-

Lipper reported a whopping $12.2 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion were from high-yield funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.

March 19 -

A coalition of healthcare industry organizations is asking for $100 billion in direct federal help, warning that the survival of some hospitals is at stake.

March 19 -

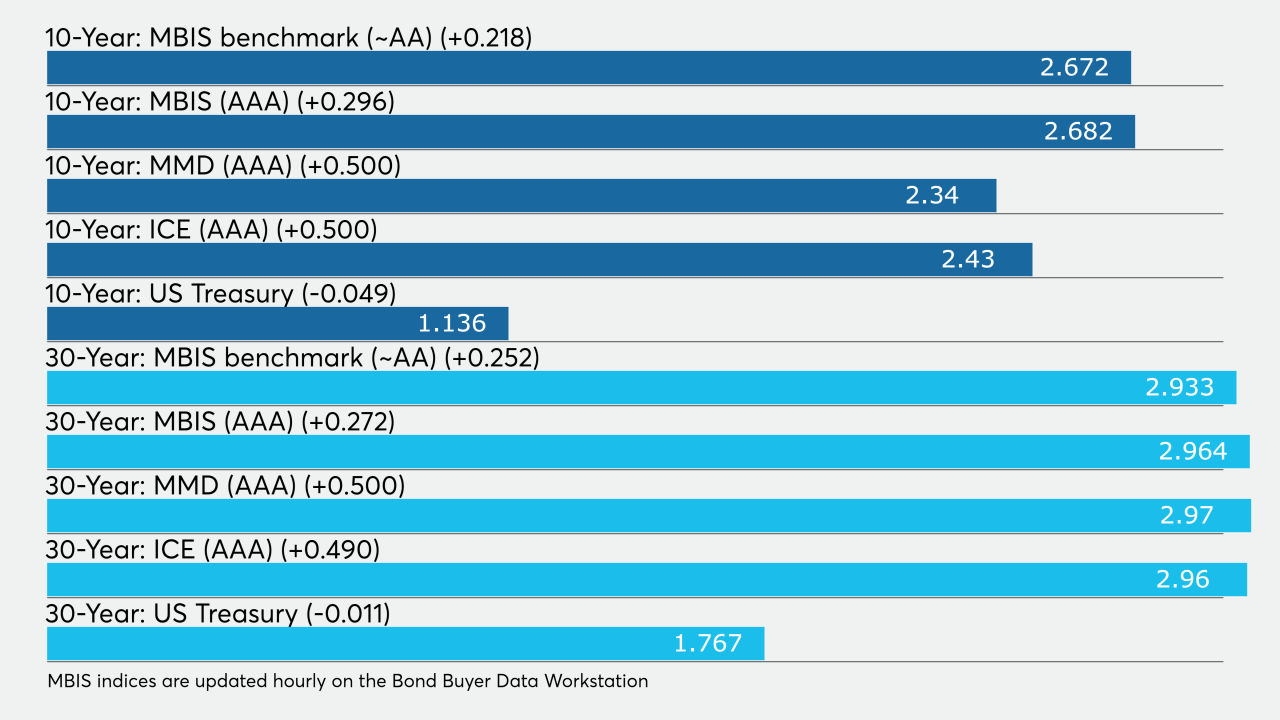

Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

March 18 -

Tax-exempt municipal yields rose substantially last week causing the MSRB to take a look at trade data, said John Bagley, MSRB chief market structure officer.

March 18 -

What will change in the age of autonomous vehicles? Almost everything, Mois Navon of Mobileye tells Chip Barnett as they talk about the future of cars and the effect it will have on tomorrow's society.

March 18 -

The municipal market is dealing with a major liquidity event, with massive short-end selling.

March 17 -

The municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.

March 16 -

Muni market players may have to rely on more than their basic instincts as the economy heads into stormy weather.

March 16 -

Uncertainty still abounds for the public finance space, as just before the market close, President Trump declared a national emergency. Meanwhile, states and cities across the country are closing schools, sporting events, and cutting back public transit. But Friday, at least, provided some reprieve from the five previous volatile days.

March 13 -

Michael Zezas, managing director of research at Morgan Stanley, notes that muni yields have not fallen as quickly as the Treasury equivalents and recession risk climbs the longer the coronavirus persists. Layer on top of those items the incipient oil competition and quite a storm is brewing. Even liquidity is becoming "disorderly." John Hallacy hosts.

March 12