-

"We believe investors should take advantage of the current high rates environment: investors should pick and choose bonds selectively in the coming weeks in anticipation of this tightening cycle's end after November," BofA strategists said.

September 15 -

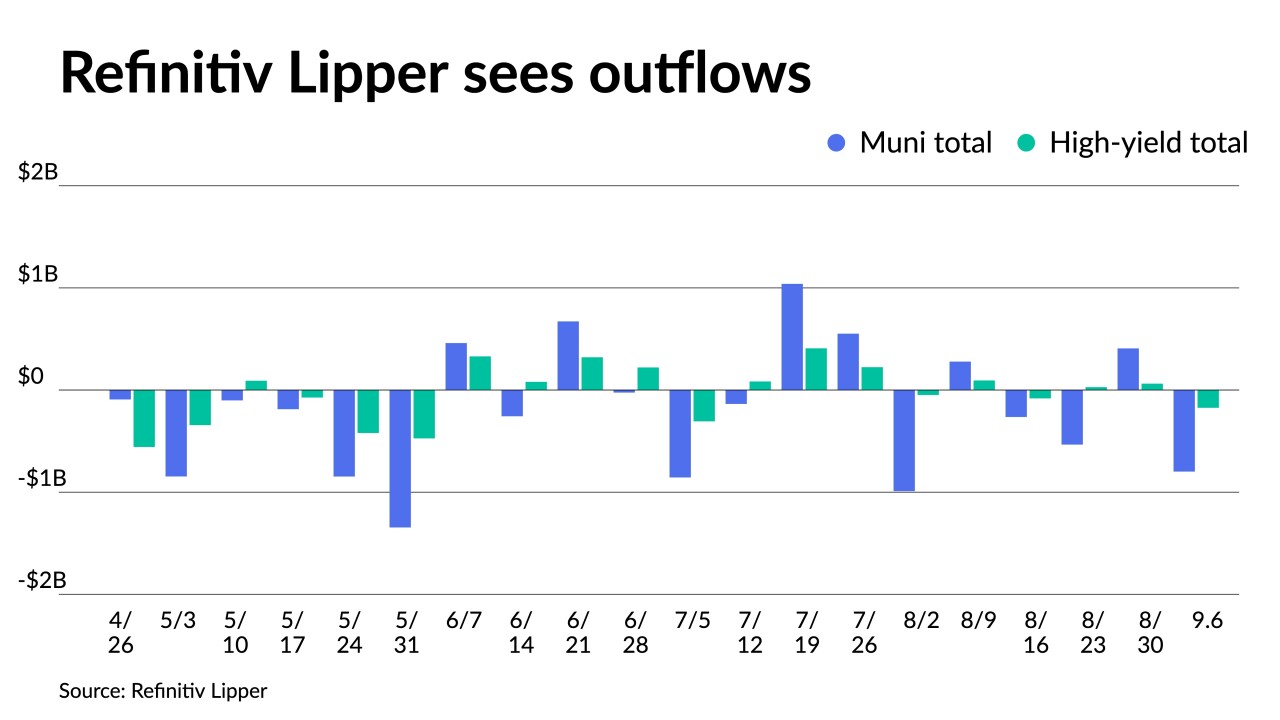

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

September 14 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

While supply this week is "softer," uncertainty and volatility may prevail once more due to "yields still not exciting longer-term investors," said Matt Fabian, a partner at Municipal Market Analytics.

September 12 -

Munis have had a slow start "down roughly 0.25% for the first week of September bringing year-to-date returns to 1.34%," said Jason Wong, vice president of municipals at AmeriVet Securities.

September 11 -

Historically, "September and, to a lesser degree, October have not been kind to municipal investors."

September 8 -

Refinitiv Lipper reported $798.474 million was pulled from municipal bond mutual funds in the week ending Wednesday after $407.976 million of inflows into the funds the previous week.

September 7 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

California and the Port Authority of New York and New Jersey held one-day retail order periods for $1 billion-plus issues.

September 6 -

Investors remain hesitant about "jumping back into munis even as rates are nearing multi-year highs as tax-exempts are still not cheap enough with the front-end ratios still yielding under 70% while the historical averages are around 90%," AmeriVet Securities' Jason Wong noted.

September 5