-

The extraordinary redemptions being used to call Build America Bonds "are based on a creative but flawed legal argument driven by the current change in interest rates," said Kramer Levin partner Amy Caton.

March 21 -

Citi's exit comes amid the larger trend of broker-dealers downsizing balance sheets, which can hurt secondary market liquidity, particularly in times of stress. Other market players are coming into the fold.

March 21 -

"The balance of March may continue to be better-than-expected, particularly given existing demand and decent reinvestment needs over the next 30 days," according to Oppenheimer's Jeff Lipton.

March 20 -

Despite several larger deals entering the primary, the vast amount of cash on hand has not allowed munis to cheapen amid UST volatility and ultra-rich ratios

March 19 -

The New York MTA has not sold fixed-rate transportation revenue bonds since February 2021. The first maturity of that deal (4% 11/15/44) priced at +81 and was evaluated at +78 as of Wednesday by BVAL, according to CreditSights strategists. The same maturity but with a 5% coupon was priced at +59 to BVAL.

March 18 -

Marc Livolsi was promoted to lead U.S. Public Finance New Issue Marketing and Business Development, and Evan Boulukos will lead Assured's Secondary Markets desk, both of whom will report to Chris Chafizadeh, senior managing director and co-head of Public Finance.

March 18 -

Municipal bond buyers looking for yield need look no further than the OTB's non-rated tax-exempt revenue bond deal that's set to be priced this week.

March 18 -

"While rate volatility returned this week, should the market return to range-bound levels for a protracted period of time, investors might want to add exposure to sectors that provide the most value and have underperformed thus far," Barclays said.

March 15 -

Inflows continued for the third consecutive week as LSEG Lipper report fund inflows of $295.5 million for the week ending Wednesday with high-yield hitting the 10th consecutive week of positive flows.

March 14 -

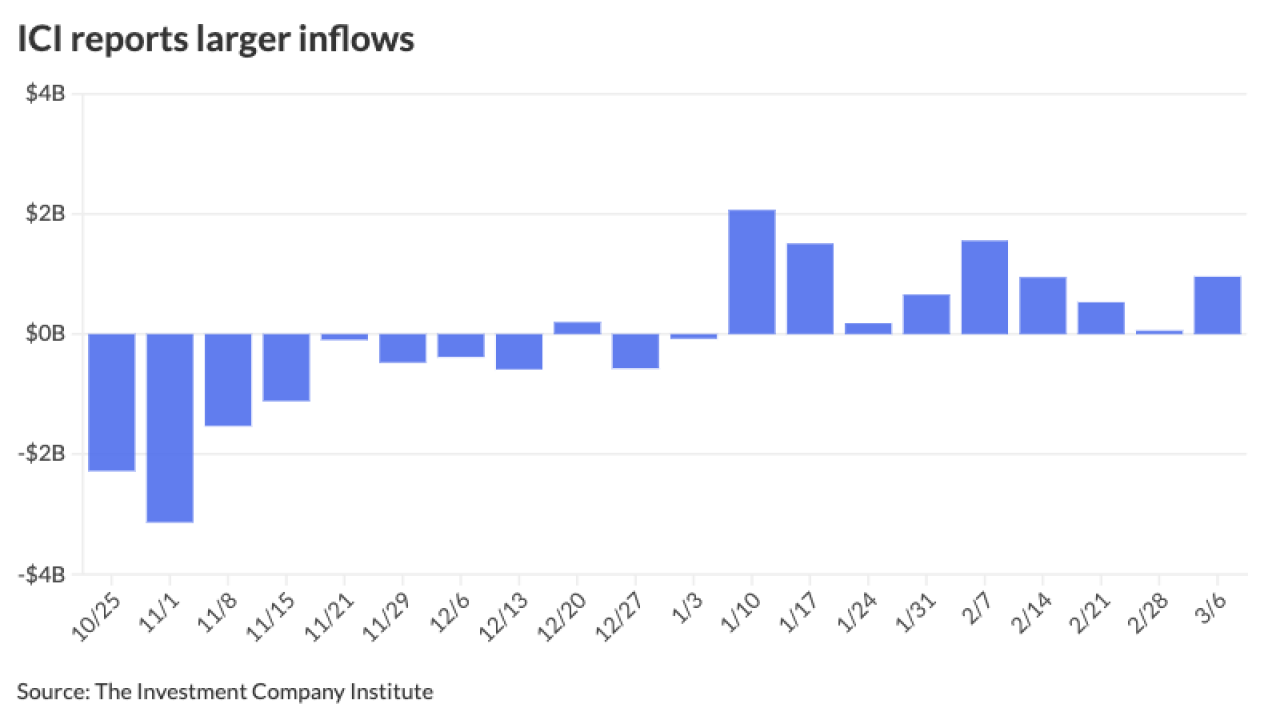

The Investment Company Institute reported larger inflows into municipal bond mutual funds for the week ending March 6, with investors adding $956 million to funds following $57 million the week prior.

March 13 -

"The muni AAA [high grade] curve has been relatively steady thus far in March, but lags relative to the broader fixed income market after sizable muni outperformance in February," said J.P. Morgan strategists.

March 12 -

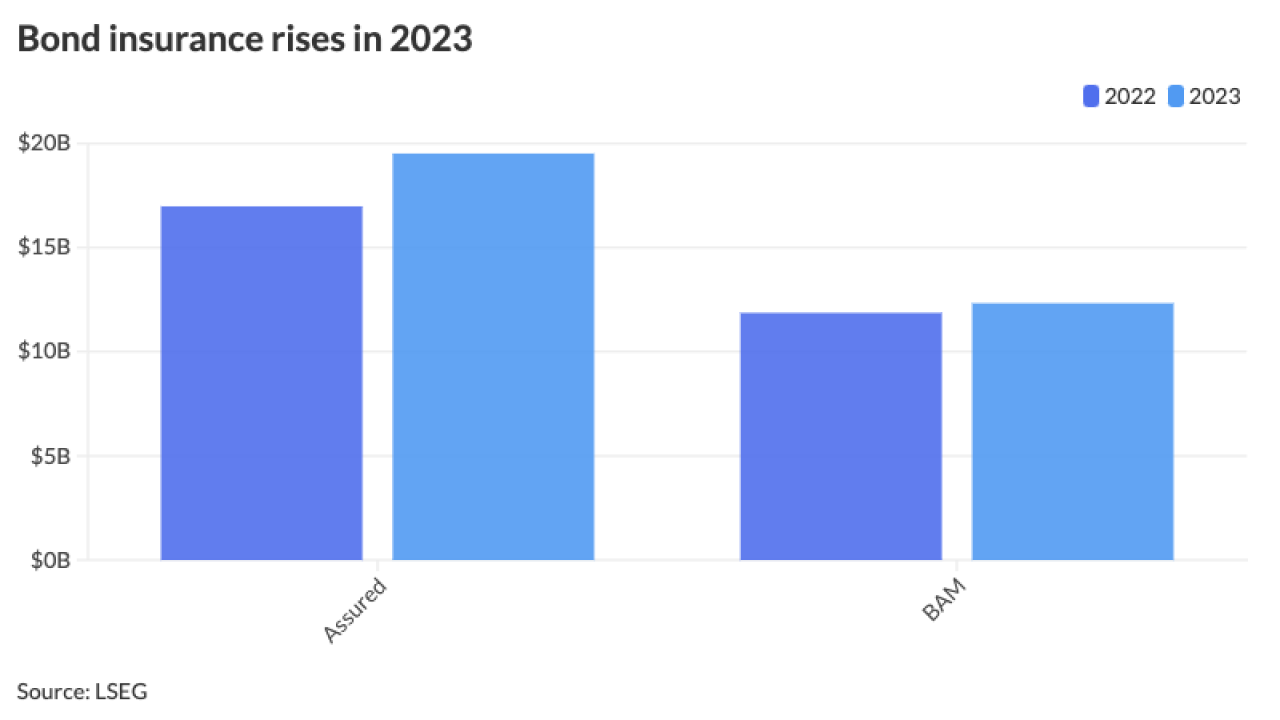

Issuers have increased their debt sale in recent weeks, as issuance has come in above $70 billion year-to-date, according to LSEG data

March 11 -

Market participants said it is yet to be seen whether issuers will pull back their BABs refundings due to concerns after several bondholders sent a letter to the trustee on a Regents of the University of California deal, saying it was "prohibited" from executing the redemption.

March 11 -

Pittsburgh-based Robert Morris University was downgraded by Moody's Ratings. The private university is part of a growing list of smaller higher education institutions, particularly in the Northeast, that are facing increasing financial pressures as the pool of potential students shrinks.

March 11 -

Vivian Altman, Head of Public Finance at Janney, sits down with Bond Buyer Executive Editor Lynne Funk to discuss the state of the muni market, how the new-issue market is faring and where risks and opportunities exist in the space.

-

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

Several investors in a challenge to a University of California Regents Build America Bonds redemption "may give issuers additional reason for pause when vetting similar refundings," J.P. Morgan strategists said.

March 7 -

The market is being led more by supply and demand than ratios or even rates. As ratios sit at extremely tight levels, there are buyers engaging at these levels, but large amounts of cash continue to sit on the sidelines.

March 7 -

Costanzo is only the fourth woman to lead a municipal banking division. Huntington has hired Citi's entire Midwest public finance banking group, and Costanzo said the firm intends to further grow its footprint in the municipal space.

March 7 -

Cabrera Capital Markets is welcoming three new public finance hires who are joining the firm from UBS: Shawn Dralle, Shawnell Holman and Chris Bergstrom.

March 7