-

The past several trading sessions have seen "crazy volatility," said Jennifer Johnston, director of research of municipal bonds at Franklin Templeton.

August 8 -

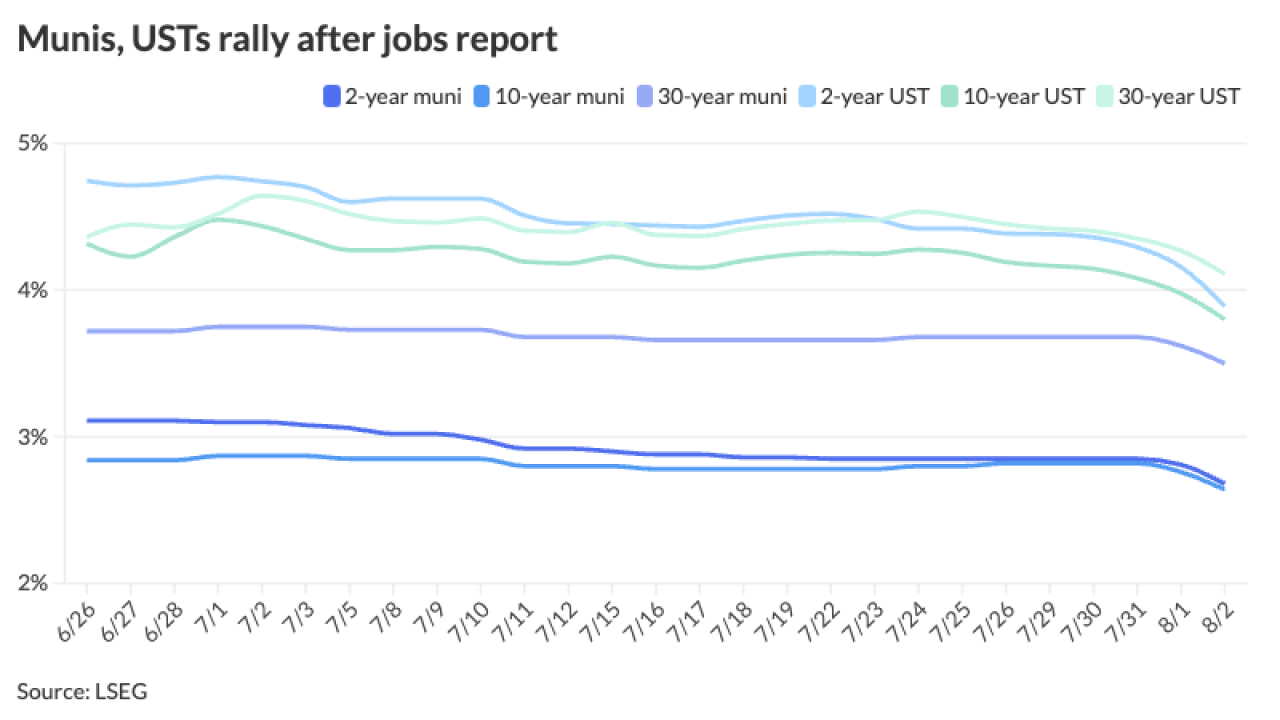

Recent events have been a "roundtrip" for rates, starting with the sentiment shifting from slowing inflation to a softening labor market, said James Pruskowski, chief investment officer at 16Rock Asset Management.

August 7 -

This week's new-issue calendar will be "outsized," said Anders S. Persson, Nuveen's chief investment officer for global fixed-income, and Daniel J. Close, Nuveen's head of municipals.

August 6 -

All eyes now turn to the September Federal Open Market Committee meeting where the Fed is expected to cut rates, but market participants are mixed on whether it will be a 25- or 50-basis-point cut.

August 2 -

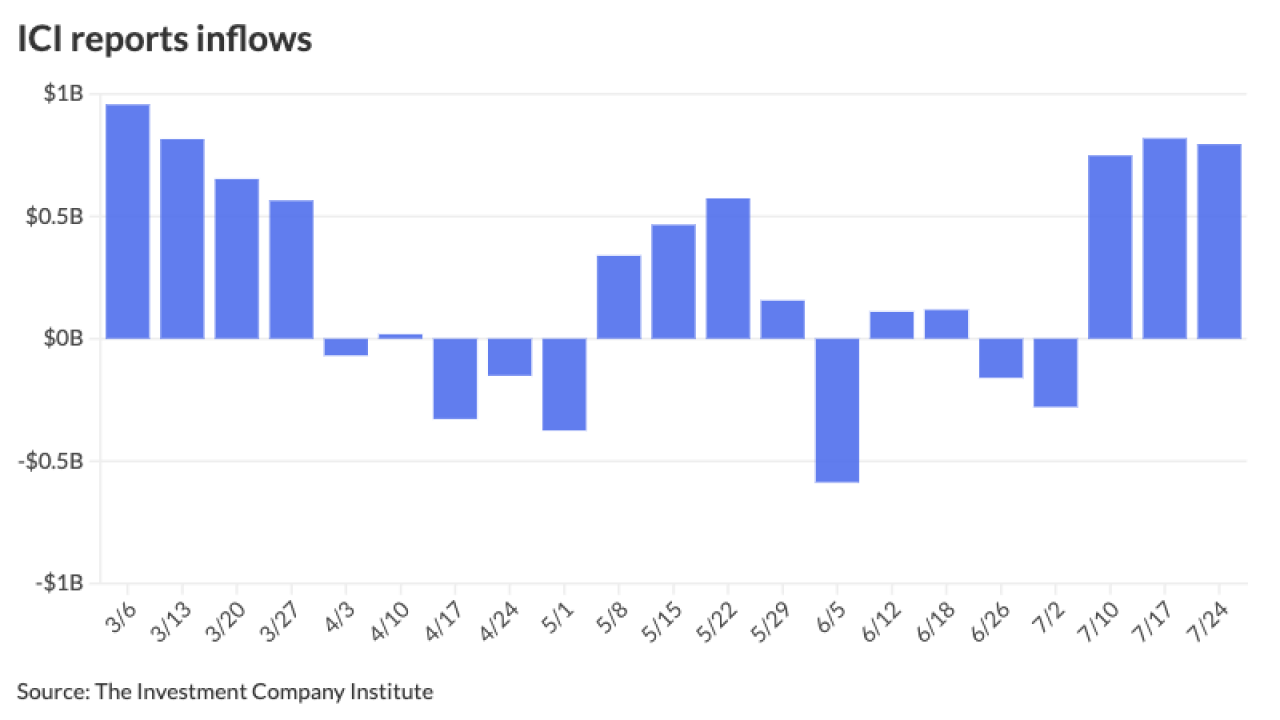

Municipal bond mutual funds saw inflows as investors added $1.112 billion to funds after $892.2 million of inflows the week prior, according to LSEG Lipper.

August 1 -

"The Fed remains data dependent as always, but it now appears that the 'more good data' bar is not as high as it was before, particularly with labor market developments becoming more important," said Michael Gregory, deputy chief economist at BMO Economics.

July 31 -

Yields may move lower after the Federal Reserve "communicates its goals to ease policy in coming meetings," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

July 30 -

"The overall muni market appears to be in a good balance despite the hefty slate of primary issuance that has occurred over the past few months," Birch Creek Capital strategists said.

July 29 -

The muni market tends to have "remarkable patience" in relation to USTs, said BofA strategists.

July 26 -

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

July 25