-

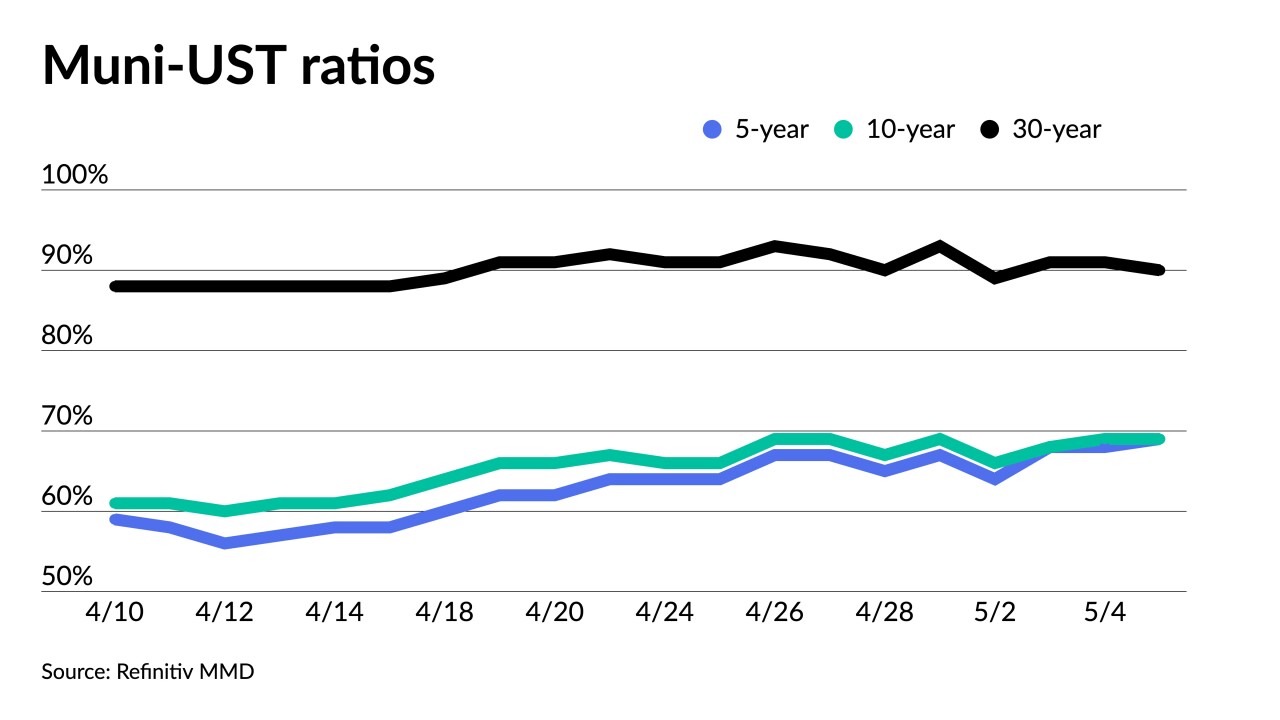

"Steep corrections occurring inside 10 years on the curve reflect an ongoing process to reduce a deep inversion," said Kim Olsan, senior vice president of municipal bond trading.

May 18 -

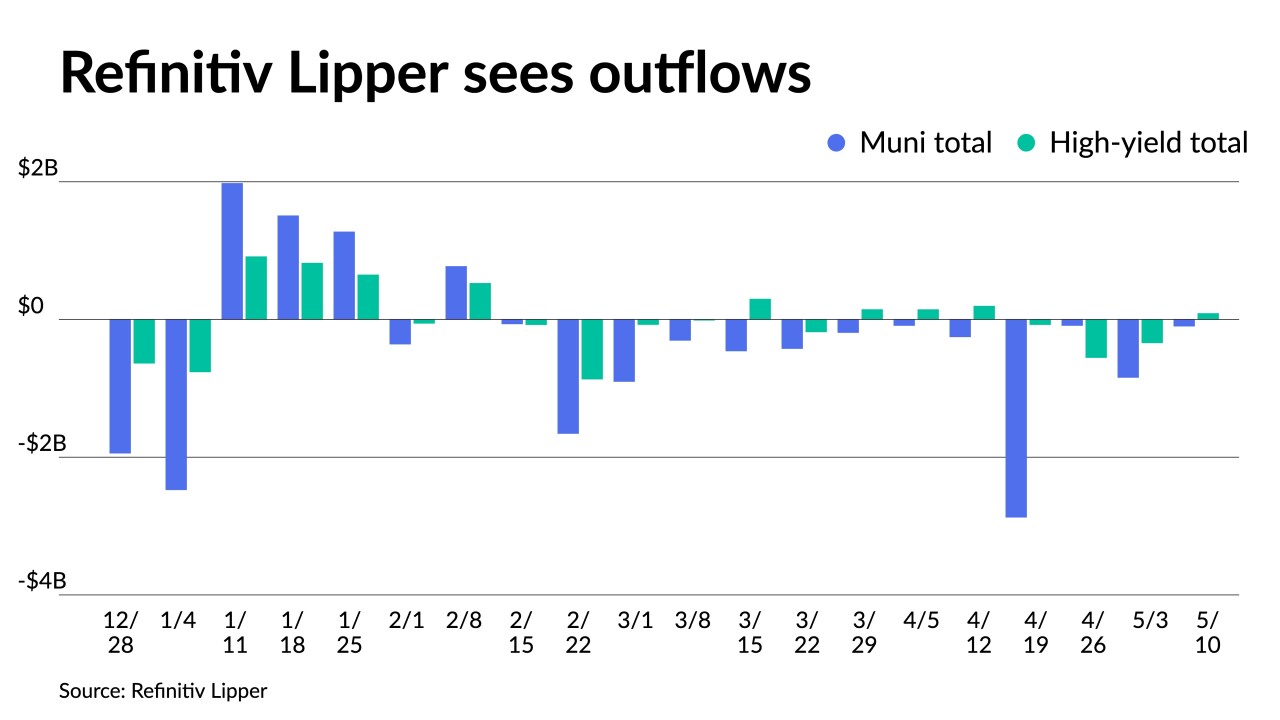

The Investment Company Institute reported investors pulled another $290 million out of municipal bond mutual funds in the week ending May 10.

May 17 -

The market is seeing a supportive environment for munis, said Nisha Patel, managing director of SMA Portfolio Management at Parametric.

May 16 -

"With rates volatility seemingly subsiding in the past few weeks, we could start to see outflows decrease and demand flow back into munis," according to AmeriVet Securities' Jason Wong.

May 15 -

Investors will be greeted Monday with a new-issue calendar estimated at $6.018 billion with a few bellwether, triple-A names coming from Loudoun County, Virginia, Frederick County, Maryland, and Columbia University with sizable deals.

May 12 -

Outflows were seen again from municipal bond mutual funds, though they lessened this week as Refinitiv Lipper reported $101.664 million was pulled as of Wednesday.

May 11 -

The CPI numbers coming in pretty much as expected "was a relief" to the markets, with the bond market rallying after the release, said Luke Bartholomew, senior economist at abrdn.

May 10 -

Despite the attraction for new issues, sources said there is still uncertainty overall in the municipal market stemming from the regional banking crisis.

May 9 -

Now that there is more "clarity from the Fed on the path of interest rates, both investors and issuers may start to move off the sidelines," said Daniel Close, head of municipals at Nuveen.

May 8 -

Investors will be greeted Monday with a new-issue calendar estimated at $7.588 billion.

May 5