-

While October is typically a busy issuance month, 2022 is not shaping up to be as more issuers are sidelined by volatility. The primary market will see another light calendar in the holiday-shortened week.

October 7 -

U.S. Treasuries saw more losses and municipal to UST ratios fell on the day's moves with the long bond valuation below 100%.

October 6 -

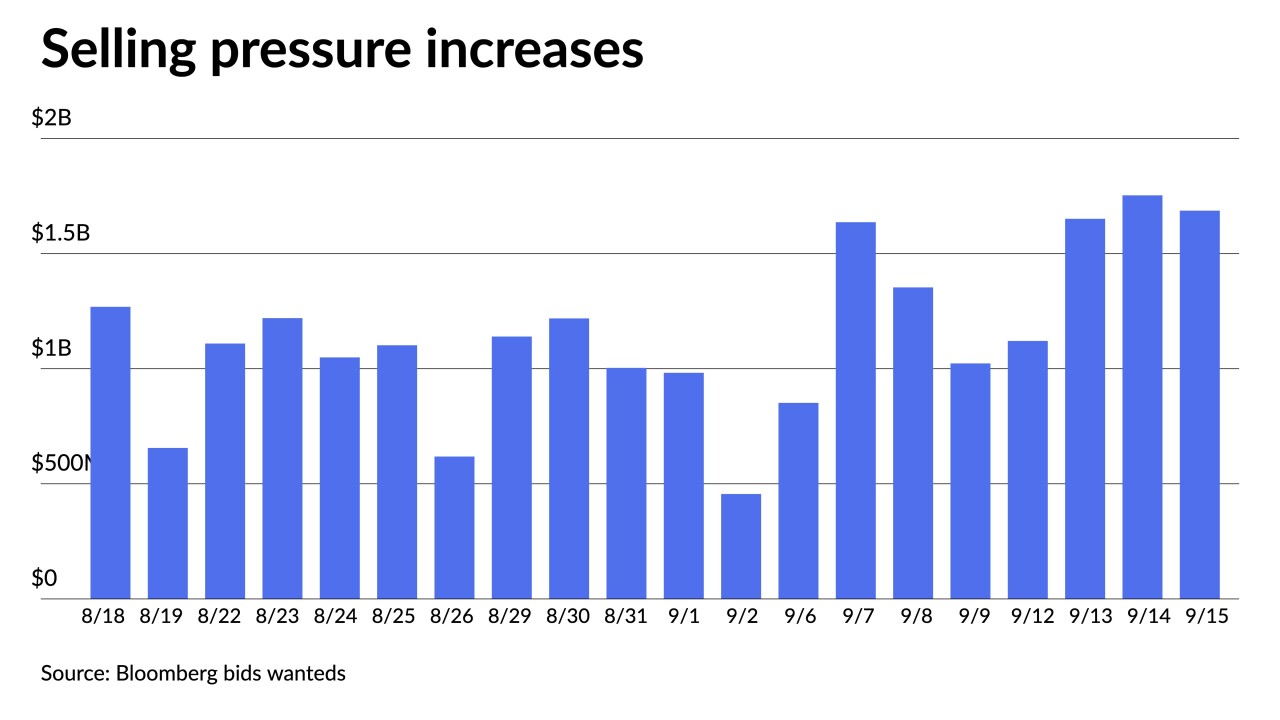

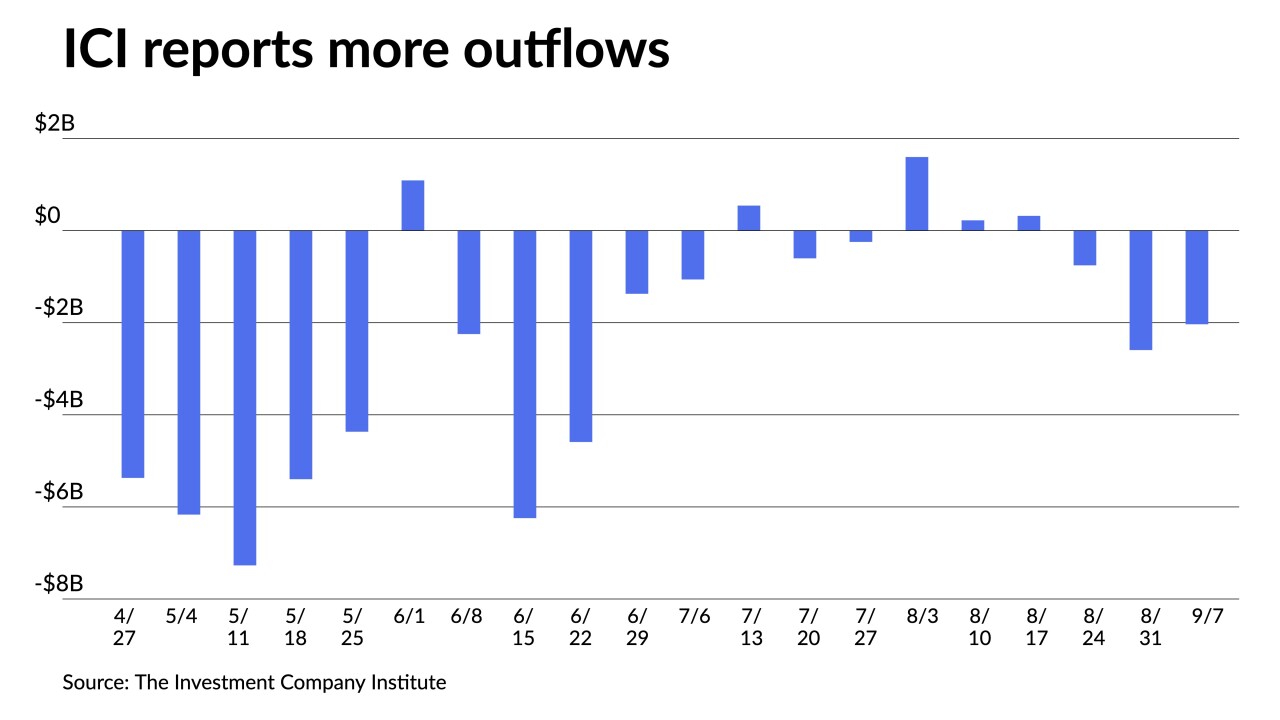

Bids wanteds are on the rise, but a constructive secondary market showed a steady to firmer market in the past two sessions. ICI's latest outflows figure is the highest since June.

October 5 -

Triple-A yields fell four to 10 basis points across the curve amid robust secondary trading with high-grade names showing clear moves to lower yields.

October 4 -

Munis open October firmer, underperforming a UST rally, but September closed out the month with 3.84% losses — the single largest monthly loss since September 2008.

October 3 -

Triple-A yields rose more than three-quarters of a point on the front end and nearly half a point out long in September as munis posted 3.84% losses.

September 30 -

Upon integration, the Lumesis DIVER product suite will provide additional municipal asset class workflow, analytics related to price transparency, and regulatory-related solutions to SOLVE'S Market Data Platform.

September 30 -

In the competitive market Thursday, the New York Urban Development Corp. sold $1.443 billion of tax-exempt personal income tax revenue bonds.

September 29 -

A larger new-issue slate led by large deals from the Texas Water Development Board and state of Illinois took focus away from the secondary.

September 28 -

Elevated secondary selling pressure on Tuesday forced more losses. Triple-A yields rose by as many as seven to eight basis points across the curve, moving the entire triple-A curve above 3% and the 30-year a dozen basis points shy of 4%.

September 27 -

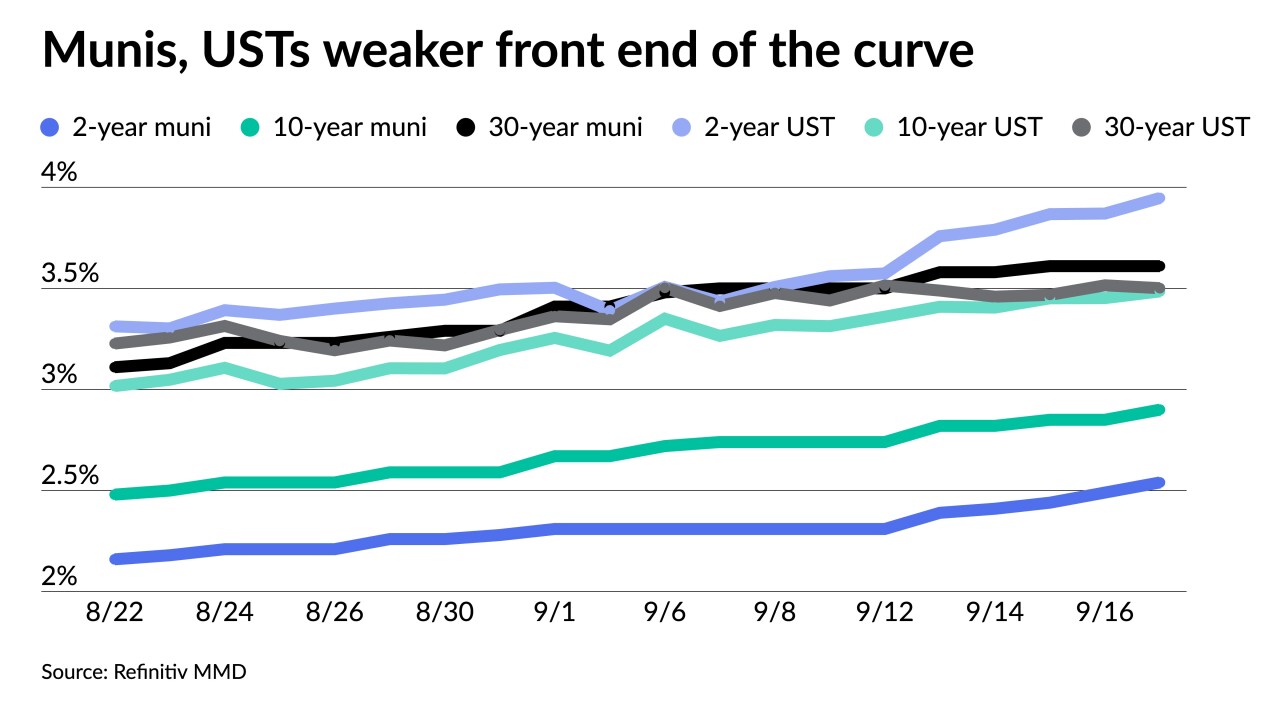

Bids wanteds have been elevated, municipal bond mutual fund outflows large and consistent and the short end of the U.S. Treasury curve continues its march upward, moves that muni investors cannot ignore.

September 26 -

Triple-A yields rose 11 to 15 basis points five years and in.

September 23 -

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23 -

One-year rates have risen 100 basis points, intermediate maturities have traded up about 25 basis points and long-term munis are nearly 50 basis points above June's close.

September 22 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

Short triple-A yields have risen more than 30 basis points over the past eight sessions while the long bond has risen 19, per Refinitiv MMD data.

September 20 -

Triple-A muni yields rose another five basis points on the short end while UST rose up to seven. UST yields are the highest since 2007.

September 19 -

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

"Everyone is trying to figure out when the outflow cycle is over," said Craig Brandon, co-director of municipal investments at Eaton Vance.

September 15 -

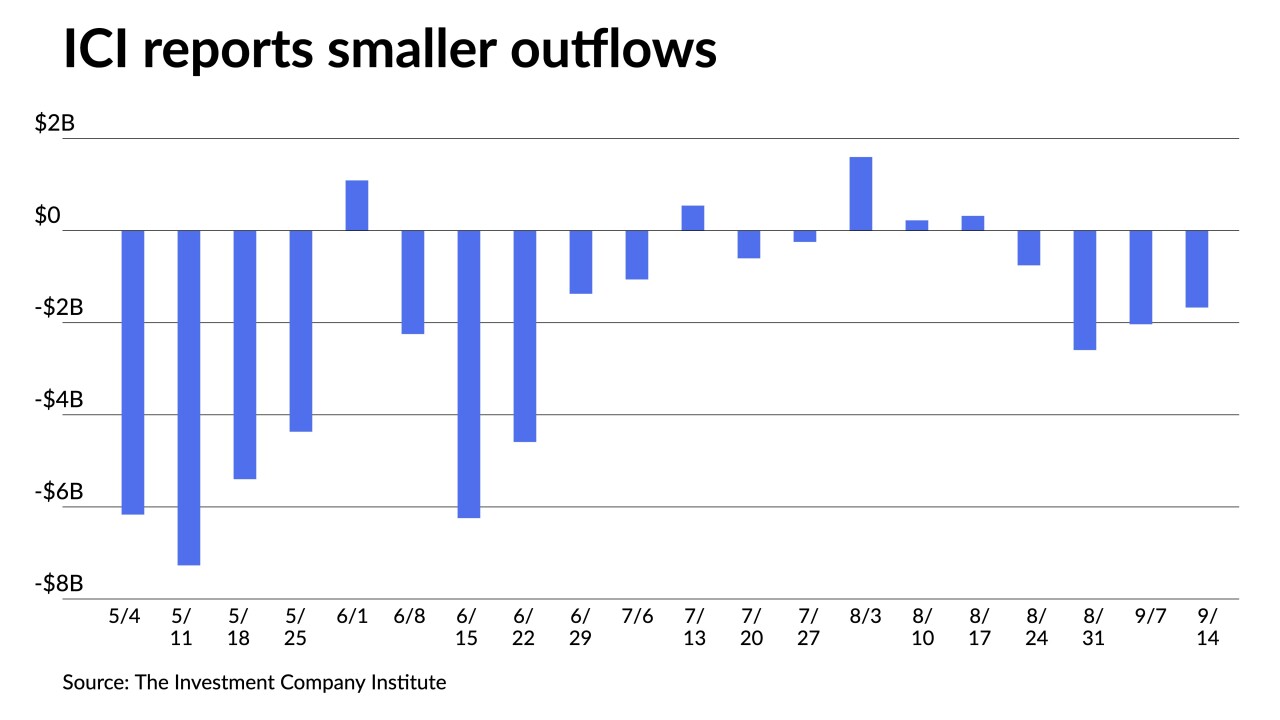

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14