-

Proceeds, along with additional monies, will be used to fund the cost of the Royal Caribbean Cruises Ltd. (RCG) campus project as well as a debt service reserve fund.

August 2 -

However another town is still struggling with issues that further threaten its already-strained viability while 14 local governments were designated as distressed under the viable utility reserve legislation.

August 2 -

J.P. Morgan held a one-day retail order for $1.65 billion of revenue bonds from the Dormitory Authority of the State of New York, while Minnesota sold $1.02 billion of GOs in the competitive market in five deals.

August 1 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

For the coming week, investors will be greeted with a larger new-issue calendar led by large New York and Texas ISD issuers, along with gilt-edged Minnesota selling competitively.

July 28 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27 -

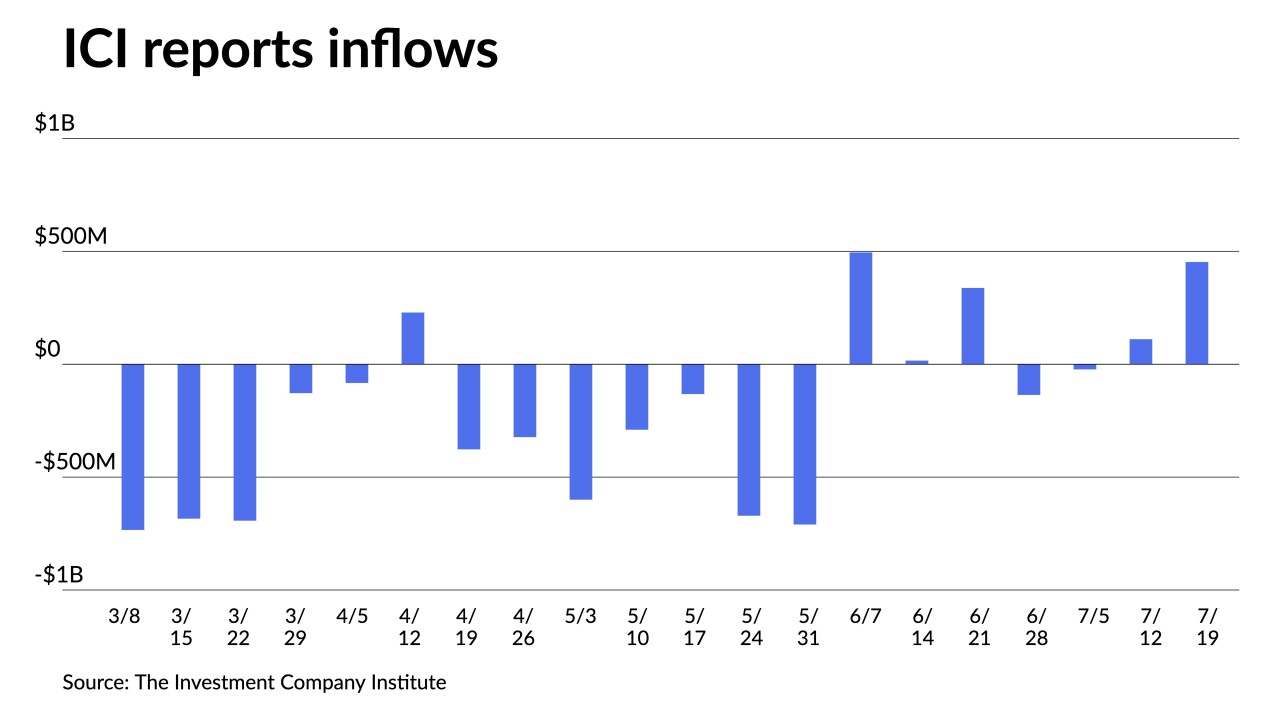

The Investment Company Institute reported investors added $453 million to municipal bond mutual funds in the week ending July 19, after $111 million of inflows the previous week.

July 26 -

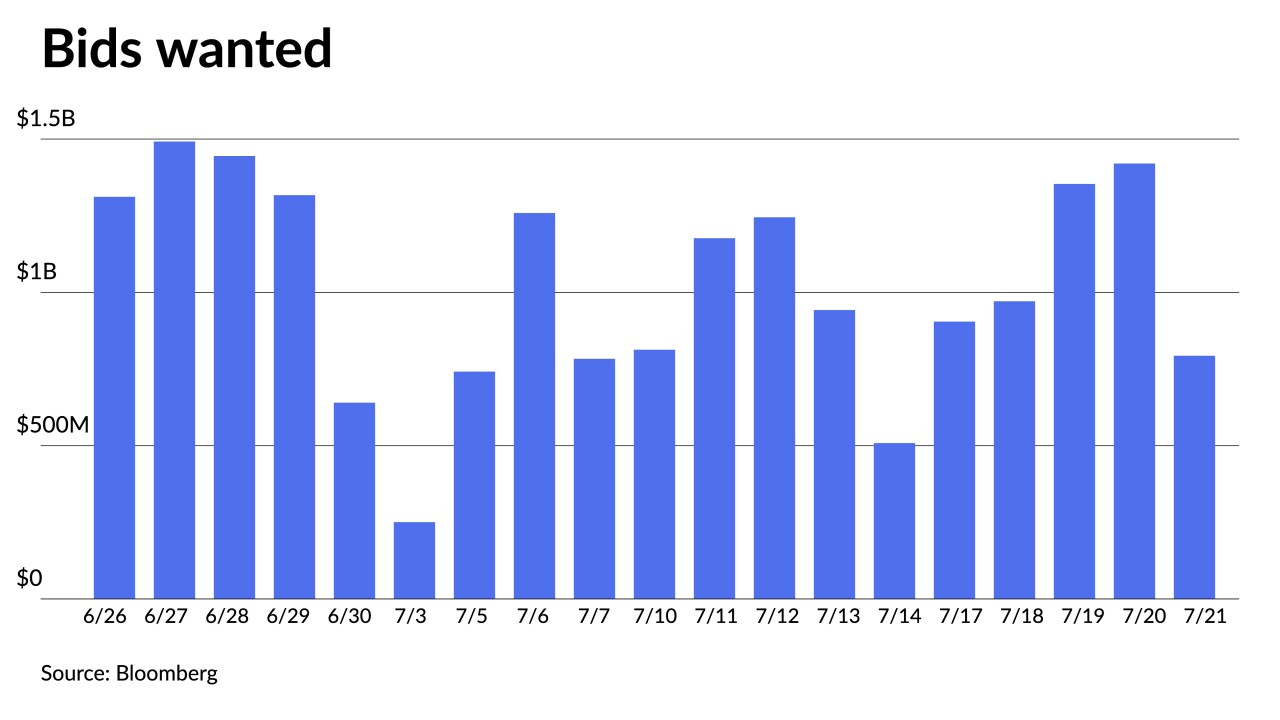

The offered side "has continued to pack the primary market with value to manage their (and the market's) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed," said Matt Fabian, partner at Municipal Market Analytics.

July 25 -

"Longer-dated bonds look attractive, as investors are locking in long-term rates before the expected decline in 2024," while "a tremendous amount of money is also invested in the short end of the curve," Nuveen strategists said.

July 24 -

Proceeds of the $178 million Series 2023 capital asset acquisition obligation bonds will finance programs for the county's general government and departments.

July 24