-

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

The CPI report showed inflation had slowed to 7.1%, giving investors confidence the Federal Open Market Committee will hike rates 50 basis points as expected following Wednesday's much-anticipated meeting.

December 13 -

The December Federal Open Market Committee meeting, combined with the release of inflation data, "will test the good cheer currently prevailing in the bond market," said MSCI Research strategists Andy Sparks, Tamas Hanis and Edina Szirma.

December 12 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.214 billion, the majority of which is a nearly $1.9 billion private activity P3 bond deal from Pennsylvania.

December 9 -

Arrick was formerly a managing director and healthcare group leader for S&P Global Ratings.

December 9 -

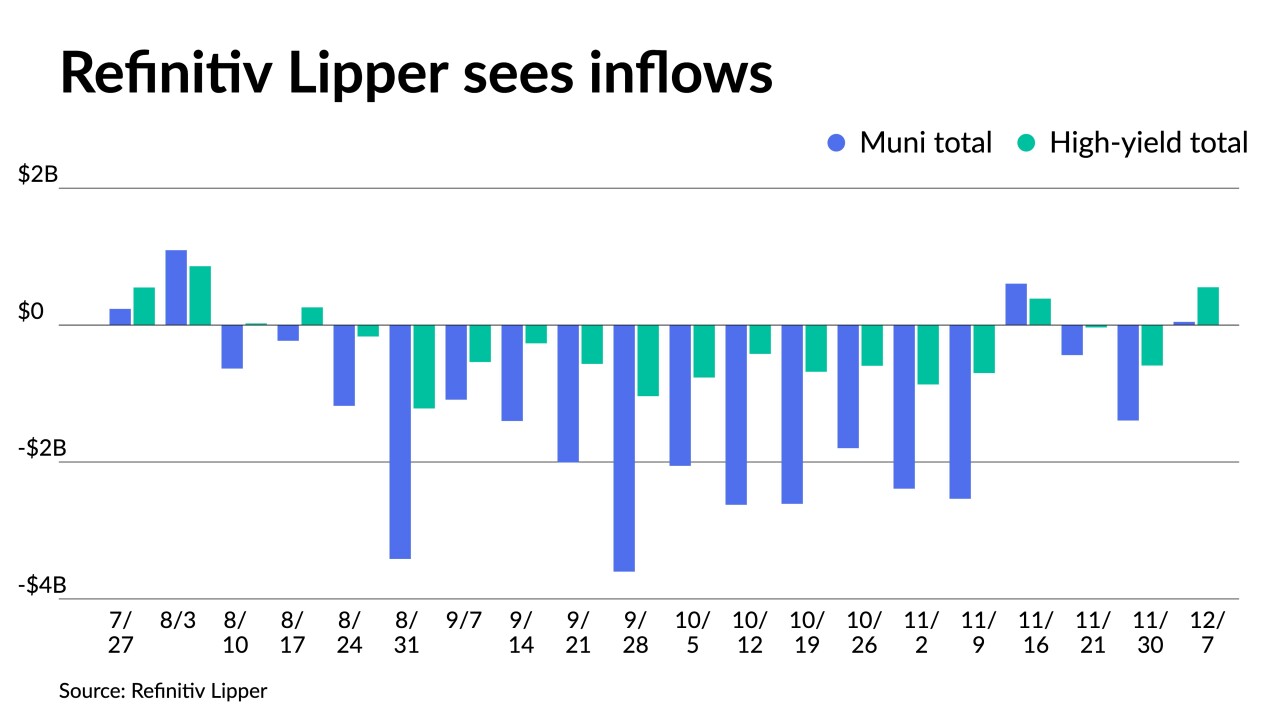

Refinitiv Lipper reported $46.912 million was added to municipal bond mutual funds for the week ending Wednesday after $1.394 billion of outflows the week prior.

December 8 -

"Yield curve inversion deepens and nears a four-decade low which is clearly setting up this economy for a recession that won't be a mild one," OANDA's Edward Moya said.

December 7 -

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

"Munis are poised to continue this rally into December as we can end 2022 on a high note and close out the worst-performing year on record for munis," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 5 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.893 billion.

December 2