-

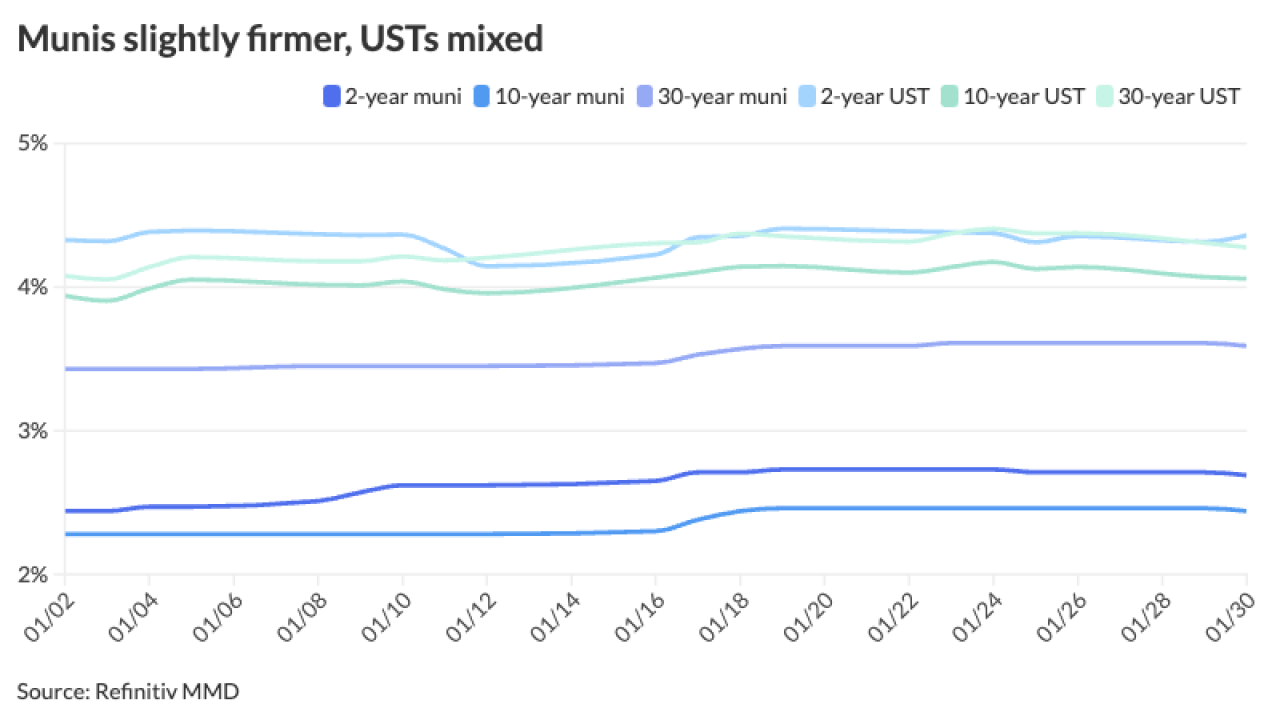

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The muni market will see "continued strength," said Wesly Pate, senior portfolio manager at Income Research + Management, largely due to a a dearth of new-issue supply.

February 12 -

"Even though it is hard to see the market falling out of bed and underperforming in the near term, we are more cautious going into March," Barclays PLC said in a report.

February 9 -

Ex-IFS Securities head of fixed income Keith Wakefield committed criminal securities and wire fraud from 2017 to 2019, a federal jury in Illinois found.

February 8 -

Municipals were steady to improved in spots in secondary trading as another day of sizable new-issues were well-received in the primary market.

February 8 -

"The debt afforablity study was just released. In this study we outlined how state debt is going to be falling by 60% over an eight year period," state Treasurer Dale Folwell said Tuesday.

February 8 -

The SIFMA Swap Index fell to 3.24% Wednesday, down 50 basis points from 3.74% from the week prior, and 131 basis points from 4.55% it hit on Jan. 24 as swings continued in the VRDO market. Tax-exempt money market funds reversed course to see inflows of almost $4 billion.

February 7 -

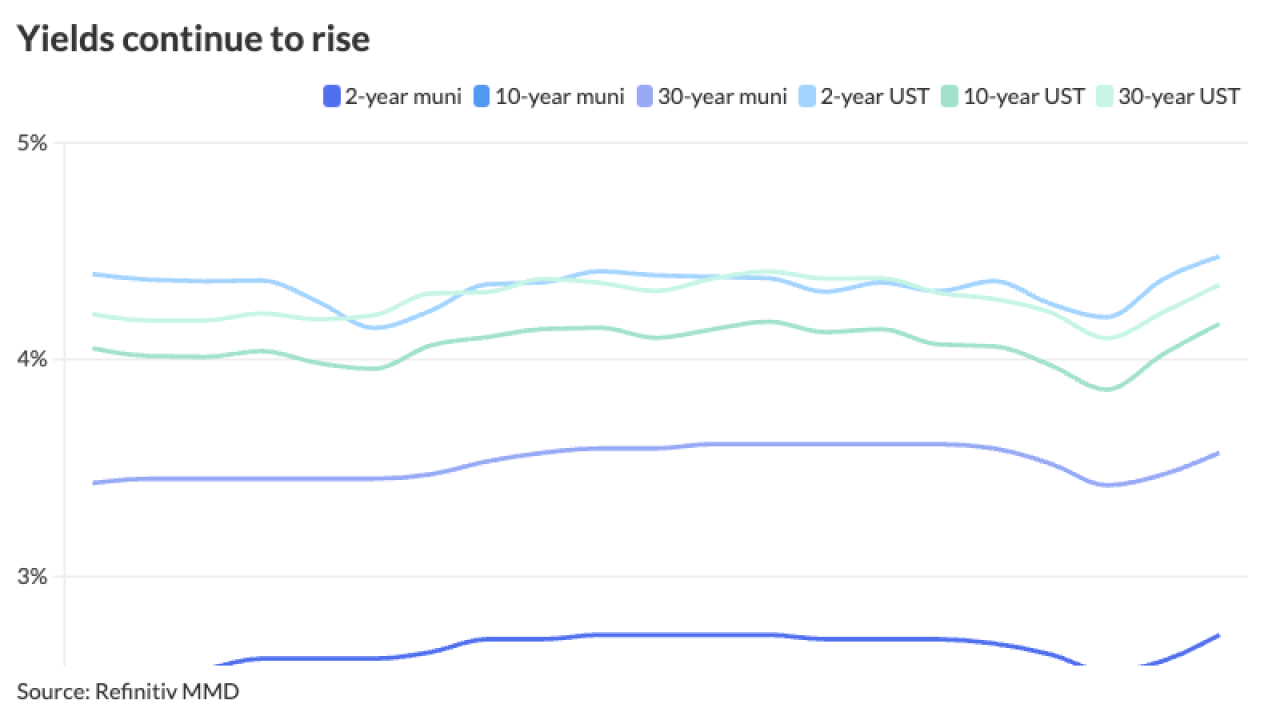

The volatility in USTs is giving municipals a difficult run to start February. The asset class lagged the selloff and outperformed the recent rally, which points to its resiliency — but those moves do not come without challenges.

February 6 -

Chad Wildman, executive director, Quantitative Strategies at FMSbonds, and Matthew Smith, founder and CEO of Spline Data, discuss how automation has repositioned the muni market and where participants can find value by using technology tools. Lynne Funk hosts. (45 minutes)

February 6 -

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

Munis saw smaller losses, outperforming a UST sell-off after the employment report came in stronger than expected, leading analysts to suggest Federal Reserve rate cuts may come later than anticipated.

February 2 -

The goal behind SOLVE's new product is to turn raw data into data-driven insights through AI, with munis being the first step before expanding to other key asset classes in fixed income, said Eugene Grinberg, co-founder and CEO of SOLVE.

February 2 -

The primary saw strong demand with the Triborough Bridge and Tunnel Authority doubling the size of its deal to $1.6 billion.

February 1 -

Fed Chair Jerome Powell said cuts are likely this year but are not guaranteed. He added that the Fed is looking for more signs that inflation is moderating. "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

January 31 -

"Yields are attractive, and there's going to be a lot of demand and there's not going to be a lot of bonds," said Scott Diamond, co-head of the municipal fixed income team at Goldman Sachs.

January 30 -

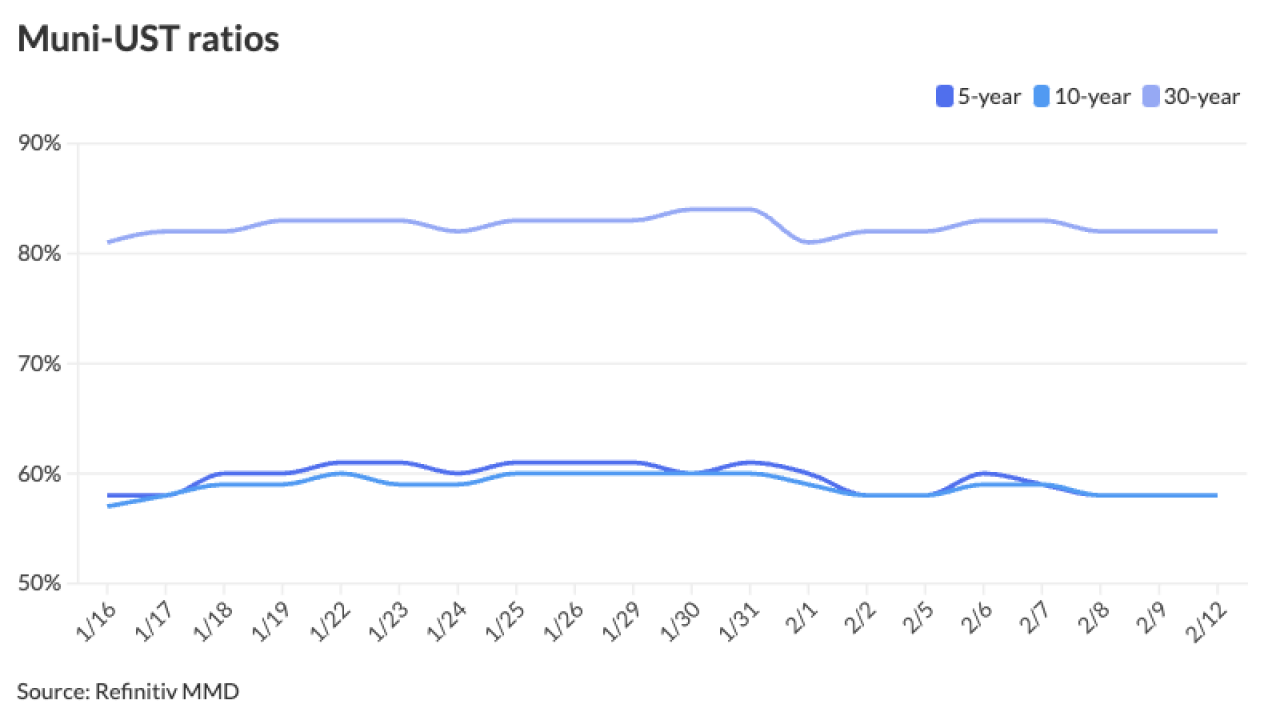

"The market seems to be coalescing around the view that these historically rich ratios can be sustained through February, but that the market technical becomes far less favorable in March and April," said Birch Creek Capital strategists in a report.

January 29 -

BofA expects muni yields to continue to move up and credit spreads to narrow "in a slow and gentle fashion" in February.

January 26 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

LSEG Lipper reported Thursday that investors added $210.6 million to municipal bond mutual funds for the week ending Wednesday — the third consecutive week — after inflows of $898 million the week prior.

January 25