-

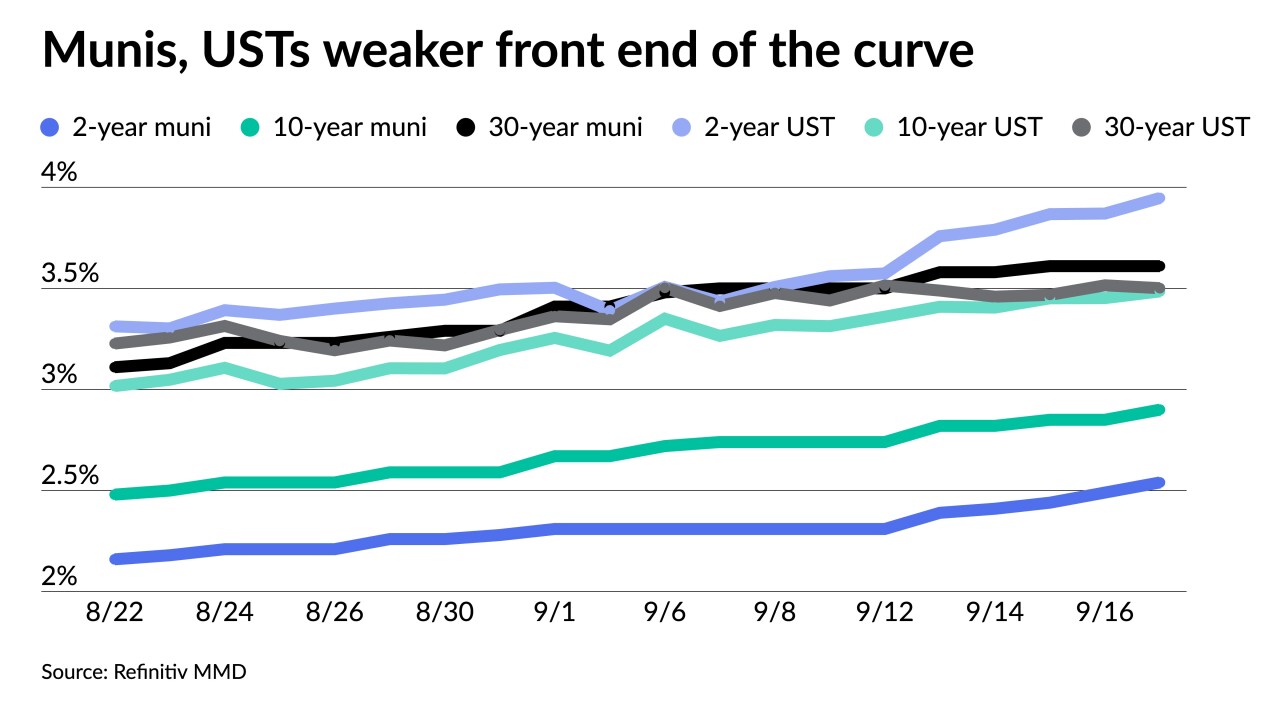

Triple-A yields rose 11 to 15 basis points five years and in.

September 23 -

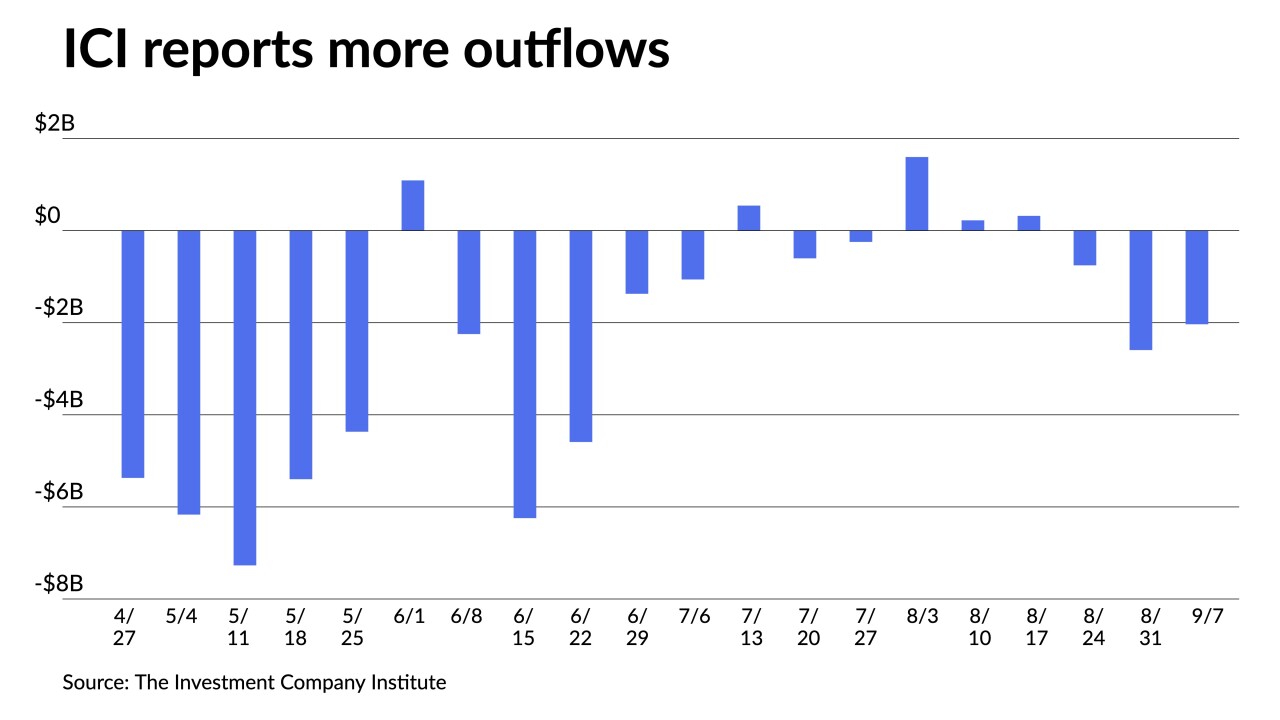

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23 -

One-year rates have risen 100 basis points, intermediate maturities have traded up about 25 basis points and long-term munis are nearly 50 basis points above June's close.

September 22 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

Short triple-A yields have risen more than 30 basis points over the past eight sessions while the long bond has risen 19, per Refinitiv MMD data.

September 20 -

Triple-A muni yields rose another five basis points on the short end while UST rose up to seven. UST yields are the highest since 2007.

September 19 -

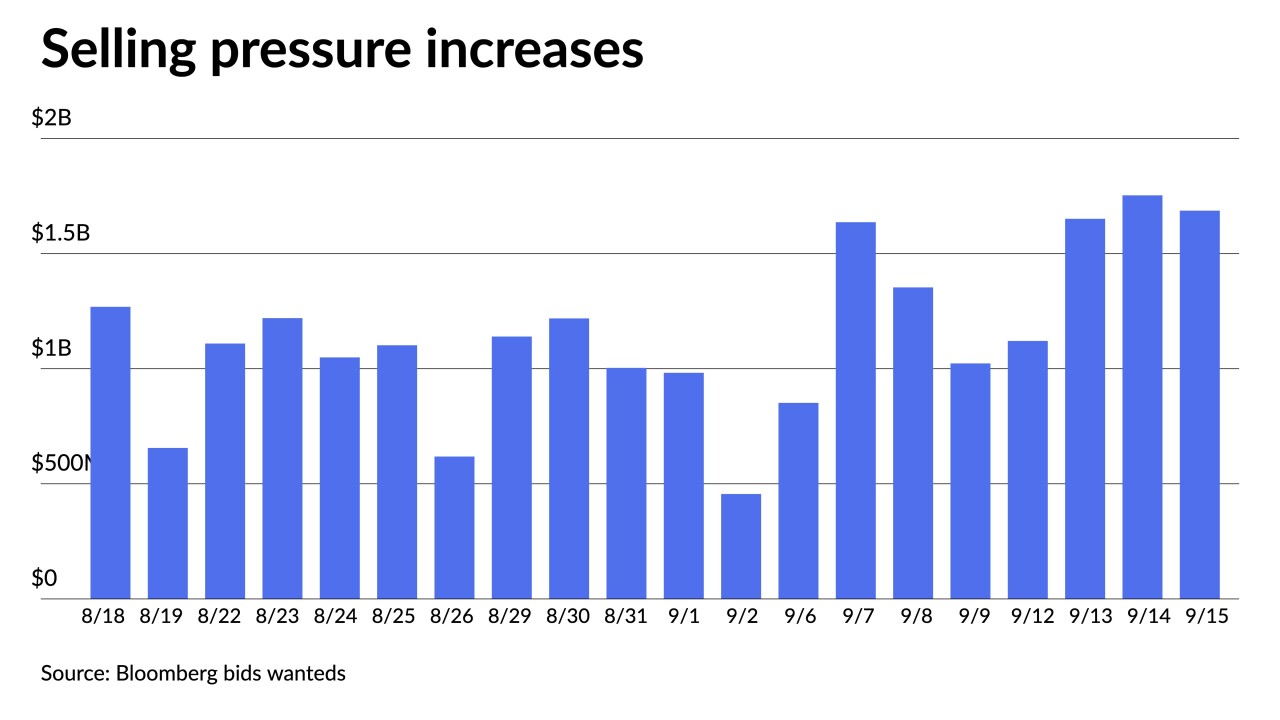

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

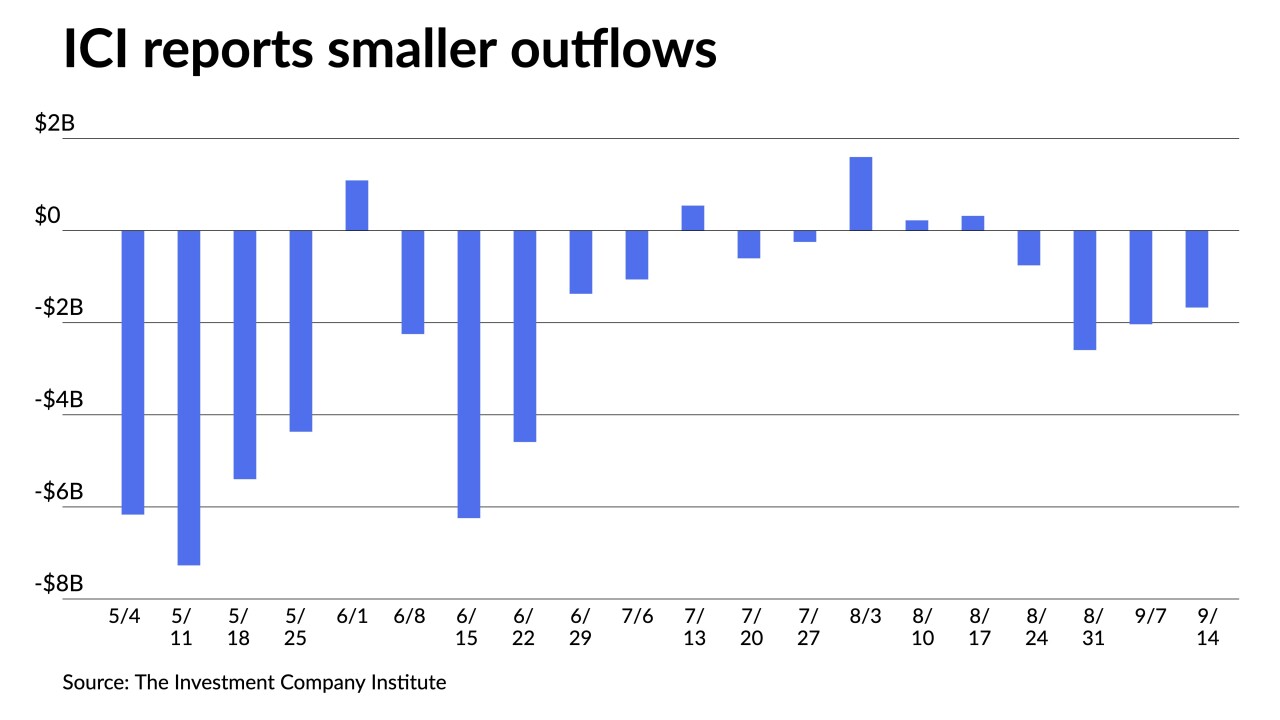

"Everyone is trying to figure out when the outflow cycle is over," said Craig Brandon, co-director of municipal investments at Eaton Vance.

September 15 -

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14 -

Muni and UST yields surged Tuesday on expectations the Fed will have to aggressively raise interest rates to bring down inflation.

September 13