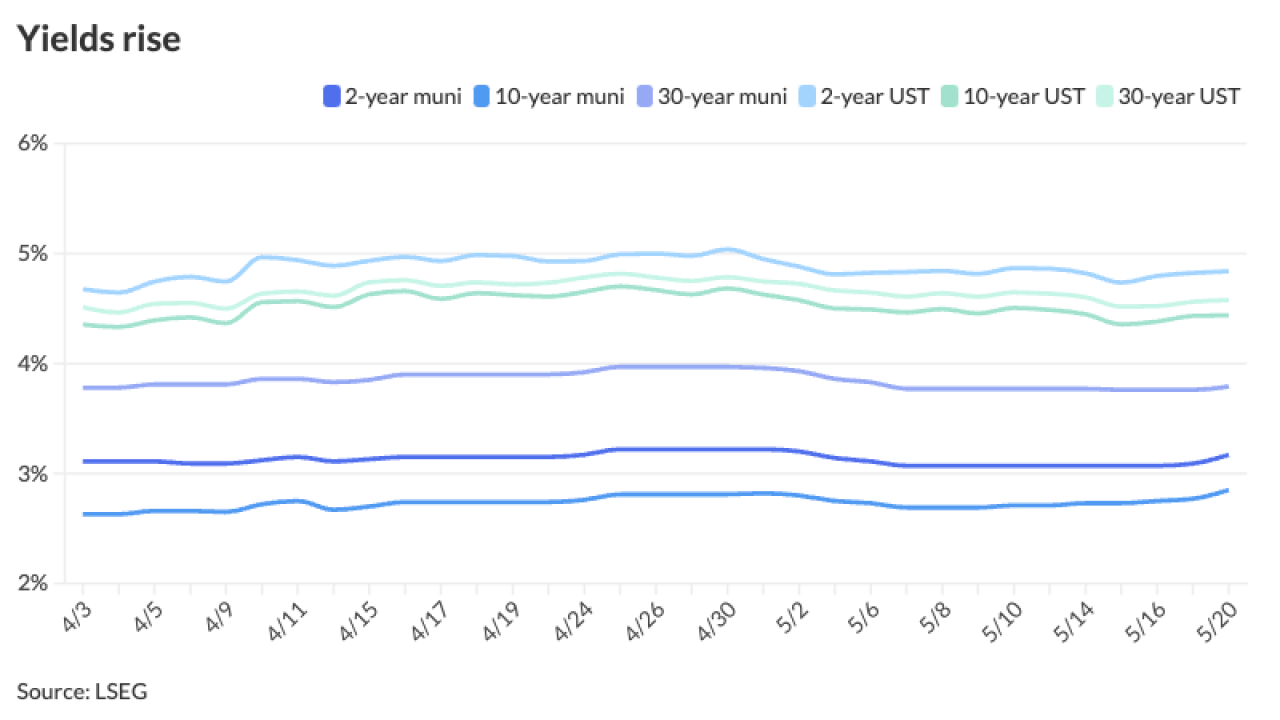

The muni market improvement has the asset class seeing gains of 1.08% so far in May, as year-to-date returns inch closer to "positive territory," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 13 -

The New York City Transitional Finance Authority leads the new-issue calendar with a total of $1.8 billion of future tax-secured subordinate bonds in the negotiated and competitive markets.

May 10 -

Municipal bond mutual funds saw another week of inflows as investors added $1.053 billion in the week ending Wednesday, the second-largest figure this year.

May 9 -

The University repriced to lower yields up to 15 basis points Wednesday while Illinois accellerated its pricing of its tax-exempt GOs and were repriced yesterday afternoon with bumps of 10 to 13 basis points and saw $1.5 billion of retail orders alone.

May 8