-

Deep-in-the-red municipal returns are not helping assuage investor concerns, creating a negative feedback loop that has yet to see a pause.

May 16 -

Despite compelling yields and ratios, buyers continue to be selective. Even if rates stabilize, municipal investors will likely be cautious for some time, waiting for fund outflows to abate, strategists said.

May 13 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.446 billion of outflows, though that was down from $2.669 billion of outflows in the previous week.

May 12 -

Outflows continue with the Investment Company Institute reporting $6.167 billion pulled from muni bond mutual funds in the week ending May 4, up from $5.371 billion of outflows in the previous week.

May 11 -

New York Dormitory Authority school bonds and Northwell Health priced and upsized, while Wisconsin and Oregon offered general obligation bonds. Analysts say municipal curves are oversold, creating a buying opportunity.

May 10 -

How technology, data and transparency can aid in rough markets. Lynne Funk talks with Stephanie Sparvero of Bloomberg BVAL. (21 minutes)

May 10 -

Despite outsized volatility and liquidity challenges ahead, the possibility of relief for munis is not too far off, analysts say, but USTs lead the way for exempts.

May 9 -

Munis again outperformed U.S. Treasuries. Participants note that municipal to Treasury ratios and nominal yield levels are “extremely attractive,” which is generating some renewed interest among the retail crowd.

May 6 -

Shorter-dated and high-yield credit will be more likely to succeed in the current volatile environment.

May 6 abrdn

abrdn -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.669 billion of outflows, though down from $2.875 billion of outflows in the previous week.

May 5 -

Outflows continue with the Investment Company Institute reporting $5.371 billion pulled from muni bond mutual funds in the week ending April 27. Exchange-traded funds saw inflows at $1 billion.

May 4 -

The municipal market was marked by some skittishness among investors on Tuesday as a new month gets underway.

May 3 -

Municipal returns in April were deeply negative, bringing the year-to-date figure to near 9% losses, the largest posted on the Bloomberg Muni Index since its inception in the 1980s.

May 2 -

Investors will be greeted Monday with a steep drop in volume, with the new-issue calendar estimated at $4.583 billion — less than half of this week's supply.

April 29 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.875 billion of outflows, down from $3.548 billion of outflows in the previous week.

April 28 -

In the week ending April 13, investors pulled $5.526 billion from the funds, down from $7.227 billion of outflows in the previous week, ICI reported.

April 27 -

Relative cheapness, wider spreads and underperformance in munis are providing better value, all set against a very solid and resilient credit background, analysts say, but supply is testing investor sentiment amid volatility.

April 26 -

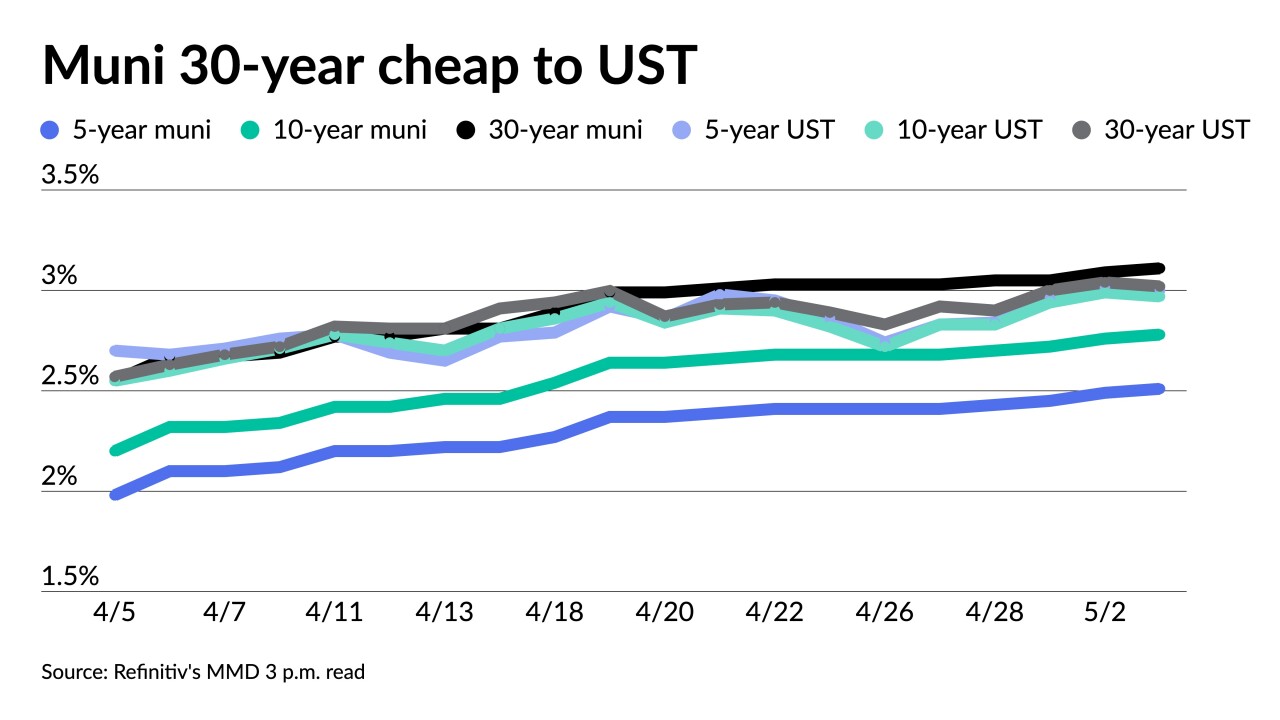

Another swing in U.S. Treasury market pushes muni to UST ratios out long even cheaper.

April 25 -

The new-issue calendar tops $9 billion led by $3 billion taxable and tax-exempts from University of California Regents, a $1 billion plus healthcare deal from Michigan and $1.35 billion of GOs from Washington State.

April 22 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $3.548 billion of outflows, down from $4.106 billion of outflows in the previous week.

April 21