-

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

New York City's $1 billion deal was re-priced to lower yields and a tax-exempt and taxable deal for the NFL's Tennessee Titans new stadium priced.

August 9 -

Municipals followed U.S. Treasuries firmer after markets reacted to the Moody's downgrade of several mid-sized U.S. banks. New issues saw good demand and repriced to lower yields as a result.

August 8 -

While triple-As were little changed the past two sessions, some damage was done last week, leaving market participants generally less optimistic for the final weeks of August.

August 7 -

Late summer is "rarely a good time for our asset class," Barclays strategists said, noting the municipal investment grade index lost money in August three years in a row, and 2023 seems to follow this trend.

August 4 -

Municipal bond mutual fund saw outflows return with Refinitiv Lipper reporting investors pulling $989.852 billion from funds for the week ending Wednesday, led by ETFs and long-end funds.

August 3 -

J.P. Morgan held a one-day retail order for $1.65 billion of revenue bonds from the Dormitory Authority of the State of New York, while Minnesota sold $1.02 billion of GOs in the competitive market in five deals.

August 1 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

For the coming week, investors will be greeted with a larger new-issue calendar led by large New York and Texas ISD issuers, along with gilt-edged Minnesota selling competitively.

July 28 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27 -

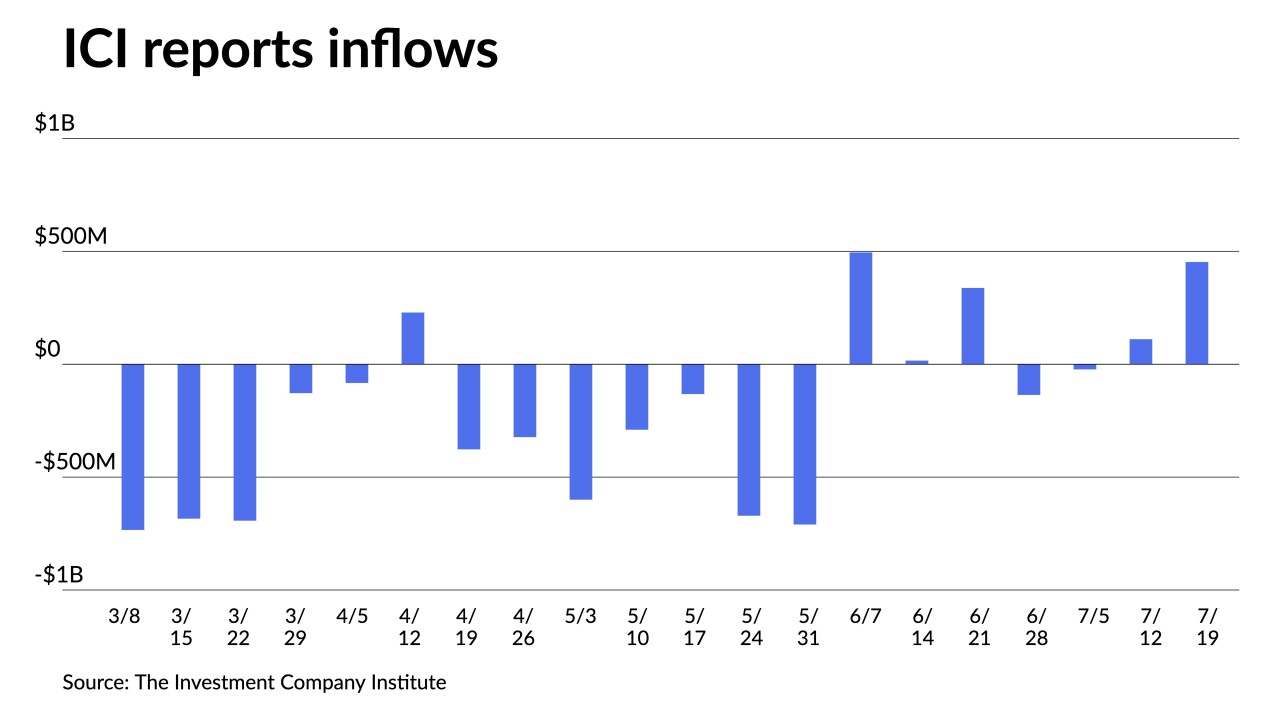

The Investment Company Institute reported investors added $453 million to municipal bond mutual funds in the week ending July 19, after $111 million of inflows the previous week.

July 26 -

The offered side "has continued to pack the primary market with value to manage their (and the market's) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed," said Matt Fabian, partner at Municipal Market Analytics.

July 25 -

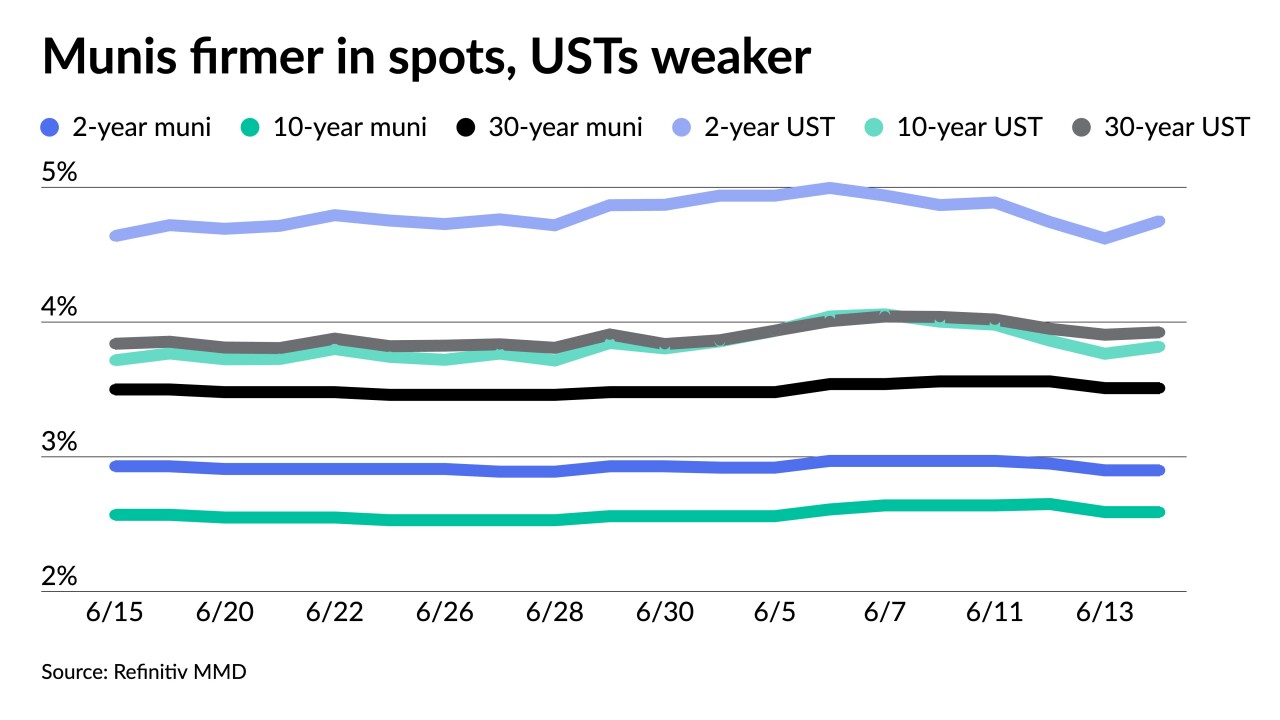

"Longer-dated bonds look attractive, as investors are locking in long-term rates before the expected decline in 2024," while "a tremendous amount of money is also invested in the short end of the curve," Nuveen strategists said.

July 24 -

Washington will bring $1.1 billion of GOs in four competitive sales Tuesday, leading a new-issue calendar estimated at $5.439 billion.

July 21 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper reporting investors added $1.040 billion to funds for the week ending Wednesday following $136.174 million of outflows the previous week.

July 20 -

The Investment Company Institute reported investors added $111 million to municipal bond mutual funds in the week ending July 12, after $ 23 million of outflows the previous week.

July 19 -

The bond division undertook two transactions last week to retire outstanding taxable public education capital outlay and state revolving fund bonds. The transactions used $200 million in program funds, along with additional money, to pay down $400 million in state debt.

July 19 -

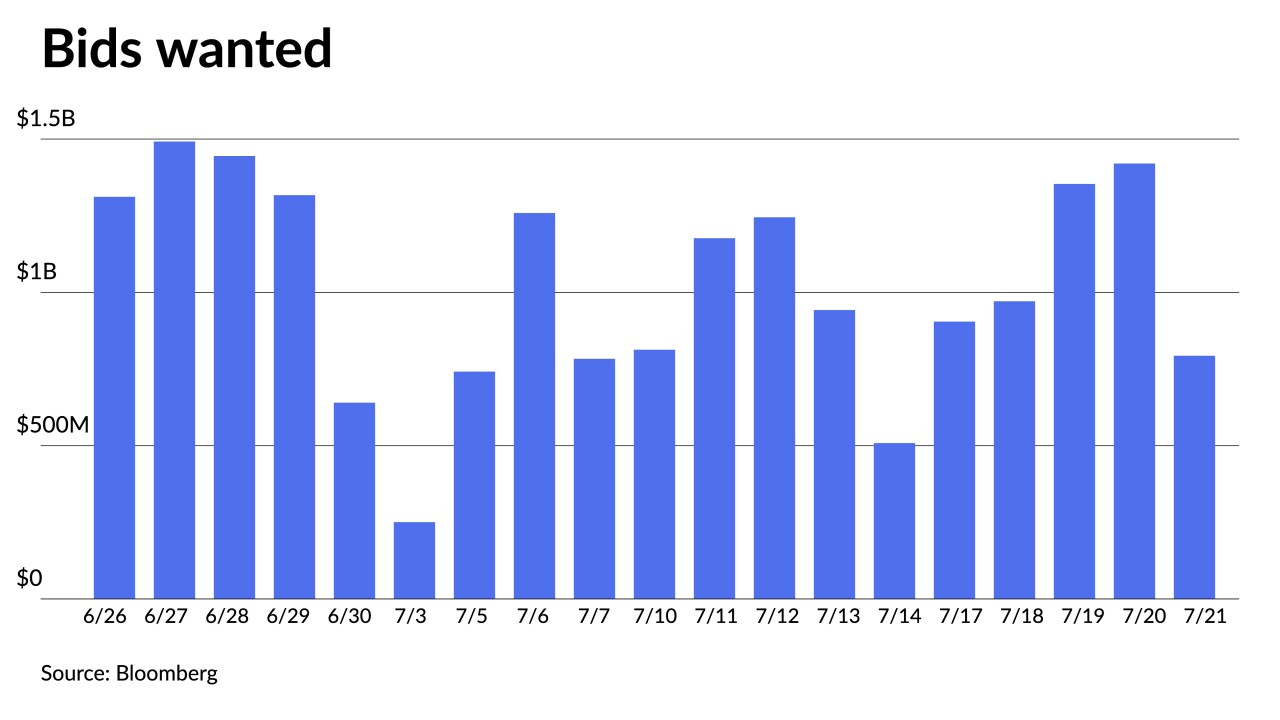

The back half of July is starting "much like the front half with ongoing UST volatility and municipal supply staying in the forefront," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 18 -

Long-duration and shorter-coupon munis saw ample demand last week. Investors, believing rates will fall as early as the first part of next year, continue to lock in long-bond yields, Nuveen strategists said.

July 17 -

Bond Buyer 30-day visible supply climbs to $13.42 billion while the new-issue calendar is led by a $1 billion-plus New York City Transitional Finance Authority future tax-secured subordinate deal.

July 14