-

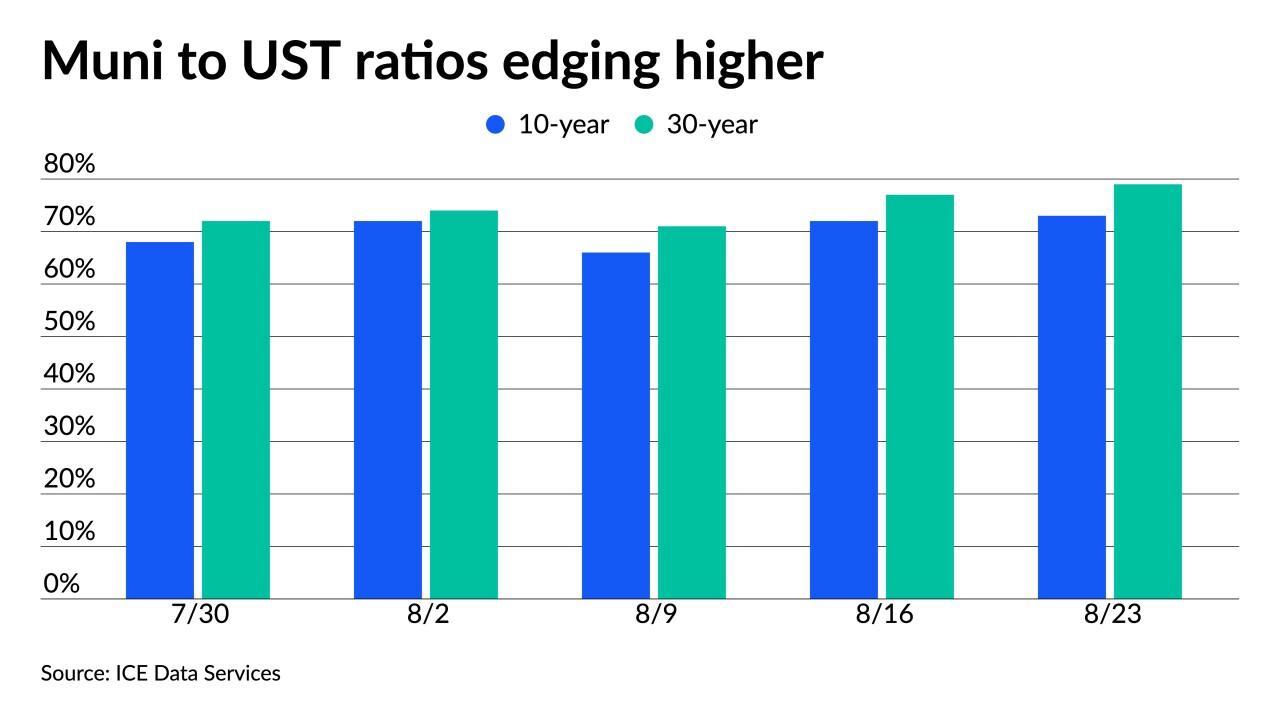

U.S. Treasuries gave little direction Monday, holding ratios and yields steady, leading most participants to argue both are satisfactory to ride out the summer.

August 23 -

Municipal bonds ended the week unchanged for the sixth consecutive trading session as inflows surged as more than $7 billion is headed to market next week.

August 20 -

Municipals were unchanged for the fourth consecutive day this week amid slight Treasury strength as demand for yield continued.

August 19 -

Demand was brisk in the primary market while the short-term market traded sideways on the pressure from the heavy new issue calendar, the release of the FOMC minutes and Treasury auction.

August 18 -

The Puerto Rico Aqueduct and Sewer Authority sold $813 million of senior lien revenue bonds consisting of tax-exempt refunding, taxable refunding and forward delivery refunding bonds.

August 17 -

As New York City launched the first of its two-day retail order period on $1.039 billion of GO bonds, the market was uneventful ahead of $9.76 billion in the primary market this week

August 16 -

The short end of the muni market saw trading of larger blocks at or below benchmarks but yield curves were little changed on a summer Friday.

August 13 -

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

August 12 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

August 11 -

The increasing influence of institutional market participants is even stronger in the taxable muni sector, a Municipal Securities Rulemaking Board report finds.

August 11