-

Bid list volume is trending higher into the end of the year, but its share as measured against overall high demand does not pose much of a threat, analysts say. Refinitiv Lipper reports $992 million of inflows.

December 10 -

Muni benchmarks were steady while new deals re-priced to lower yields in a tale of two markets. ICI reported more inflows.

December 9 -

Strong technicals, low supply, yield-seekers keep munis outperforming.

December 8 -

The primary's diversity of credits and size relative to November has grown, but it is just not enough to push yields higher as redemptions flood the market. Some analysts still say a mild correction at least is due.

December 7 -

A heavier calendar still will not fulfill the $20 billion-plus of December redemptions. Muni/UST 10-year ratios fell to 74% as the UST 10-year came closer to 1.00%.

December 4 -

Difficulty tracking securities means a harder time for investors to understand their credit risk during the pandemic.

December 4 -

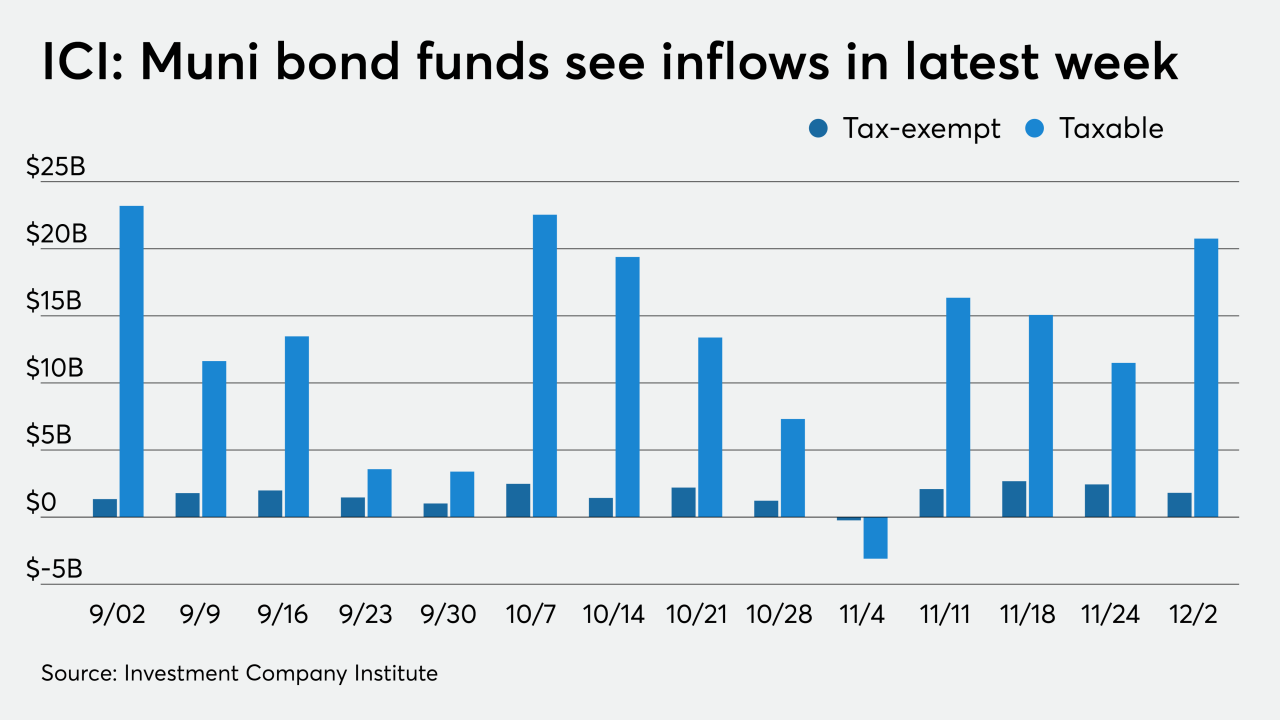

Refinitiv Lipper reported inflows of net $201 million for the week ending Dec. 2, down from $386 million the week prior.

December 3 -

Until supply increases, year-end demand has munis outperforming. ICI reports another multi-billion week of inflows.

December 2 -

Munis are likely to lag Treasuries in some fashion once year-end empathy settles in mid-month and ratios become a factor.

December 1 -

After volume in November came in around $19 billion, the lowest since 1999, investors look to December.

November 30