-

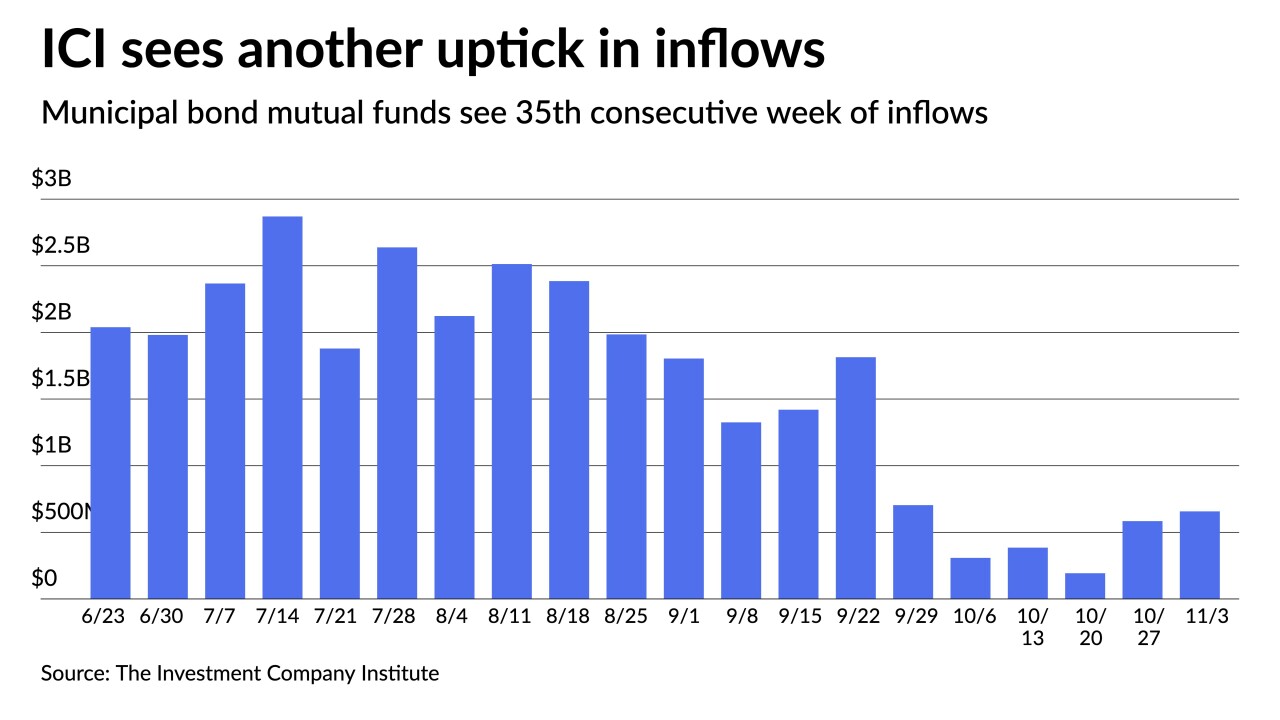

The Investment Company Institute reported $1.608 billion of inflows into municipal bond mutual funds for the week ending Nov. 10, up from $657 million a week prior.

November 17 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

November 15 -

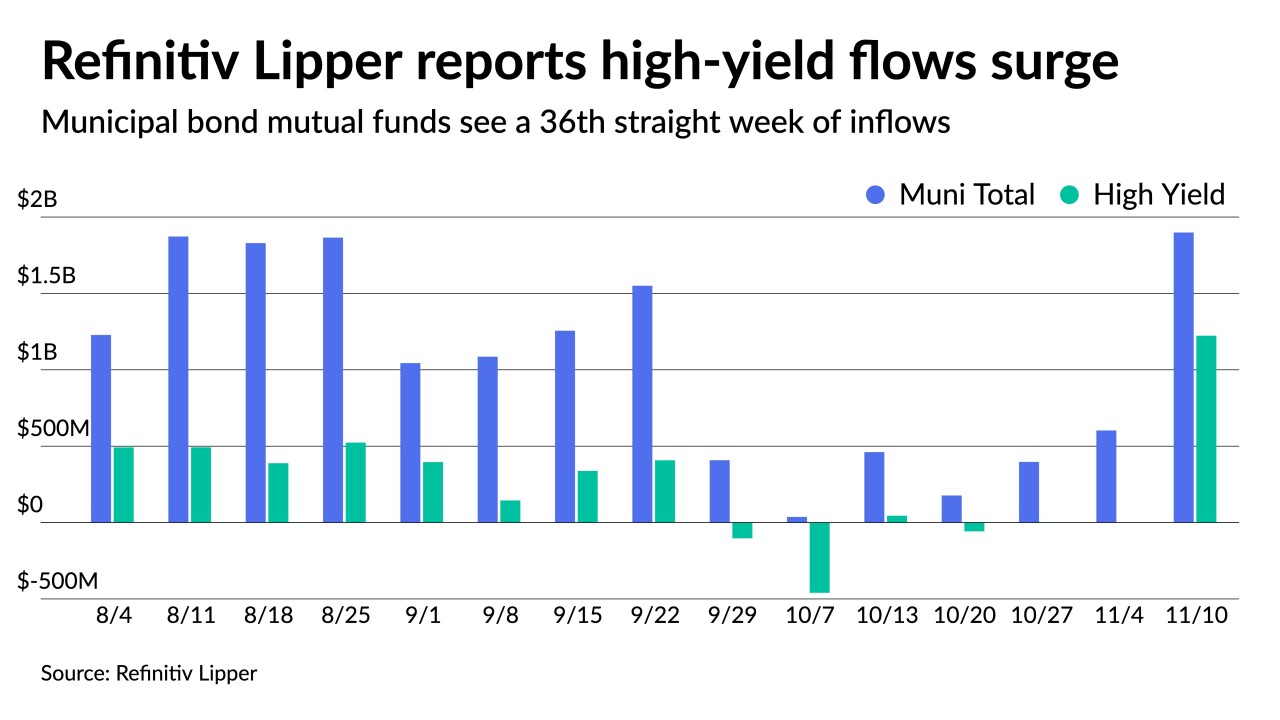

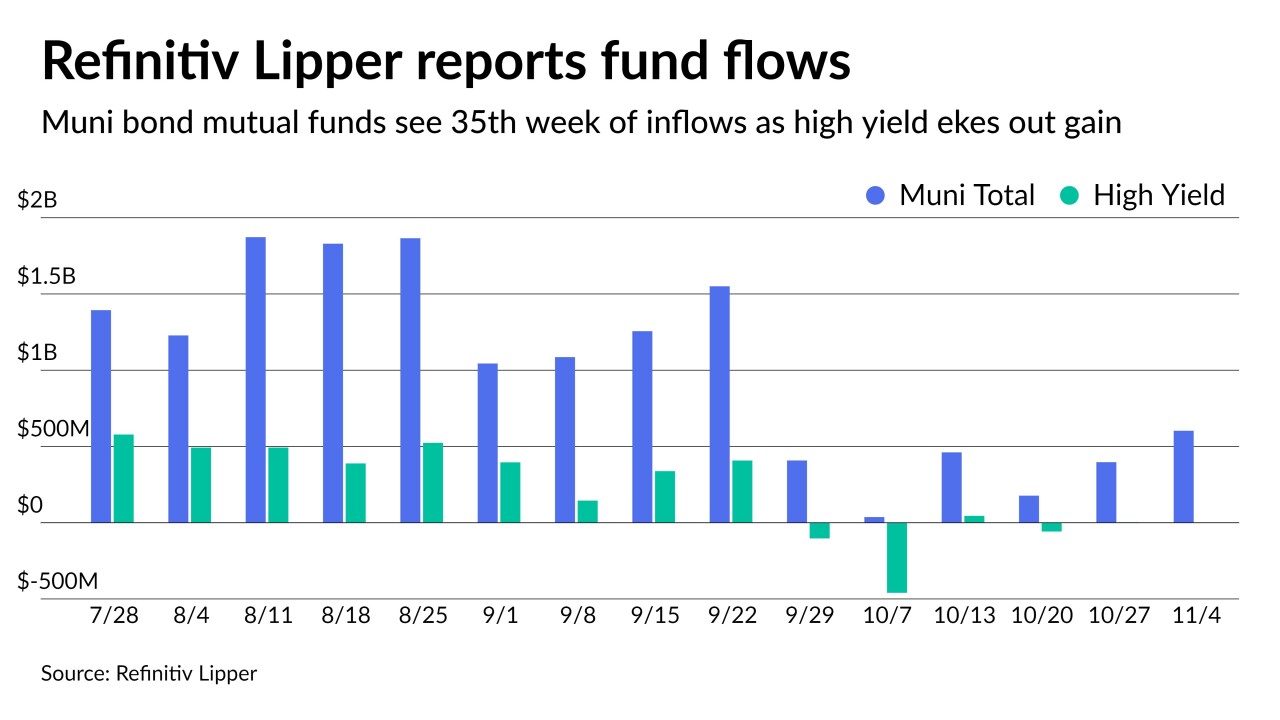

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

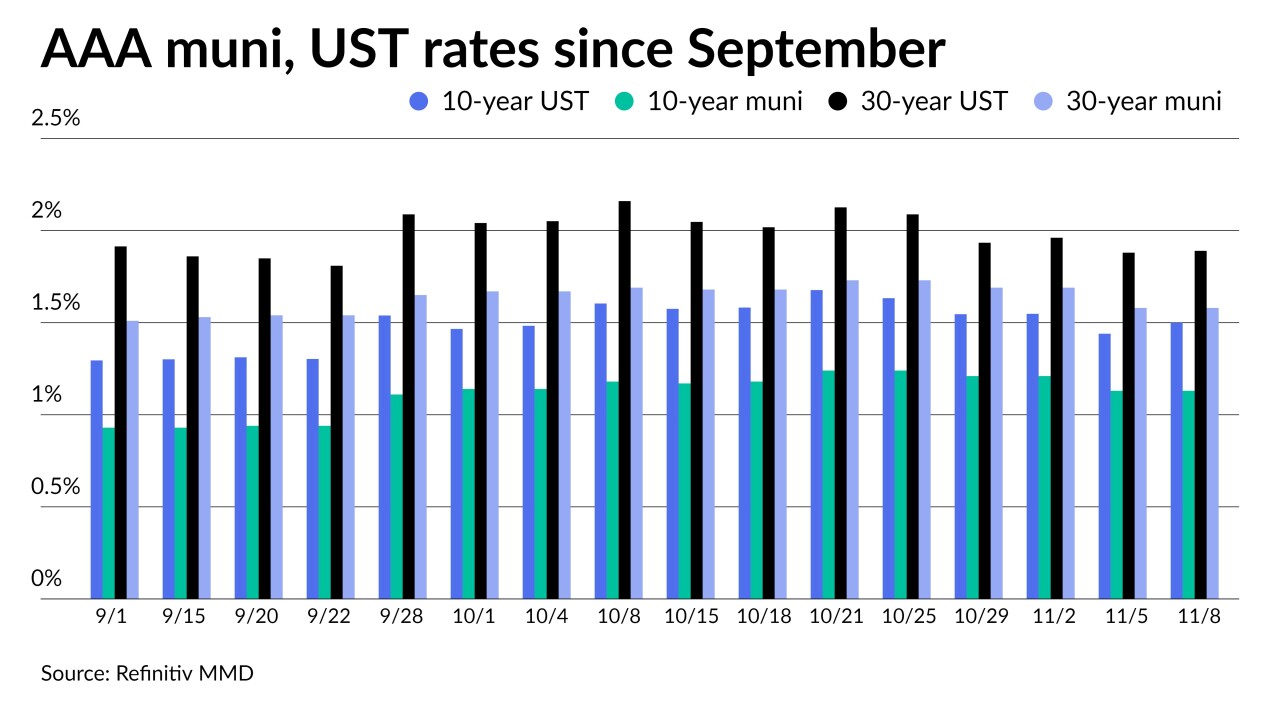

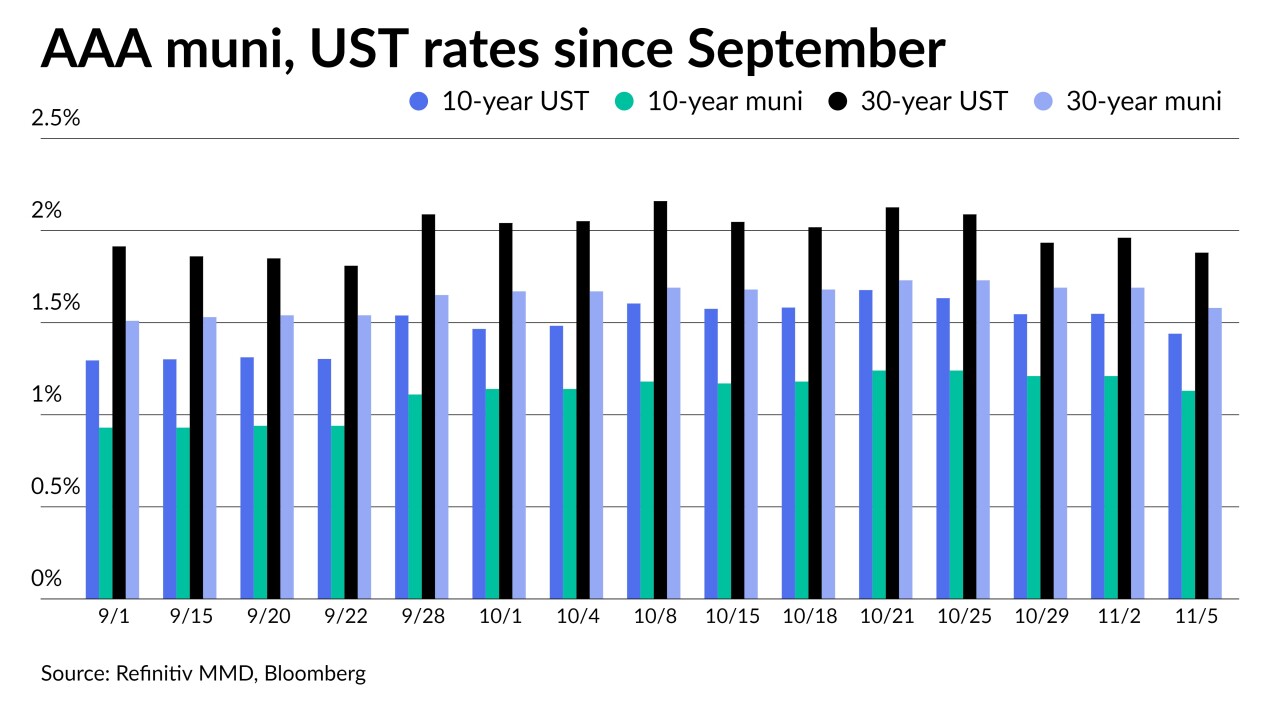

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8 -

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

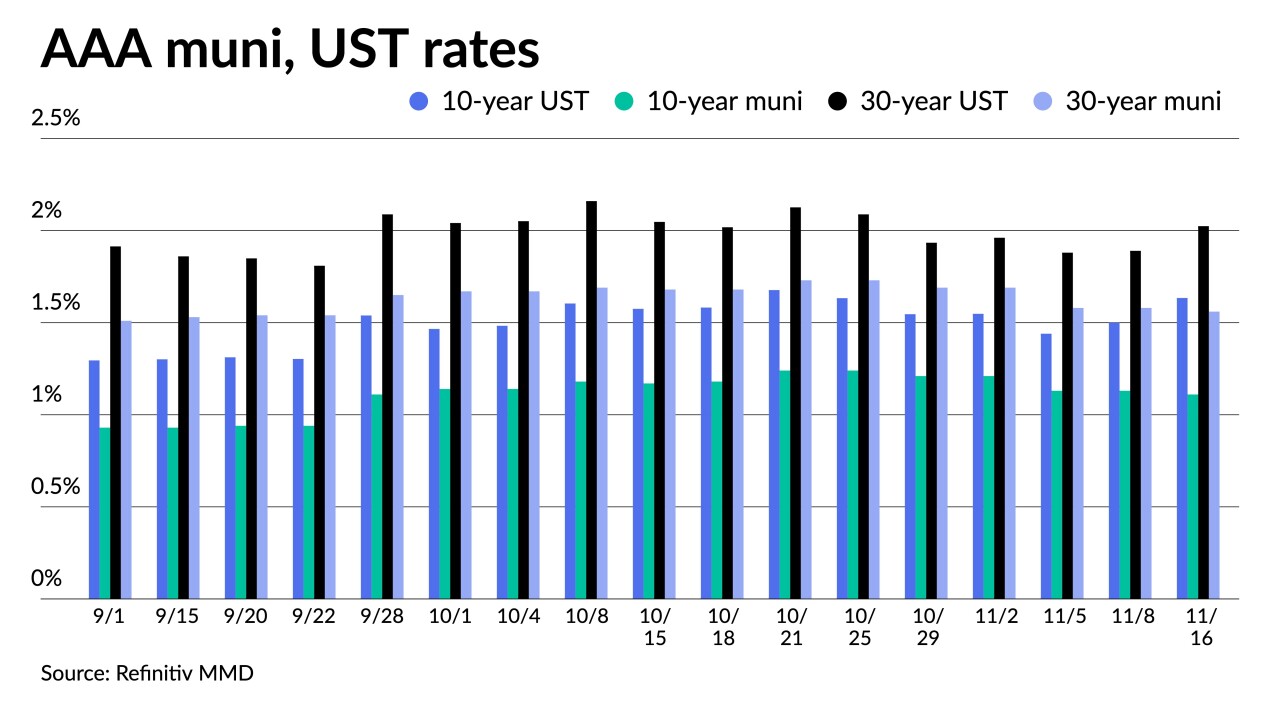

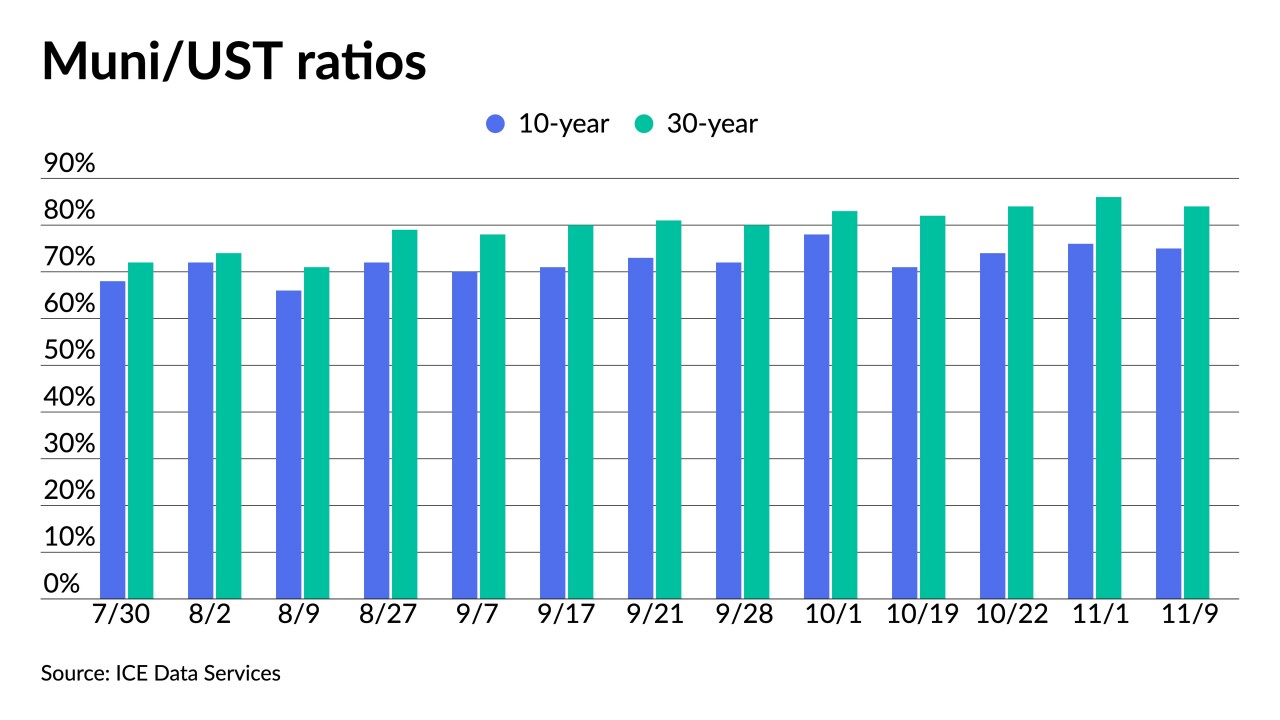

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3