-

Volume for the upcoming week is estimated at $8.34 billion, consisting of $6.30 billion of negotiated deals and $2.04 billion of competitive sales.

January 13 -

Underwriting fees generated for the board totaled some $7.4 million, an almost 50% drop from the $14.3 million the board received in 2020.

January 13 -

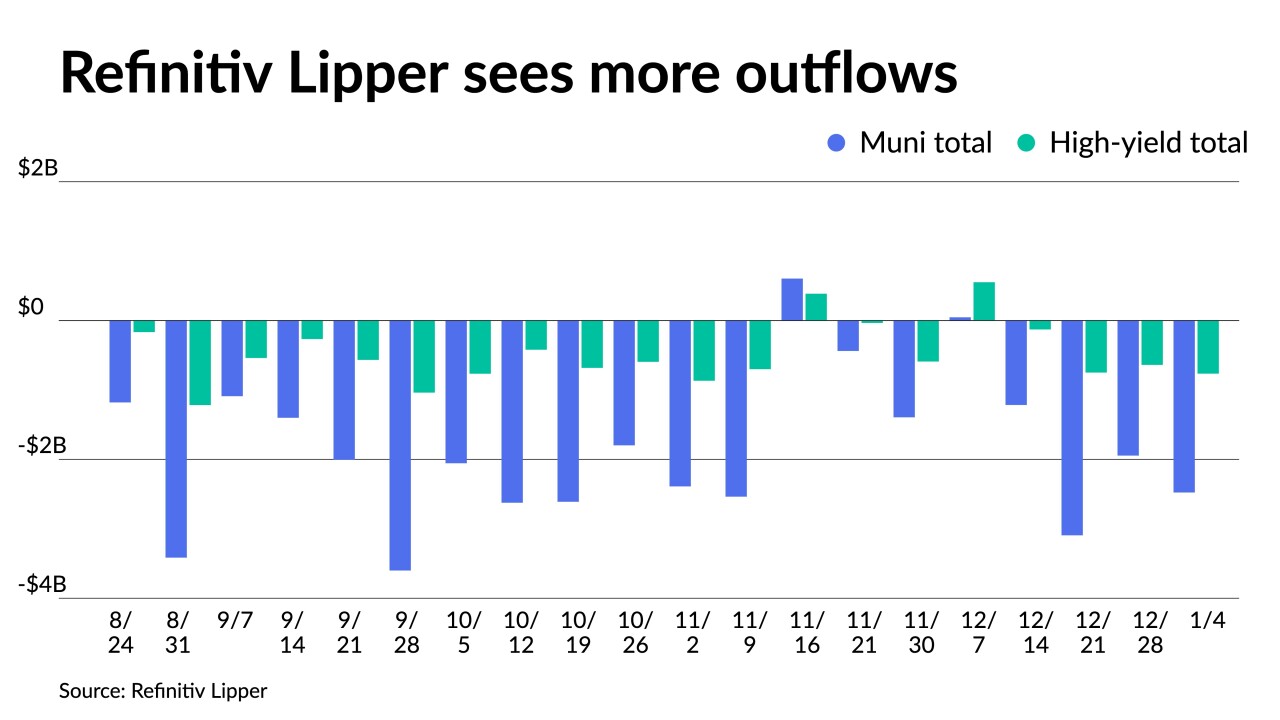

Outflows lessened, with the Investment Company Institute reporting investors pulled $3.157 billion from mutual funds in the week ending Jan. 4, after $3.402 billion of outflows the previous week.

January 11 -

"There was strong demand for the Pennsylvania Housing Finance Authority deal, which was three times oversubscribed," said a New York trader.

January 10 -

This week's "manageable" calendar will continue what has been a quiet start to the new year in the municipal market, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

January 9 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.303 billion.

January 6 -

Outflows continued as Refinitiv Lipper reported $2.477 billion was pulled from municipal bond mutual funds in the week ending Wednesday after $1.946 billion of outflows the week prior.

January 5 -

The muni market "is being teed up to enter 2023 from a relative position of strength," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 3 -

"Bond investors bid a not-so-fond farewell to 2022 as they look forward to a much more attractive 2023," said Bryce Doty of Sit Investment Associates.

December 30 -

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30