-

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

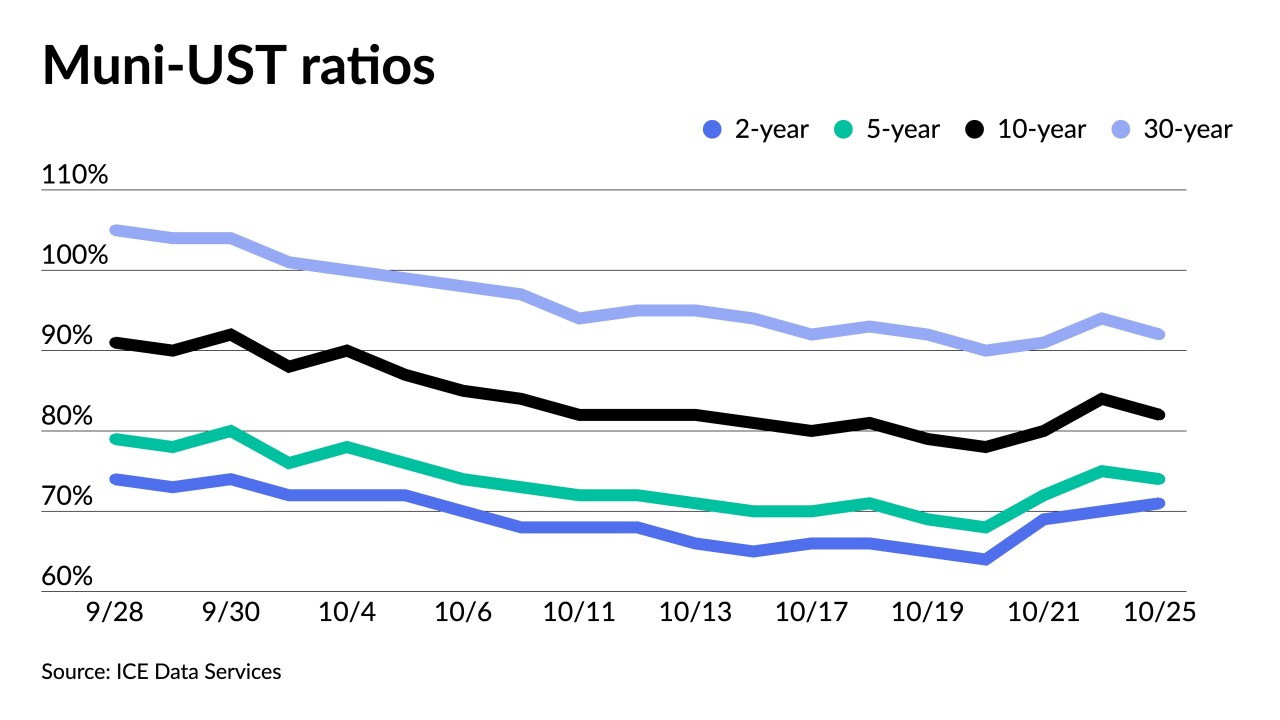

Municipal to UST ratios have risen this week with the 10-year approaching 90% and the 30-year topping 100%.

October 27 -

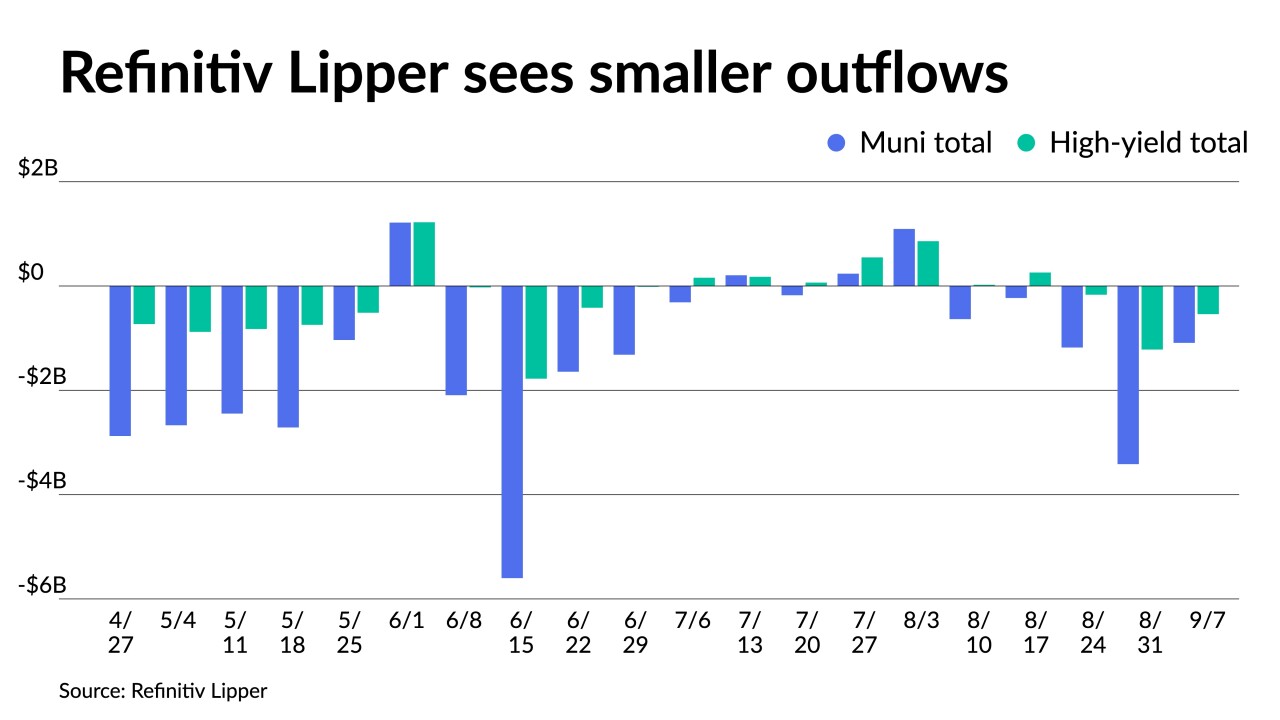

Outflows continued as investors pulled $3.876 billion from mutual funds in the week ending Oct. 19 after $4.532 billion of outflows the previous week, according to the Investment Company Institute.

October 26 -

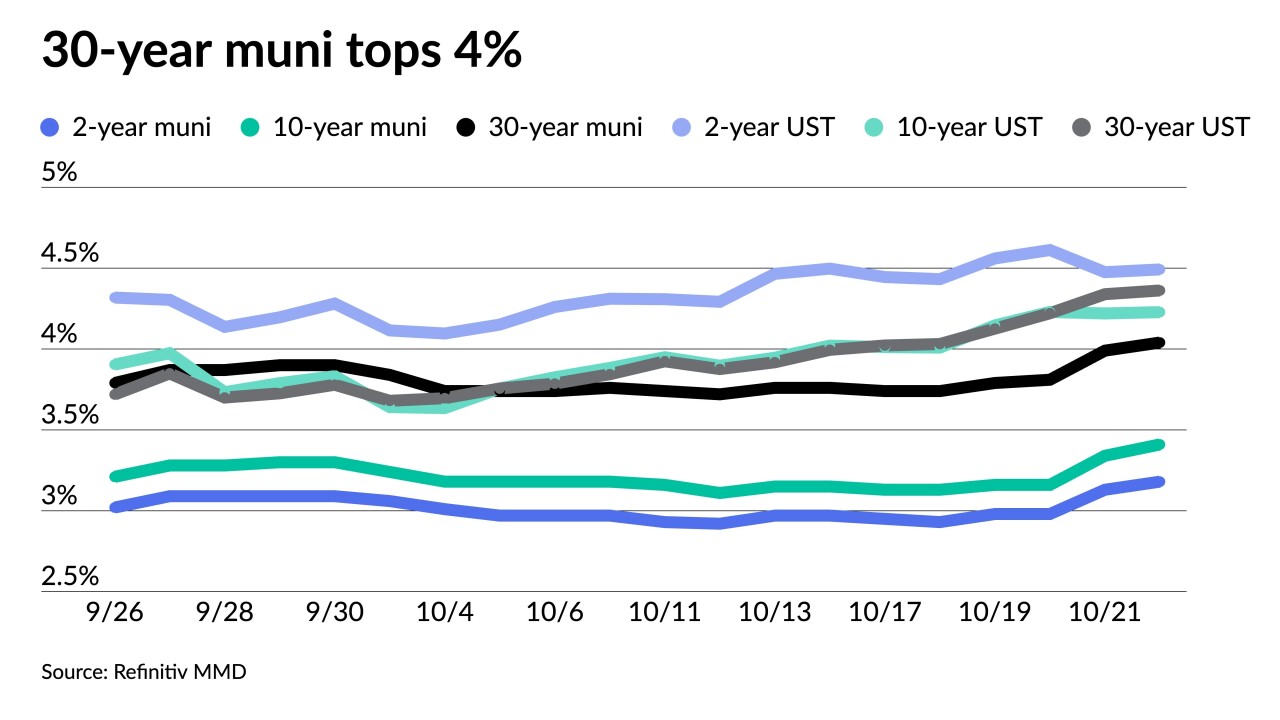

While muni performance has turned negative for October, "the asset class is significantly outperforming UST," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 25 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

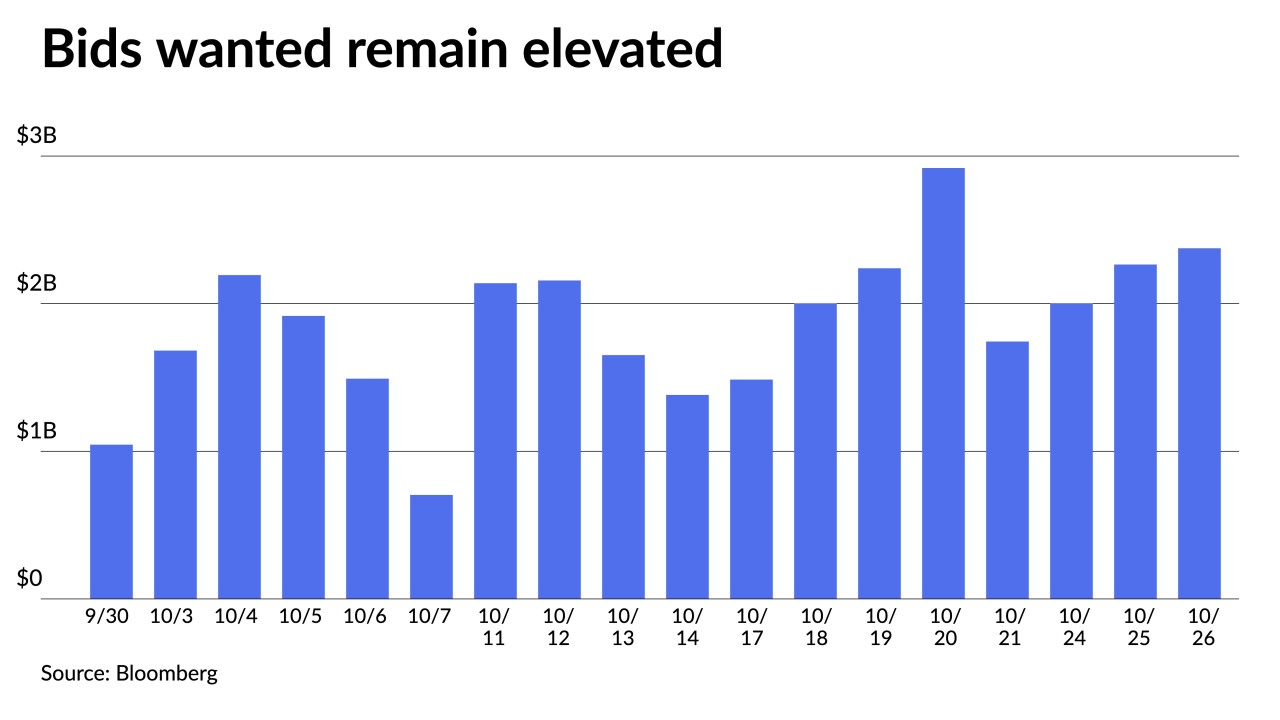

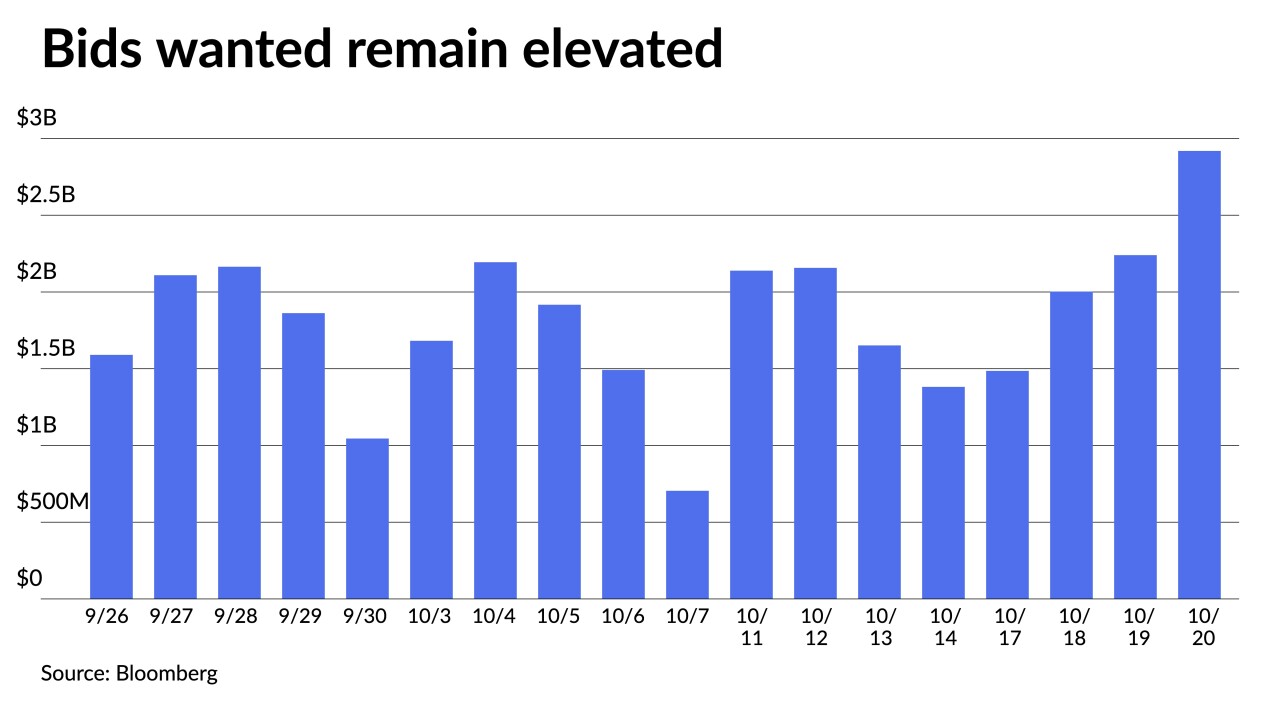

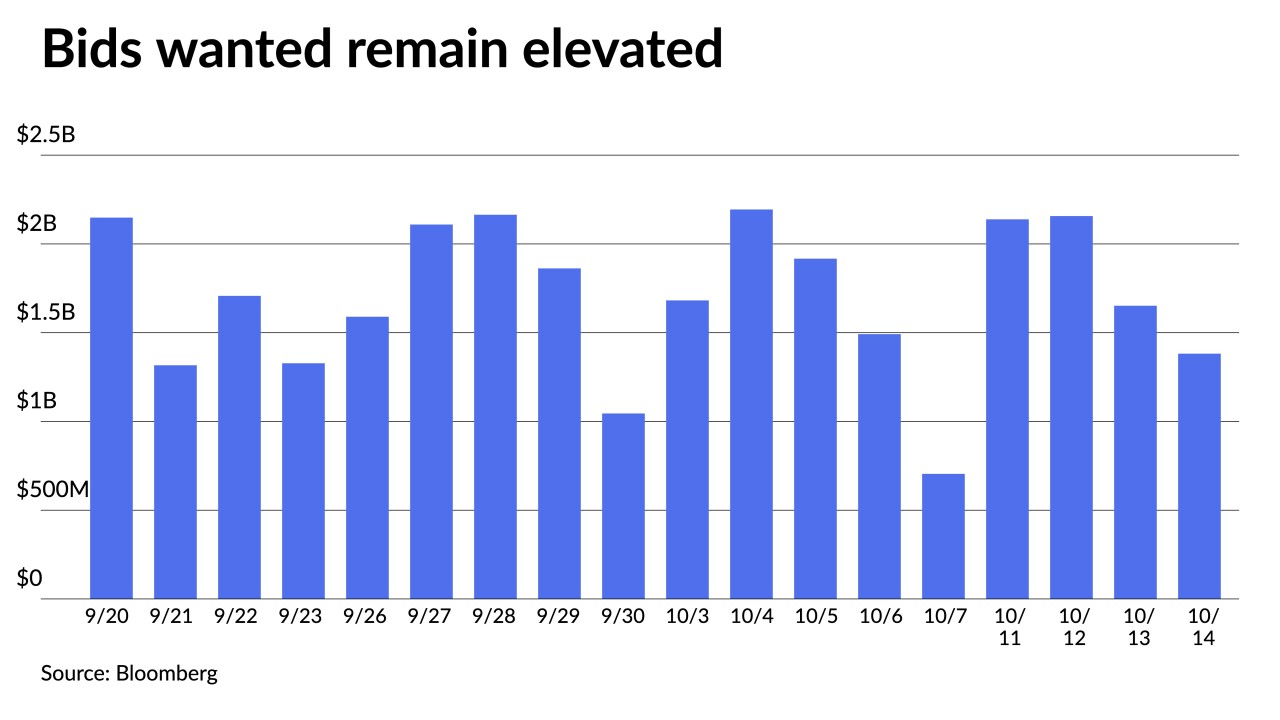

Selling pressure was on the rise again this week. Thursday's $2.919 billion of bonds out for the bid was only surpassed on March 19, 2020, when they hit $4.115 billion. A larger calendar closes out October.

October 21 -

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17