-

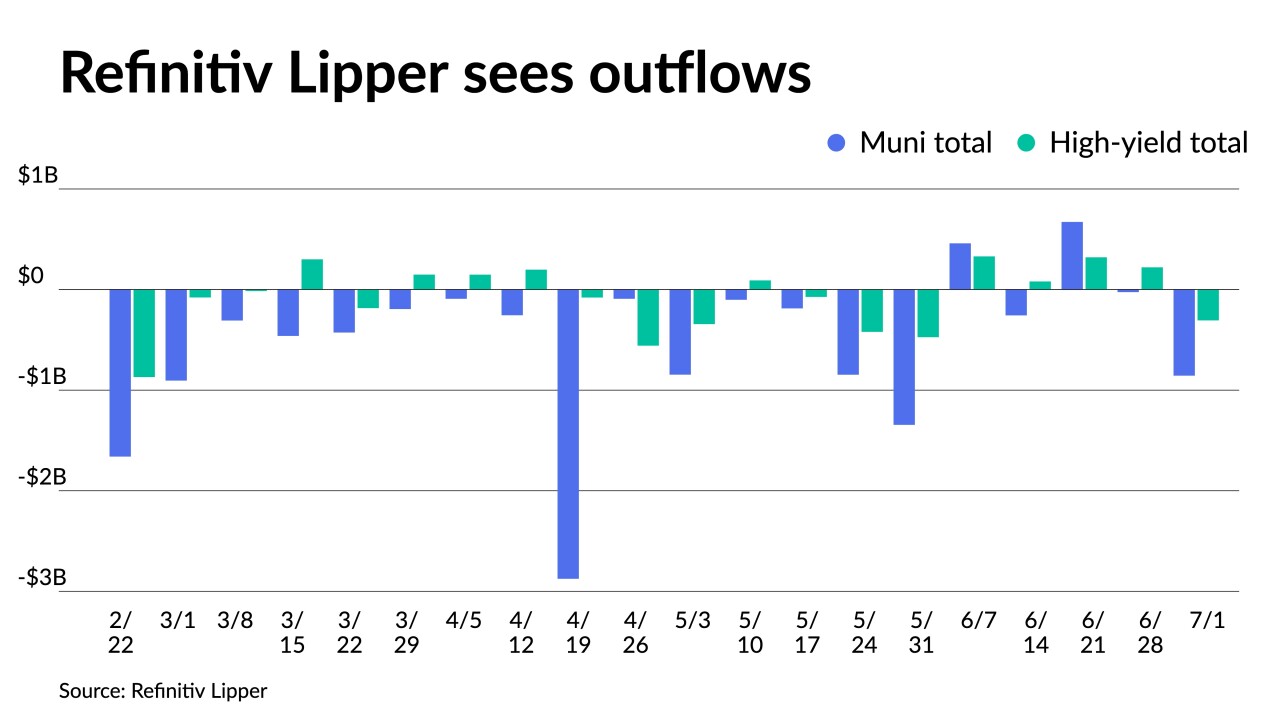

Municipal bond mutual fund outflows intensified as Refinitiv Lipper reported investors pulled $855.719 million from the funds for the week ending Wednesday following $25.331 million of outflows the week prior.

July 6 -

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week.

July 5 -

"Lower volumes, lighter primary issuance, and heavier reinvestment cash flows are likely going to contribute to a continued bout of muni relative performance," said Birch Creek Capital strategists.

July 3 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $304.5 million. This marks the lowest week of issuance in 2023.

June 30 -

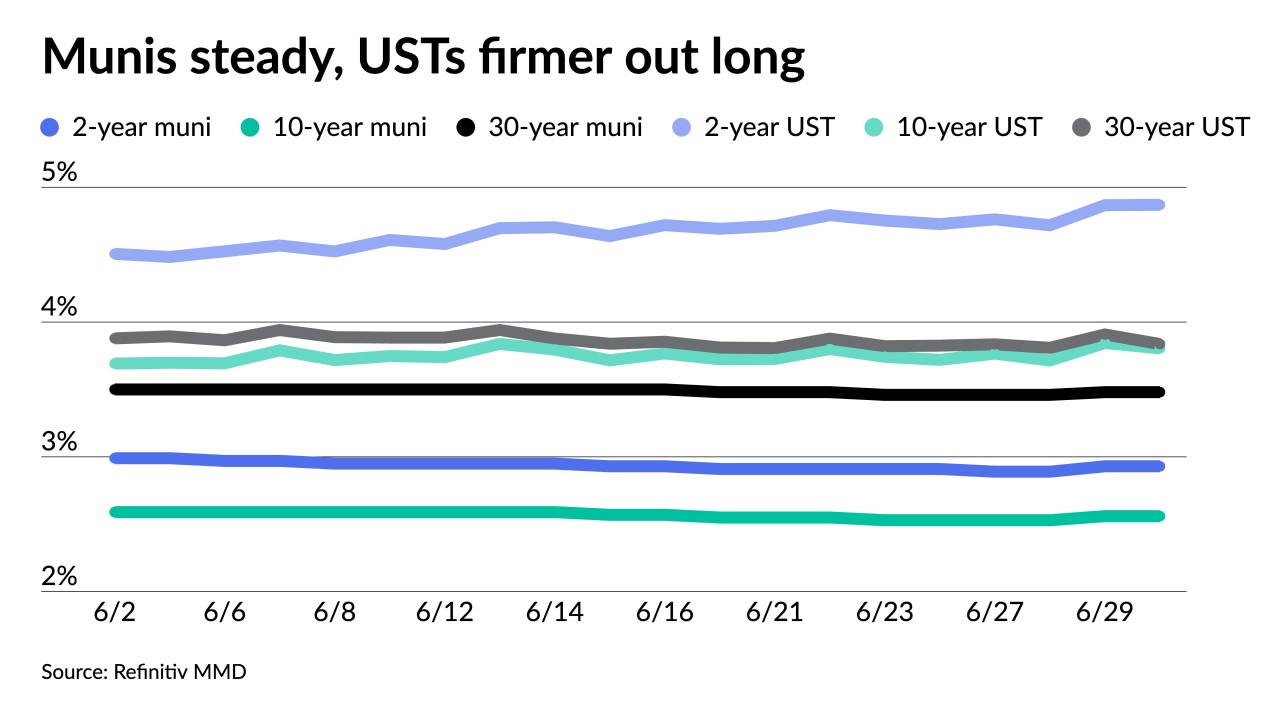

Triple-A yields rose one to five basis points, depending on the scale, as secondary trading showed cheaper prints and some new-issues had to be cheapened to clear the market while USTs saw larger losses of up to 16 basis points on the three and five year.

June 29 -

With the first half of the year ending on Friday, municipal sources say the second half of the year will be off to a good start.

June 28 -

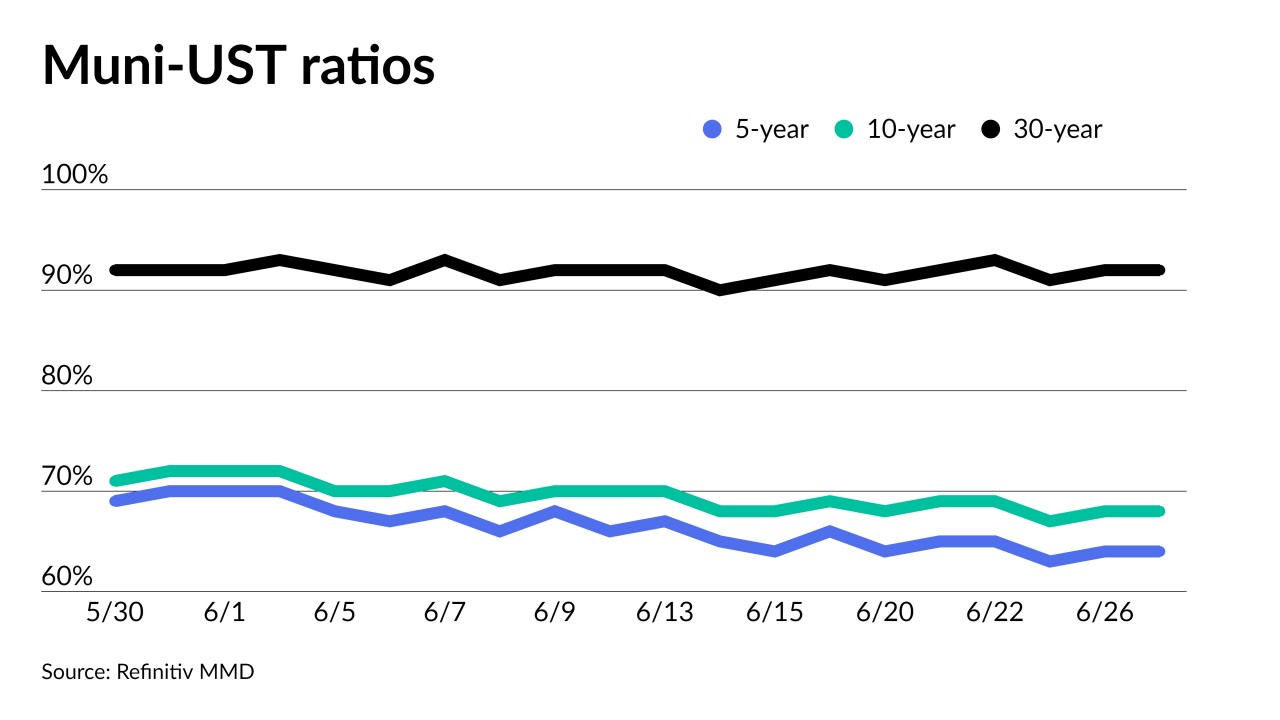

While supply has started to pick back up with an outsized primary market calendar this week, it's still not enough to meet demand, said Cooper Howard, a fixed income strategist at Charles Schwab.

June 27 -

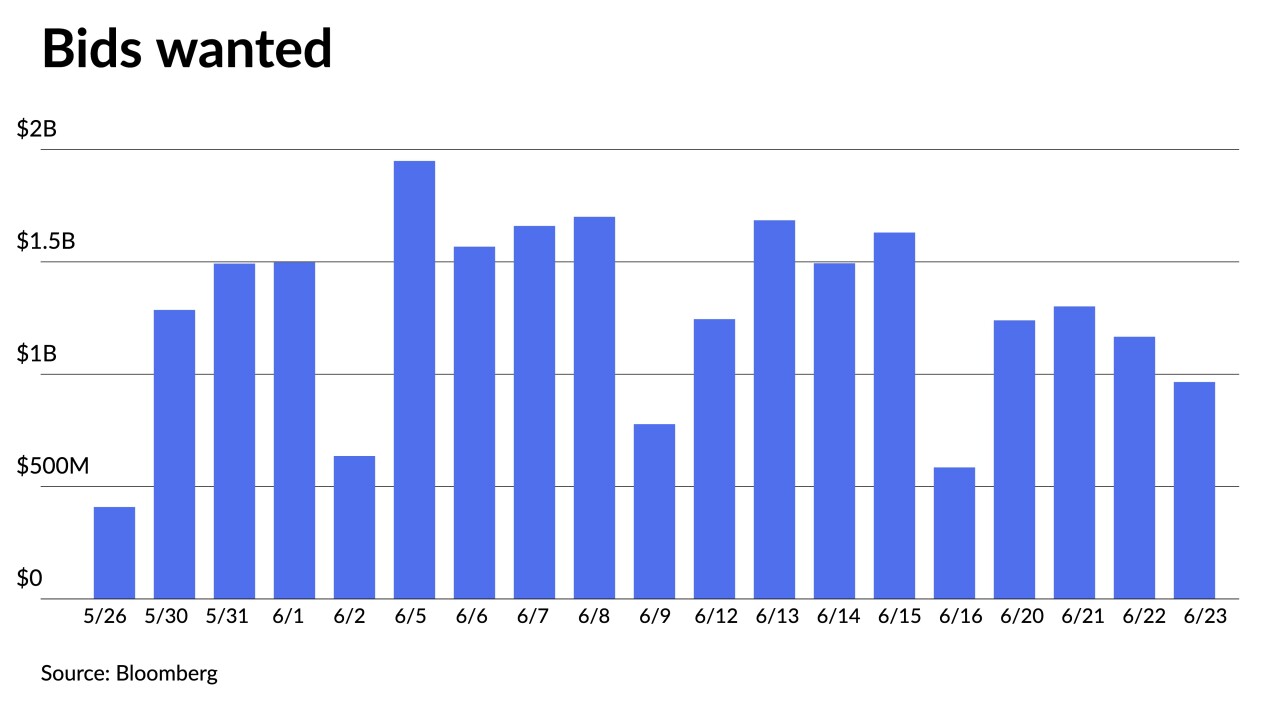

Despite a slow start to the week, "buyers are becoming more constructive, and there's increased buying going on," said Pat Luby, a CreditSights strategist.

June 26 -

The $6.9 billion new-issue calendar features high-grade deals from Georgia, Washington and Massachusetts, among other frequently traded credits, which should provide direction for scales.

June 23 -

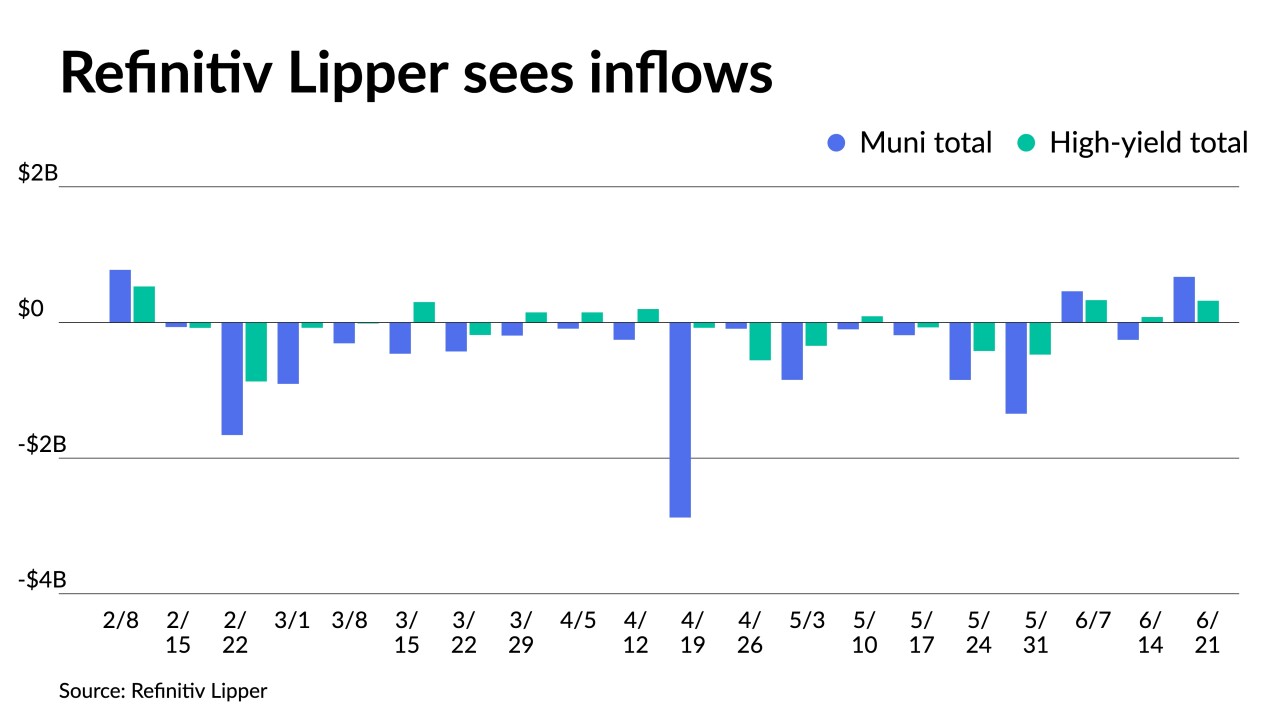

Municipal bond mutual fund inflows returned as Refinitiv Lipper reported investors added $672.288 million for the week ending Wednesday following $256.532 million of outflows the week prior.

June 22