-

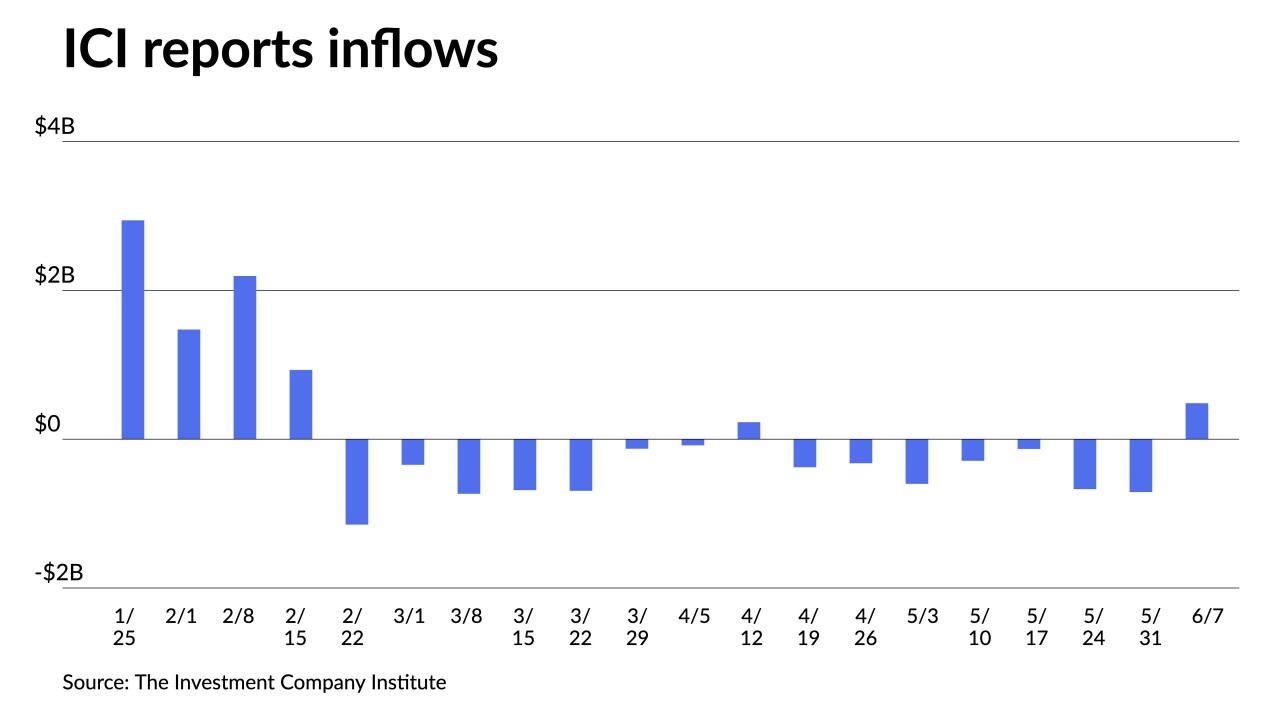

The Investment Company Institute reported investors added $16 million to municipal bond mutual funds in the week ending June 14, after $495 million of inflows the previous week.

June 21 -

Due to the Fed meeting-induced lighter new-issue calendar last week, and a holiday-shortened week this week, Birch Creek strategists said, "buyers had no qualms about putting cash to work."

June 20 -

Investors will be greeted with a new-issue calendar estimated at $5.031 billion led by several New York issues.

June 16 -

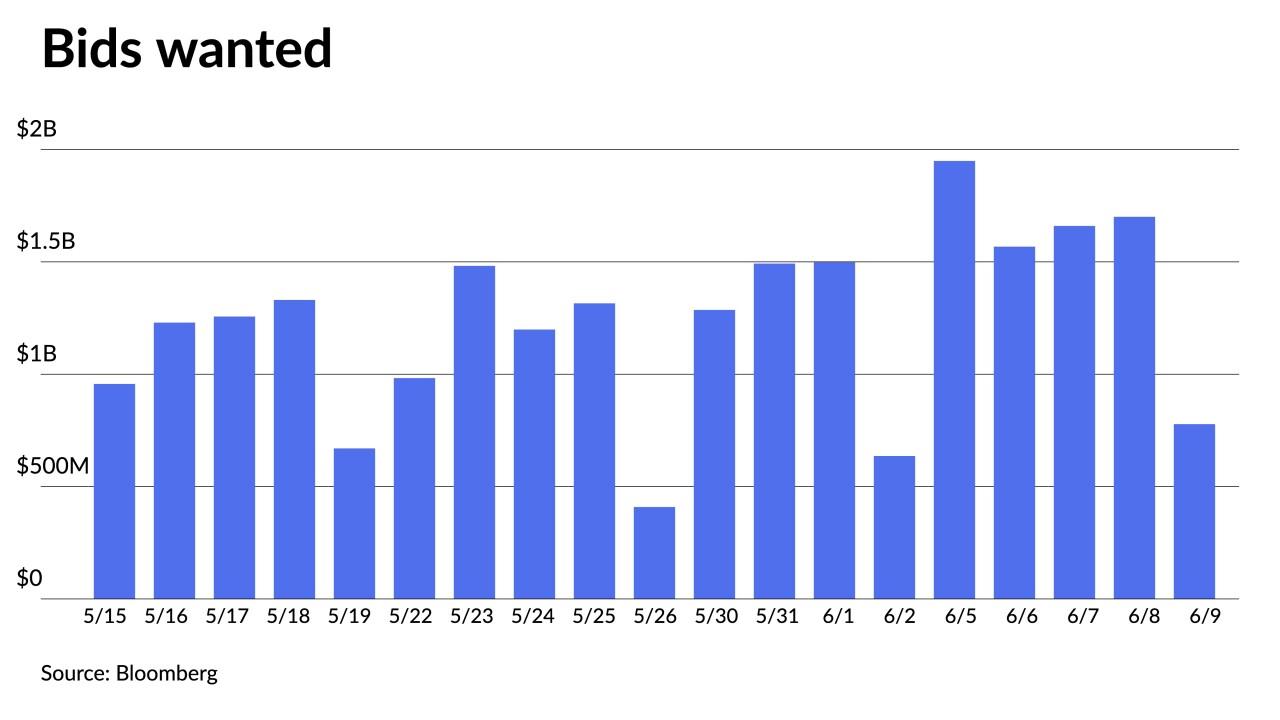

Those "holding out for wider yields or relative value" are frustrated due to an extremely tight muni range, but FHN Financial's Kim Olsan said, "the reality is that supply has yet to materialize to force that change."

June 15 -

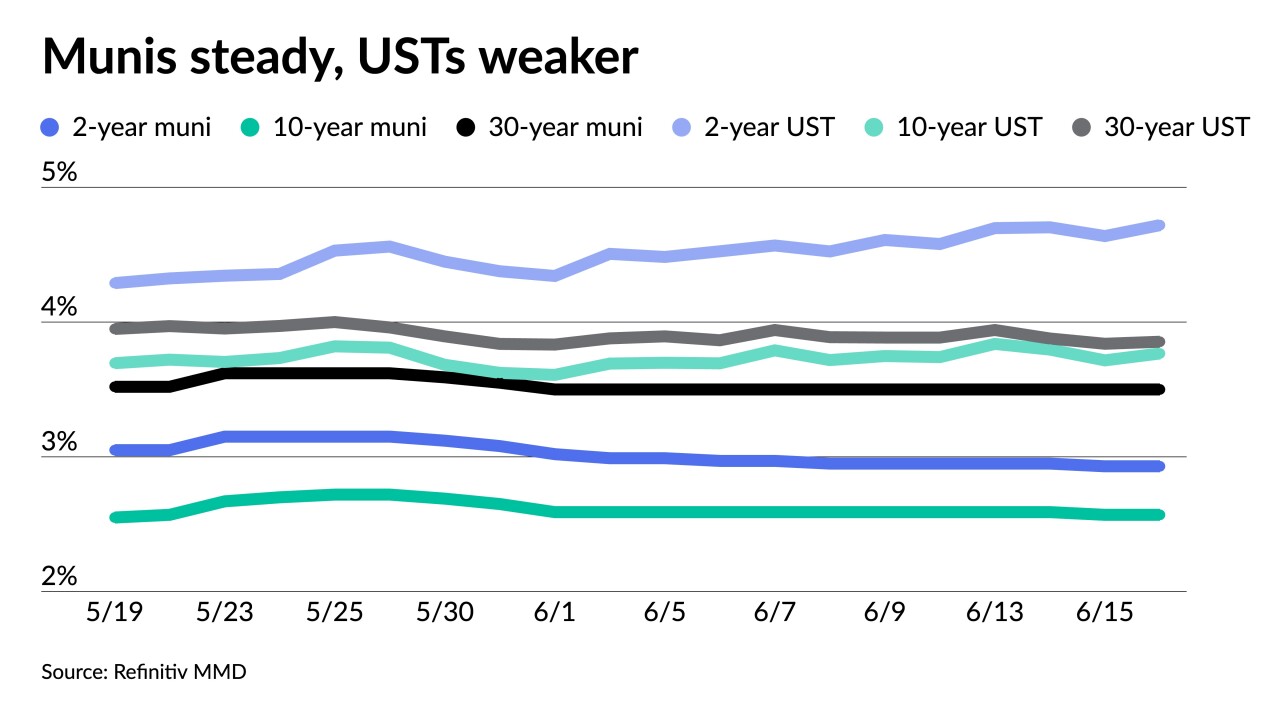

Munis did not follow USTs yet, "but given the outperformance of munis over the last couple days and while I wouldn't be surprised if they weaken a little given how expensive ratios are," said Breckinridge's Matt Buscone.

June 14 -

The Louisiana Stadium and Exposition District is selling bonds to continue renovations on the Caesars Superdome, which will host the 2025 Super Bowl.

June 14 -

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Matthew Gastall and Daryl Helsing of Morgan Stanley delve into how municipals are performing versus other asset classes, where taxable munis fit and how they see the market performing heading into the summer reinvest. Jessica Lerner hosts. (36 minutes)

June 13 -

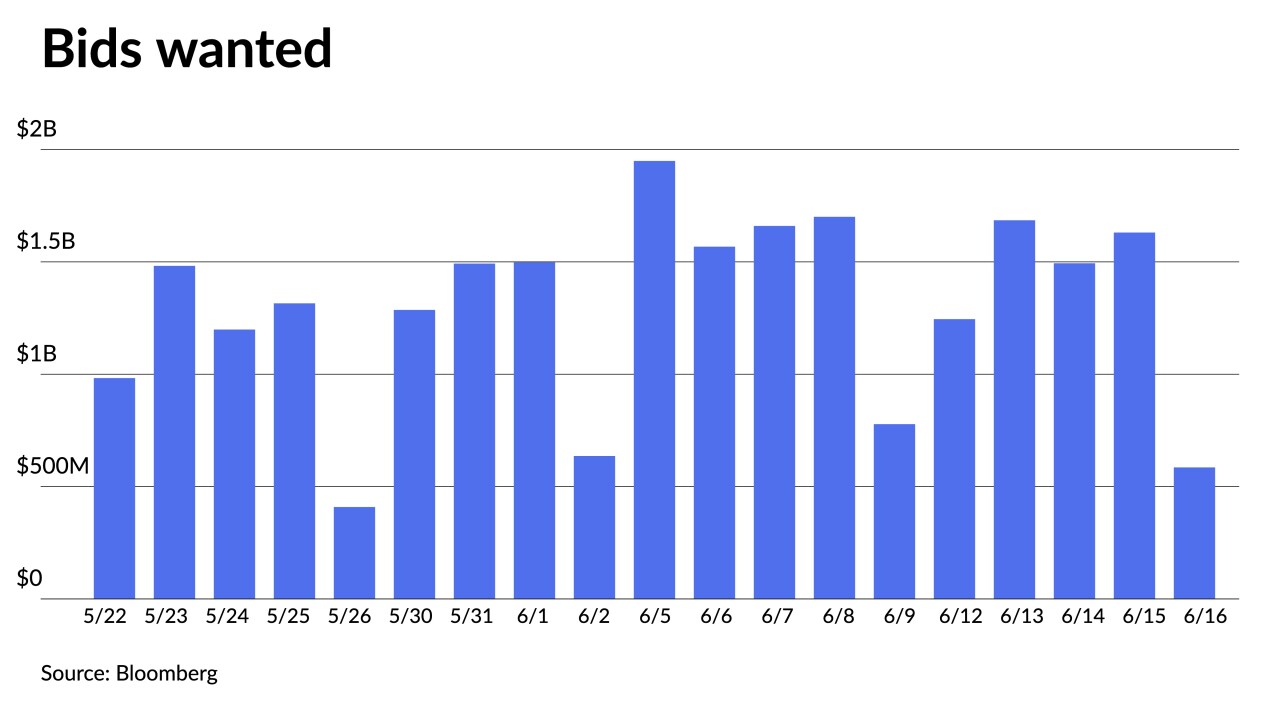

Elevated new issues, Federal Deposit Insurance Corp. sale lists, and heavy reinvestment cash "helped to offset each other [last] week and keep the muni market stable," said Birch Creek strategists.

June 12 -

Municipals have continued outperforming, "building on the trend that started in late May," Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel said.

June 9