-

Driven by ongoing capital expenditure funding and current refunding opportunities, airport issuance is estimated at $21 billion in 2024, with a slew of from June through September and more planned in December, according to Ramirez.

June 12 -

"We will remain cautious until CPI and the FOMC are in the rear-view mirror and as long as these don't catalyze a sell-off (since that would trigger outflows) or catalyze a sharp rally (as municipals lag rates during a sharp rally and ratios can increase optically) ... " said Vikram Rai, head of municipal markets strategy at Wells Fargo.

June 11 -

Munis should see better performance this week as issuance falls to $5.2 billion this week and cash still needs to be reinvested, said Jason Wong, vice president of Municipals at AmeriVet Securities.

June 10 -

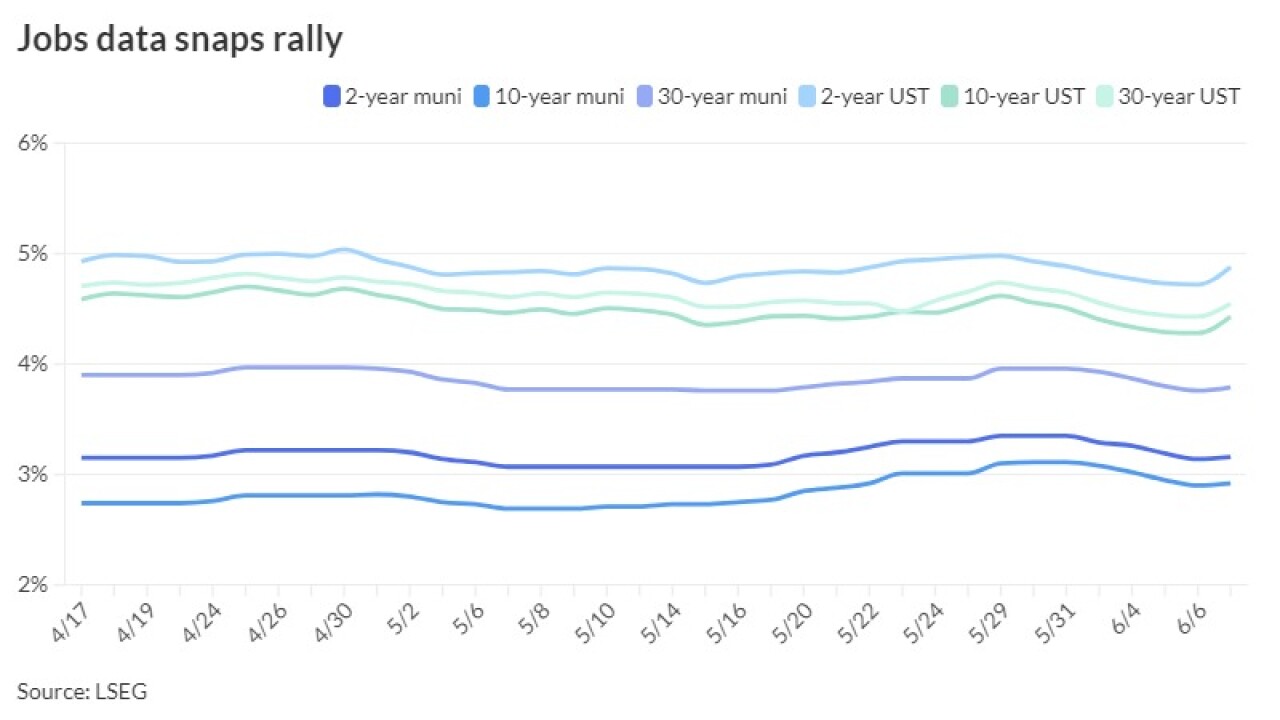

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

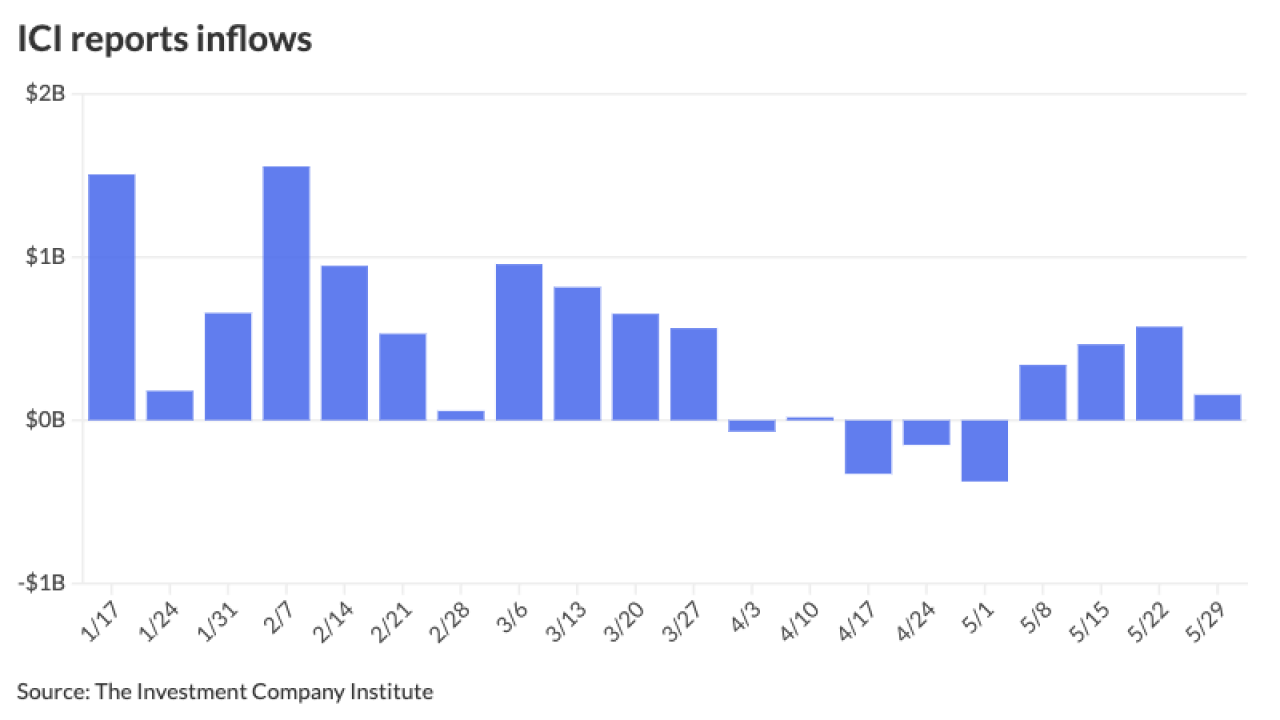

Municipal bond mutual funds saw inflows as investors added $549.2 million after $94.9 million of outflows the week prior, according to LSEG Lipper.

June 6 -

Issuance remains robust Wednesday with an estimated $5.9 billion, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

New-issue volume has topped $50 billion over the past few weeks, said AllianceBernstein in a weekly report.

June 4 -

Falling occupancy figures, staffing shortages, and rising labor costs have elevated the sector's risk, with Greenwich Investment Management's bankruptcy yet another example of how the sector requires thorough credit analysis.

June 4 -

This week's surge in issuance, which tops $14 billion, is "likely going to keep a lid on any enthusiasm," Birch Creek strategists said in a weekly report.

June 3 -

While particpants expect some pressure in the near-term with more than $16 billion on tap, they also say the current yield and ratio levels offer investors opportunity.

May 31