-

The SEC has signaled a focus on pay-to-play and disclosure fraud.

December 27 -

The SEC announced the settlement with former UBS broker Chris Rosenthal, the biggest yet from its ongoing flipping investigation.

December 21 -

Sen. John Kennedy blasted the Municipal Securities Rulemaking Board during a Senate Banking, Housing and Urban Affairs Committee meeting.

December 12 -

Richard Gounaud, accused by the SEC of participation in a muni bond "flipping" scheme, claimed the use of the slang term created unfair bias.

December 11 -

Todd Barker was one half of a duo the SEC said engaged in a $62 million fraudulent senior housing bond scheme.

December 5 -

The Mojave Desert city will soon be current on bonds that led the city to a bond fraud settlement with the SEC.

November 28 -

A federal court imposed an unusually stiff financial penalty and a lifetime ban against the already-jailed Christopher St. Lawrence.

November 15 -

Todd Barker appears prepared to have negotiated a monetary settlement with the SEC, while Dwayne Edwards plans to contest the SEC's motion in court.

November 8 -

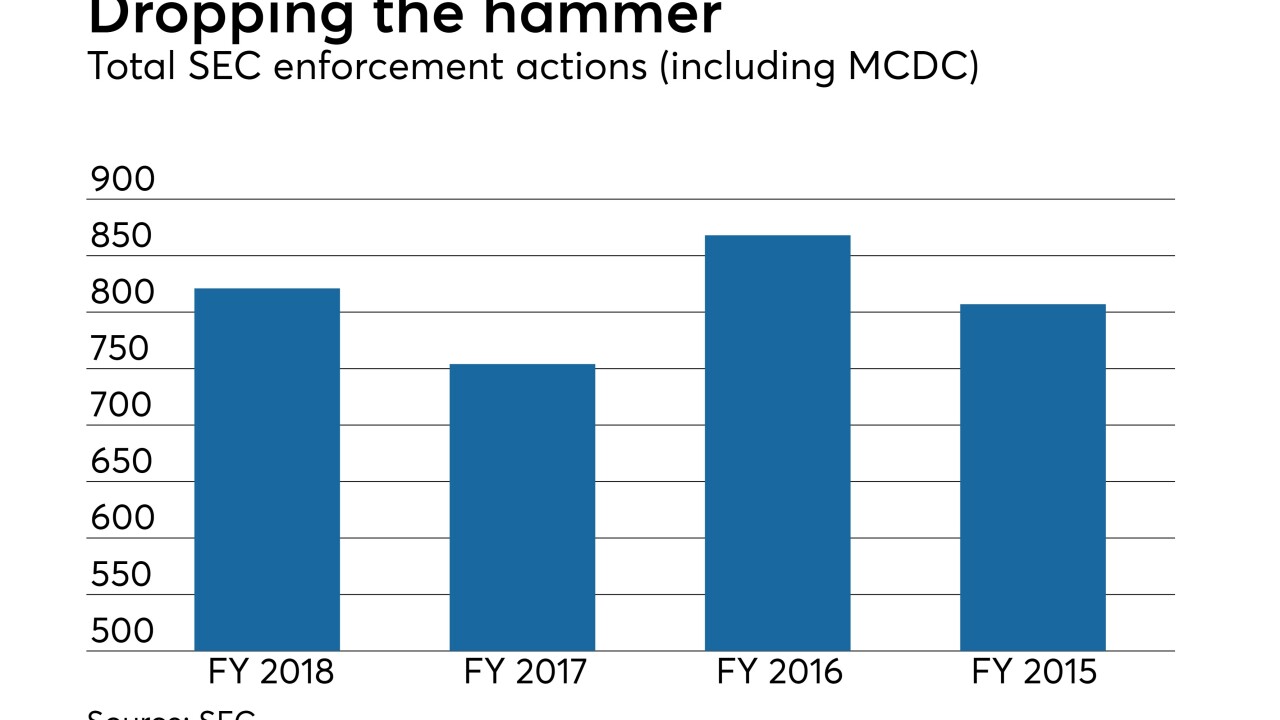

Public finance cases represented 3% of the SEC's enforcement actions the past fiscal year.

November 2 -

Next month's event may also give attendees a rare chance to hear about muni issues directly from every commissioner.

November 1