-

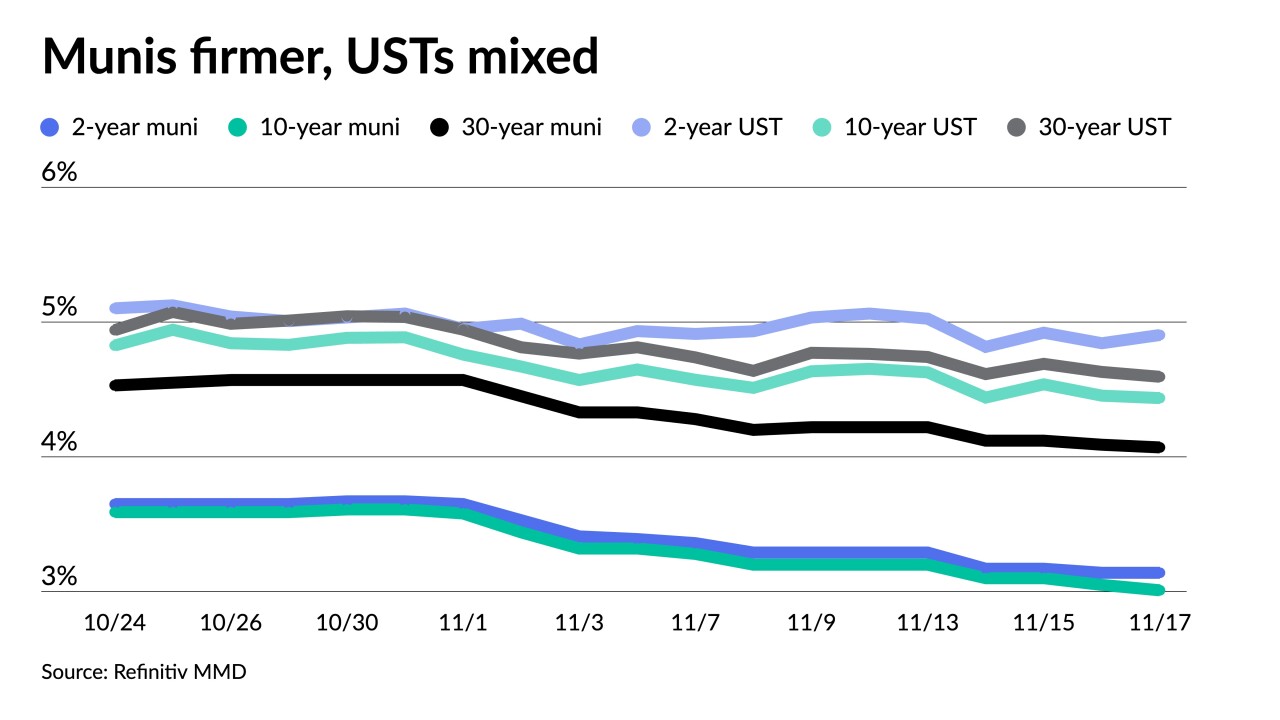

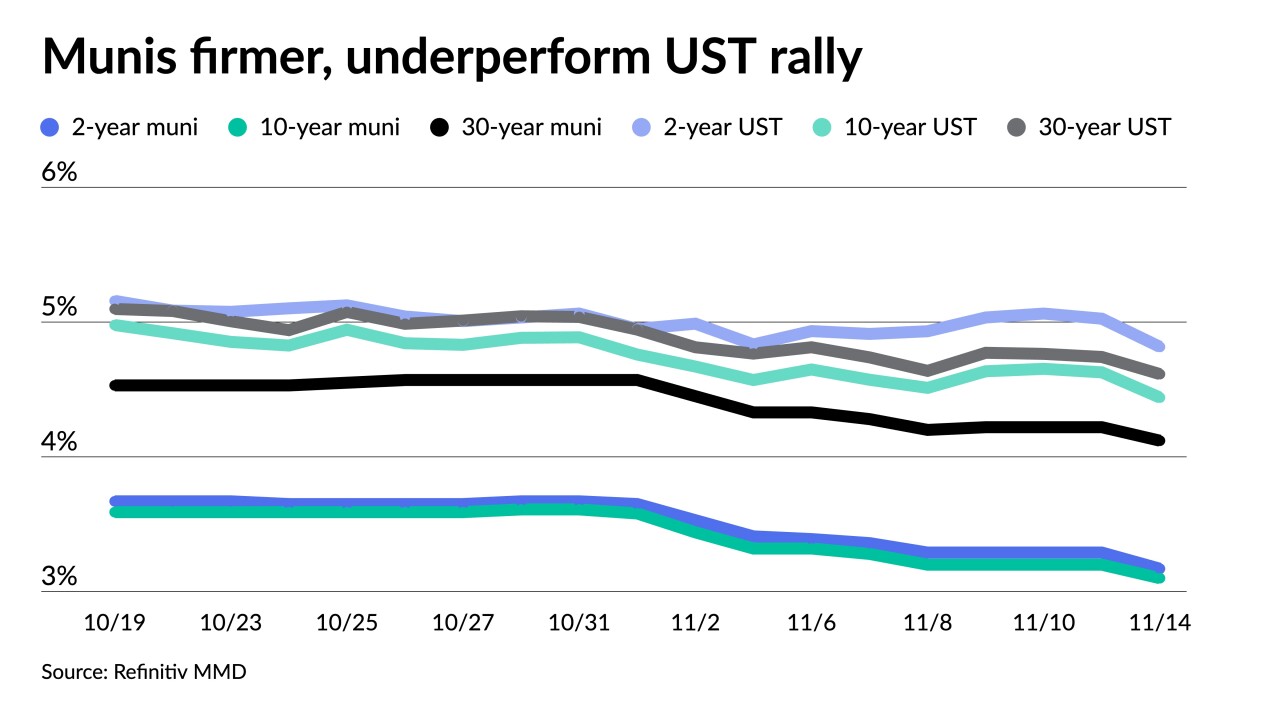

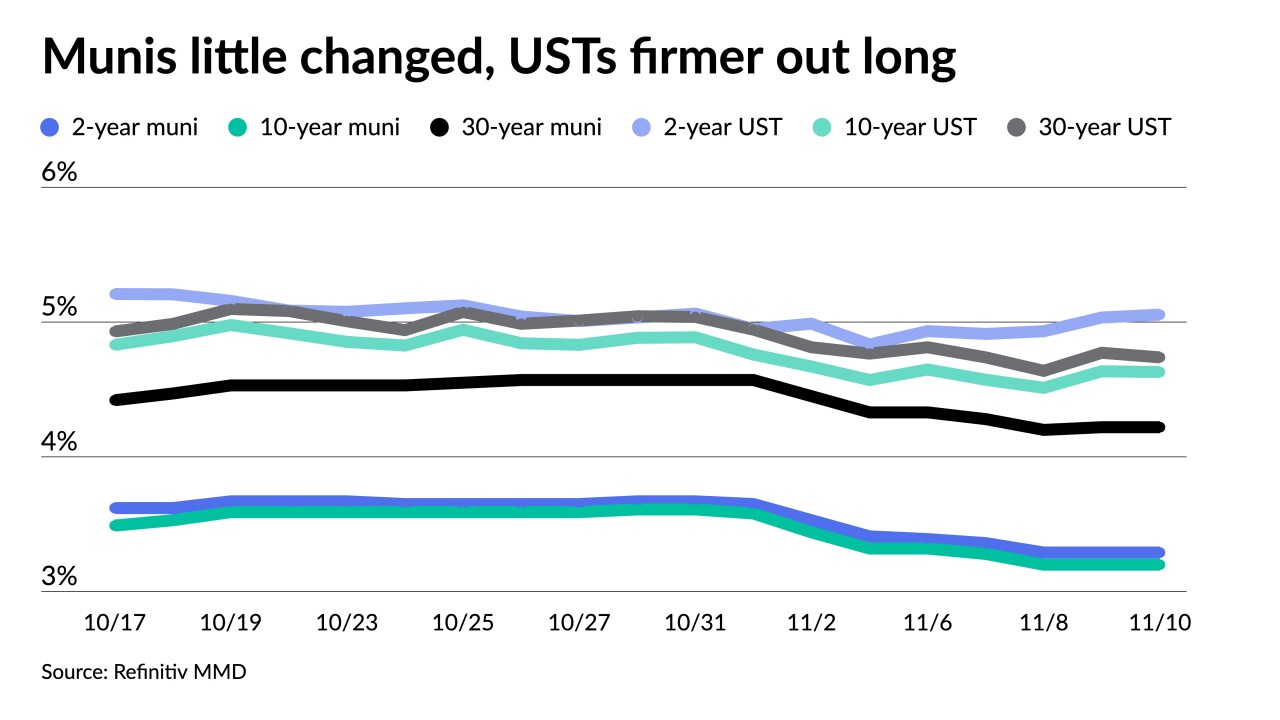

The rally in munis over the last three weeks has "pushed ratios to levels that we have not seen since the start of the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 20 -

Tradeweb created a model that examines outstanding municipal securities, both tax-exempts and taxables, and it looks for similarities in bond features, such as maturities, call dates, use of proceeds and coupon structures.

November 20 -

BofA Global Research strategists said they believe peak muni yields in this Fed tightening cycle were attained in October 2023 and "the bull market for munis is underway."

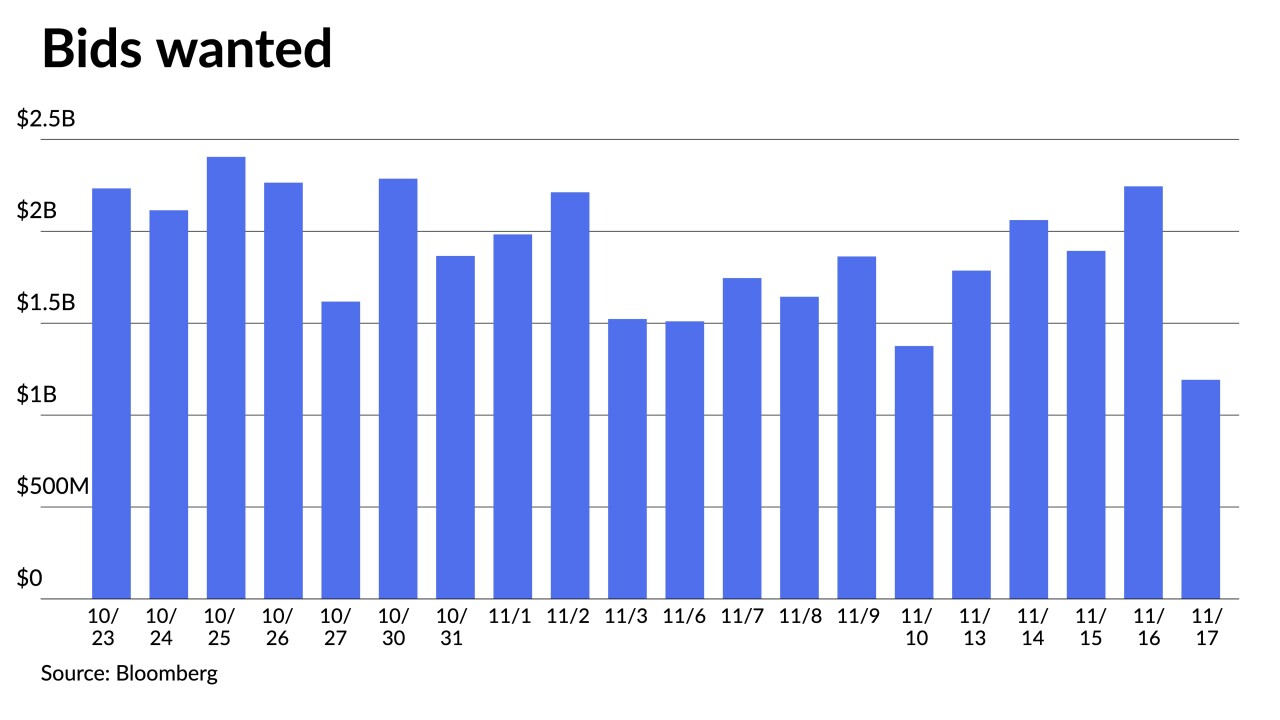

November 17 -

The municipal dashboard solves three challenges: bond linkage, pricing and spread aggregation.

November 17 -

"Demand is firming up. Interest rates have moved off the recent highs. Intermediate muni yields are about 50 basis points off from those highs," said Stephen Shutz, head of tax-exempt fixed income and a portfolio manager at Brown Advisory.

November 16 -

"Everyone is reevaluating and taking a breather after the numbers [on Tuesday]," a New York trader said.

November 15 -

Munis yields fell nine to 12 basis points, depending on the curve, but underperformed larger gains along the UST curve. Large new-issues began pricing.

November 14 -

November "continues to be off to a strong start as yields have fallen an average of 34 basis points across the curve since the start of the month," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 13 -

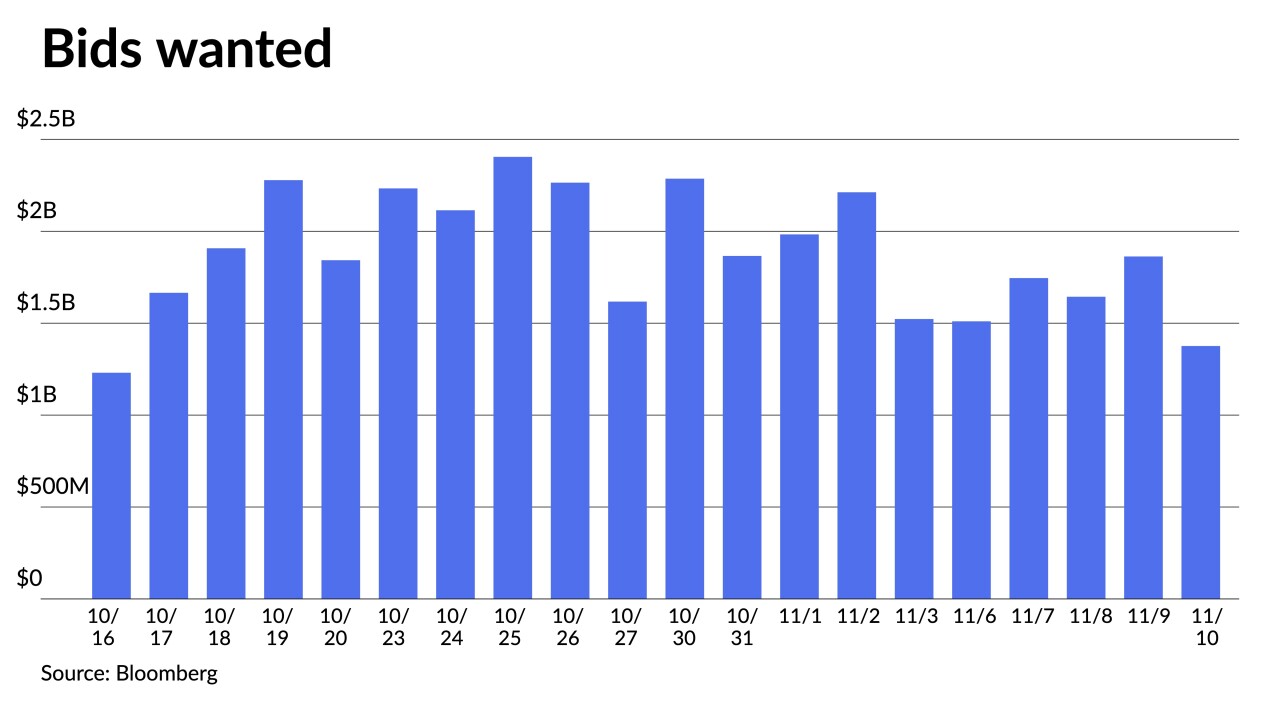

"As with most fast rallies there are sessions when the market pauses to assess where fair value should play out," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

November 10 -

A constructive trading session in the secondary aided a busy primary once again as investors appear to be more engaged in the asset class.

November 8