-

Secondary trading picked up somewhat while the new-issue market saw a large amount of taxables in the negotiated space while Pennsylvania competitively sold $470 million of general obligation bonds.

September 16 -

This deal is designed to expand MarketAxess’ existing municipal bond trading solution for global institutional investor and dealer clients, the firm said.

September 16 -

The Puerto Rico Housing Finance Authority may issue $250 million of tax-exempt capital fund modernization program refunding bonds the week of Sept. 28.

September 15 -

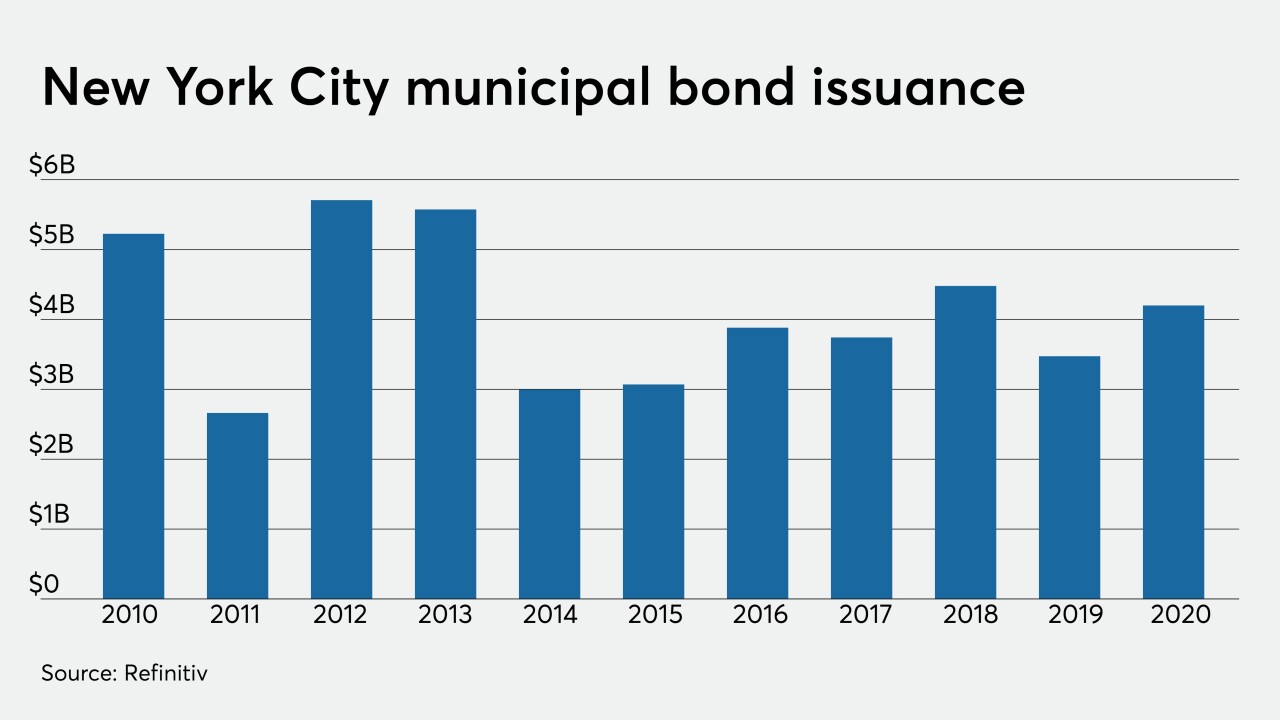

"Yields are just still so remarkably low," a New York City trader said.

September 14 -

Municipals held firm ahead of a strong supply stream of bonds in a calendar heavy with taxable and green bond deals.

September 11 -

Longer-dated municipals strengthened Thursday as transportation deals from Oregon, Texas and Atlanta issuers came to market.

September 10 -

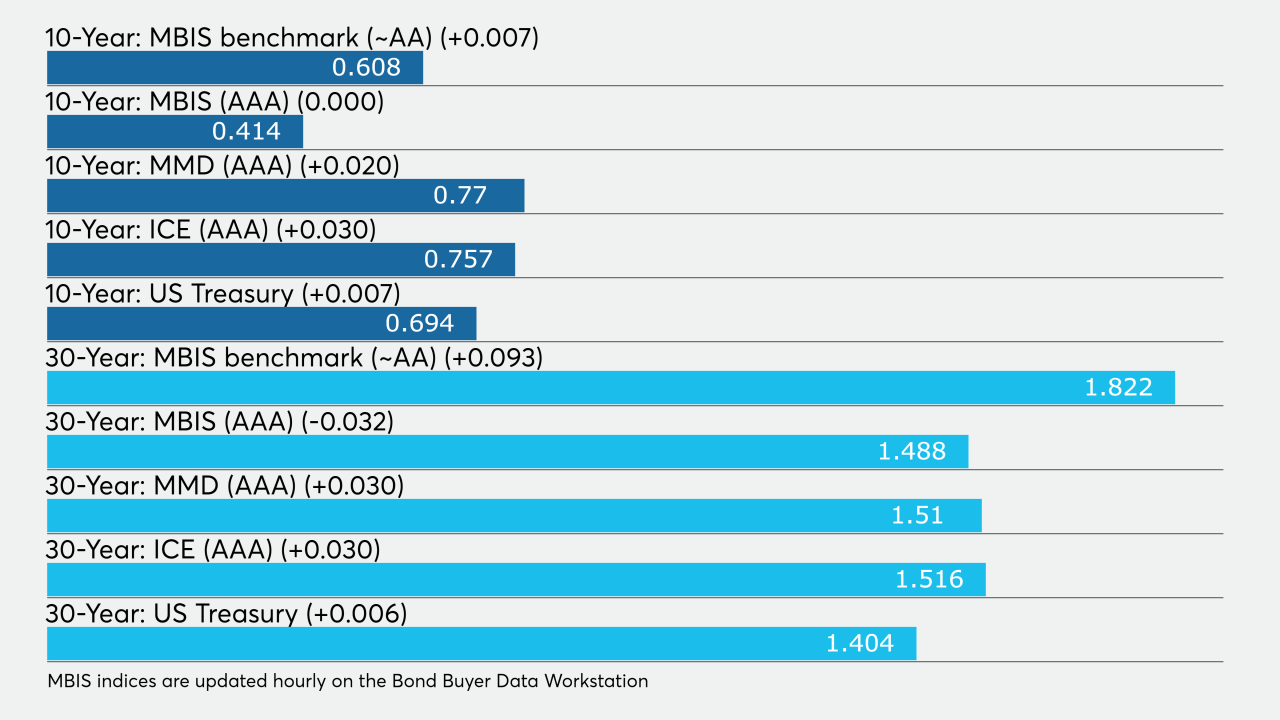

Muni yields fell a basis point on some AAA curves Wednesday as deals from Maryland and California hit the screens.

September 9 -

The fluid nature of municipal credit during the coronavirus is countering what are 'fairly solid technical factors' for the market while participants await news out of Washington for more stimulus.

September 8 -

Siddharth Singhai, chief investment officer at IronHold Capital, explores how pension funds can choose better money managers. Paul Burton hosts. (16 min.)

September 8 -

As the long Labor Day holiday beckoned, munis remained mostly steady in quiet trading. Cal trades up.

September 4 -

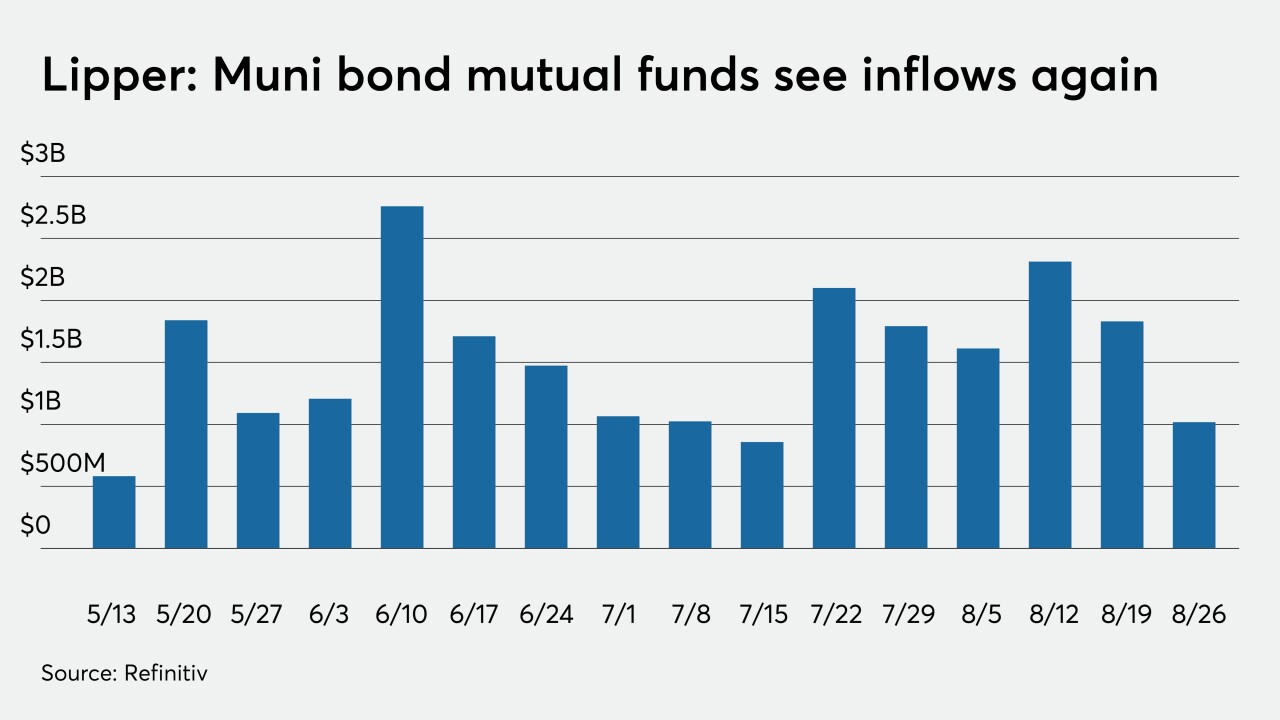

Refinitiv Lipper reported $139.364 million of muni fund inflows, the 17th week in a row of positive results, but the lowest gain since July.

September 3 -

The Florida State Board of Administration Finance Corp. deal was upsized by $1 billion on a day that gave muni buyers a wide variety of paper to choose from.

September 2 -

September got off to a good start as buyers had their pick of a variety of new issues, which priced into a stable market environment.

September 1 -

Price guidance was issued on California's $2.4 billion GO deal as the State of New York Mortgage Agency got ready for its first social bond issue as the ESG muni market expands.

August 31 -

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

More supply sold Thursday as the Chicago Transit Authority, the Austin ISD, Texas and Kern HSD, Calif., all came to market.

August 27 -

Ashton Goodfield, head of municipal bonds at DWS Group, talks with Chip Barnett about how the municipal bond market has been coping with the effects of the COVID-19 pandemic and what's in store for the rest of the year. (22 minutes)

August 27 -

Munis continued to weaken with yields on the AAA scales rising by as much as three basis points.

August 26 -

Municipals turned weaker on the long end Tuesday as NYC's tax-exempt GOs were priced for retail investors.

August 25 -

Municipal bonds ended unchanged on Monday ahead of this week $8 billion of new issuance.

August 24