-

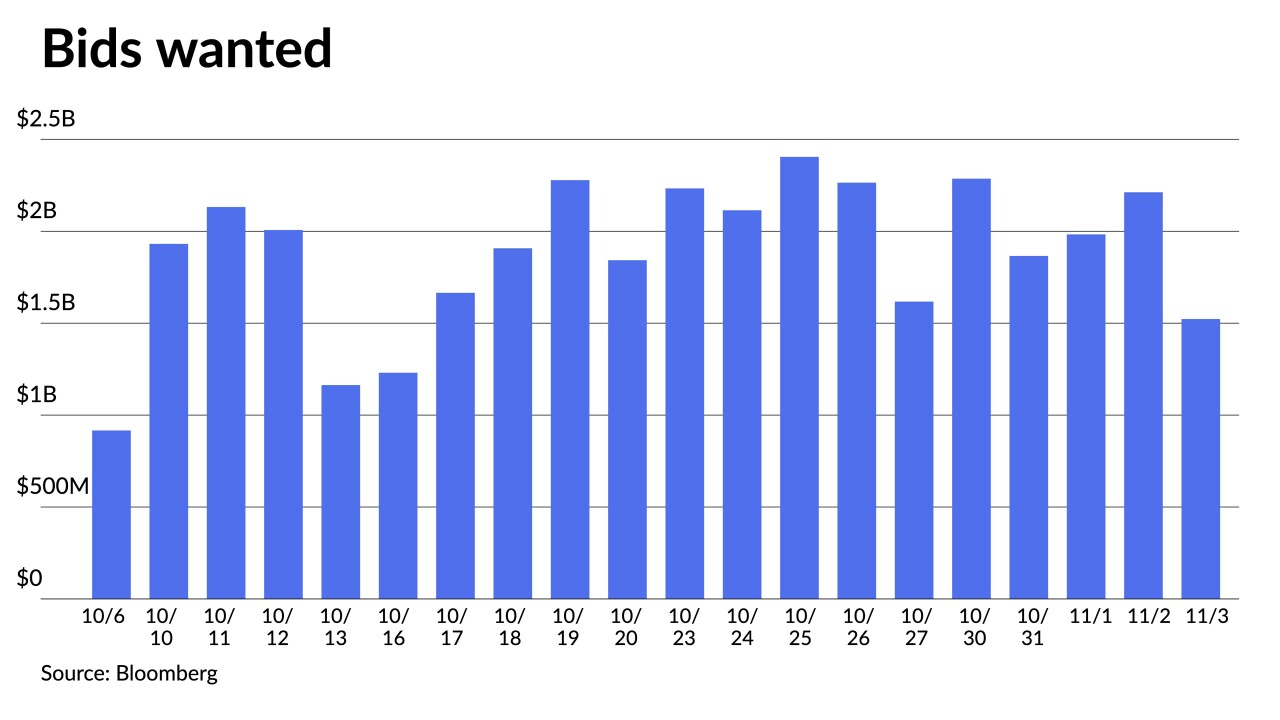

"As with most fast rallies there are sessions when the market pauses to assess where fair value should play out," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

November 10 -

A constructive trading session in the secondary aided a busy primary once again as investors appear to be more engaged in the asset class.

November 8 -

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

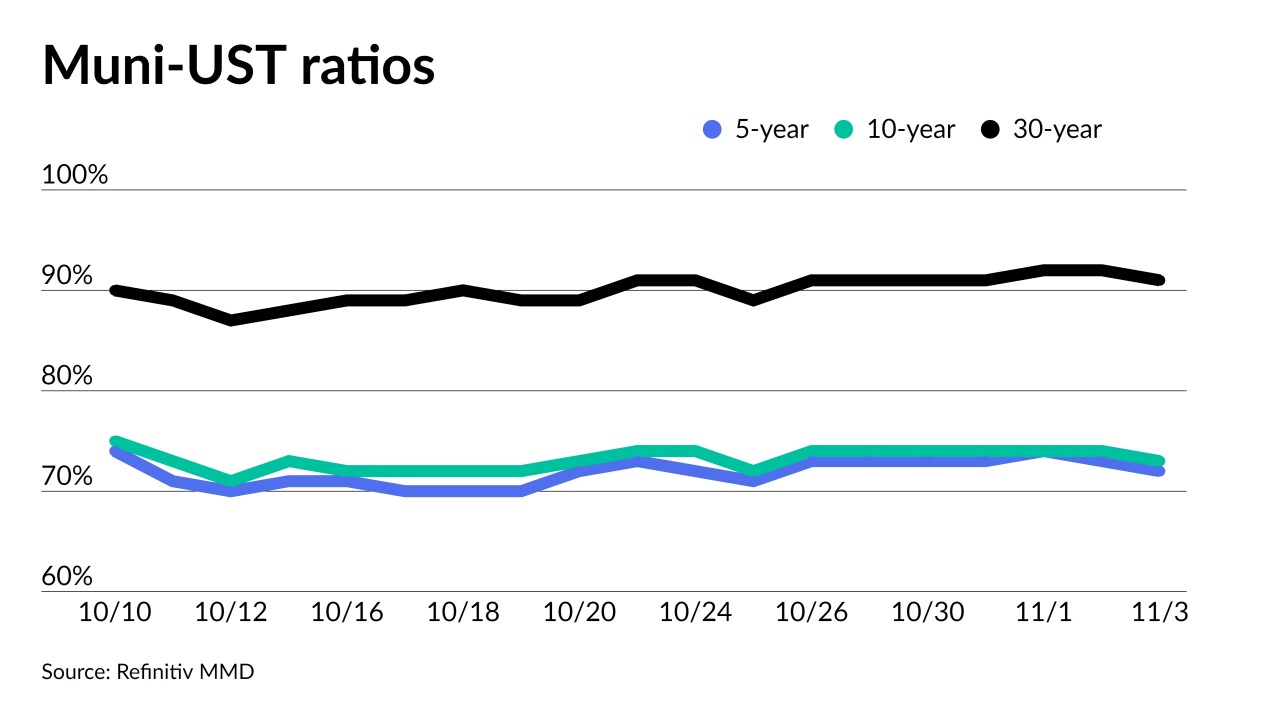

The recent rally is good news for munis, which have "posted a total-negative return loss for three straight months," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

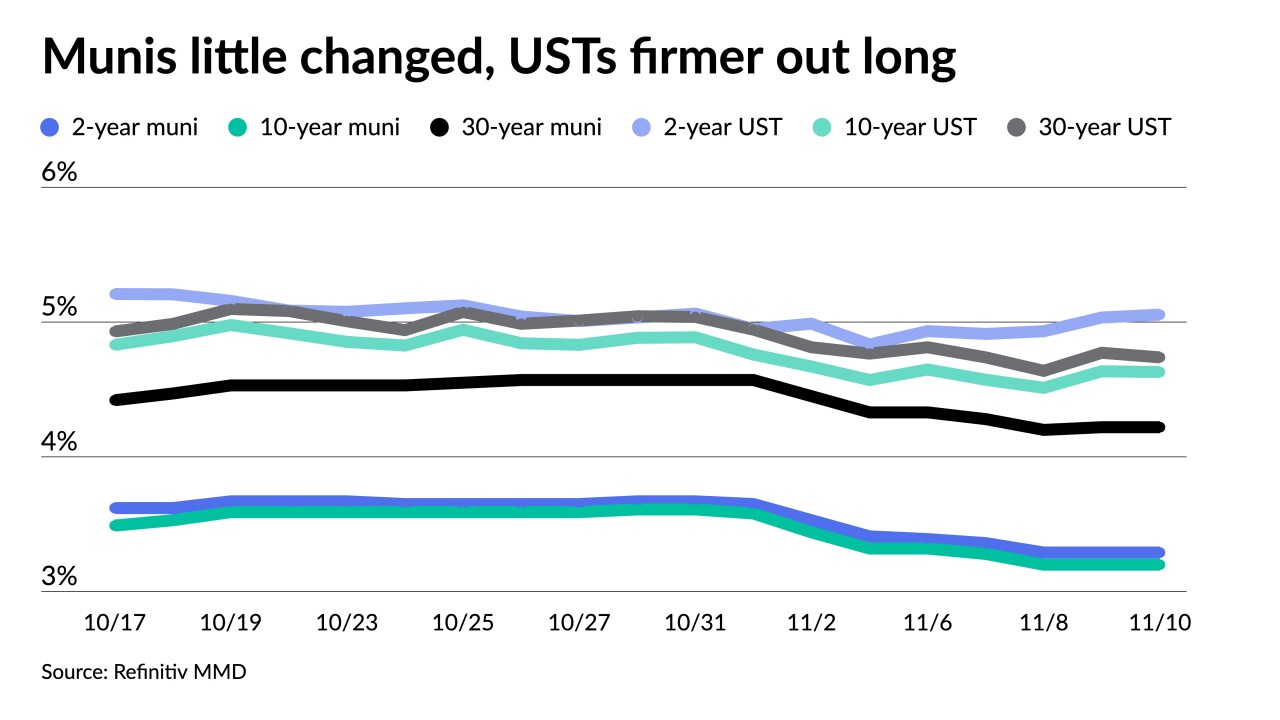

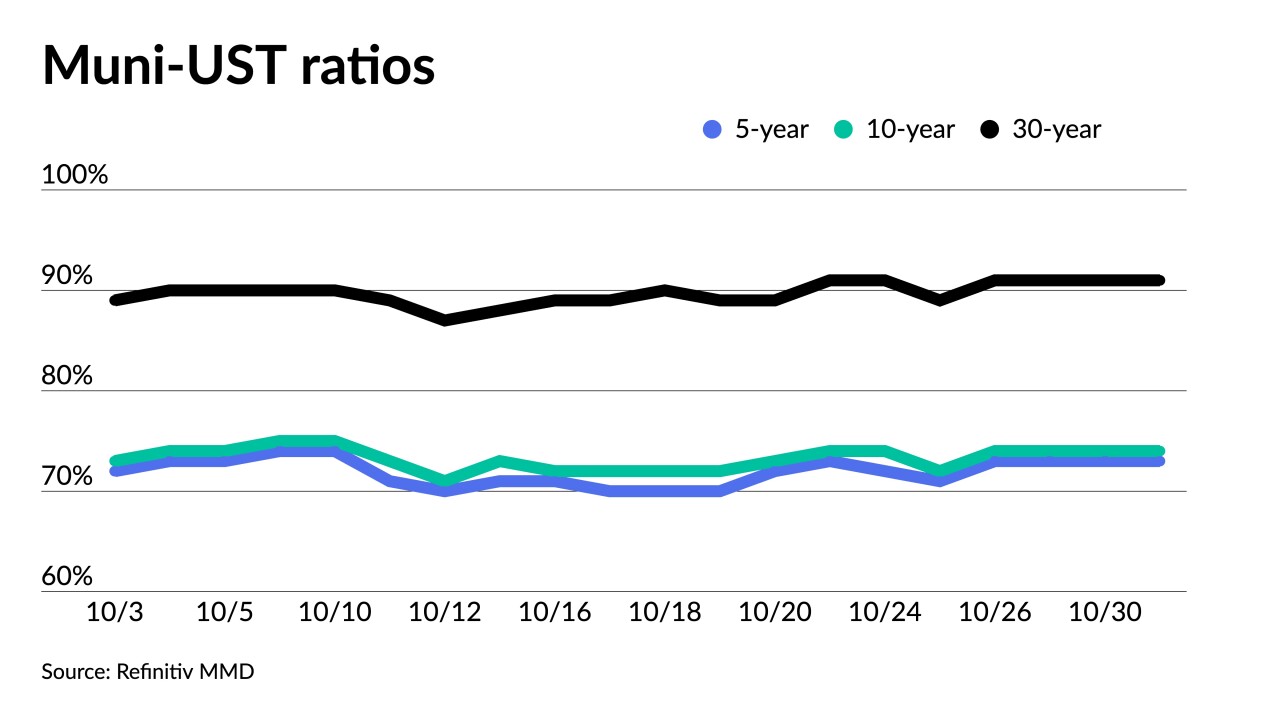

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

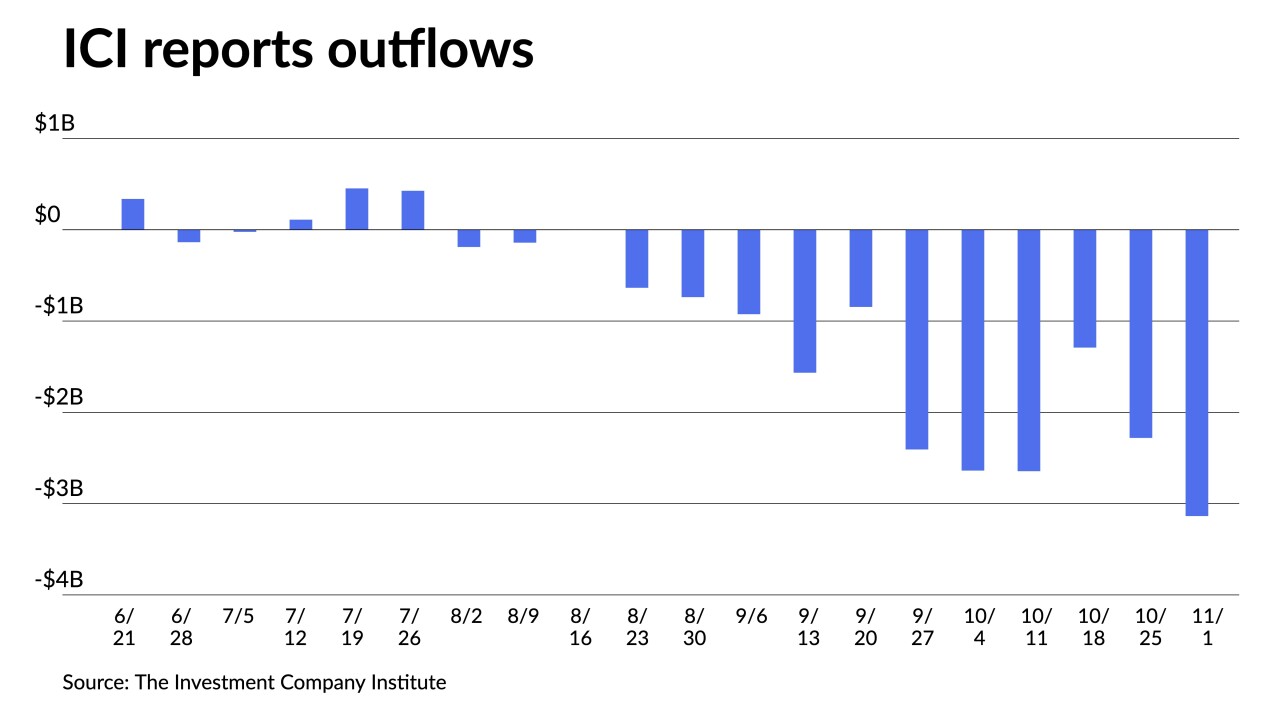

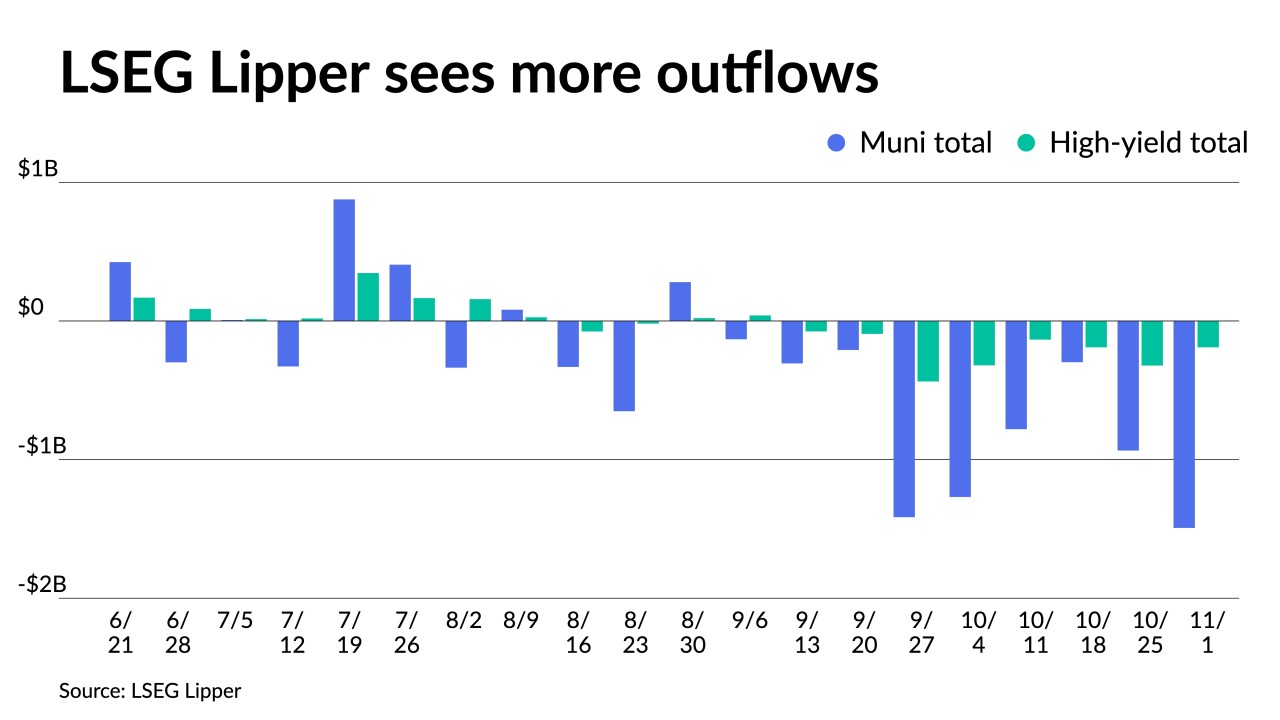

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

Bond Buyer Senior Reporter Keeley Webster shares an interview with California Treasurer Fiona Ma on her run for lieutenant governor as a prelude to a fireside chat Wells Fargo Director Julia Kim conducted with the state treasurer at The Bond Buyer's California Public Finance conference.

October 31 -

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30