-

Municipal yields fell as much as three basis points on Friday as Treasuries soared in a flight-to quality bid as stocks plunged on fears about the emergence of a new COVID variant.

November 26 -

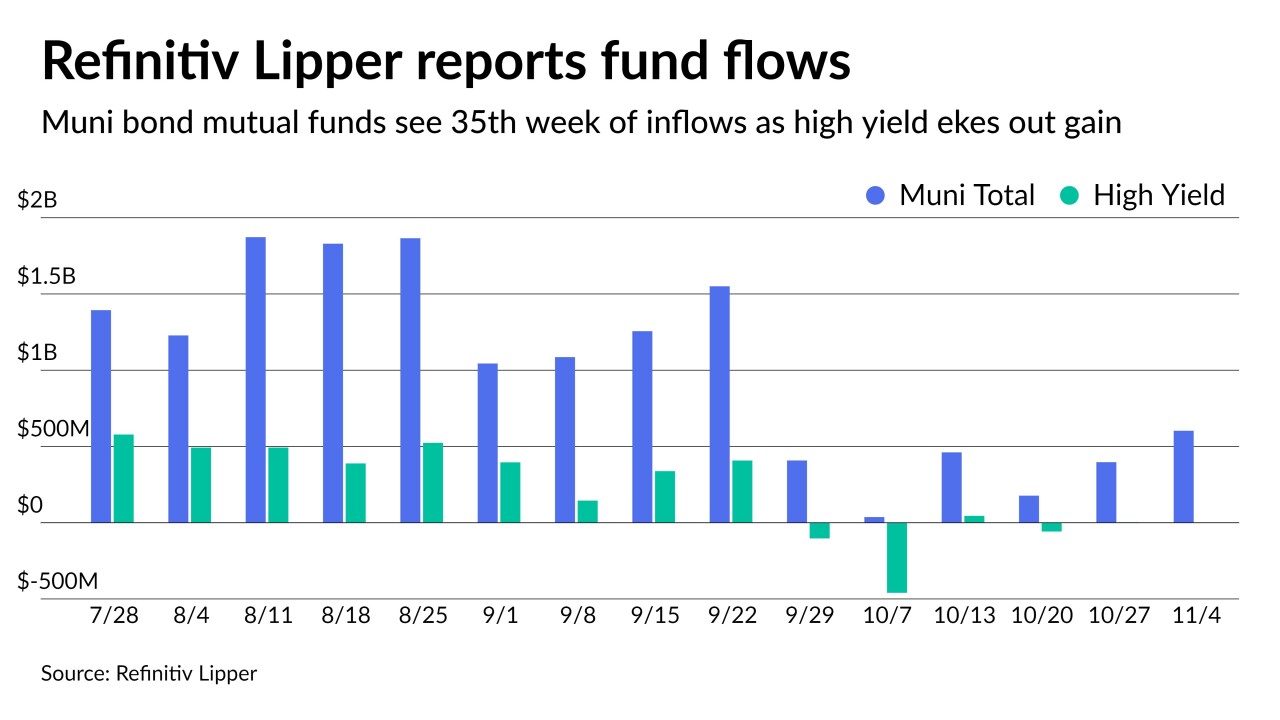

ICI reported $1.43 billion of inflows into municipal bond mutual funds in the week ending Nov. 17, down from $1.61 billion in the previous week.

November 24 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

November 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

November 22 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

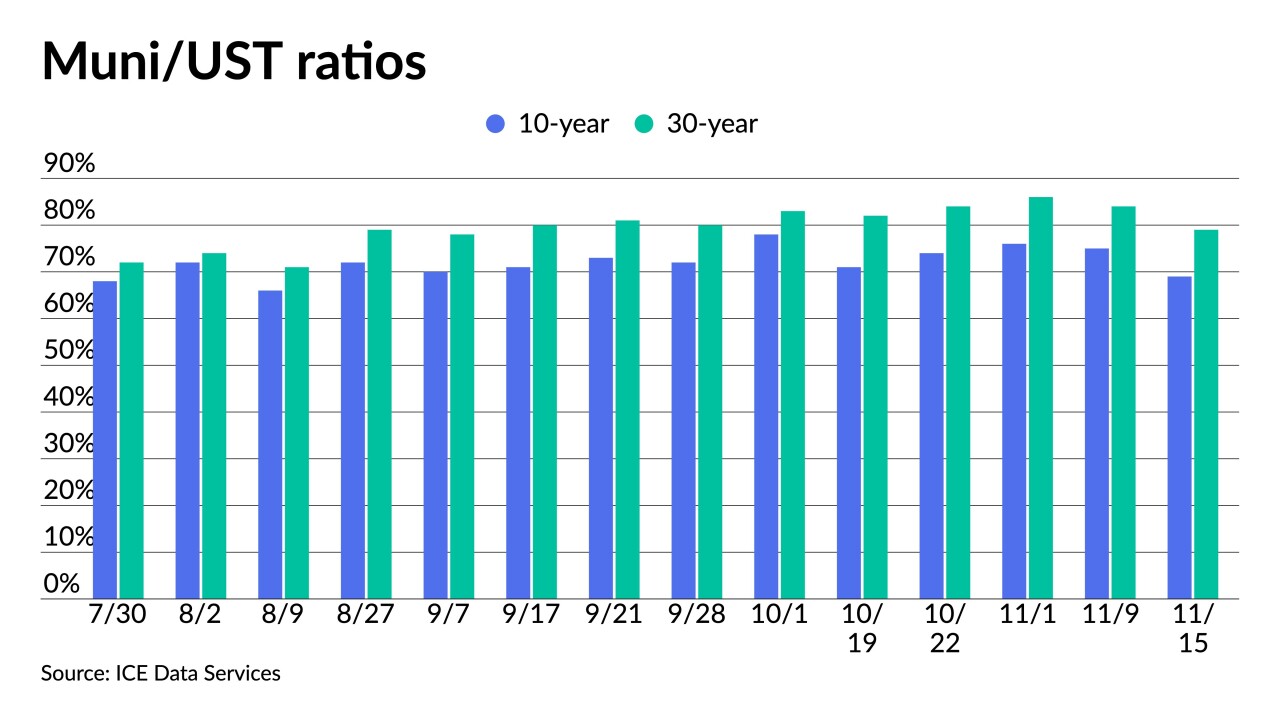

Month over month, the municipal market is in a much better position, as heavy demand and flows continue to drive it.

November 18 -

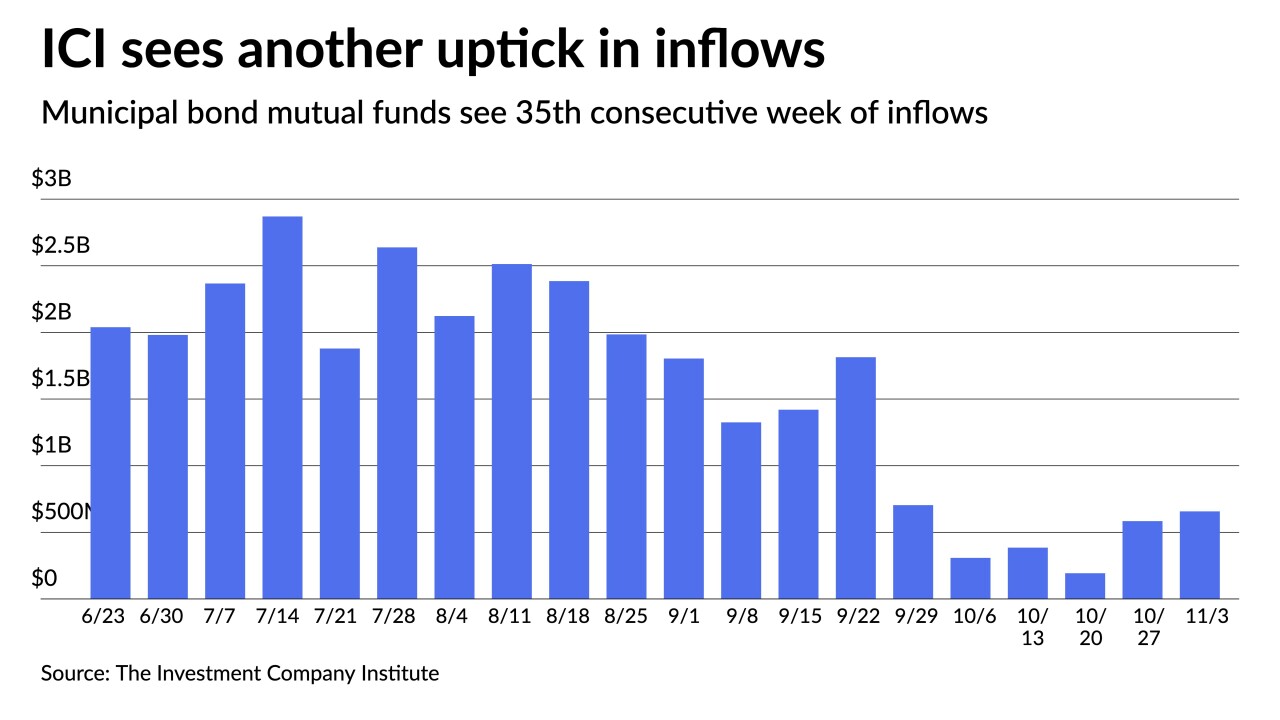

The Investment Company Institute reported $1.608 billion of inflows into municipal bond mutual funds for the week ending Nov. 10, up from $657 million a week prior.

November 17 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

November 15 -

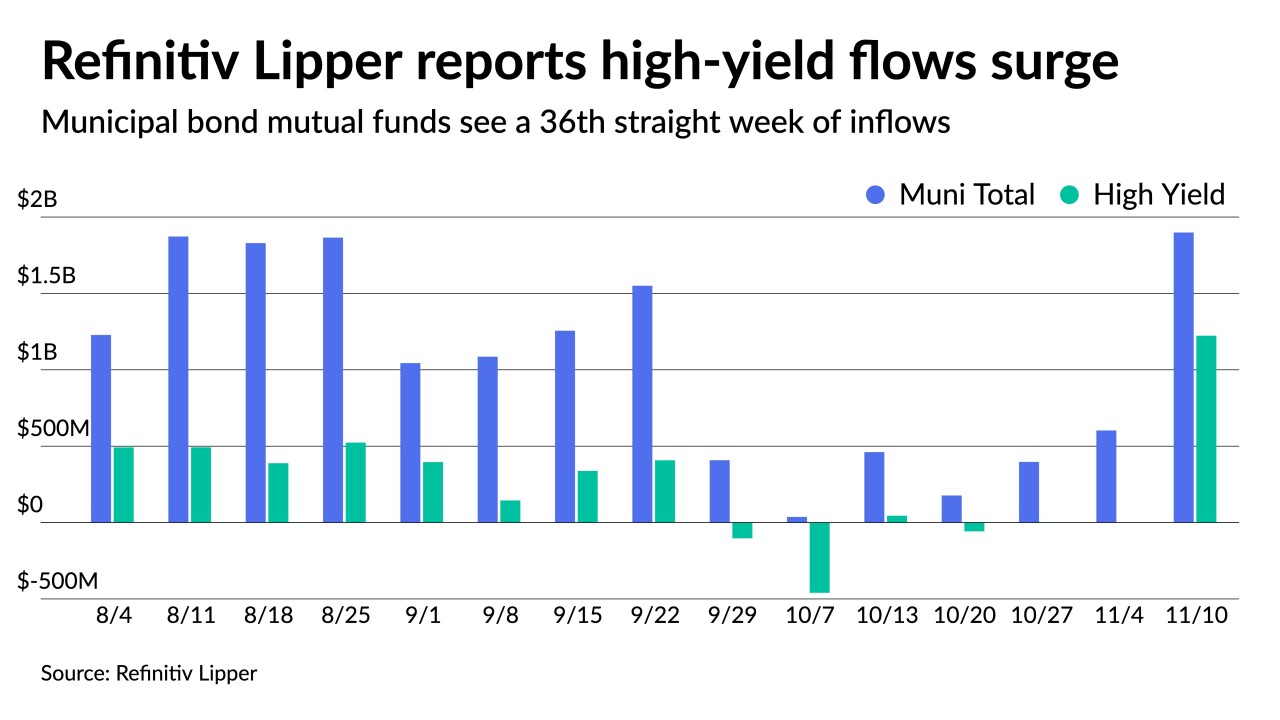

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

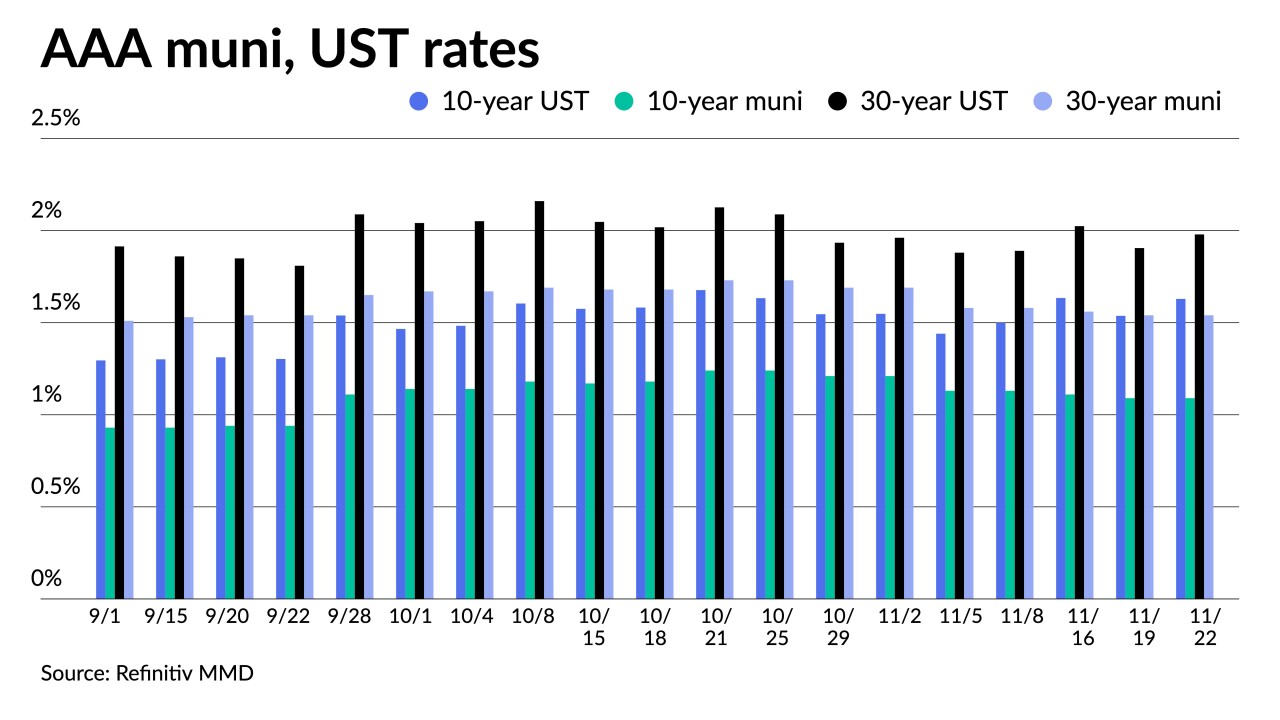

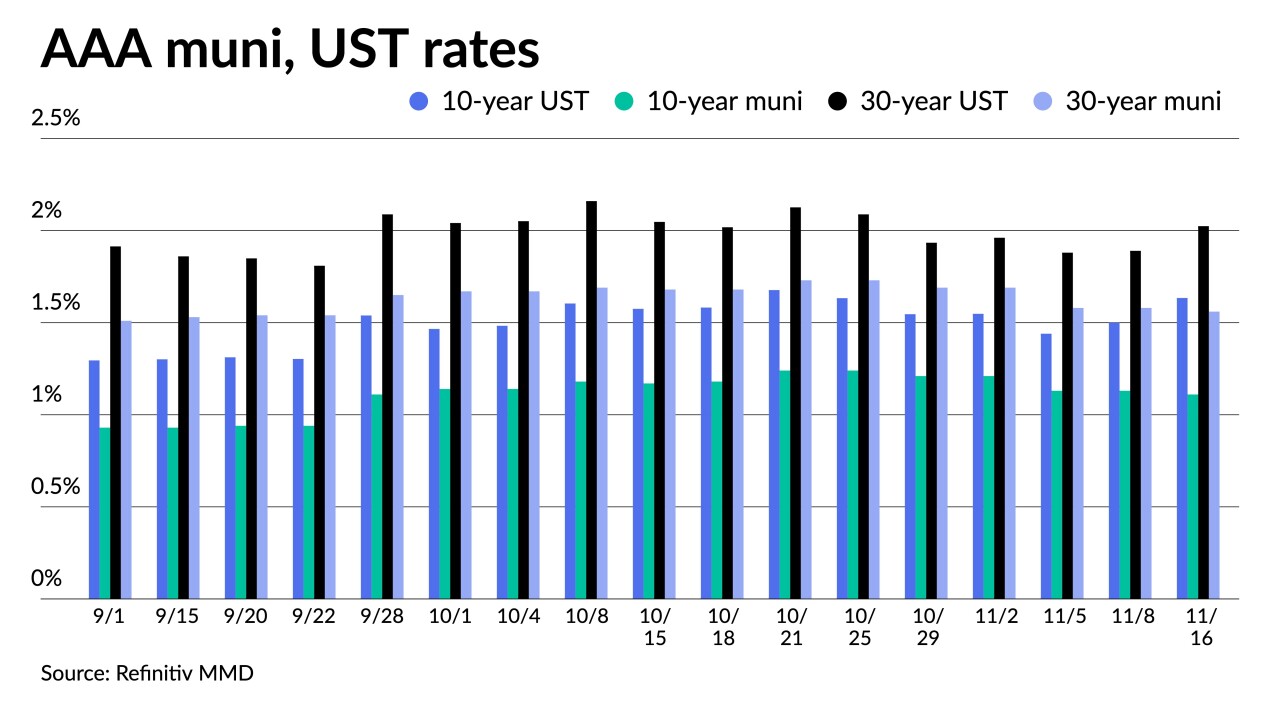

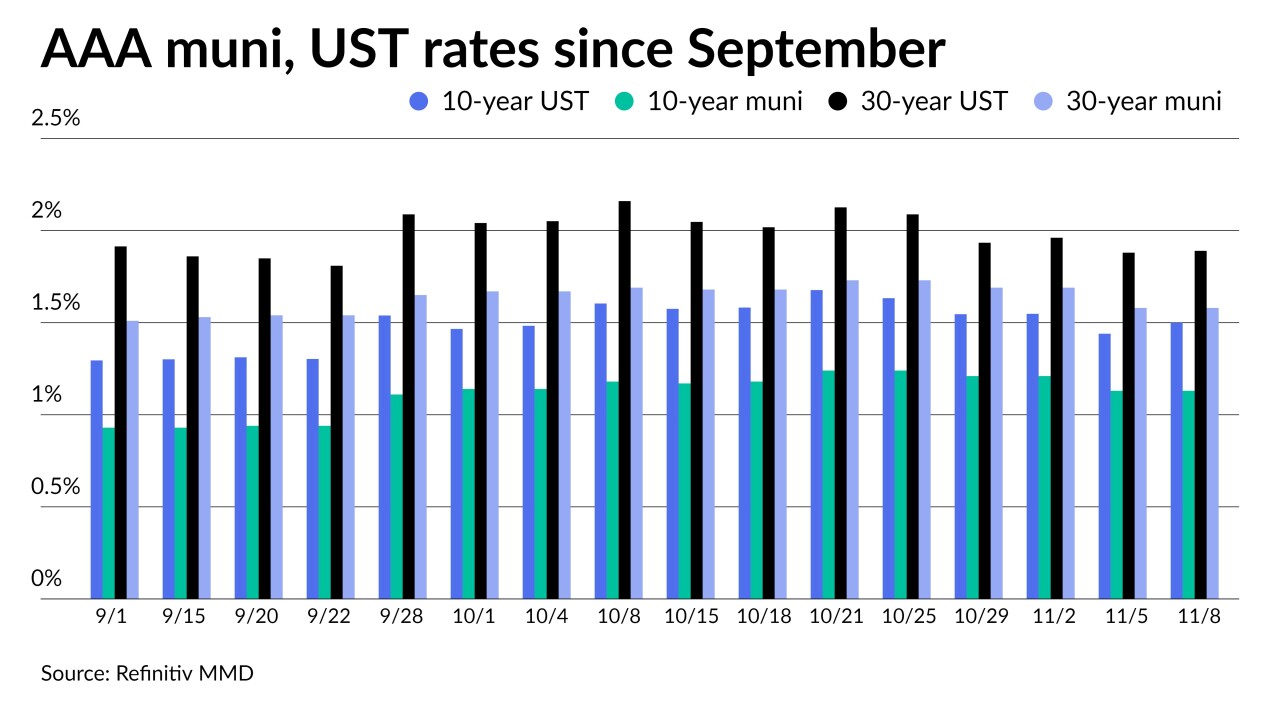

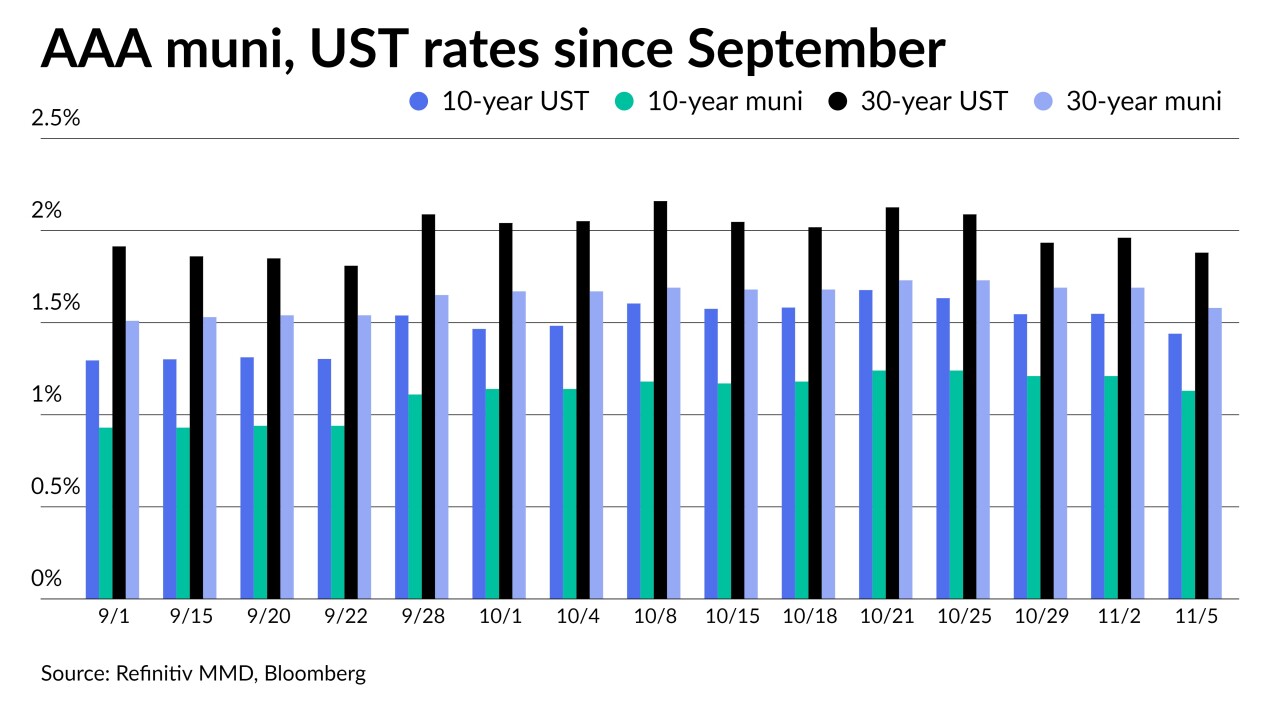

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8 -

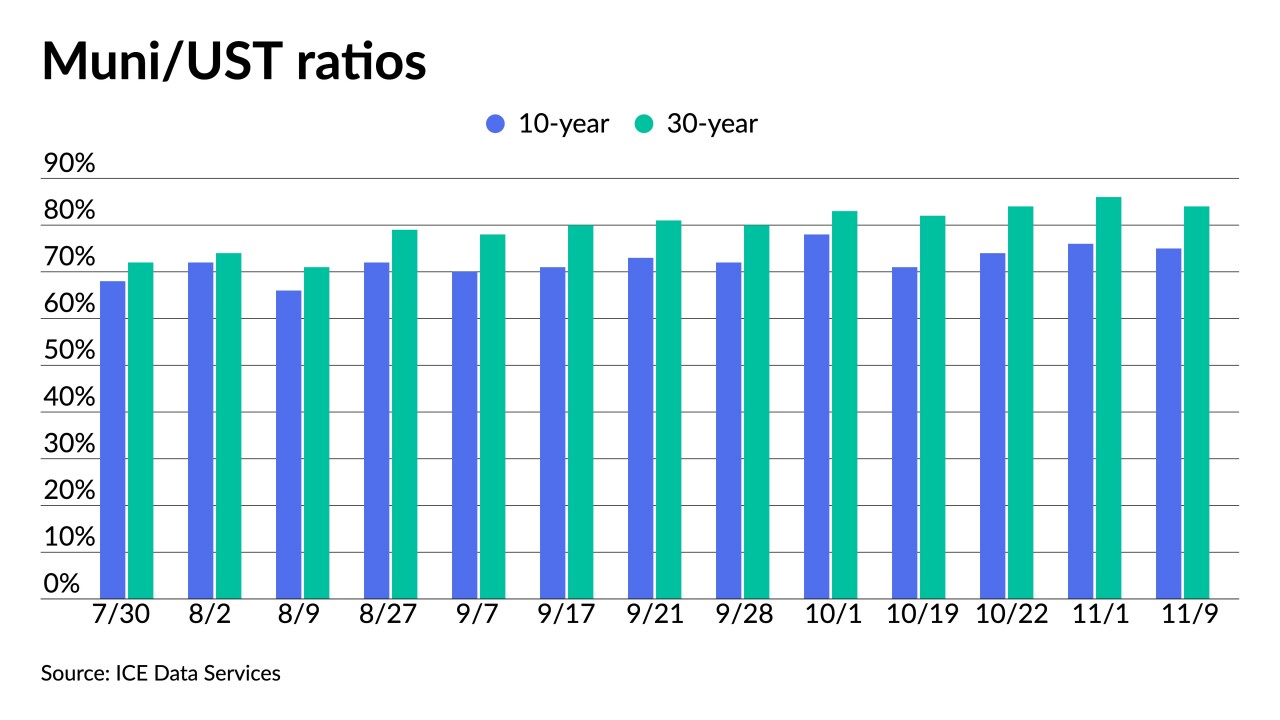

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3 -

The FOMC will likely take the opportunity to profess its reliance on data to decide liftoff and reiterate the threshold for a rate hike remains higher than for taper.

November 2 -

Chuck Stavitski and Elaine Brennan of Roosevelt & Cross and Ken Bieger of the Niagara Falls Bridge Commission talk about how the Canadian border closing due to COVID-19 affected upstate New York issuers. Chip Barnett hosts. (16 minutes)

November 2 -

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

November 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29