-

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The muni market will see "continued strength," said Wesly Pate, senior portfolio manager at Income Research + Management, largely due to a a dearth of new-issue supply.

February 12 -

"Even though it is hard to see the market falling out of bed and underperforming in the near term, we are more cautious going into March," Barclays PLC said in a report.

February 9 -

Municipals were steady to improved in spots in secondary trading as another day of sizable new-issues were well-received in the primary market.

February 8 -

The SIFMA Swap Index fell to 3.24% Wednesday, down 50 basis points from 3.74% from the week prior, and 131 basis points from 4.55% it hit on Jan. 24 as swings continued in the VRDO market. Tax-exempt money market funds reversed course to see inflows of almost $4 billion.

February 7 -

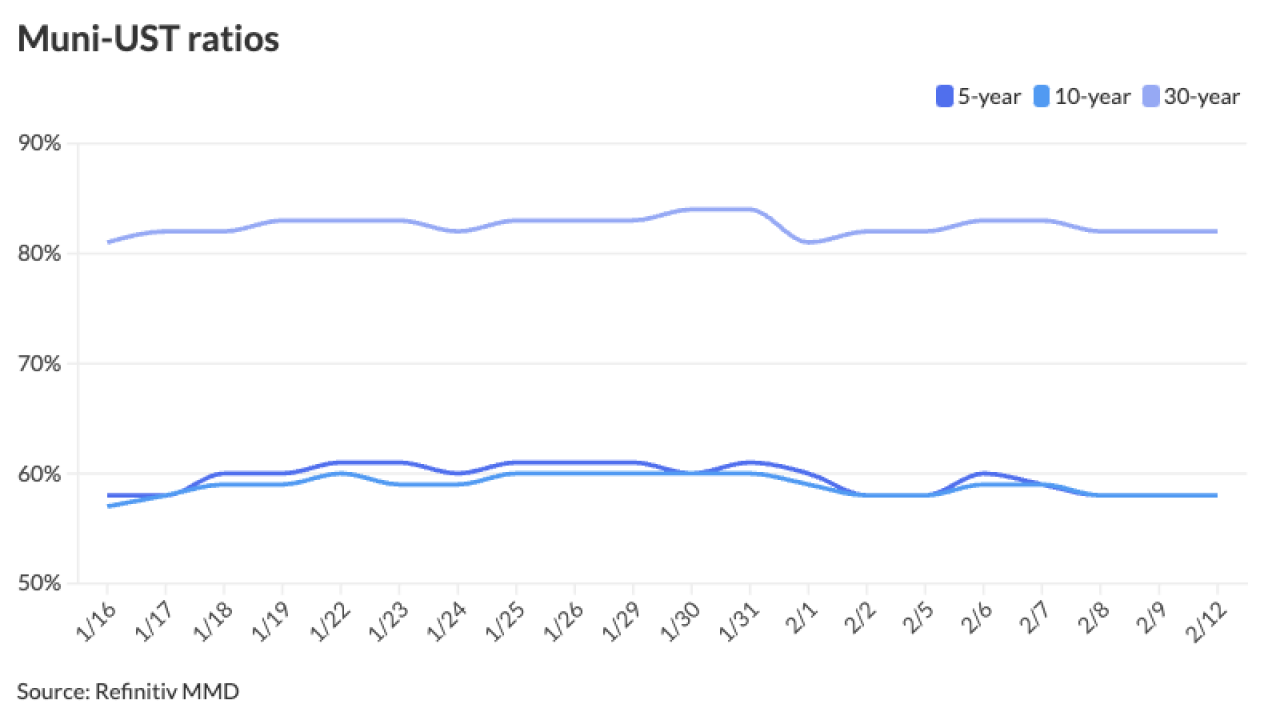

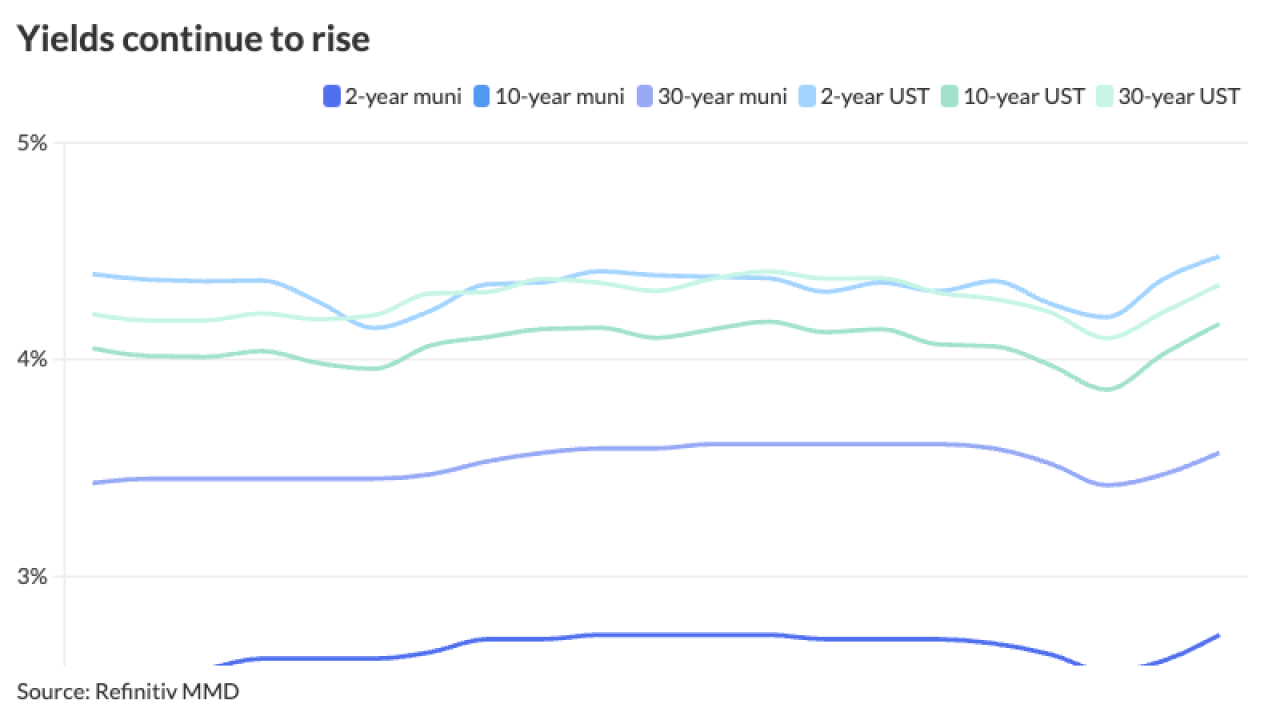

The volatility in USTs is giving municipals a difficult run to start February. The asset class lagged the selloff and outperformed the recent rally, which points to its resiliency — but those moves do not come without challenges.

February 6 -

Chad Wildman, executive director, Quantitative Strategies at FMSbonds, and Matthew Smith, founder and CEO of Spline Data, discuss how automation has repositioned the muni market and where participants can find value by using technology tools. Lynne Funk hosts. (45 minutes)

February 6 -

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

Higher interest rates, inflation and slower economic growth could create headwinds for the U.S. public finance sector, S&P Global Ratings said.

February 5