-

This week's "manageable" calendar will continue what has been a quiet start to the new year in the municipal market, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

January 9 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.303 billion.

January 6 -

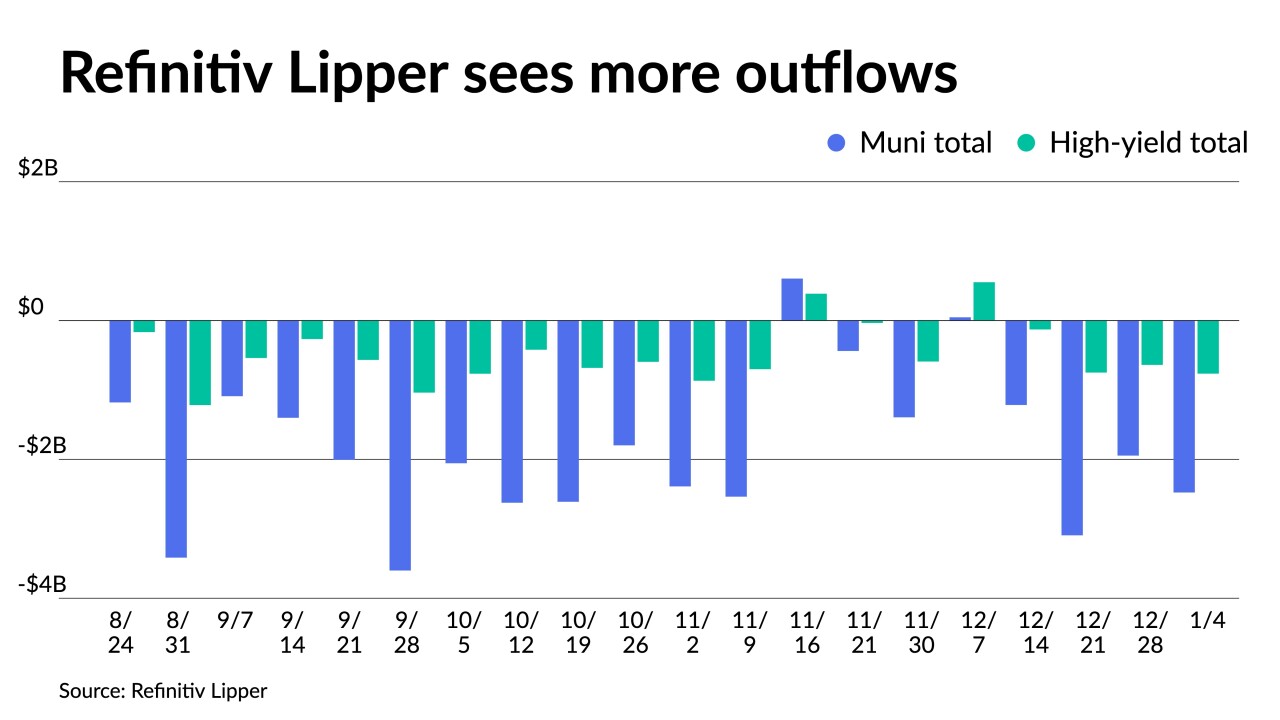

Outflows continued as Refinitiv Lipper reported $2.477 billion was pulled from municipal bond mutual funds in the week ending Wednesday after $1.946 billion of outflows the week prior.

January 5 -

The muni market "is being teed up to enter 2023 from a relative position of strength," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 3 -

"Bond investors bid a not-so-fond farewell to 2022 as they look forward to a much more attractive 2023," said Bryce Doty of Sit Investment Associates.

December 30 -

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30 -

Outflows continued as Refinitiv Lipper reported $1.946 billion was pulled from municipal bond mutual funds in the week ending Wednesday after $3.094 billion of outflows in the prior week.

December 29 -

"With only a few days remaining in the year, muni bonds have had a tough year losing roughly 8.44% for the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 28 -

"Although late-year volumes may be smaller, the market tone is holding firm on the premise of no supply/rollover demand — somewhat typical for December but noteworthy for the level of volatility the market has endured," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 27 -

Munis were unchanged Friday heading into the Christmas hiatus as light trading preceded the early market close, according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

December 23